You open your mail, see the renewal notice, and honestly? It feels like a gut punch. You haven't had a single accident, your car is getting older, and you’ve stayed loyal to the same company for years. Yet, the price jumped again.

If you're asking did car insurance rates go up, the short answer is a resounding yes. But the "why" is a bit more complicated than just a simple "everything is more expensive now."

Across the United States, the average cost of full coverage car insurance hit $2,638 in 2025. That is roughly a 12% increase from 2024. If that sounds like a lot, consider that in 2024, rates actually spiked by about 16.5% to 19% depending on who you ask. We are essentially living through a multi-year surge where premiums have climbed by over 30% in just a 24-month window.

The Reality Behind Why Did Car Insurance Rates Go Up

It isn't just one thing. It's a "perfect storm" of high-tech fenders, legal fees, and mother nature having a bad year.

Cars are basically computers on wheels now

Think back ten or fifteen years. If you backed into a pole, you maybe dented a piece of metal. You'd hammer it out or swap the bumper for a few hundred bucks.

Now? That same bumper is packed with ultrasonic sensors, cameras, and radar modules for your lane-assist and automatic braking. A "minor" fender bender that used to cost $500 to fix is now a **$4,000 repair job** because all those sensors need to be replaced and recalibrated by a specialist. According to the Bureau of Labor Statistics, the cost of motor vehicle maintenance and repair rose 5.4% just in the last year, and that's on top of double-digit jumps in 2023.

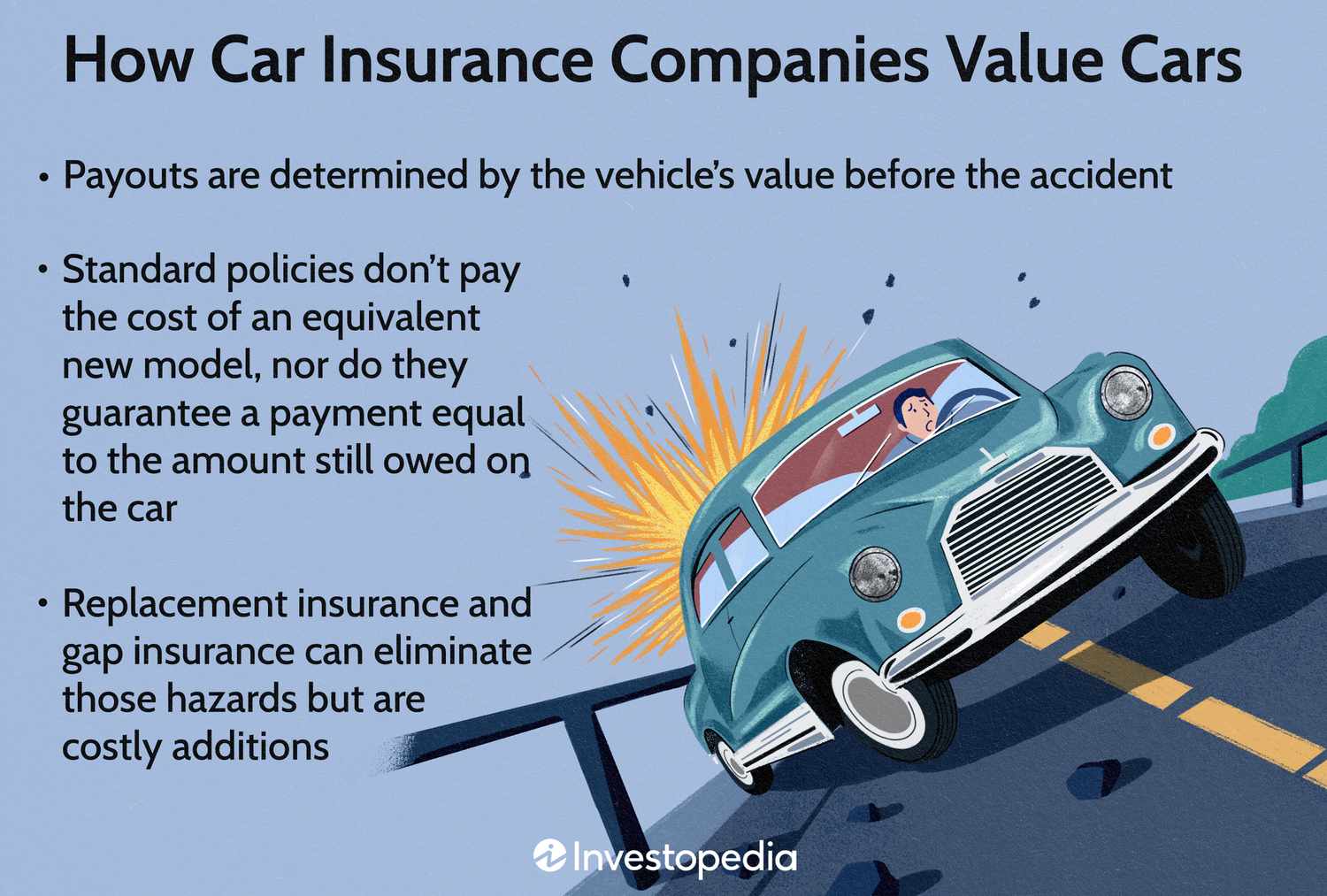

The "Total Loss" problem

Because cars are so expensive to fix, insurance companies are "totaling" vehicles more often. If a car is worth $20,000 but the repair bill is $15,000 because of all the tech, the insurer often decides it's cheaper to just write you a check for the car's value. But since used car prices stayed stubbornly high for a long time, those checks are bigger than they used to be.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Extreme weather isn't just for homeowners

We used to think of "catastrophe risk" as something that only affected house insurance. Not anymore. Between the massive hailstorms in the Midwest and hurricanes like Helene and Milton hitting the East Coast, thousands of cars are getting totaled by water and ice every year.

