You’re sitting on your couch, scrolling through a fast-fashion app or maybe a tech site, and you see a pair of sneakers or a new gadget for $75. You click buy. A week later, it shows up at your door. No extra fees. No surprise tax bills. No customs headache. This seamless experience exists because of a legal threshold called the de minimis value. It’s basically the "too small to care" rule of international trade.

Legally, de minimis non curat lex is Latin for "the law does not concern itself with trifles." In the world of shipping and taxes, it means if your package is worth less than a specific dollar amount, the government won’t bother collecting duties or formal paperwork on it. It’s too much work for too little payoff. But honestly, this little-known trade rule is currently at the center of a massive political brawl involving giants like Shein, Temu, and the U.S. government.

What is De Minimis anyway?

At its core, the de minimis threshold is the valuation ceiling for goods that can enter a country duty-free and tax-free. If you stay under the limit, your package sails through customs. If you go over? Prepare for a bill.

In the United States, that magic number is $800.

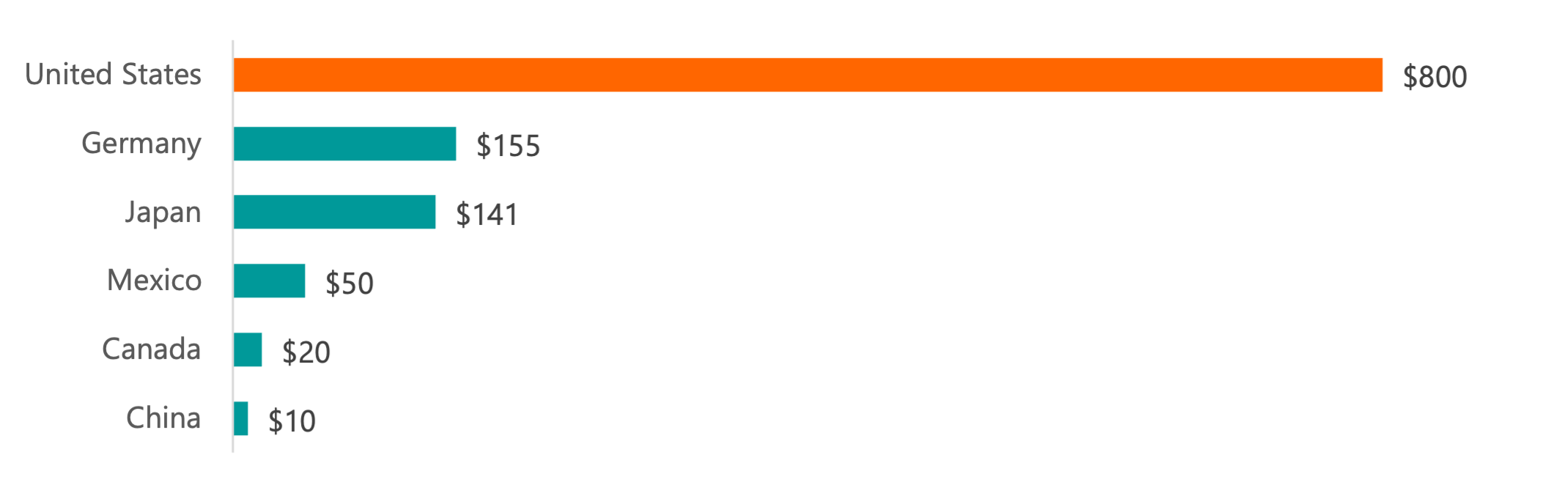

Think about that. You can buy an $800 smartphone from a retailer in Tokyo or London, and as long as it’s for personal use and imported via a carrier like FedEx or USPS, you pay zero import tax. Most other countries aren't nearly that generous. In the European Union, the threshold for VAT (Value Added Tax) was actually scrapped recently for many items to level the playing field for local businesses, though the duty-free limit often sits around €150. In Canada, it’s a measly $20 CAD for most mail items, though it jumps slightly for certain shipments from the U.S. or Mexico under trade agreements.

🔗 Read more: Ford Motor Stock Price Today: What Most People Get Wrong

The U.S. limit wasn't always this high. Before 2016, the American de minimis was only $200. Congress bumped it to $800 to help small businesses reduce paperwork and speed up the supply chain. They didn't really anticipate that it would turn into a highway for millions of individual packages a day.

Why the 2016 jump changed everything

When the Trade Facilitation and Trade Enforcement Act (TFTEA) raised the bar to $800, it was intended to be a bureaucratic time-saver. Customs and Border Protection (CBP) was drowning in small-value packages. By raising the limit, the government could focus its limited manpower on high-value shipments and dangerous goods.

It worked. Too well.

Suddenly, the "Section 321" entry—which is the technical name for these de minimis shipments—became the lifeblood of e-commerce. It allowed international sellers to ship directly to consumers (D2C) without the overhead of traditional importing. If a big retailer like Walmart imports a shipping container of shirts, they pay duties. If you buy those same shirts one by one from an overseas seller, nobody pays duties.

The Shein and Temu Factor

You can't talk about de minimis today without mentioning the explosion of Chinese e-commerce. Companies like Shein and Temu have built billion-dollar empires largely on the back of this $800 loophole. Because they ship individual orders directly from warehouses in China to your doorstep in Ohio or Florida, almost every single one of those millions of packages falls under the $800 limit.

👉 See also: Big Tray San Francisco: Why This Iconic Kitchen Equipment Giant Actually Closed

This gives them a massive price advantage.

