Most credit cards make you wait. You spend money, you wait for the statement to close, you wait for the "points" to clear, and then you spend three hours trying to figure out if 50,000 points is enough for a flight to Des Moines or just a toaster. It’s annoying. Apple decided to skip that whole dance. With the daily cash apple card system, the money just shows up. It’s sitting there in your digital wallet before you’ve even finished your latte.

But honestly? Most people are leaving money on the table because they treat it like a standard 1.5% cashback card. It isn't.

If you’re just swiping the physical titanium card everywhere, you’re basically doing it wrong. That heavy metal card is a status symbol that actually costs you money. When you use the physical card, Apple only gives you 1% back. To actually make the daily cash apple card worth the space in your pocket, you have to lean into the ecosystem. You have to be "that person" using Apple Pay for everything from a pack of gum to a new MacBook.

The 3% Tier is Where the Magic Happens

The real power of the daily cash apple card isn't the 1% or even the 2% you get for standard Apple Pay transactions. It's the 3% partnerships. Apple has been aggressive about bringing in merchants that people actually use daily. We aren't talking about obscure luxury brands. We’re talking about Walgreens, Uber, and T-Mobile.

If you pay your T-Mobile bill with your Apple Card via Apple Pay, you get 3% back every single month. On a $200 family plan, that’s six bucks back for doing literally nothing. Over a year, that pays for a couple of months of Netflix. Panera Bread is on that list too. Nike is on it. ExxonMobil is on it. If you’re gassing up your car and not using the Exxon app paired with your Apple Card, you’re just throwing away 3% of your fuel cost.

It adds up. Fast.