In Minnesota, for example, hail damage was a primary driver for the state seeing nearly a 20% jump in premiums. When a single storm wipes out an entire dealership's worth of inventory or floods a coastal parking garage, every driver in that pool eventually pays for it.

States Where the Price Hikes Hit Hardest

It's definitely not a level playing field. Where you park your car at night matters just as much as how you drive it.

- Florida and Louisiana: These are consistently the most expensive spots. In Louisiana, people are spending nearly 7% of their total household income just to stay insured.

- Texas: Everything is bigger there, including the rate hikes. Texas saw a 15% jump in 2024, and 2025 hasn't been much kinder, with premiums edging toward that $3,000-a-year mark.

- California and New Jersey: Both states saw massive double-digit jumps (over 15%) recently after years of state regulators keeping rates somewhat suppressed. Now, the "catch-up" is happening all at once.

Interestingly, Michigan—which used to be the most expensive state in the nation—actually saw some stabilization. It's one of the few places where rates didn't skyrocket quite as much lately, though it's still far from "cheap."

The "Invisible" Factors: Credit and Lawsuits

Most people don't realize how much their credit score dictates what they pay for car insurance. In most states (except California, Hawaii, and Massachusetts), insurers use a "credit-based insurance score."

Data shows that a driver with poor credit might pay double what a driver with excellent credit pays, even if both have a perfect driving record. Insurers claim there's a statistical link between credit management and claim risk. Whether that feels fair or not, it's a huge factor in why your rate might have gone up if your debt-to-income ratio shifted recently.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Then there's the legal side. "Social inflation" is a term the industry uses to describe the rising cost of legal settlements. Juries are awarding much higher payouts in accident lawsuits than they used to. To cover these multi-million dollar "nuclear verdicts," insurance companies raise liability limits and premiums for everyone.

Is There Any Relief in Sight?

There’s a tiny bit of good news, but don't go celebrating yet.

The pace of the increases is finally starting to slow down. While 2024 felt like a rocket ship, 2025 is trending toward a more "moderate" 7% to 8% increase. Some experts, like those at LexisNexis Risk Solutions, noted that insurance companies actually started making a profit again in late 2024 and early 2025.

When insurers are profitable, they stop panic-hiking rates. They might even start competing for your business again with better "introductory" rates.

However, there's a new wildcard: Tariffs.

Mark Friedlander from the Insurance Information Institute has pointed out that about 60% of car parts are imported. If new tariffs on countries like China, Mexico, or Canada go into effect, the cost of those parts will go up. If parts go up, repair costs go up. If repair costs go up... well, you know the rest.

What You Can Actually Do About It

Checking "did car insurance rates go up" is usually the first step in a very frustrating afternoon of looking at your budget. But you aren't totally stuck.

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

1. The "Reshop" Rule

If you have been with the same carrier for more than three years, you are probably paying a "loyalty tax." Use an independent agent or a comparison site to get at least three other quotes.

2. Audit Your Mileage

Since the pandemic, a lot of people are working from home or hybrid. If you told your insurer years ago that you commute 40 miles a day, but now you only drive 10, tell them. Dropping into a lower "mileage tier" can save you 5% to 10% instantly.

3. Telematics (The "Spy" In Your Car)

Programs like Progressive’s Snapshot or State Farm’s Drive Safe & Save track your actual driving. If you're a "grandma driver" who doesn't hard-brake or drive at 2 AM, these programs can shave 20% or more off your bill. Just know that if you drive like a maniac, it could actually hurt you in some states.

4. Check Your Deductible

If you have $1,000 in an emergency fund, you shouldn't have a $250 or $500 deductible. Moving to a $1,000 deductible can drop your premium significantly. You're basically telling the insurance company, "I'll handle the small stuff; you just cover the big disasters."

5. Bundle—But Actually Check the Math

Bundling home and auto is usually cheaper, but not always. Sometimes a cheap auto policy from Company A and a cheap home policy from Company B is less expensive than the "bundled" price from Company C.

The reality is that car insurance is no longer a "set it and forget it" bill. It’s a dynamic cost that requires an annual checkup. While the industry is stabilizing, the days of the $600-a-year full coverage policy are likely gone for good.

Actionable Next Steps:

- Pull your current "Declarations Page" to see exactly what coverages you're paying for.

- Call your agent and ask specifically if your credit score has been updated in their system recently, especially if your score has improved.

- Compare quotes from at least two "direct" insurers (like Geico or Progressive) and one "captive" agent (like State Farm or Allstate) to see the spread in your specific zip code.

- Review your car's value. If you're driving an older vehicle worth less than $5,000, you might be overpaying for collision coverage that won't pay out much in a total loss.