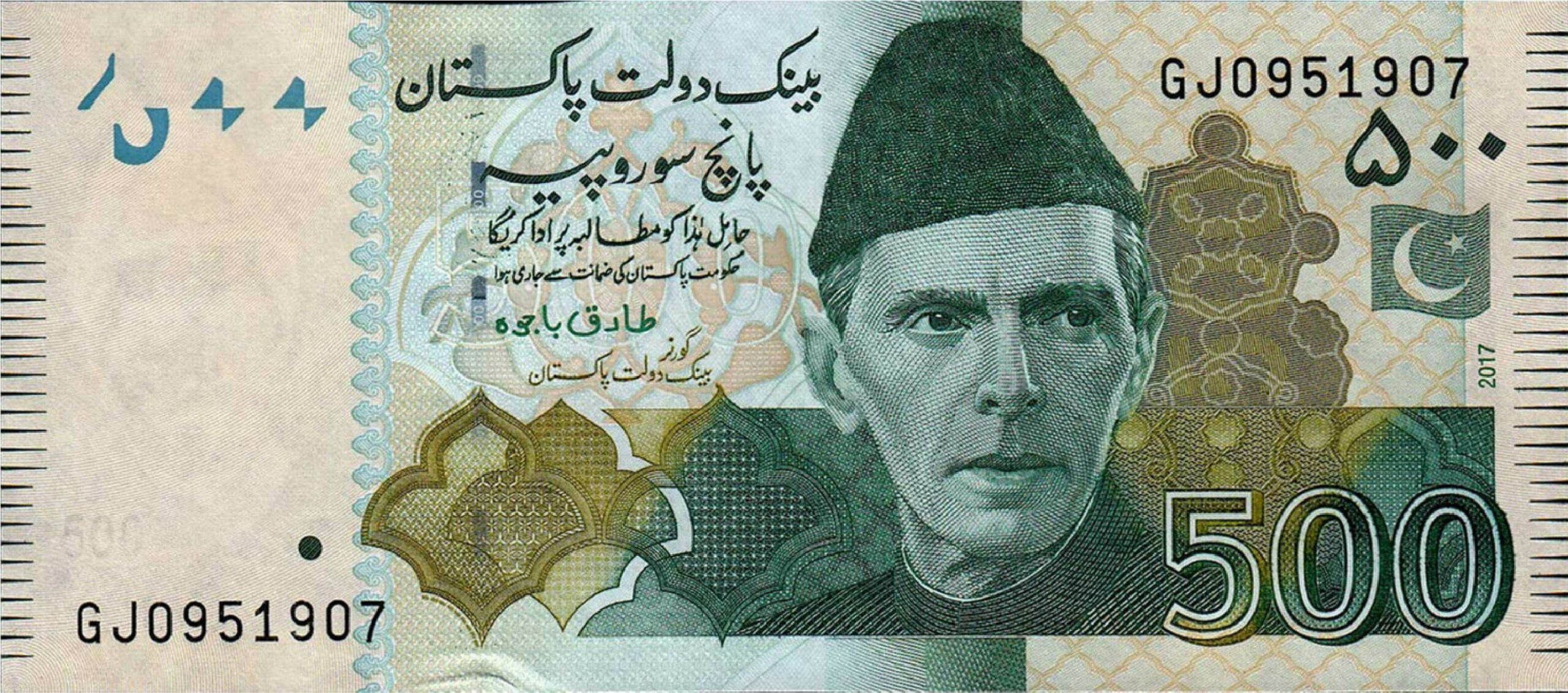

Money is weird. One day you’re looking at a screen seeing the dollar to pakistani rupees rate sitting at 280, and the next thing you know, the open market is screaming something entirely different. It’s frustrating. If you're someone sending money home to Lahore or a business owner in Karachi trying to clear a container at the port, these numbers aren't just digits. They're your profit margins. They're your grocery bills.

Honestly, the PKR has had a rough ride. We all saw that massive slide where it felt like the currency was in a freefall, hitting those painful highs near 300. But then, things got quiet. Why? Because the State Bank of Pakistan (SBP) started tightening the screws.

What’s actually driving the dollar to pakistani rupees rate right now?

It’s not just one thing. It's a messy cocktail of IMF demands, import pressures, and whether or not people are stuffing greenbacks under their mattresses. When the IMF says "jump," the Ministry of Finance asks "how high?" and usually, that means letting the market determine the price of the dollar.

That "market-determined" rate is a double-edged sword. On one hand, it stops the black market from getting too crazy. On the other, it means your purchasing power can evaporate overnight.

The IMF factor and the SBP tightrope

The International Monetary Fund (IMF) is the shadow director of the Pakistani economy. They’ve been very clear: no more artificial propping up of the rupee. In the past, the government would burn through foreign exchange reserves just to keep the dollar to pakistani rupees rate looking "pretty" for the news. Those days are gone.

