You buy a stock. You hope the price goes up. That’s the basic "buy low, sell high" mantra we’ve all had drilled into our heads since forever. But there’s this other side of the coin that feels almost like a cheat code when you first discover it. It’s the dividend in stock market circles—basically, a company saying "thanks for sticking with us" by sending a slice of their profits directly into your brokerage account. No selling required.

I remember talking to a friend who thought dividends were some kind of complex debt instrument. Nope. It’s literally just profit sharing. If Apple or Coca-Cola makes a billion dollars, they have choices. They can build a new factory. They can buy back their own shares. Or, they can just cut a check to the people who own the company. That’s you.

The plumbing of a dividend payment

How does this actually work? It’s not like the CEO venmos you.

When a board of directors decides to pay a dividend, they set a few key dates that you absolutely have to know, or you'll end up missing out on the cash. First is the declaration date. This is just the announcement. Then comes the big one: the ex-dividend date. If you buy the stock on or after this date, you aren't getting that specific payment. The person who sold it to you gets it. You need to own the shares before this date.

Then there's the record date, which is just the company’s internal deadline for seeing who is on the books. Finally, you get the payment date. This is the day the money actually hits your account. It’s a bit of a slow process, honestly. Usually, these happen quarterly in the U.S., though some European companies like to do one big "annual" dividend or a "interim" and "final" split.

Why do companies even bother?

You might wonder why a company would "give away" its cash. If Tesla or Amazon historically didn't pay dividends, why does a company like Altria or Chevron do it?

It’s about the stage of the business. High-growth tech companies usually want to reinvest every single penny into becoming the next global hegemon. They don't have "excess" cash because they’re too busy building data centers. But a utility company? Or a massive consumer goods firm? They have steady, predictable cash flow. They don't need to build a new power plant every week. So, to keep investors interested and the stock price stable, they share the wealth.

It’s a signal of strength. A company that consistently raises its dividend for 25 years—these are called Dividend Aristocrats—is telling the market that their business model is basically an ATM. Think companies like Johnson & Johnson or Procter & Gamble.

The math you actually need to care about

Don't get blinded by big numbers. If a stock pays a $5 dividend, is that good? You can't know until you look at the dividend yield.

👉 See also: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

$$\text{Dividend Yield} = \left( \frac{\text{Annual Dividend per Share}}{\text{Stock Price}} \right) \times 100$$

If a stock costs $100 and pays $5 a year, that’s a 5% yield. Pretty solid. But if the stock costs $500 and pays $5, that’s only 1%.

Here is the kicker: high yields can be a trap. If you see a company with a 15% dividend yield, run for the hills—or at least look closer. Usually, the yield is that high because the stock price has crashed. And the stock price crashed because the market thinks the company is about to go bankrupt or cut the dividend. We call this a "yield trap."

Payout Ratios: The "Is this fake?" filter

You have to look at the payout ratio. This tells you what percentage of earnings a company is using to pay that dividend. If a company earns $1 per share and pays out $0.50 in dividends, they have a 50% payout ratio. That’s healthy. They have a "buffer."

But if they earn $1 and pay out $1.10? They’re borrowing money to pay shareholders. That is a ticking time bomb. It’s unsustainable. Eventually, they’ll have to cut the dividend, and when that happens, the stock price usually craters because all the income-seeking investors flee at once.

The magic of the DRIP

If you don't need the cash right now to pay for groceries or a mortgage, you should probably look into a DRIP (Dividend Reinvestment Plan).

Instead of taking the cash, your brokerage automatically buys more shares (or fractional shares) of that same stock. This creates a compounding effect that is honestly hard to wrap your head around over long periods. You own more shares, so next quarter you get a bigger dividend, which buys even more shares.

I’ve seen portfolios where the original "cost basis" was $10,000, but because of twenty years of DRIP, the investor is now getting $2,000 a year in dividends alone. Their "yield on cost" is massive.

✨ Don't miss: USD to UZS Rate Today: What Most People Get Wrong

Different flavors of dividends

Most of the time, we’re talking about cash dividends. Simple.

