You’ve probably seen the name pop up while scrolling through sports trivia or checking the sidelines during a big NFL game. Usually, it’s linked to Tracy Wolfson. But honestly, if you’re looking for David Reichel net worth data, you’re going to find a lot of "internet math" that doesn't quite add up.

David isn’t a flashy Hollywood star. He isn't a tech billionaire with a public ticker tape of his assets. Instead, he’s a high-level finance executive who has spent decades navigating the shark-infested waters of Wall Street and global banking.

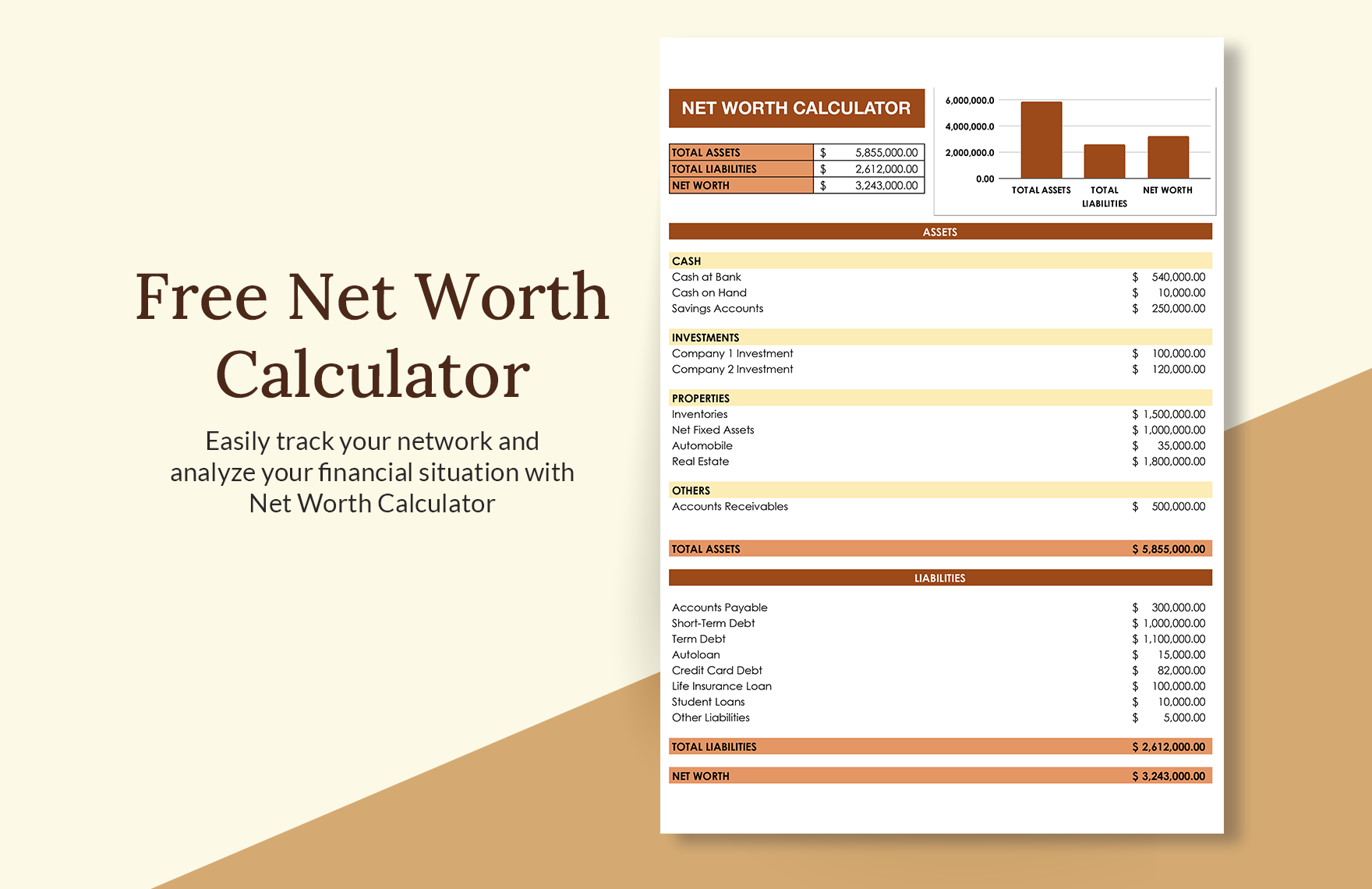

Estimates online often peg David Reichel’s net worth around $2 million to $5 million, but that’s kinda just the tip of the iceberg when you look at his actual career trajectory. When you’re dealing with senior roles at firms like Barclays Capital, "net worth" is a moving target built on bonuses, equity derivatives, and long-term investments rather than just a flat salary.

The Finance Engine Behind the Scenes

Most people know him as the husband of CBS Sports’ lead sideline reporter, Tracy Wolfson. While she’s the one talking to Patrick Mahomes or Tom Brady on national TV, David is busy managing relationships with some of the world’s largest asset management firms.

