DBS Group Holdings Limited isn't just another bank. Honestly, if you live in Southeast Asia, it’s practically the air you breathe. Whether you're tapping a card for a latte in Orchard Road or looking at regional trade finance, DBS is usually the name behind the screen. It’s huge. It's the largest bank in Southeast Asia by assets, and for a long time, it’s been the "safe bet" for investors looking for stability in the "Little Red Dot." But things are changing. Between shifting interest rates and a massive push into digital assets, DBS Group Holdings Limited is facing a landscape that looks a lot different than it did even five years ago.

You’ve probably heard people call it the "World’s Best Bank." They’ve won that title from Euromoney and Global Finance more times than most people can count. But what does that actually mean for someone holding the stock or someone wondering if their money is safe? It’s not just about having a flashy app. It’s about how they’ve managed to turn a traditional, somewhat stuffy government-linked corporation into a tech company that just happens to have a banking license.

The Piyush Gupta Era and the Tech Transformation

When Piyush Gupta took the helm back in 2009, DBS was a different beast. It was reliable, sure, but it wasn't exactly "cool." Gupta, a Citibank veteran, basically told everyone that DBS needed to stop acting like a bank and start acting like a startup. He famously used the acronym "GANDALF" to describe the company’s tech aspirations—referencing Google, Amazon, Netflix, Deutsche Bank (the "D" they wanted to replace), LinkedIn, and Facebook. It sounds a bit cheesy, I know. But it worked.

They moved their infrastructure to the cloud. They started hiring more engineers than bankers. This wasn't just for show; it allowed them to scale across India and Indonesia without needing to build thousands of physical branches. By the time the 2020s rolled around, DBS Group Holdings Limited was already miles ahead of its regional peers in terms of digital integration.

But here’s the thing: being a tech leader comes with massive risks. We saw this in 2023 when DBS suffered a string of high-profile digital banking outages. It was a mess. Customers couldn't access their accounts for hours, and the Monetary Authority of Singapore (MAS) wasn't happy. They actually hit the bank with capital requirements penalties. It was a humbling moment. It proved that you can have the best tech in the world, but if the "plumbing" fails, the trust goes with it.

Why the Dividend Matters So Much

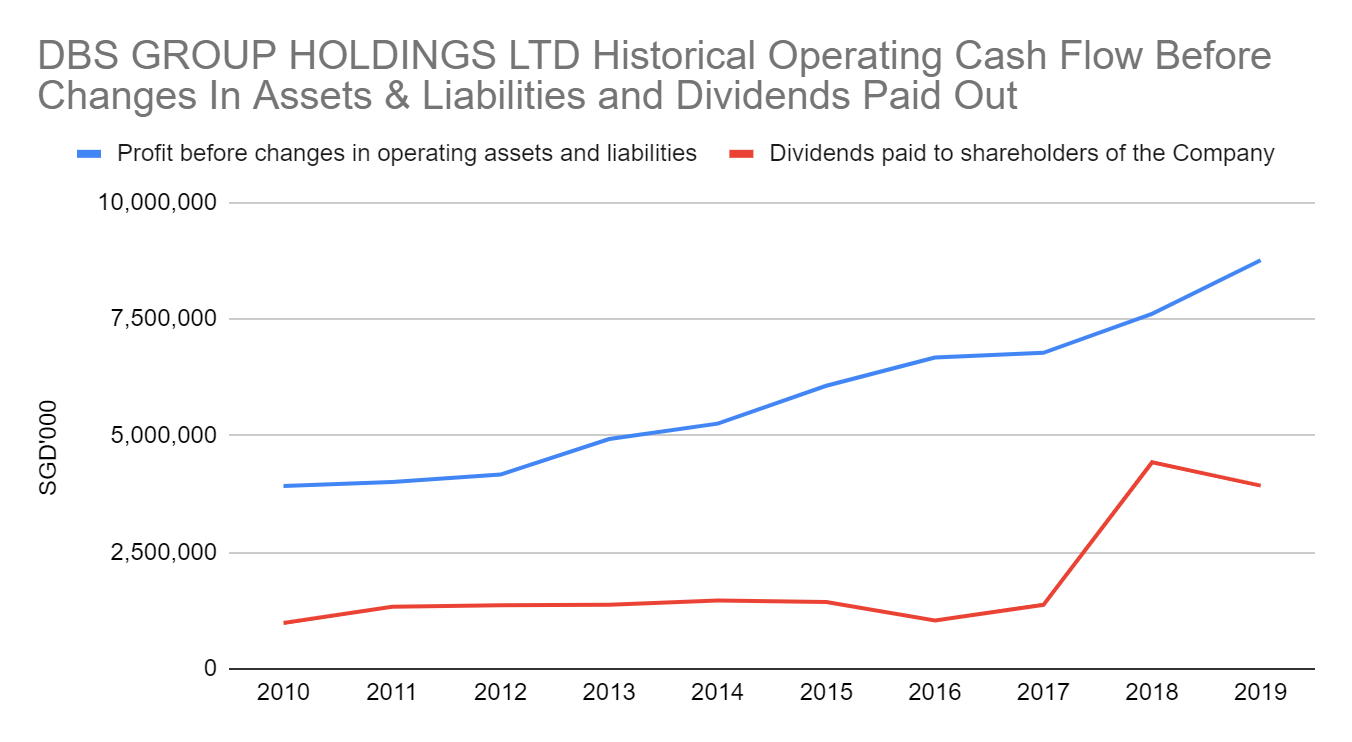

If you talk to any "uncle" or "auntie" in Singapore about DBS Group Holdings Limited, they won't talk about cloud computing. They’ll talk about the dividends. DBS has a reputation for being a dividend powerhouse. Because Temasek Holdings (Singapore's sovereign wealth fund) owns a massive chunk of it, there’s an inherent expectation of consistent returns.

