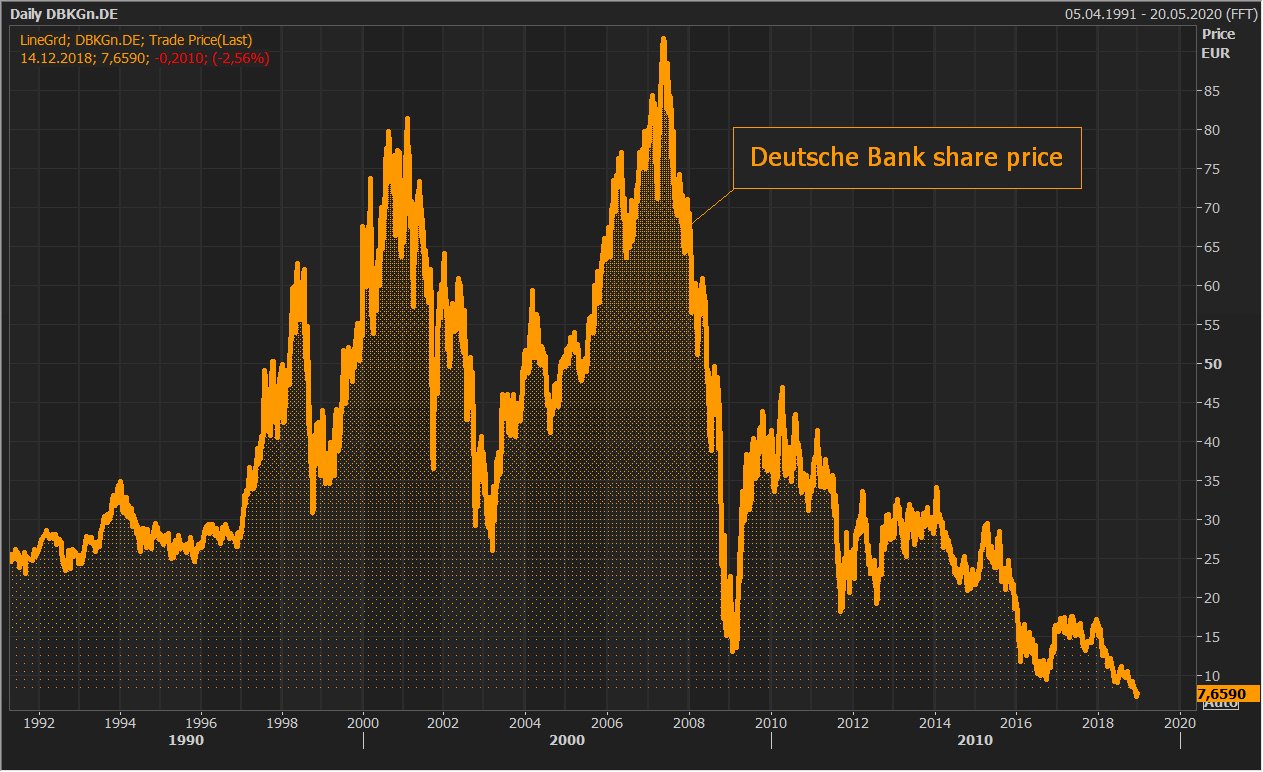

It’s been a wild ride for anyone watching the Deutsche Bank share price lately. Honestly, if you had looked at this stock five years ago, you might have laughed at the idea of it being a "top pick" in 2026. But here we are. On January 15, 2026, the stock is hovering around $39.13 on the NYSE, showing a bit of a mid-day dip but maintaining a massive gain over its 52-week low of $18.56.

Investors are literally asking: Is this a real recovery, or just another "dead cat bounce" for a bank that has spent the last decade breaking hearts?

