You've probably seen the headlines. Maybe you watched NVIDIA’s market cap pull a disappearing act back in 2025 when a relatively unknown Chinese lab released a model that did more with less. Naturally, the first thing any sane person does is open their brokerage app. You type in "DeepSeek" and... nothing. You try "Deep Seek AI." Still nothing. Honestly, it’s frustrating.

Here is the flat-out truth: there is no deepseek ai stock ticker symbol because DeepSeek is not a publicly traded company. You can't buy it on the Nasdaq. You can't find it on the New York Stock Exchange. You can't even find it on the Hong Kong exchange yet.

It’s a private entity, and its ownership structure is unlike almost any other AI titan you’ve heard of. While OpenAI is essentially a complicated marriage with Microsoft, and Anthropic is fueled by billions from Amazon and Google, DeepSeek is the brainchild of a Chinese quantitative hedge fund.

The Secretive Powerhouse Behind the Model

To understand why there isn't a ticker, you have to look at High-Flyer Quantitative Investment Management. Based in Hangzhou, High-Flyer is one of China’s most successful "quant" funds. We’re talking about a firm that, at its peak, managed over $10 billion.

✨ Don't miss: New DeWalt 20V Tools: What Most People Get Wrong

The founder, Liang Wenfeng, didn't follow the Silicon Valley playbook. He didn't spend years courting venture capitalists or begging for Series A funding. Instead, he used the massive profits from his hedge fund to bankroll DeepSeek.

"DeepSeek hasn't raised VC funding in part because Liang believes VCs want to 'exit and hope to commercialize products as soon as possible.'"

Basically, they have "forever money" from their own trading algorithms. This is why they can afford to release models like DeepSeek-V3 and the reasoning-heavy R1 as open-source (under the MIT license). They aren't trying to please shareholders this quarter. They’re trying to dominate the architecture of the future.

🔗 Read more: Memphis Doppler Weather Radar: Why Your App is Lying to You During Severe Storms

How People Are "Trading" DeepSeek (Indirectly)

Since you can't just buy the deepseek ai stock ticker symbol, investors have started playing a game of "six degrees of separation." It’s sort of like trying to invest in a specific chef by buying stock in the company that makes his favorite pans.

- The Hardware Correlation: When DeepSeek releases a new paper showing they can train a world-class model for a fraction of the cost—like the $6 million reported for V3—investors often panic-sell NVIDIA (NVDA). The logic? If DeepSeek proves you don't need 100,000 H100s to be smart, maybe the "GPU gold rush" is over.

- The Chinese Tech Giants: Companies like Alibaba (BABA) and Tencent (TCEHY) are often seen as proxies. These giants are integrated into the Chinese AI ecosystem and often benefit from the open-source breakthroughs DeepSeek puts out into the world.

- The ETF Route: Some people look at the Invesco China Technology ETF (CQQQ). While DeepSeek isn't in it, the sentiment around Chinese AI breakthroughs often lifts the entire sector.

Will There Ever Be an IPO?

