You’re looking at a map of the United States, maybe dreaming of a cross-country move or finally buying that first home. You’ve probably heard whispers about "tax-friendly" states. Everyone talks about income tax. They brag about moving to Florida or Texas because the state doesn't take a bite out of their paycheck. But then the tax bill for the house arrives. It’s a gut punch. So, you start wondering: does all states have property tax? The short answer is yes.

Every single state in the U.S. has property taxes. It’s unavoidable. Even if the state government itself doesn't collect a dime, the local guys do. Your county, your city, your school district—they all need a piece of the pie to keep the lights on and the buses running. It's the price of admission for living in a civilized society, or at least that’s what the local treasurer will tell you when you call to complain about your assessment.

Why the "No Property Tax" Myth Persists

It’s easy to see why people get confused. You’ll find lists online of the "10 States with No Income Tax." That’s a real thing. Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t tax your wages. New Hampshire doesn't tax earned income either. But property tax? That’s a whole different beast.

Property taxes are local.

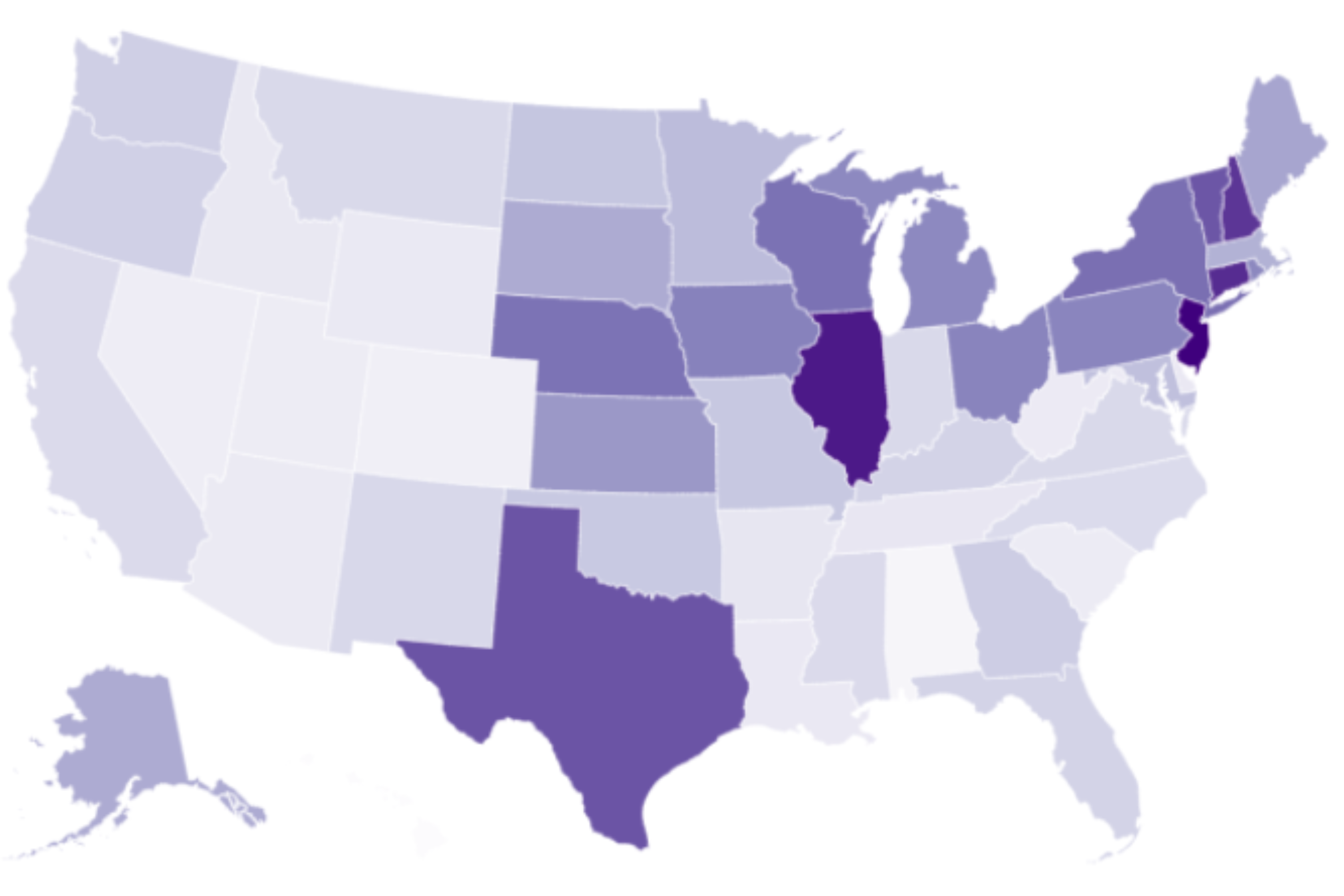

While some states like Hawaii have incredibly low effective rates—we're talking $0.27$ per $100$ of assessed value—they still have them. In fact, Hawaii has the lowest property tax rate in the country, but because the houses cost a fortune, the actual check you write is still pretty painful. On the flip side, you have New Jersey. Poor New Jersey. They have the highest property tax rates in the nation, often exceeding $2%$.

Imagine two different worlds. In one, you pay a tiny percentage on a massive home value. In the other, you pay a massive percentage on a modest home. Both results end with you staring at a bill that feels too high. Honestly, the way these taxes are calculated feels like a dark art involving local assessors, complex formulas, and sometimes just a bit of bad luck regarding when your neighborhood was last "revalued."

The Breakdown: How These Taxes Actually Work

Most people think the state sends them the bill. Usually, it’s the county.

The process is basically a three-step dance. First, a local official (the assessor) decides what your property is worth. They don't usually walk through your front door; they look at what the house next door sold for and maybe check some satellite imagery or building permits. Next, the local "taxing authorities"—think school boards, fire departments, and library districts—set their budgets. They figure out how much money they need to operate. Finally, they apply a "millage rate" to your property's value.

