You’ve probably heard the voice. That booming, Tennessee-inflected baritone telling a caller to "live like no one else so that later you can live like no one else." It’s Dave Ramsey. And when he starts talking about the Dave Ramsey and 401k strategy, people tend to have one of two reactions: they either start cutting up their credit cards in a frenzy of excitement, or they roll their eyes at his "outdated" math.

Honestly, the middle ground is where the truth usually sits.

Most people get the 401k part of the Ramsey plan wrong because they ignore the order of operations. You can't just jump into a 401k because your boss offered a match. Well, you can, but Dave would tell you you’re being "stupid with a capital S" if you still have credit card debt. He wants you to stop all investing—yes, even the free match—until you’ve cleaned up your mess. It sounds crazy. It feels like leaving money on the table. But the logic is basically about focus.

Why the Ramsey 15% Rule is Actually a Math Trap

If you’re following the Baby Steps, you don't touch your 401k until Baby Step 4. That’s after the $1,000 emergency fund and after the debt snowball is finished. Once you hit Step 4, the magic number is 15%.

Not 10%. Not "whatever the company matches."

💡 You might also like: Hello Class Action Lawsuit: What Most People Get Wrong About the Toothpaste Settlement

Fifteen percent of your gross household income. In 2026, the 401k contribution limits have climbed to $24,500. For most folks, 15% won't even hit that ceiling, but the goal isn't necessarily to "max it out" just for the sake of it. It’s to hit that specific percentage consistently.

The Match vs. The Roth

Dave’s hierarchy for your 15% is pretty straightforward, though it requires a bit of calculator work:

- The Match: If your company gives you a 401k match, you invest there first. Only up to the match, though.

- The Roth IRA: After you’ve grabbed the match, you move any remaining money from that 15% into a Roth IRA. Why? Because taxes are a beast. Dave loves the Roth because your money grows tax-free.

- Back to the 401k: If you still haven’t hit your 15% total after maxing out the Roth IRA (which is $7,500 for most people in 2026), you go back to the traditional 401k to finish the job.

Wait, what if your company offers a Roth 401k?

That's the "holy grail" in the Ramsey world. If you have a Roth 401k with good mutual fund options, you can just dump the whole 15% in there and call it a day. No need to mess with outside IRAs unless your fund choices are total garbage.

The 12% Return Debate: Is He Dreaming?

This is the part where "Wall Street" guys usually start screaming. Dave Ramsey famously claims you can expect a 12% average annual return on your 401k if you invest in "good growth stock mutual funds."

Is that realistic? Sorta.

✨ Don't miss: 40000 yuan to usd: What Most People Get Wrong

If you look at the S&P 500's historical average since its inception, the number is close to 11% or 12%. But there's a catch. Inflation exists. And the "real" return—what your money actually buys you—is usually closer to 7% or 8%.

When Dave says 12%, he’s using the "average annual return." Most financial planners prefer the "geometric mean" or the "compound annual growth rate" (CAGR). If the market goes up 100% one year and down 50% the next, your "average" is 25%, but your actual money stayed exactly the same. You have $0 in gains.

Dave isn't technically lying, but he's being an optimist. He uses that 12% number to keep people motivated. It's much easier to save $500 a month when the calculator says you'll be a multi-millionaire, rather than "just okay."

