Let’s be real for a second. Banking apps are usually the digital equivalent of a dentist’s waiting room—functional, but you’d rather be literally anywhere else. But the Delta Credit Union app is a bit of an outlier. While giant national banks spend billions on flashy features you’ll never use, Delta Community Credit Union seems to have focused on making sure you can actually deposit a check or pay your mortgage without wanting to throw your phone across the room.

It’s an interesting beast. On one hand, it’s consistently snagging awards from places like MagnifyMoney for being the top-ranked mobile banking app in the country. On the other, if you look at the recent 2026 reviews, some long-time users are definitely feeling some "growing pains" from recent interface updates.

If you’re trying to figure out if this app is actually going to make your life easier or just clutter up your home screen, here is the unfiltered truth about what works, what’s buggy, and how to actually use it.

The Good Stuff: Why It Actually Ranks So High

It’s kinda rare for a credit union to beat out the Chase or Wells Fargo apps of the world, but Delta does it by keeping the "tiny branch in your pocket" vibe alive. Honestly, the best part isn't the complex stuff—it's the Quick Balance feature.

You know when you’re standing in line at the grocery store and you suddenly realize you might not have enough in checking to cover that $80 haul? You don't have time to wait for a FaceID scan and a two-factor code. With Quick Balance, you just swipe down on the login screen and boom: your balances and last five transactions are right there. No login required. It’s a lifesaver, though you should definitely keep a PIN on your phone if you’re going to enable it.

What You Can Actually Do in There

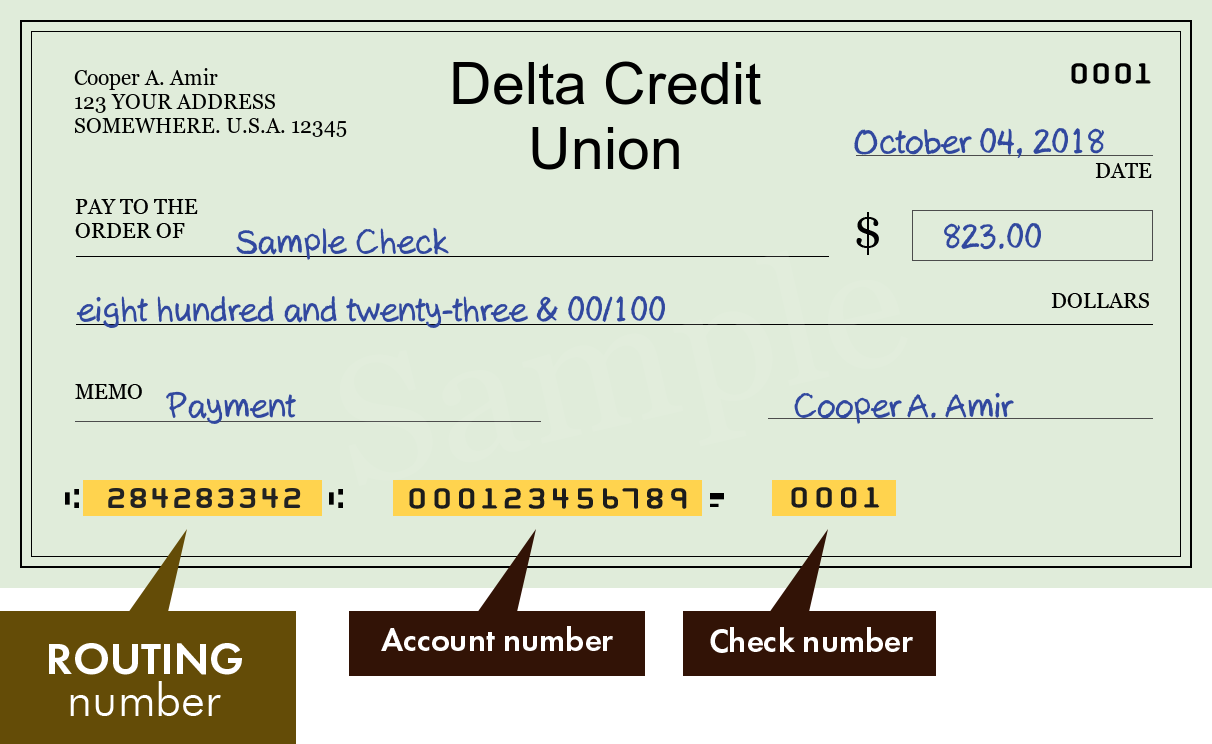

- Mobile Deposits: This is the bread and butter. You take a photo of the check, and it goes in.

