You’ve probably been there. You type "DeKalb County tax map" into a search bar, hoping for a simple grid of property lines, but instead, you get hit with a wall of confusing GIS portals, broken "legacy" links, and tax commissioner pages that don't actually show you a map. It’s frustrating. DeKalb County, Georgia, doesn't make it easy to find everything in one spot, especially since they've been migrating their data to newer, shinier "MApps" platforms over the last couple of years.

Honestly, most people just want to know where their property line ends or why their neighbor’s assessment is lower. But the "tax map" isn't just one thing. It is a shifting ecosystem of parcel IDs, land lots, and "neighborhood" codes that determine how much money leaves your bank account every year.

The Tool You're Actually Looking For

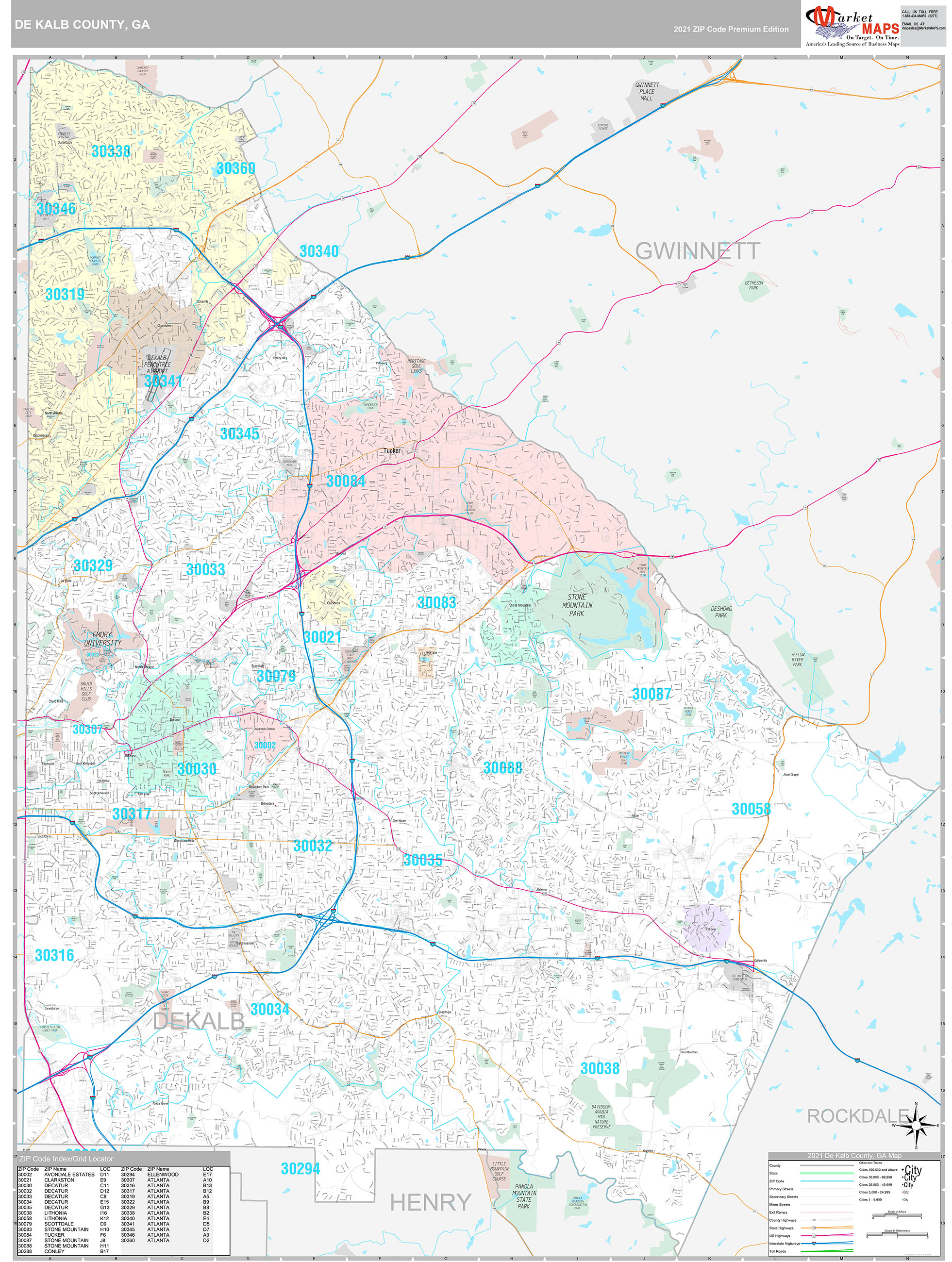

If you’re trying to see a visual layout of land, you’re likely looking for the DeKalb County Property Information Web App. This is the modern version of what people used to call the tax map. It’s managed by the Geographic Information Systems (GIS) department, headed by Stacy Grear. They’ve moved away from the old-school paper-style maps and into an interactive ArcGIS environment.

