You've probably seen the headlines or heard the chatter at the local market. Everyone in Accra and Kumasi is talking about the same thing: the cedi. If you’re trying to figure out the dollar rate in Ghana today, honestly, it depends entirely on where you’re standing. Are you at a high-end bank in Airport Residential? Or are you haggling at a forex bureau near Circle? The answer changes by the minute.

As of January 18, 2026, the Bank of Ghana interbank rate is sitting around GH¢10.85. But wait. Don't go to a bureau expecting that number. If you walk into a private forex bureau right now, you’re likely looking at a selling rate closer to GH¢12.10 or GH¢12.25. That’s a massive gap. It’s kinda frustrating, right? One number is "official," and the other is what you actually pay to get cash in your hand.

The Massive 2025 Rebound Nobody Saw Coming

To understand where we are now, we have to look at the wild ride of last year. In early 2025, things looked pretty bleak. The cedi was crashing, hitting nearly GH¢16 to the dollar at one point. People were panicking. Then, something shifted. The Bank of Ghana got aggressive. They tightened the money supply, and by May 2025, the cedi had clawed its way back to around GH¢10.80.

Actually, the cedi ended 2025 as one of the best-performing currencies in the world. It gained over 40% against the dollar across the year. That's almost unheard of for a currency that had been struggling so much. It was its first annual gain since 1994.

🔗 Read more: Who is the Owner of ABC News? What Most People Get Wrong

But 2026 has started with a bit of a "January fever." The rate has been creeping up slightly every few days. Just last week, the interbank rate was GH¢10.70, and now we're pushing toward GH¢10.85. It's a slow climb, but it’s there.

Why the Dollar Rate in Ghana is Bubbling Right Now

Why the sudden pressure? Basically, January is always a mess for the cedi. Think about it. This is the time when multinational companies are packing up their 2025 profits and sending them back to their home countries in dollars. Plus, Ghanaian importers are restocking their shops after the Christmas rush. They need dollars to buy everything from rice to electronics from China and Europe.

"When companies struggle to access foreign currency, pressure builds on the cedi and can trigger rapid depreciation," the Bank of Ghana noted in their recent FX operations framework.

To keep things from spiraling, the central bank has stepped in. They announced plans to sell about $1 billion into the market this month alone. They aren't trying to force the rate to a specific number—they just want to stop it from jumping from 10 to 15 overnight.

