People are constantly refreshing their feeds, asking the same four words: did they pass the bill? It sounds simple. You’d think a "yes" or "no" would suffice, but the U.S. legislative process is rarely that kind. Right now, the "bill" everyone is actually talking about is the Tax Relief for American Families and Workers Act of 2024. It’s a massive piece of legislation that promised to expand the Child Tax Credit and bring back some pretty vital business tax breaks.

It passed the House. It’s sitting in the Senate. And honestly, it’s stuck in the kind of political mud that makes people lose faith in D.C. entirely.

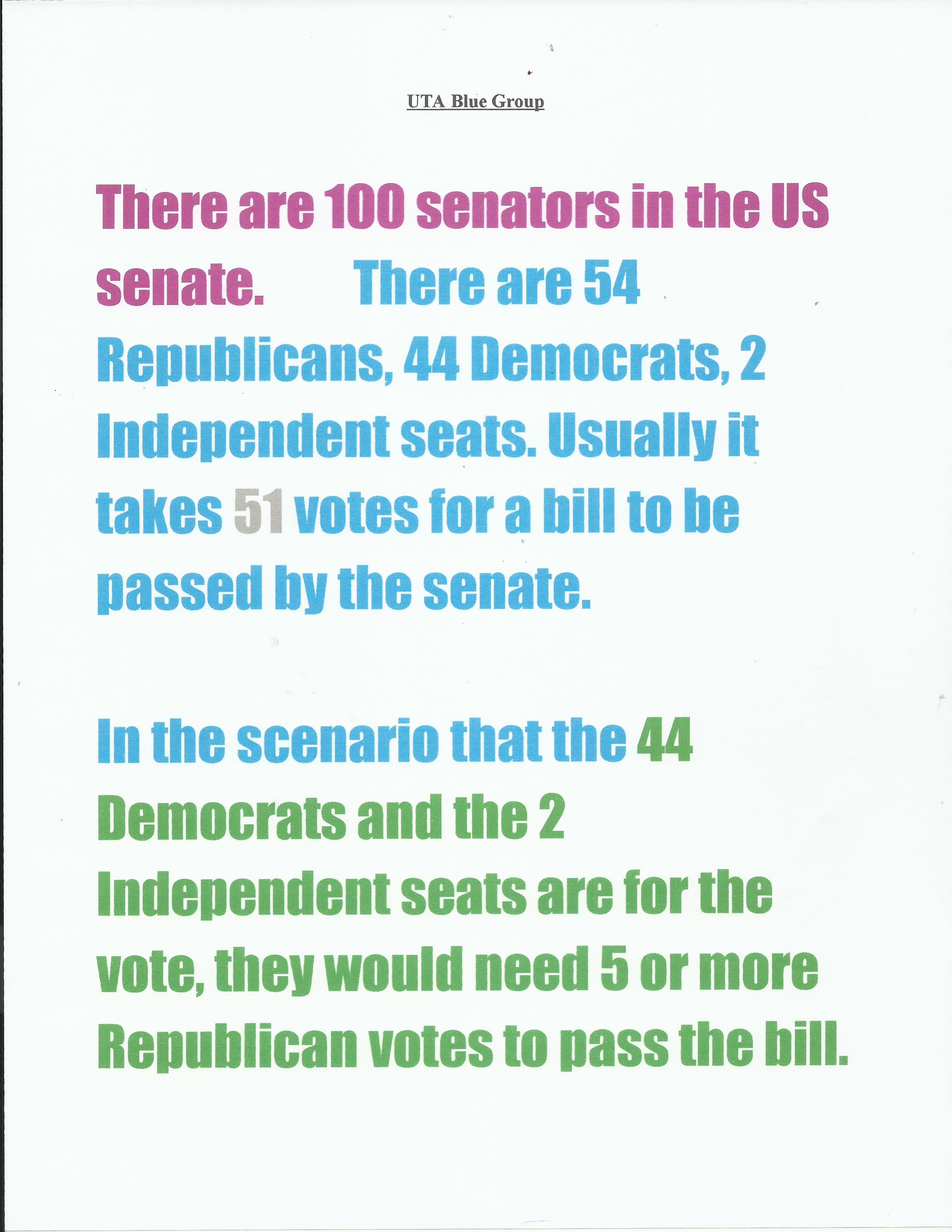

To understand why the answer to did they pass the bill is currently "sort of, but not really," you have to look at the math and the egos involved. This isn't just about money; it's about an election year. In 2026, we’re looking back at a cycle of gridlock that started with high hopes in early 2024. The bill, known technically as H.R. 7024, soared through the House of Representatives with a bipartisan vote of 357-70. That’s huge. In a divided Congress, getting that many people to agree on anything is like finding a unicorn in a parking garage. But then it hit the Senate floor, or rather, it hit the Senate's inbox and stayed there.

The Senate Standoff: Why the Bill is Ghosting You

So, what’s the hold-up? If the House liked it, why didn't the Senate just rubber-stamp it?