In recent years, the bank has moved toward a quarterly dividend payout, which investors love for the cash flow. But keep an eye on the payout ratio. While they’ve been generous, banking is a cyclical game. When interest rates are high, DBS makes a killing on the Net Interest Margin (NIM). They borrow low and lend high. But as global central banks start to toy with rate cuts, that margin gets squeezed.

Beyond Singapore: The Greater China and India Play

Singapore is a tiny market. It’s wealthy, but it’s saturated. For DBS Group Holdings Limited to keep growing, it has to look North and West.

Their acquisition of Citibank’s consumer banking business in Taiwan was a massive move. It instantly made them the largest foreign bank in Taiwan. Why does that matter? Because Taiwan is a hub for wealth management and tech-sector financing. But it also puts DBS right in the middle of geopolitical tensions. If things get rocky between China and Taiwan, DBS is exposed in a way a purely domestic bank wouldn't be.

Then there’s India. DBS has been trying to crack the Indian market for decades. They finally got a big break with the acquisition of Lakshmi Vilas Bank in 2020. This gave them a physical footprint in Southern India that they never had before. It was a bold play—taking over a struggling local bank—but it showed that DBS is willing to get its hands dirty to capture the growing Indian middle class.

👉 See also: Why the US Steel Nippon Steel Deal Became America's Biggest Political Headache

The Crypto and Digital Asset Gamble

Most traditional banks run away from crypto. DBS Group Holdings Limited did the opposite. They launched the DBS Digital Exchange (DDEx). It’s an institutional-grade platform for trading digital assets, including Bitcoin and Ethereum.

They aren't trying to be a "crypto bro" exchange. They are targeting high-net-worth individuals and institutional investors who want to trade crypto but don't trust unregulated platforms. It’s a smart move. It positions them as the "adult in the room" in the digital asset space. However, the volume on these exchanges is highly volatile. It’s a great talking point for their tech credentials, but it doesn't always move the needle on the bottom line as much as traditional mortgages or corporate loans do.

Understanding the Risks: It’s Not All Sunshine

No bank is bulletproof. For DBS, the biggest risk is probably its concentration in the property market. Singapore’s real estate prices have been on a tear, and a huge portion of the bank’s loan book is tied up in mortgages and building loans. If the Singapore property bubble ever pops—or even just deflates significantly—DBS will feel it first.

- Asset Quality: Keep an eye on non-performing loans (NPLs). During economic downturns in China or Southeast Asia, SMEs struggle, and that reflects on the bank's balance sheet.

- Regulatory Scrutiny: As mentioned, MAS is a tough regulator. They don't tolerate downtime. If DBS has more technical glitches, expect heavier fines and more restrictions on their growth.

- Geopolitics: Being a bridge between the West and China is lucrative until the bridge gets caught in the crossfire. Trade tensions can drastically reduce the volume of letters of credit and trade financing that DBS handles.

What Most People Get Wrong About DBS

People often think DBS Group Holdings Limited is just a proxy for the Singapore economy. While that’s partially true, it’s increasingly a proxy for Asian trade. They are heavily involved in the "China plus one" strategy, where companies move manufacturing out of China and into places like Vietnam or Indonesia. DBS is the one financing those new factories.

Also, don't assume that because they are "government-linked" they are inefficient. In fact, DBS is often more aggressive and innovative than its private-sector rivals, UOB and OCBC. They compete fiercely for talent, often poaching people from top Silicon Valley firms.

Practical Steps for Your Portfolio

If you’re looking at DBS Group Holdings Limited as an investment or just trying to understand its place in the market, here’s how to actually use this information:

- Watch the Fed, not just Singapore: Because the Singapore Dollar is managed against a basket of currencies and local interest rates often track the US Federal Reserve, the Fed's decisions have a massive impact on DBS's profitability. If the Fed cuts rates, expect the Net Interest Margin (NIM) at DBS to tighten.

- Monitor the Wealth Management Fee Income: Since interest rates are unpredictable, DBS is trying to grow its "fee income." This comes from selling insurance, managing portfolios, and charging for credit cards. If fee income is growing, the bank is becoming less dependent on the "spread" and more like a diversified financial services firm.

- Check the CET1 Ratio: This is the bank’s "rainy day fund." DBS usually keeps a very strong Common Equity Tier 1 (CET1) ratio, often well above regulatory requirements. If this starts to dip, it might mean they are getting too aggressive or facing internal stress.

- Keep an eye on the CEO succession: Piyush Gupta has been the face of DBS for a long time. Any news about his eventual departure or a successor will cause a ripple in the stock price. The market hates uncertainty, especially when a leader has been this transformative.

DBS Group Holdings Limited remains a cornerstone of the Asian financial system. It’s a weird, successful hybrid of a stable utility and a high-growth tech firm. It has its flaws—mainly the occasional tech hiccup and heavy exposure to regional property—but its ability to adapt has kept it at the top of the pile. Whether you're a customer or an investor, you can't ignore the fact that as Asia grows, DBS is positioned to be the one holding the keys to the vault.