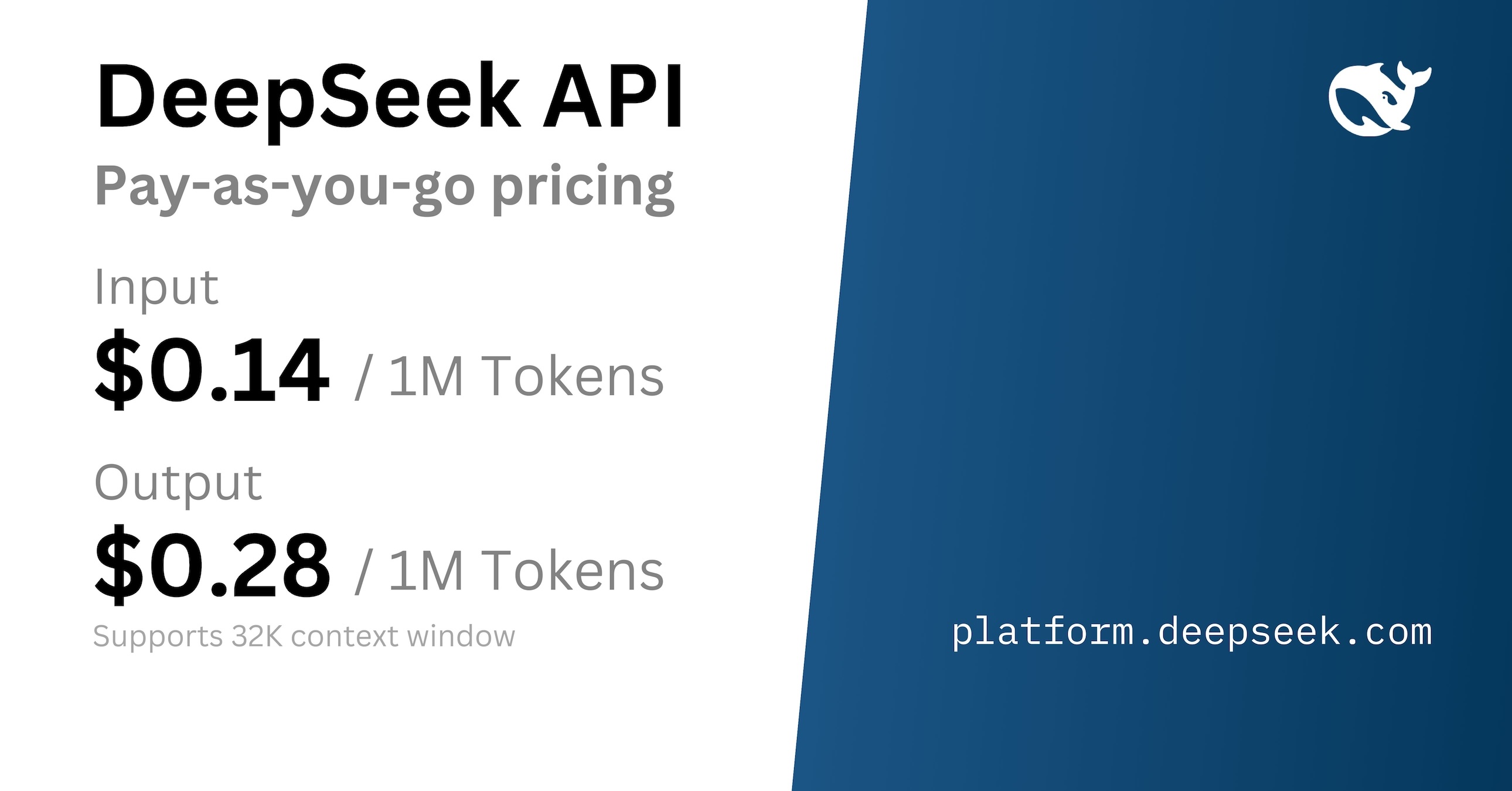

Never say never, but right now, an IPO seems light-years away. For a company to go public, they need a clear path to revenue that justifies a multibillion-dollar valuation. DeepSeek’s current "product" is mostly free or incredibly cheap. Their API costs are a tiny fraction of what OpenAI charges.

Also, there’s the regulatory side of things. Being a Chinese company with significant influence over AI "reasoning" makes a US listing almost impossible in the current political climate. Any future deepseek ai stock ticker symbol would likely appear in Shanghai or Hong Kong first.

💡 You might also like: LG UltraGear OLED 27GX700A: The 480Hz Speed King That Actually Makes Sense

What’s Next for the AI "Disruptor"?

As of early 2026, the buzz is all about DeepSeek V4. It’s rumored to be dropping around the Chinese New Year, and if the leaks are right, it’s going to target coding and logical reasoning with even higher efficiency.

Every time they release something, the market reacts. It’s a weird reality where a company without a stock ticker moves the prices of the biggest companies in the world more than their own earnings reports do.

Practical Steps for Interested Investors

If you were hoping to get in early on the next big AI "moonshot," here is how you should actually handle the lack of a ticker:

- Watch the Secondary Markets: If you are an "accredited investor" (meaning you have a high net worth), platforms like Forge Global or Hiive sometimes have private shares available. But be warned: DeepSeek is 84% owned by Liang himself, so shares are rarer than a quiet day on Wall Street.

- Monitor the "DeepSeek Moment": Stay tuned to their official GitHub and research papers. The real "value" of DeepSeek isn't in a stock price; it's in how their Mixture-of-Experts (MoE) architecture is being adopted by other companies you can invest in.

- Hedge Your AI Bets: If you own a lot of big-tech AI stocks, DeepSeek is your biggest "risk factor." They are the ones proving that AI doesn't have to be expensive. If they keep winning, the profit margins of the US "Magnificent Seven" might actually shrink.

Don't go looking for a ticker that doesn't exist. Instead, watch how this one private lab in Hangzhou keeps making the "trillion-dollar club" sweat.