Why the Deutsche Bank share price is suddenly everyone's favorite topic

Let’s be real. Deutsche Bank used to be the "problem child" of European finance. It was basically a meme for litigation costs and management reshuffles. But something shifted. The bank has been aggressively cleaning up its act. They've been issuing long-dated senior notes—basically locking in funding for the next few decades—and pivoting hard toward technology.

Today, the stock is trading at a P/E ratio of around 11.2, which is kinda cheap when you compare it to some of the American giants. But cheap doesn't always mean "buy."

Recent moves, like the launch of their Vote Connect Total US digital proxy platform and new partnerships in the private banking sector, have actually given the market some confidence. You've got analysts at JPMorgan raising their price targets to €40 ($43.50 approx), while Morgan Stanley is also leaning into a "Buy" rating. It feels like the smart money is finally looking past the scandals of the 2010s.

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The AI tailwind and the 2026 outlook

It’s almost annoying how every conversation ends up being about AI, right? But for Deutsche Bank, it’s actually a core part of their "Capital Markets Outlook 2026." Their Global CIO, Christian Nolting, has been pretty vocal about AI being a structural growth engine.

They aren't just using it to trade; they’re using it to slash operational costs. If they can actually prove that AI makes them more efficient, the Deutsche Bank share price could easily break past its recent 52-week high of $39.82.

Breaking down the numbers (without the corporate fluff)

If you're looking at the ticker right now, you'll see the stock is down about 0.6% today. Big deal? Not really. Most of the European banking sector is taking a breather after a massive 2025.

- Current Dividend Yield: Around 1.85% to 2.0%. It's not a "dividend aristocrat" yet, but they’ve raised it for four years straight.

- Market Cap: Roughly $74.6 billion. That’s huge, but still small compared to JPMorgan or BofA.

- Book Value: The stock still trades at a discount to its book value (around €40.47 per share).

Basically, when you buy Deutsche Bank, you're buying a house that’s been renovated but still has a few "as-is" signs on the lawn. The foundation is solid, but the neighborhood (the European economy) is still a bit shaky.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

Risks that could wreck the party

We have to talk about the risks. Honestly, it’s not all sunshine. The bank has a lot of exposure to U.S. Commercial Real Estate (CRE). If those office buildings in Manhattan and Chicago keep losing value, Deutsche Bank's credit losses could spike.

Also, litigation. It’s the ghost that never leaves. While they've settled most of their big legacy issues, any new regulatory fine can send the Deutsche Bank share price into a tailspin in minutes.

What the experts are saying right now

There is a huge split in opinion. Simply Wall St’s community valuation puts the "fair value" anywhere between €19 and €38. That is a massive range. It tells you that nobody is 100% sure if the "new" Deutsche Bank is here to stay.

However, looking at the technicals, the stock is in a medium-term rising trend. It recently broke through resistance at €31.80 and has stayed above it. When a stock breaks resistance and stays there, it usually means the "floor" has moved up.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

Actionable insights for your portfolio

If you’re thinking about jumping in, don't just chase the green candles.

- Watch the January 29 earnings call. This is the big one. If they beat EPS estimates (currently expected around $0.72 for the quarter), the stock will likely pop.

- Monitor the European Central Bank (ECB). If the ECB keeps rates steady while the Fed cuts, Deutsche Bank’s margins might actually look better than their American counterparts.

- Check the "Fair Value" vs. Market Price. Right now, the stock is trading very close to what many consider "fair value." If it dips toward $35, it might be a better entry point than buying at the top near $40.

The Deutsche Bank share price isn't just a number on a screen; it’s a barometer for how much the world trusts European banks again. It’s been a long road back from the brink, but for the first time in a decade, the bank actually looks like a business instead of a legal department with a vault.

Next Steps for Investors:

Review your exposure to European financials before the January 29th earnings report. If you already hold the stock, setting a trailing stop-loss around the $33.50 mark—which acted as recent support—can help protect the gains from the 2025 rally. For those looking to enter, wait to see if the stock can decisively close above $40 to confirm the next leg of the bull run.