💡 You might also like: Easy recipes dinner for two: Why you are probably overcomplicating date night

A mill is one-thousandth of a dollar. So, if your tax rate is $20$ mills, you pay $20$ for every $1,000$ of your home's assessed value.

The Real-World Impact of Location

Take a look at Texas. People flock there for the zero income tax. But Texas has some of the highest property taxes in the country. They have to get their money from somewhere. Since they aren't taking it from your salary, they take it from your dirt. According to the Tax Foundation, Texas ranks near the top for property tax as a percentage of owner-occupied housing value.

Then there’s Alaska. It’s the wild card. Alaska is the only state that has neither a state sales tax nor an individual income tax. But yes, does all states have property tax applies here too. Local municipalities in Alaska still levy property taxes. However, because of the petroleum wealth (the Permanent Fund), some areas are incredibly lenient, and senior citizens often get massive exemptions that can wipe out their tax liability entirely.

Hidden Factors That Change Your Bill

You can’t just look at a state's average rate and know what you’ll pay. It’s not that simple.

- Assessment Ratios: Some states don't tax $100%$ of your home’s value. They might only tax $10%$, $35%$, or $60%$. This makes a "high" tax rate look much lower in practice.

- Homestead Exemptions: This is a big one. Many states give you a break if the home is your primary residence. In Florida, for example, the Homestead Exemption can shave $50,000$ off your assessed value for certain taxes.

- Circuit Breakers: No, not the ones in your garage. These are programs that limit property taxes for seniors or low-income residents based on their ability to pay.

- Value Caps: Some states, like California with its famous Proposition 13, limit how much your assessed value can go up each year, regardless of how much the market explodes.

California is actually a fascinating case study in "be careful what you wish for." Prop 13, passed in 1978, capped property taxes at $1%$ of the purchase price and limited annual increases to $2%$. This is great if you bought your house in 1980. Your taxes are dirt cheap. But if you're a young couple buying that same house today? You’re paying taxes based on the 2026 market value, while your neighbor might be paying a fraction of that. It creates a weirdly stagnant housing market because nobody wants to move and lose their tax "lock-in."