Interbank vs. Forex Bureau: The Great Divide

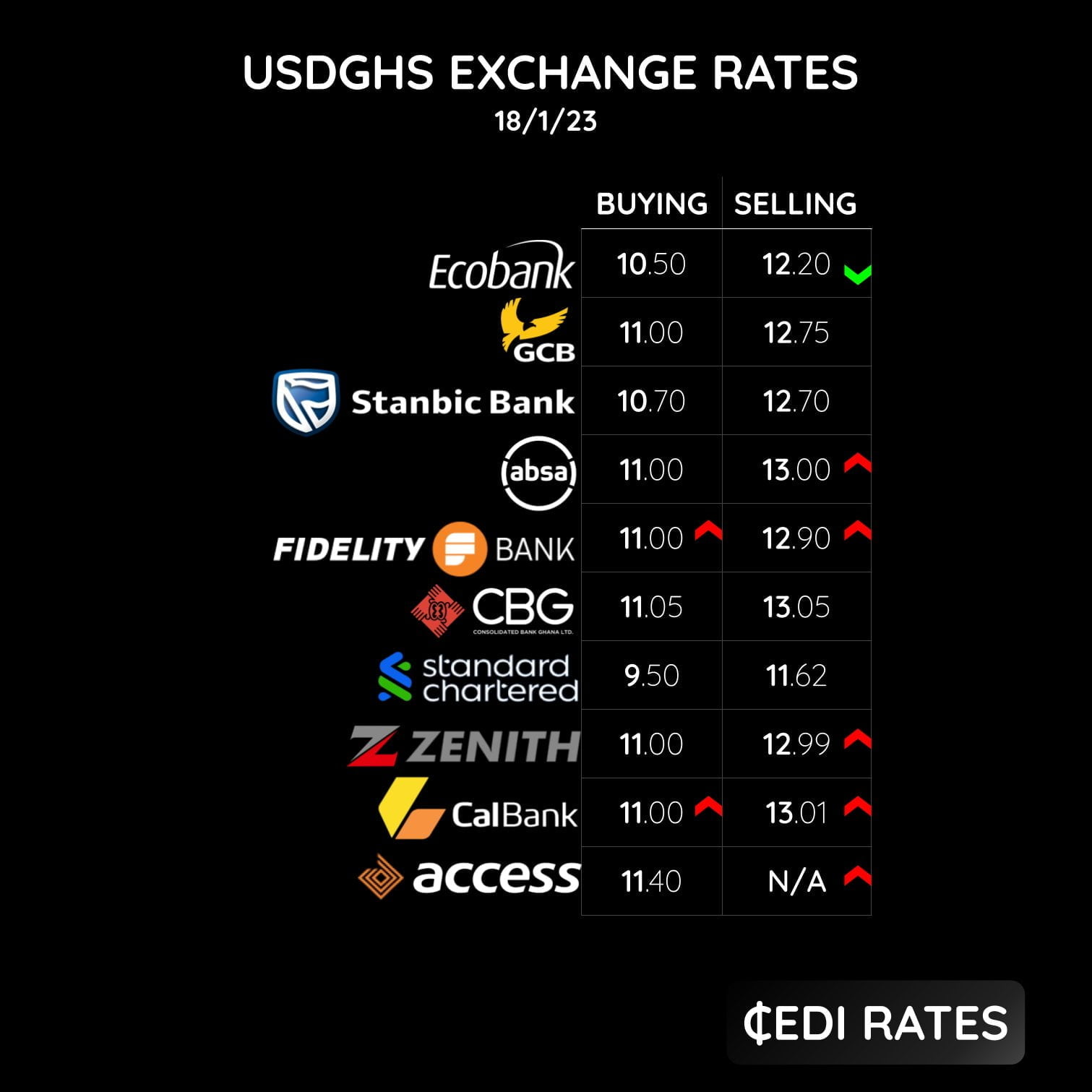

If you’re checking the dollar rate in Ghana on Google, you’re usually seeing the interbank rate. This is the rate banks use to trade with each other. It's the "clean" number.

✨ Don't miss: How a Mortgage Equity Loan Calculator Prevents Expensive Financial Blunders

The forex bureau rate is the "real world" number. Bureaus have higher overhead and less access to the bulk dollar auctions from the central bank. Because of this, they charge a premium. Currently, the spread—the difference between the two—is quite wide.

- Bank of Ghana Rate: Buying at ~GH¢10.84, Selling at ~GH¢10.85.

- Forex Bureau Rate: Buying at ~GH¢11.75, Selling at ~GH¢12.10.

- Remittance Apps (like LemFi or Taptap Send): Often sit somewhere in the middle, around GH¢11.50 for those sending money from abroad.

It's a bit of a cat-and-mouse game. If the official rate stays stable, the bureau rates usually start to drift back down toward it. But if people get nervous, the bureau rates take off like a rocket.

What to Expect for the Rest of 2026

Experts aren't calling for a total collapse, so don't lose sleep just yet. Fitch Solutions recently projected that the cedi might weaken by about 8% over the whole of 2026. If that holds true, we might see the year end with the dollar around GH¢11.30 to GH¢11.50 on the official market.

Compared to the 10% or 20% drops we’ve seen in the past, an 8% slide is actually considered "stable" in the world of emerging markets. High gold prices are helping big time. Ghana is a top gold producer, and since gold is priced in dollars, those exports bring in the hard currency the country desperately needs to keep the cedi afloat.

However, there are risks. Inflation in Ghana is still hanging around 23%. When prices for bread and fuel go up, the value of the cedi in your pocket naturally goes down. It’s a cycle that’s hard to break.

📖 Related: Tenth of Ramadan City: Why This Industrial Giant is Egypt's Real Economic Engine

How to Protect Your Money

Since you're looking for the dollar rate in Ghana, you're probably trying to figure out how to handle your cash. If you're an importer or you're planning a trip, waiting for the "perfect" rate is usually a losing game.

First, shop around. Don't just walk into the first bureau you see. Rates in Osu might be different from rates in East Legon. Second, if you're receiving money from family overseas, check the rates on different apps before they hit "send." Sometimes the fee is low, but the exchange rate they give you is terrible.

Most importantly, keep an eye on the Bank of Ghana’s Monetary Policy Committee (MPC) meetings. They usually happen every twond month. When they raise interest rates, it often makes the cedi more attractive to investors, which can temporarily strengthen the currency.

Actionable Steps for Navigating the Current Rate:

- Use Interbank Apps: Download a local banking app to see the daily mid-market rate so you know how much you're being overcharged at the bureau.

- Monitor Commodity Prices: If gold and cocoa prices are high, the cedi usually has a better safety net.

- Time Your Purchases: If you need to buy dollars for business, try to avoid the very beginning or very end of the month when demand is highest.

- Consider Cedi Investments: With the cedi stabilizing significantly since its 2025 lows, some local high-yield treasury bills are actually outperforming the dollar's growth.

The situation is miles better than it was two years ago, but in Ghana, the exchange rate is never just a number—it's a daily conversation. Stay sharp and keep checking the daily updates from the Bank of Ghana's official treasury page to stay ahead of the curve.