Picking the Right Funds Without Getting Fancy

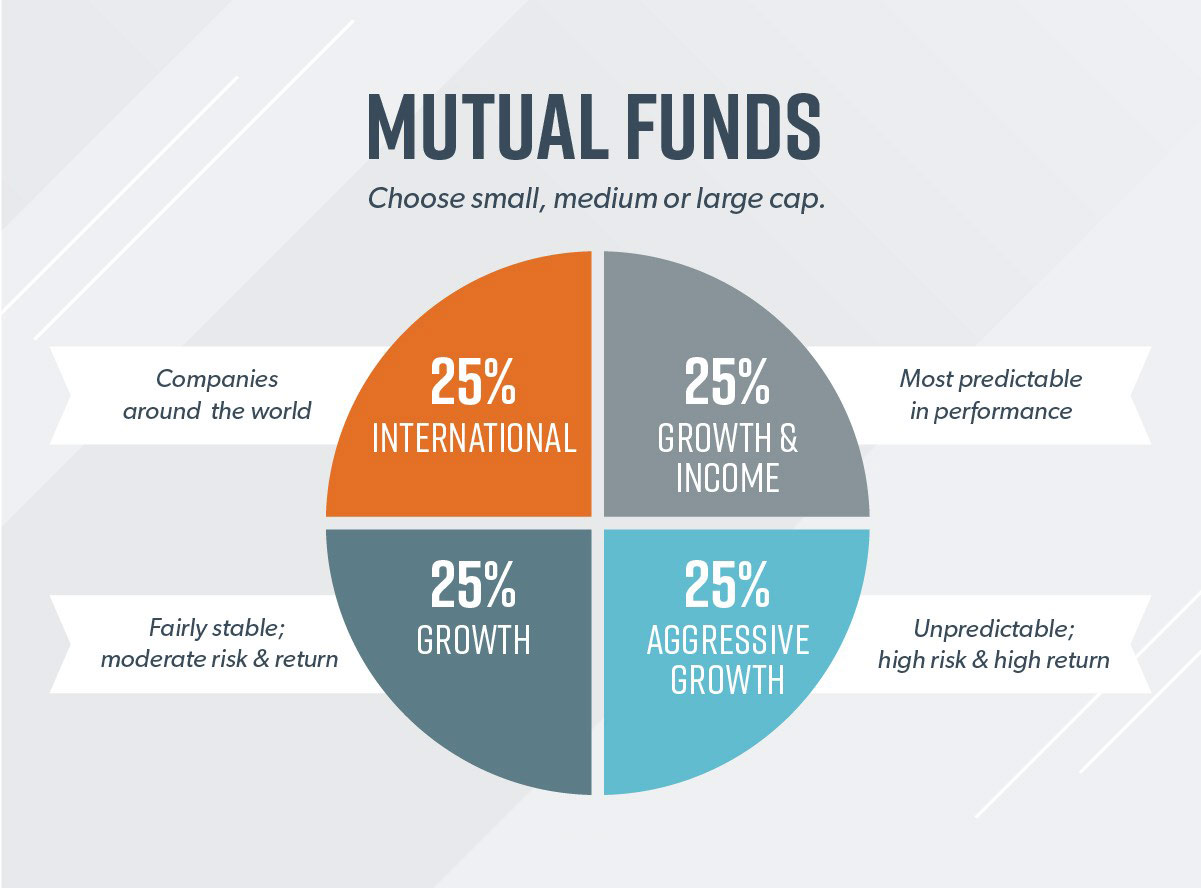

Dave doesn't like bonds. He hates them. He thinks they’re "lazy" money. For your 401k, he recommends a very specific, very simple four-way split:

- 25% Growth and Income: These are "Big, Boring Companies." Think Apple or Exxon. Large-cap stocks.

- 25% Growth: Mid-cap stocks. Companies that are still growing but aren't startups.

- 25% Aggressive Growth: Small-cap stocks. The "wild child" of the portfolio. High risk, high reward.

- 25% International: Companies outside the U.S.

Most 401k plans won't use these exact names. You’ll have to look at the "prospectus" (that boring PDF your HR department sent you) and find the funds that match these descriptions. If you see a "Target Date Fund," Dave would tell you to run. He thinks they’re too conservative because they move your money into bonds as you get older.

The 401k Loan: A Fast Track to Poverty

One thing you will never hear Dave Ramsey support is a 401k loan.

It’s your money, right? Why not borrow it to pay off a credit card?

👉 See also: Rite Aid Lackawanna NY: What Happened to the Local Pharmacy Scene

Don't. When you take a loan from your 401k, you’re taking that money out of the market. It stops growing. Plus, you’re paying it back with after-tax dollars. If you leave your job—or get fired—that loan is usually due in full almost immediately. If you can’t pay it, the IRS treats it as a withdrawal.

That means you’ll owe income tax on the balance plus a 10% early withdrawal penalty. It’s a nightmare.

Actionable Steps for Your 401k Today

If you want to apply the Dave Ramsey and 401k philosophy to your life right now, don't just guess. Here is how you actually execute it:

- Check your Debt: Are you still paying for a couch you bought three years ago? If yes, stop your 401k contributions today. Use that money to kill the debt.

- Audit your 15%: Calculate 15% of your gross (pre-tax) pay. If you make $70,000, you need to be putting away $10,500 a year.

- Find the Roth: Ask your HR rep if a Roth 401k option exists. If it does, switch your contributions there.

- Rebalance the Mix: Look at your current allocations. If you’re 100% in a "2055 Target Date Fund," you aren't following the Ramsey plan. Look for those four categories (Large, Mid, Small, International) and split them evenly.

- Leave it Alone: The market will drop. It happened in 2022, and it’ll happen again. The biggest mistake people make is "pausing" their 401k when the news gets scary. That's when stocks are on sale. Buy more.

Building wealth through a 401k isn't about being a math genius. It’s about being a "cro-magnon," as Dave says—just keep doing the same simple thing for 30 years until you wake up wealthy. It’s boring, it’s slow, and it works.

Next Steps for You:

Log into your employer's retirement portal and check your "Investment Elections." Compare your current funds to the four categories mentioned above to see how closely you align with a growth-focused strategy.