✨ Don't miss: CDW Layoffs July 2025: What Most People Get Wrong

He didn't just stumble into this.

David Reichel is a heavy hitter in the world of equity derivatives. He currently serves as a senior salesperson at Barclays Capital. Before landing there, he was the head options trader at Bascom Hill Partners, which is an equity-focused hedge fund. You don't get those jobs by being average. You get them by understanding risk, leverage, and the kind of complex financial instruments that would make most of our heads spin.

A Career Built on Strategy

- University of Michigan: Graduated in 1996 with a BA in Economics.

- NYU Stern School of Business: Earned his MBA in Finance and Economics in 2001.

- The Big Leagues: Held major roles at Citigroup and Credit Suisse, specifically running the technology and media sector derivatives trading books.

If you know anything about Wall Street pay structures, you know that senior roles in derivatives trading and sales at tier-one banks like Barclays and Citi come with significant compensation packages. We’re talking base salaries that are impressive, but bonuses that can often double or triple that base depending on market performance.

Comparing the Power Couple’s Earnings

It’s actually pretty interesting to see how their careers parallel. Tracy and David both went to Michigan (though they didn't start dating until after college). While Tracy was building her brand as one of the most respected voices in sports broadcasting, David was climbing the ladder in the financial sector.

Tracy Wolfson’s net worth is often estimated at $5 million, with an annual salary reportedly around $1 million. When you combine that with David’s career in finance, the household’s total wealth is substantial.

They live in Tenafly, New Jersey—a town known for being home to high-earning professionals and families who want a quiet life outside the NYC chaos. It’s not about flashy red carpets for them. It’s about raising their three sons—Dylan, Ari, and Evan—and staying grounded.

Why the $2 Million Estimate is Likely Low

Let’s be real. Most celebrity net worth websites use basic algorithms. They see "Finance Professional" and "New Jersey" and spit out a conservative number.

But look at the math:

David has been in the industry for over 25 years. He’s worked at Credit Suisse, Citigroup, and now Barclays. In the world of equity derivatives, senior sales and trading roles are some of the most lucrative positions in the bank.

If you factor in:

- Decades of high-six-figure (and likely seven-figure) earnings.

- Strategic investments made with the knowledge of a professional options trader.

- Real estate appreciation in the New Jersey/New York area.

It’s highly probable that his personal contribution to the family’s net worth exceeds the generic $2 million figure floating around. However, because David keeps a low profile and doesn't flaunt his wealth on social media, the exact numbers remain speculative.

The "Other" David Reichels

If you’re confused by different stats, it might be because there are a few David Reichels out there.

🔗 Read more: Debt consolidation loans calculator: Why your math is probably lying to you

There’s a David Reichel who was a standout basketball player at Cal State San Bernardino. There’s a Dr. David Reichel who is an internist in Florida. And there’s even a David Reichel who is a researcher for the EU Agency for Fundamental Rights.

The David Reichel we’re talking about—the finance pro married to Tracy Wolfson—is the one whose net worth is most often queried because of his proximity to the sports world.

The Reality of Private Wealth

In an era where everyone wants to show off their bank account, David Reichel is a bit of an anomaly. He’s successful, but he’s private. He coaches his kids’ basketball teams and goes to Michigan games.

His wealth isn't just about a number on a screen. It’s about the stability it provides for a high-profile family where one parent is constantly traveling for the NFL and March Madness.

How to Think About This Data

If you are looking at David Reichel as a case study for building wealth, the takeaway isn't "marry a sports reporter." It’s "specialize in a high-value niche." Derivatives trading and institutional sales are high-barrier-to-entry fields. David used a top-tier education (Michigan and NYU Stern) to bridge into a sector where the earning potential is virtually uncapped if you can handle the pressure.

👉 See also: Getting Your Freightliner in Bryan TX Fixed Without Losing Your Mind

Actionable Insights for Your Own Path:

- Education Matters: Notice the MBA from NYU Stern. In finance, pedigree and specialized degrees act as a massive multiplier for your lifetime earnings.

- Niche Down: David didn't just go into "business." He specialized in technology and media sector derivatives. The more specific your expertise, the more indispensable you are.

- Support Systems: Success in high-pressure jobs (like Wall Street or Sideline Reporting) requires a partner who understands the grind. The Reichel-Wolfson "teamwork" approach is a blueprint for high-earning households.

Don't get hung up on the specific $2 million or $5 million number. Focus on the career longevity. Twenty-five years of consistent, high-level performance in finance is the real engine behind the David Reichel net worth story.

To better understand how these types of finance roles are compensated, you can look into the annual salary reports for "Managing Director" or "Senior Sales" roles at bulge-bracket banks like Barclays. You'll find that the total compensation—including deferred stock and bonuses—is what truly builds that long-term net worth.