Politics.

Senate Republicans, led by figures like Mike Crapo of Idaho, raised serious concerns about the Child Tax Credit (CTC) expansion. They argued that the "lookback" provision—which allows parents to use a prior year's income to qualify for the credit—would discourage people from working. Democrats, on the other hand, viewed this as a lifeline for families struggling with the lingering effects of inflation. It’s a classic ideological divide. One side sees a safety net; the other sees a trap.

🔗 Read more: How Did Black Men Vote in 2024: What Really Happened at the Polls

While they argue, millions of taxpayers are left in limbo. If you're a parent waiting on that increased refund, or a small business owner trying to write off R&D costs, the delay feels like a personal slight. It is.

What was actually in the package?

The bill wasn't just a one-trick pony. It was a trade-off. To get Democrats on board with the Child Tax Credit changes, Republicans wanted—and got—the restoration of three major business tax incentives.

- Research and Development (R&D) Expensing: Instead of spreading the cost over five years, companies could deduct it all at once.

- Interest Deductibility: A more generous limit on how much interest businesses can deduct on their loans.

- 100% Bonus Depreciation: This allowed businesses to immediately write off the full cost of equipment and machinery.

These aren't just "handouts" for the wealthy. They are engines for the economy. When a local machine shop can't deduct the cost of a new lathe immediately, they don't buy the lathe. When they don't buy the lathe, the guy who makes the lathe doesn't get a paycheck. It’s all connected.

The Real-World Impact of "No"

When people ask did they pass the bill, they are usually thinking about their own bank accounts. Let's talk about the Child Tax Credit for a second. The proposed change would have increased the maximum refundable amount per child from $1,600 to $1,800 for the 2023 tax year, eventually hitting $2,000 by 2025.

That might not sound like "buy a private island" money. But for a family in Ohio or New Mexico? That’s four months of groceries. It’s a set of new tires. It’s the difference between saying "yes" or "no" to a child's field trip.

💡 You might also like: Great Barrington MA Tornado: What Really Happened That Memorial Day

The Center on Budget and Policy Priorities estimated that this expansion alone would lift roughly 400,000 children out of poverty. When the Senate balked, those 400,000 kids stayed exactly where they were.

The Confusion of Tax Season

One of the biggest headaches caused by the question did they pass the bill was the timing. The House passed it right as the 2024 tax filing season was kicking off. The IRS Commissioner, Danny Werfel, actually had to go on record telling people not to wait. He told taxpayers to file their returns as usual and promised that if the bill passed later, the IRS would automatically adjust the checks.

Imagine the chaos.

Millions of people were terrified that if they filed early, they’d miss out on thousands of dollars. If they filed late, they’d face penalties. It was a "damned if you do, damned if you don't" scenario created entirely by legislative sluggishness.

Is There Still Hope?

Technically, a bill isn't "dead" until the legislative session ends. But in the world of D.C., a bill that hasn't moved in six months is basically on life support. There have been attempts to attach these tax breaks to "must-pass" spending bills, but leadership often keeps them separate to use as leverage for other fights.

📖 Related: Election Where to Watch: How to Find Real-Time Results Without the Chaos

It’s frustrating.

We’ve seen this movie before. In 2021, the American Rescue Plan temporarily expanded the Child Tax Credit, and it worked. Child poverty plummeted. Then, the expansion expired, and poverty rates climbed right back up. The Tax Relief for American Families and Workers Act was supposed to be the middle ground—a way to bring back some of those benefits without the massive price tag of the 2021 plan.

Misconceptions to Clear Up

- "The bill passed, I'm just waiting for my check." No. If you haven't seen a change in your tax status, it's because the Senate hasn't moved.

- "It's only for low-income families." False. The business tax breaks in the bill affect everything from tech giants to your local construction crew.

- "Both parties hate it." Actually, both parties mostly like it. It’s the 10% they disagree on that’s holding up the 90% they agree on.

The Bottom Line for You

If you are still searching for did they pass the bill, the most accurate answer for today is: The House of Representatives said yes, the Senate has not yet voted, and the odds of it passing in its current form are slimming by the day.

What should you do?

First, don't build your 2026 financial plan around money that hasn't been cleared by the Treasury. If you are a business owner, talk to your CPA about "protective claims." These are essentially placeholders that let the IRS know you might be owed money if the law changes retroactively.

For parents, keep filing your taxes on time. The IRS has become surprisingly good at "math error" corrections, meaning if the bill passes in October, they can often cut you a supplemental check without you having to file a messy amended return.

Next Steps for Taxpayers:

- Check the official Congress.gov page for H.R. 7024 to see the "Latest Action" status.

- Review your 2023 and 2024 filings to see if you would have qualified for the "refundable" portion of the Child Tax Credit.

- If you’re a business owner, keep detailed records of all R&D expenses from 2022 onwards, as any fix is likely to be retroactive.

- Contact your state's Senators. It sounds cliché, but when their phones ring off the hook about a specific tax bill, it moves up the priority list.