Walk into any grocery store in 2026 and you’ll see it. The person ahead of you pays for organic dragon fruit with a titanium card without glancing at the total. The person behind them is sweating, literally sweating, as they decide which item to put back because the eggs went up another fifty cents.

It's not just "the economy." It's two different economies living in the same zip code.

Honestly, the division of wealth in the united states has reached a point where the numbers almost sound fake. We talk about "the 1%" like it's a monolith, but even that is a misunderstanding. If you have a couple million bucks, you're in the top few percent, sure. But you aren't even playing the same sport as the people at the very peak.

The gap isn't a crack anymore. It’s a canyon.

The 2026 Reality: A Tale of Two Balances

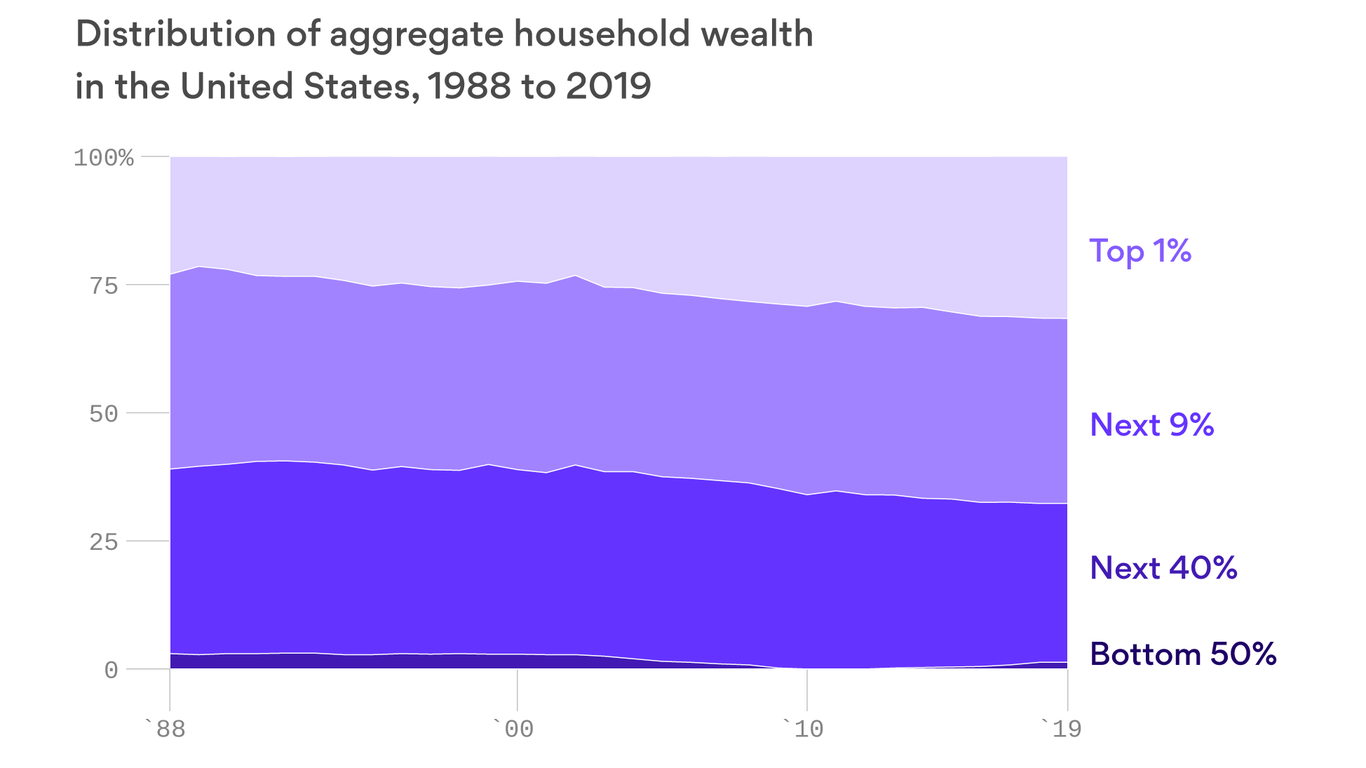

As of early 2026, the collective net worth of just the top 12 American billionaires has surged past $2.7 trillion. Let that sink in. Twelve people. That is more than the GDP of most nations. Meanwhile, the bottom 50% of American households—about 65 million families—scrape by with roughly 2.5% of the total national wealth.

You’ve probably heard the term "K-shaped recovery" back during the pandemic. Well, that K never closed. It just kept growing.

People often confuse income with wealth. Income is the paycheck that hits your account on Friday. Wealth is the "stuff" you own—the stocks, the real estate, the businesses that make money while you sleep. While wages have struggled to keep pace with the price of a gallon of milk, asset prices have been on a rocket ship.