Now, we see the SBP keeping interest rates high—sometimes at staggering levels like 20% or 22%—just to keep inflation from eating the country alive. This makes the rupee "expensive" to hold, which theoretically stabilizes the exchange rate. But it also kills local business growth. You can't win.

✨ Don't miss: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

The gap between Interbank and Open Market

If you’ve ever gone to a local exchange company like Western Union or a small booth in Blue Area, Islamabad, you know the price isn't what Google says. Google shows the interbank rate. That's for the big boys—banks trading with other banks.

The open market is where regular people live.

Usually, there's a "smuggling premium." If the Afghan border is porous and dollars are flowing out of Pakistan, the local supply drops. Suddenly, the dollar to pakistani rupees rate in the street is 5 or 10 rupees higher than what the news reports. This gap is a massive indicator of trust. When the gap is small, people trust the system. When it widens, people start panicking and buying gold or crypto.

Why the "Hundi" system still exists

Let’s be real. Overseas Pakistanis in the UK, UAE, and USA often bypass the official banking channels. Why? Because "Hundi" or "Hawala" sometimes offers a better rate than the official dollar to pakistani rupees quote.

The government hates this. It starves the country of official reserves. But if you're a worker in Dubai trying to send every extra dirham back to your family, you’re going to look for the highest number possible. It’s basic survival. The Remittance Incentive Schemes launched by the SBP are trying to fix this, but trust takes years to build and only seconds to break.

🔗 Read more: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Real-world impact on the average person

Think about oil. Pakistan imports almost all of its fuel. When the dollar to pakistani rupees rate spikes, your petrol price goes up. Then the truck driver carrying tomatoes from the farm to the city has to pay more for diesel. Then the tomatoes in the market cost more.

It’s a domino effect that hits the poorest people first.

- Electronics: Your next iPhone or Dell laptop? Those prices are pegged directly to the dollar. If the rupee slips 10%, that laptop isn't just 10% more expensive; retailers often hike it 15% to "hedge" against future drops.

- Education: Students headed to the UK or Australia are feeling the burn. A tuition fee that was manageable two years ago is now a mountain of debt because the currency devalued so aggressively.

- Medicine: This is the scary one. Many raw materials for life-saving drugs are imported. When the dollar gets too strong, pharmacies start reporting shortages.

Surprising things people get wrong about the exchange rate

Most people think a "strong" rupee is always good. That’s not necessarily true. If the rupee is too strong, our exports—like textiles and surgical goods from Sialkot—become too expensive for the rest of the world. If a t-shirt made in Pakistan costs more than one made in Bangladesh because of currency rates, the American buyer goes to Bangladesh.

We need a stable rupee, not necessarily a "strong" one. Volatility is the real enemy. Businessmen can't plan for six months down the road if they don't know if the dollar to pakistani rupees rate will be 275 or 320.

The role of "Sentiment"

Market sentiment is basically just "vibes." If there’s a rumor of a political shift or a delay in an IMF tranche, the rupee starts shaking. It’s a psychological game. Speculators jump in, buying up dollars because they think the price will go up, which actually causes the price to go up. It’s a self-fulfilling prophecy.

💡 You might also like: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

How to navigate the fluctuations

If you're dealing with dollars, you have to be smart. Don't just watch the daily ticker; look at the monthly trends.

- Watch the Foreign Exchange Reserves: If the SBP reserves are going up, the rupee usually stabilizes. If they drop below $8 billion, get ready for a bumpy ride.

- Diversify: Don't keep all your liquid cash in PKR if you have expenses in USD. It’s common sense, but many people wait too long to hedge.

- Use Official Channels: While the black market might offer a few extra rupees, the risk of counterfeit notes or legal trouble isn't worth it. Plus, official remittances help the national economy, which eventually helps stabilize the rate you're complaining about.

The dollar to pakistani rupees situation isn't going to fix itself overnight. It requires structural changes—more exports, less reliance on foreign debt, and a lot more stability in Islamabad. Until then, we’re all just watching the green numbers on the screen and hoping for the best.

Actionable Next Steps

To manage your finances against the fluctuating dollar to pakistani rupees rate, start by tracking the SBP's weekly liquid foreign reserve reports; a consistent downward trend is your signal to delay large PKR-based purchases of imported goods. If you are an exporter or freelancer, look into "forward contracts" with your bank to lock in a rate for future payments, protecting you from sudden rupee appreciation. For those sending remittances, compare the "interbank" versus "kerb" rate daily on official exchange company websites like Exchange自 Association of Pakistan to ensure you aren't being overcharged by more than the standard 1-2% spread.