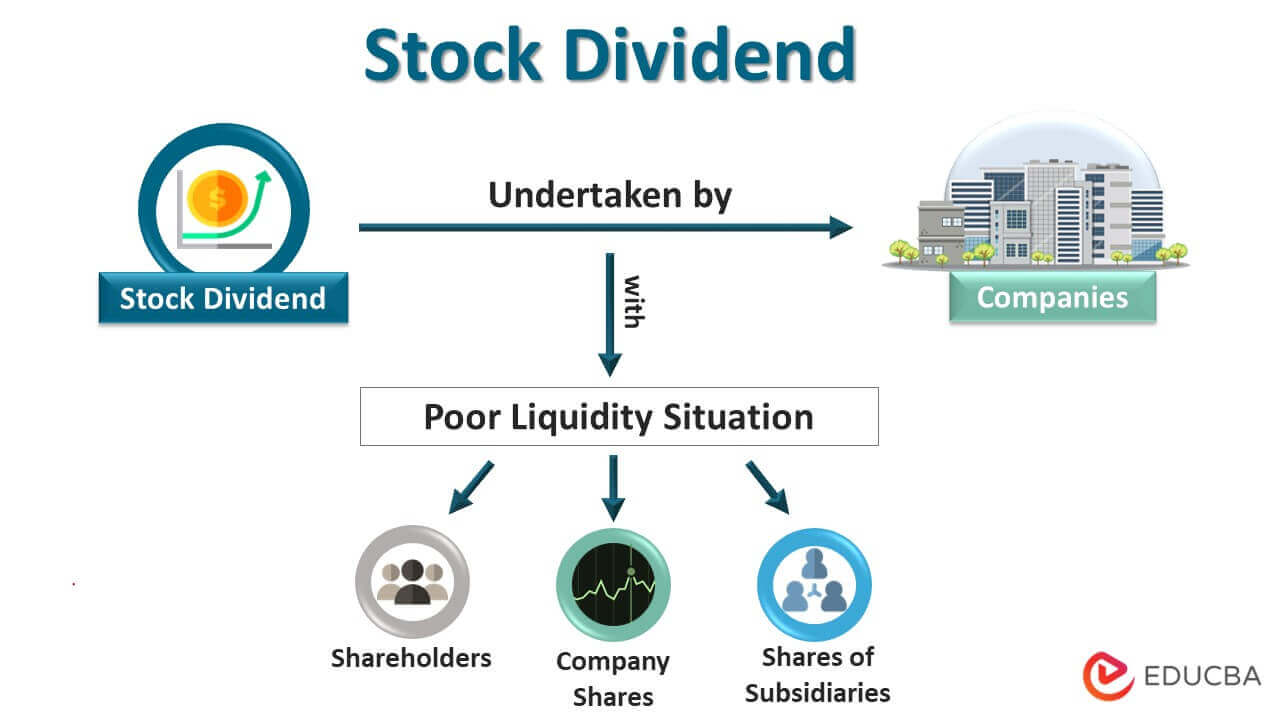

But sometimes, companies do stock dividends. They give you more shares instead of cash. This doesn't actually change the value of your holding (it’s like cutting a pizza into 12 slices instead of 8), but it can lower the price per share to make it more "accessible" to retail traders.

Then there are special dividends. These are one-time "bonuses." Maybe the company sold off a big subsidiary or had a record-breaking year and just wants to flush the cash out to owners. Costco is famous for doing this every few years. It’s like a surprise Christmas bonus for shareholders.

Taxes: The government always wants a slice

Sorry to be the bearer of bad news, but the IRS considers dividends income. However, not all dividends are taxed the same.

Qualified dividends are taxed at the lower capital gains rate (usually 0%, 15%, or 20% depending on your total income). To be qualified, you usually just have to have held the stock for more than 60 days. Ordinary (non-qualified) dividends are taxed at your regular income tax bracket, which can be much higher. This is common with REITs (Real Estate Investment Trusts) because of how they are legally structured.

Real-world example: The 2024 Meta Surprise

For years, Meta (Facebook) was the poster child for "we don't pay dividends, we're a growth company." Then, in early 2024, Mark Zuckerberg announced their first-ever dividend.

The market went nuts. Why? Because it signaled that Meta had matured into a "cash cow" that could both innovate in AI and reward shareholders with cold, hard cash. It changed the narrative of the stock from a risky tech bet to a foundational portfolio staple. It’s a classic move for a company transitioning from its "wild youth" to "stable adulthood."

Where people mess up

The biggest mistake is chasing yield without looking at the business.

🔗 Read more: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

I've seen people buy into dying shipping companies or struggling oil trusts because the yield was 12%. Six months later, the dividend is suspended and the stock is down 40%. You didn't "earn" 12%; you lost a huge chunk of your principal.

Total return is what matters.

$$\text{Total Return} = \text{Capital Gains} + \text{Dividends}$$

If your stock price goes down by 10% but you got a 4% dividend, you're still down 6%. Don't let the "income" distract you from the "loss."

Practical steps to start dividend investing

If you're ready to actually use this information, don't just go buy the highest-yielding stock on a random screener.

- Check the Dividend Aristocrat list. These are S&P 500 companies that have increased their dividends for at least 25 consecutive years. It’s a great starting point for safety.

- Look for Dividend Growth, not just Yield. A company paying 2% today that grows that payment by 10% every year is often a better investment than a company paying 5% that never increases it.

- Use an ETF if you're lazy. There’s no shame in it. Funds like VYM (Vanguard High Dividend Yield) or SCHD (Schwab US Dividend Equity) do the heavy lifting for you. They buy a basket of hundreds of dividend-paying stocks so if one company fails, your whole portfolio doesn't tank.

- Mind the accounts. If you're holding high-dividend stocks or REITs, try to keep them in a tax-advantaged account like a Roth IRA. That way, those quarterly checks don't trigger a tax bill every year, allowing the compounding to work much faster.

- Verify the payout ratio. Before you click "buy" on an individual stock, look up their "Earnings Per Share" (EPS) versus their "Annual Dividend." If the dividend is more than 75% of the earnings, be very skeptical unless it's a utility or a REIT.

Dividend in stock market strategies aren't about getting rich tomorrow. They're about building a snowball. It starts small—maybe enough to buy a cup of coffee. Then it's enough to pay your phone bill. Eventually, if you stay disciplined and keep reinvesting, it's enough to pay your rent. That’s the "passive income" dream everyone talks about, but it's built on boring companies selling toothpaste, insurance, and soda.

Honestly, boring is usually where the money is.