Why the Middle is Disappearing

It’s easy to point at the ultra-rich, but the real story is what’s happening to the "middle." For decades, the 50th to 90th percentiles—the core of the American middle class—held a respectable chunk of the pie. That’s changing.

📖 Related: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Federal Reserve data shows a slow, steady leak. This group’s share of wealth has been shrinking as the top 1% and 0.1% gobble up the gains. If you own a home, you’ve probably seen your net worth go up on paper. That's great. But if you don't own stocks or a business, you're falling behind the people who do.

The stock market is a massive engine of inequality. The top 10% of households own nearly 90% of all stocks. When the S&P 500 rallies, it’s a celebration for a tiny slice of the population. For everyone else, it’s just a headline.

The Generation Gap: Boomers vs. The Rest

Age is the new class divide. It's kinda wild when you look at the breakdown. Baby Boomers are currently sitting on about $83 trillion. They are approaching peak wealth as they move further into retirement.

Millennials and Gen Z? Despite being the largest workforce, they hold only about 10.5% of the wealth.

- Baby Boomers: $83.3 trillion (roughly 51% of all wealth)

- Gen X: $42.6 trillion

- Millennials/Gen Z: $17.1 trillion

If you’re a Millennial, you’ve basically lived through "once-in-a-generation" financial crises every five years. It makes saving for a down payment feel like trying to climb a greased pole. Younger generations are actually wealthier than Boomers were at the same age in total dollars, but the distribution within those generations is even more skewed. A few tech founders are pulling up the average for everyone else.

The Education Premium (and the Debt Trap)

There’s a massive "diploma divide" in the division of wealth in the united states. Households headed by a four-year college graduate own about 75% of total household wealth.

But there's a catch.

👉 See also: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Student debt is a weight that doesn't exist for the wealthy. If your parents paid for your degree, you start the race at the 50-yard line. If you took out $80,000 in loans, you’re starting 20 yards behind the end zone. Even if you earn a high salary, your ability to build wealth is stunted for a decade or more.

What Most People Get Wrong About "The Rich"

We love to talk about the Top 1%. But the 1% is actually kind of "poor" compared to the Top 0.1%.

To be in the Top 1% in 2026, you generally need a net worth of around $13 million. That’s a lot of money! It’s "never work again" money. But the Top 0.1% starts at roughly $60 million. And the Top 0.01%? They’re the ones buying the $100 million yachts and influence.

The "lower" part of the 1% are usually doctors, lawyers, and successful small business owners. They pay a lot in income tax. The 0.1% get most of their money from capital gains, which are often taxed at lower rates or not at all if they never sell their assets. This is why you see reports of billionaires paying a lower effective tax rate than a schoolteacher. It’s not necessarily "cheating"—it’s how the system is designed.

Real Estate: The Last Stronghold?

For the bottom 90%, the family home is the primary source of wealth. It's basically the only asset where the "little guy" has a significant stake. In fact, the bottom 90% owns over 55% of the residential real estate market.

This is why the housing crisis of 2026 is so devastating. When home prices become unaffordable for the next generation, we aren't just talking about where people live. We are talking about cutting off the only reliable way for the average family to build any semblance of wealth.

Actionable Steps to Protect Your Own Wealth

The macro numbers are depressing. No doubt about it. But you can't control the Federal Reserve or the tax code. You can only control your own balance sheet.

✨ Don't miss: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

Diversify beyond your home. If all your wealth is tied up in the four walls of your house, you’re vulnerable. Even if it's just a small amount, getting into low-cost index funds allows you to capture a tiny piece of that "snowball effect" the wealthy enjoy.

Attack high-interest debt aggressively. Wealth isn't just what you have; it's what you don't owe. Credit card debt at 24% interest is a wealth-killer. You cannot out-invest that kind of debt.

Focus on "Asset-Light" income. In 2026, the people winning are those who own intellectual property or digital assets. Whether it's a side hustle, a brand, or a specialized skill, having an income stream that doesn't rely on a physical location or a 9-to-5 boss is the best hedge against a widening gap.

Understand the tax game. You don't need a team of accountants to use a Roth IRA or a 401(k). These are some of the few tools available to the average person to shield their gains from the taxman, just like the big players do.

The division of wealth in the united states isn't going to fix itself overnight. It's a structural reality of the modern world. Staying informed and focusing on asset accumulation—no matter how small you start—is the only way to make sure you aren't the one sweating in the checkout line.

Check your retirement allocations. Make sure your portfolio isn't just sitting in a "safe" savings account that's losing value to inflation. Real wealth comes from ownership. Aim to own.