While a local American shop has to pay for shipping, storage, and the initial import duties on their inventory, a direct-to-consumer platform skips the duty part entirely. Retail groups and labor unions are, quite frankly, furious about it. They argue it’s a "hidden subsidy" for foreign companies that hurts the American high street.

But it’s not just about money. CBP officials have testified that the sheer volume of these packages—over a billion a year now—makes it nearly impossible to screen for things like fentanyl, counterfeit goods, or products made with forced labor. When a package is "de minimis," it requires very little data. Sometimes it’s just a vague description like "apparel" and a value.

Recent crackdowns and policy shifts

Things are changing fast. In late 2024 and heading into 2025, the Biden-Harris administration and various members of Congress started moving to tighten these rules.

One major proposal involves excluding certain goods—like those subject to "Section 301" tariffs (mostly goods from China)—from being eligible for de minimis treatment. If that happens, that $15 shirt might suddenly cost $20 or $25 once the duties and processing fees are tacked on. The government is also pushing for "Type 86" entry changes, which would require these fast-shipping companies to provide much more detailed data on what’s inside the box before it even hits U.S. soil.

How this actually affects your wallet

If you’re a consumer, you’ve probably never thought about de minimis. You just like the low prices. But if the threshold is lowered or the rules are tightened, you’re going to feel it in three specific ways:

- Price Hikes: Retailers aren't going to eat the cost of new duties. They’ll pass them to you.

- Shipping Delays: If customs has to manually inspect or process paperwork for millions of additional packages, "fast shipping" becomes a memory.

- Returns Complexity: Shipping something back internationally is already a nightmare. If you paid duties on the way in, getting a refund on those taxes when you return a defective item is a bureaucratic marathon.

There’s also the business side. Small businesses that rely on importing components or specialized tools from overseas under the $800 limit might find their margins evaporated overnight. It's a classic example of a policy that helps one group (local manufacturers) while potentially hurting another (small assembly businesses and consumers).

💡 You might also like: 1 US Dollar to Qatari Riyal: Why the 3.64 Rate Never Moves

Misconceptions about the "Loophole"

A lot of people think using the de minimis rule is "cheating." It’s not. It’s a completely legal trade provision. However, it was designed for a world where people occasionally bought a souvenir from abroad, not a world where we order a single charging cable from halfway across the globe every Tuesday.

Another big myth? That de minimis applies to everything.

It doesn't.

Alcohol and tobacco are almost always excluded. You can't ship a $100 bottle of rare Japanese whisky and expect it to be duty-free just because it's under $800. Some "special" categories like perfume containing alcohol or certain agricultural products also face immediate scrutiny regardless of their value.

Real-world examples of the "Trifle" rule

Imagine you're a photographer. You order a specific lens filter from a boutique shop in Germany for $150.

- In the U.S.: It arrives. You pay $150. Done.

- In the U.K.: The de minimis for VAT is basically zero for most commercial goods now. You'd likely pay the $150 plus 20% VAT, plus a "handling fee" to the courier for the privilege of them collecting that tax for the government.

That difference is why the U.S. has seen such a massive surge in international e-commerce compared to other nations. We’ve made it incredibly easy to buy from abroad.

The dark side: Safety and Fentanyl

We have to talk about the serious stuff. Law enforcement is worried. The "small package" problem is a primary vector for the fentanyl crisis. Because the de minimis rule allows for "informal entry," the data provided to customs is often garbage. "Gift" or "Daily Necessities" are common labels used by bad actors to hide illicit chemicals.

When you have 4 million packages entering the country every single day under Section 321, you simply cannot X-ray every one. You can't dog-sniff every one. It’s a needle in a haystack where the haystack is growing by the second. This is the strongest argument for lowering the threshold—not to collect more tax, but to force better data collection so the "bad" packages are easier to spot.

What happens next?

The debate over de minimis isn't going away. You’re likely to see a "bifurcated" system soon. High-risk categories like textiles or electronics from certain countries might lose their duty-free status, while your aunt shipping you a birthday sweater from Italy remains unaffected.

If you’re an e-commerce seller, you should be diversifying your supply chain now. Relying on "direct-from-China" duty-free shipping is a risky bet for 2026. The political winds have shifted. Both parties in the U.S. seem to agree that the $800 limit is a bit too "wild west" for the current economic climate.

Actionable Steps for Navigating De Minimis

If you frequently buy or sell goods internationally, don't get caught off guard by shifting regulations. Here is what you should do:

- Check the Country's De Minimis: Before shipping, use a tool like the International Trade Administration's website to check the threshold of your destination country. Don't assume everyone is as relaxed as the U.S.

- Audit Your "Section 321" Usage: If you're a business owner, calculate how much of your profit margin depends on that $800 exemption. If that exemption dropped to $50 tomorrow, would you go bankrupt? If yes, you need a domestic warehousing strategy.

- Demand Better Data: If you are importing, ensure your shippers provide precise "HS Codes" (Harmonized System codes). Even for de minimis shipments, having the right code can prevent your package from being flagged and delayed for "vague description."

- Watch for New Fees: Keep an eye on your checkout screens. Many platforms are starting to "pre-collect" estimated duties even for low-value items just to avoid customs hold-ups. If you see a "landed cost" at checkout, take it—it’s usually cheaper than the fee a courier will charge you at your door.

- Stay Informed on Legislation: Follow the "De Minimis Reciprocity Act" or similar bills in the House and Senate. These are the specific pieces of law that will determine if your next online haul gets a 25% price bump.