When you open the current DeKalb County tax map interface, you aren't just looking at lines. You can toggle layers for zoning, floodplains, and even "Commissioner Districts." If you're using the older "Interactive GIS Map," be careful. The county has explicitly stated they are phasing that version out. You want the "Property Information" or "DeKalb Explorer" apps found on the official dcgis-dekalbgis hub.

Wait, there’s a catch. The map is updated frequently, but it isn't "real-time" in the way Google Maps is. If a lot was split or a boundary line was adjusted last week, it might not show up for a while. The GIS staff maintains these official ownership maps for tax purposes, but the actual values attached to them come from a completely different office: the Property Appraisal Department.

Decoding the Parcel ID

Ever looked at a DeKalb Parcel ID and thought it looked like a secret code? It basically is. A typical ID like 15 123 01 045 isn't random.

- 15: This is the Land District.

- 123: This represents the Land Lot.

- 01: This is the Block number, designated by the Tax Assessor.

- 045: This is your specific Lot number.

Knowing this is actually kinda useful if you’re digging through the DeKalb History Center records or trying to find old plat books at the courthouse on McDonough Street. The DeKalb County tax map uses these identifiers to link the physical land to the "Tax Digest," which is the master list of everything the county can tax.

Why Your Assessment Notice Might Be Wrong

Every May, DeKalb sends out the Annual Assessment Notice. In 2026, as home prices in Metro Atlanta continue to fluctuate, these notices are a huge point of stress. The county uses a "mass appraisal" system. They don't walk into your house. They don't even look at your specific backyard. Instead, they group you into a "neighborhood" with similar homes and apply a data-driven value.

Sometimes the DeKalb County tax map data is just plain wrong. Maybe it says you have a finished basement when you’re currently staring at bare concrete and a sump pump. Or perhaps it thinks your lot is 0.75 acres when it's actually 0.5. If the map data is wrong, your tax bill is wrong.

You only have 45 days from the date on that notice to file an appeal. If you miss that window? You're stuck with that value for the year. No exceptions.

The "Freeze" and How to Get It

If you live in the house you own, you need a homestead exemption. Period. In DeKalb, this is a game-changer because of the Property Assessment Freeze. When you get a basic H1 homestead exemption, the county "freezes" the assessed value for the county portion of your taxes.

While your school taxes (which make up a massive chunk of the bill) will still go up as your property value rises, the county portion stays tied to your "base year" value. It's one of the few ways to stay sane while property values in areas like Decatur or Brookhaven skyrocket. Just remember: you have to apply by April 1st. If you bought a house in late 2025 and haven't filed yet, do it now.

📖 Related: IonQ Stock a Buy: What Most People Get Wrong About Quantum Investing

Actionable Steps for Property Owners

Don't just look at the map—use it.

- Verify your acreage: Open the Property Information web app and use the measurement tool. If the county has you down for significantly more land than you actually have, that’s your first piece of evidence for an appeal.

- Check the "Sales Search": Use the Real Estate Data Search tool (the one with the blue sidebar) to look at "Comps." If the DeKalb County tax map shows your neighbor's identical house sold for $50,000 less than your appraised value, take a screenshot.

- Opt into E-Billing: DeKalb allows you to sign up for E-Alerts at dekalbtax.org. It’s better than relying on the USPS to deliver a notice that has a strict 45-day ticking clock.

- Visit the History Center: If you're dealing with a boundary dispute, the DeKalb History Center has 1928 topographic maps and old Sanborn Fire Insurance maps. Sometimes the "current" tax map is just a digital trace of a mistake made forty years ago.

The maps are tools, not absolute truths. If you treat them as the starting point for an investigation rather than the final word, you’ll be in a much better position when tax season rolls around.