The "Invisible" Property Taxes

Even if you don't own a home, you’re paying property tax.

Renters often think they’re exempt. They aren't. Your landlord is writing that check to the county every year, and you can bet every cent of that tax bill is baked into your monthly rent. If the property taxes in your city spike, expect your rent to follow suit when your lease is up. It’s one of those hidden economic realities that hits the hardest in high-growth urban areas.

📖 Related: How is gum made? The sticky truth about what you are actually chewing

Then there’s personal property tax. Some states don't just tax your land; they tax your "stuff."

In Virginia or South Carolina, for instance, you might get a separate tax bill every year just for owning a car. It’s basically a property tax on wheels. You pay it annually, and it’s based on the current value of the vehicle. If you've lived in a state that doesn't do this and you move to one that does, it feels like a total shakedown.

Where the Money Actually Goes

It’s easy to get angry at the bill, but it helps to see what it buys. In most of the U.S., property tax is the primary funding source for K-12 public schools.

If you live in an area with "good schools," your property taxes are likely high. There’s a direct correlation. Beyond schools, this money pays for:

- Paving the street in front of your house.

- The police officer patrolling your neighborhood.

- The librarians who organize the summer reading program.

- The local parks and recreation departments.

- Water and sewer infrastructure.

In states like New Hampshire, where there is no sales or income tax, property taxes are the absolute backbone of the entire state's economy. They rely on it more than almost anyone else. It’s a trade-off. You keep more of your paycheck, but you pay a premium to own property.

Is There Any Way Out?

Technically, you can't escape it. But you can challenge it.

Most people just pay the bill. That’s a mistake. Local assessors are human; they make mistakes. They might think your house has a finished basement when it’s actually a damp crawlspace. They might have your square footage wrong. Or they might just be overestimating the market.

👉 See also: Curtain Bangs on Fine Hair: Why Yours Probably Look Flat and How to Fix It

Almost every jurisdiction has an "appeals" window. It’s usually a few weeks after you get your assessment notice. You can go down to the office (or file online) with "comps"—recent sales of similar homes in your area that sold for less than your assessment. It’s a bit of a chore, but it can save you thousands.

Smart Moves for the Tax-Conscious Mover

If you are planning a move and property tax is a dealbreaker, don't just look at the state. Look at the county.

Within a single state, property taxes can vary wildly. One town might have a special levy for a new high school, while the town three miles away has a much lower rate because they share services with a neighbor.

What You Should Do Right Now

Before you sign a mortgage or move to a new state, do these three things:

- Check the Effective Tax Rate: Don't look at the "millage" or the "nominal rate." Look for the effective rate, which is the actual percentage of the home's market value you’ll pay. Websites like SmartAsset or the Tax Foundation are great for this.

- Look Up the Tax History: Go to the county assessor's website for the specific property you’re eyeing. Look at what the current owners paid over the last five years. Did it jump $20%$ in one year? Why?

- Investigate Exemptions: Call the local tax office. Ask: "Do you have a homestead exemption? What about for veterans or seniors?" You might find that the "scary" tax bill in a certain state is actually quite manageable once you apply the right credits.

Property taxes are a constant. They are the only tax that you have to pay even if you have no income and buy nothing. You can stop working and stop shopping, but as long as you own that piece of dirt, the government is going to want its share. Understanding that does all states have property tax is a universal reality helps you plan your finances with clear eyes.

The goal isn't necessarily to find a place with no tax—because that doesn't exist—but to find a place where the tax you pay provides the value you actually want in your life, whether that's top-tier schools or just a well-paved road to your front door.

Actionable Insight: If you're a homeowner, find your most recent assessment notice today. Compare the "Assessed Value" to what you actually think your home could sell for in today's market. If the assessment is higher than the market value, mark your calendar for the next appeals window. You could be leaving money on the table every single year just by staying silent.