- Zelle Integration: It’s built-in. You don't need a separate app to send money to your friends for pizza.

- Loan Payments: You can pay your car loan, personal loan, or even your mortgage directly through the interface.

- Card Management: If you lose your Visa, you can lock it down pretty fast.

The "Check Deposit" Limit Frustration

Here’s a detail that trips people up. As of early 2026, the standard mobile deposit limit for many users is stuck around $1,300.

🔗 Read more: The Stock Market Since Trump: What Most People Get Wrong

If you get a tax refund or a decent bonus check, the app basically says "thanks, but no thanks." You’ll have to drive to a branch or an ATM. It’s a weird bottleneck for an app that is otherwise very modern. Some users have been vocal about wanting this bumped up, especially since most competitors allow $2,500 or more.

Security: The TOTP Situation

Security is tight, maybe even "annoyingly" tight for some. Delta recently leaned heavily into Time-based One Time Passcodes (TOTP).

Basically, instead of just getting a text message (which hackers can sometimes intercept), they want you to use an authenticator app like Google Authenticator or Microsoft Authenticator. It adds a 6-digit code layer that changes every 30 seconds.

If you’re setting this up for the first time, don't just wing it. You have to go into My Settings > Security Options on a desktop first to link the accounts. If you try to do it all on your phone without the QR code, it’s a bit of a headache involving copying and pasting long alphanumeric strings.

Why Some Users Are Grumpy Lately

If you check the App Store or Google Play right now, you’ll see some 1-star reviews buried under the 4.9-star average. Why?

💡 You might also like: Target Town Hall Live: What Really Happens Behind the Scenes

The 2025/2026 updates changed the UI (User Interface) to be much "bolder." Some people hate it. They say the text is too thick, the dates are hard to read, and the transaction screen feels cluttered.

Also, a heads-up for Android users: a common bug recently has been the app not fully closing when you hit "logout." You might have to manually "Clear All" in your open apps to make sure it’s actually shut down. It's a small thing, but if you're obsessive about your phone's battery and security, it’s worth noting.

Quick Troubleshooting Guide

If the Delta Credit Union app is acting like a brick, check these three things before calling support:

- The "Old App" Trap: Delta did a massive overhaul a while back. If you’re still trying to log in with a Member Number and Access Code, you’re using the "ghost" version. You need a customized Username and Password created on their website.

- Biometric Reset: If your FaceID stops working, it’s usually because you changed your password recently. The app forces a biometric re-enrollment every time the password changes for security.

- The "No Accounts" Glitch: Occasionally, the app will show a blank screen saying you have no accounts. Don't panic—your money didn't vanish. Usually, this is just a server sync error. Killing the app and restarting it fixes it 90% of the time.

Setting Up the App the Right Way

To get the most out of it without the headache, do this:

First, go to the App Store or Google Play and make sure you have the version with the butterfly logo. There are some legacy apps out there—avoid them.

📖 Related: Les Wexner Net Worth: What the Billions Really Look Like in 2026

Once you’re in, go straight to Settings > Quick Balance and turn that on for your main checking account. It’ll save you so much time. Then, set up your Alerts. You can get a push notification the second a transaction over $100 (or whatever amount you want) hits your account. It's the fastest way to spot fraud before it becomes a disaster.

If you’re moving from a big bank, you’ll notice the app feels a bit more "local." It includes a map of 70,000+ surcharge-free ATMs, which is actually a bigger network than most national banks.

Next Steps for New Users:

- Enroll in Online Banking first: You can't set up the app until you have a username/password created on a browser.

- Check your deposit limits: Look under the "Mobile Deposit" tab to see your specific daily limit; it varies based on account age and standing.

- Link Zelle: Do this immediately so you don't have to wait for the verification period when you’re actually trying to pay someone back.

The app isn't perfect—no software is—but for a credit union, it’s remarkably polished. Just be prepared for a slightly steeper learning curve if you’re setting up the high-level security features.