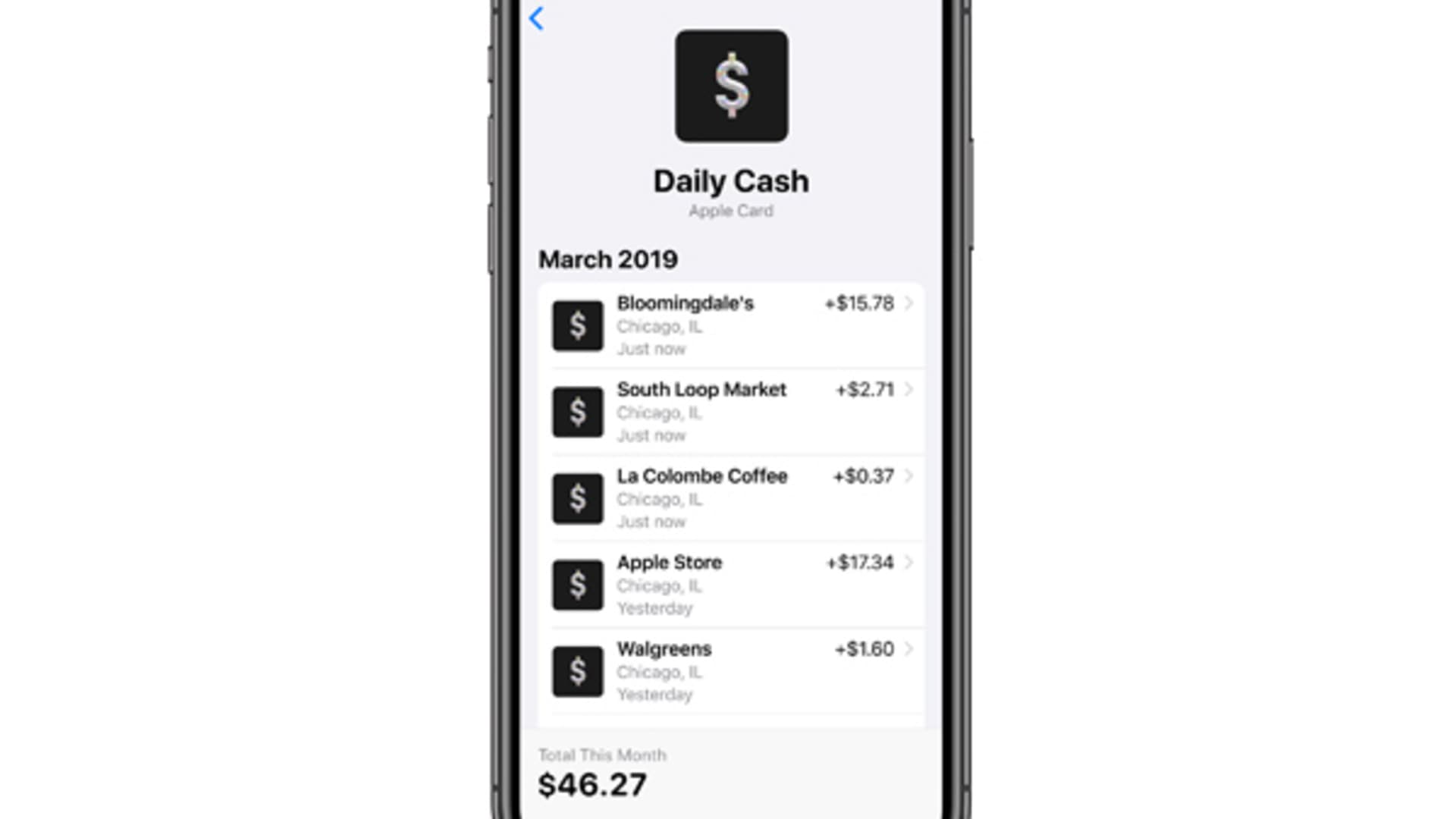

The beauty of the "Daily" part of the name is the psychological hit. You buy a pair of Jordans at the Nike store, and by the time you get to your car, a notification pops up. $6.00 added to your Apple Cash. It feels like a discount rather than a reward. It’s immediate gratification in a financial world that usually thrives on delay.

Where the Daily Cash Apple Card Actually Lives

So, where does this money go? It doesn't just vanish into the ether or sit as a credit on your statement (though you can do that if you're boring). By default, it lands in your Apple Cash account. This is basically a digital debit card inside your Messages app. You can send it to your friend to split a pizza, or you can use it to pay off the card balance itself.

But the real "pro move" that most users missed when it launched in 2023 is the Apple Savings account managed by Goldman Sachs.

You can set your daily cash apple card rewards to automatically deposit into a high-yield savings account. As of early 2024, that rate was sitting around 4.50% APY. Think about that for a second. You get cash back instantly, and then that cash back immediately starts earning interest at a rate that beats almost every "big bank" checking account in the country. It’s a closed-loop wealth builder. It’s small, sure, but it’s frictionless. Friction is the enemy of saving. When you remove the need to manually transfer money, you actually end up with a balance that surprises you in six months.

The Titanium Trap

Let's talk about that physical card again. It’s beautiful. It’s heavy. It makes a satisfying clink on a marble countertop. It’s also the least efficient way to use the account.

If you go to a restaurant that doesn't take Apple Pay—which is becoming rarer but still happens—you’re only getting 1% back. In that scenario, almost any other "starter" credit card like the Chase Freedom Unlimited or the Wells Fargo Active Cash is going to beat Apple by 0.5% or more.

The daily cash apple card is a digital-first product. If you find yourself swiping the physical card more than five times a week, you’re using the wrong financial tool for your lifestyle. This card is designed for the person who has their phone or Apple Watch glued to their wrist. It’s for the person who orders their Starbucks ahead of time and uses "Sign in with Apple" for their Uber Eats orders.

The Nuance of "Pending" Transactions

One thing that trips people up is the timing. While Apple says "Daily," it really means "as soon as the merchant clears the transaction."

If you buy something on a Saturday at a local boutique, the merchant might not settle their credit card batches until Monday. You won't see your daily cash apple card rewards until that settlement happens. It’s not a flaw in Apple’s system; it’s just how the aging pipes of the global banking system work. However, for big retailers like Apple themselves or Amazon (when using Apple Pay), it’s nearly instantaneous.

📖 Related: The Real Farmers Market Salinas CA Scene: Where to Go and What to Actually Buy

Buying a new iPhone is the ultimate flex for this card. You get 3% back on a $1,200 phone. That’s $36.00. That $36.00 shows up, you move it to your savings, or you use it to buy a case and a screen protector immediately. No other card really lets you "re-invest" your rewards into the same transaction cycle like that.

Is the Daily Cash Apple Card Actually Good?

Expert opinion on this is actually somewhat split. If you look at the raw math, there are better cards. The Citi Double Cash gives you 2% on everything (1% when you buy, 1% when you pay). That beats Apple's 1% on physical swipes.

But the daily cash apple card wins on transparency and user interface. The "Daily Cash" dashboard in the Wallet app is arguably the best financial visualization tool on the market. It shows you exactly where you spent your money on a map. It categorizes it with colors. It tells you exactly how much interest you'll pay if you don't pay the full balance, down to the cent, in real-time.

Most banks want you to be a little confused. Confused people pay interest. Apple’s interface is designed to make it very hard to accidentally screw up your finances. That transparency has a value that doesn't show up in a cashback percentage.

Privacy and Security Perks

Every time you use Apple Pay, a unique transaction code is generated. Your actual card number isn't shared with the merchant. This means the risk of your card getting "skimmed" or stolen in a data breach is virtually zero.

If you do use the physical card, you’ll notice there are no numbers on it. No CVV. No expiration date. Nothing. If you lose it, you just lock it in the app. You don't have to wait for a new number to be mailed to you to keep using Apple Pay. Your digital card number can be reset instantly in the app while the new physical titanium slab is in the mail.

Actionable Steps to Maximize Your Returns

If you have the card, or you’re looking at getting it, don't just use it blindly. Follow a strategy.

First, go into your Wallet app and set up the Savings account. It takes about two minutes. Direct all your rewards there. Even if it’s only $10 a month, let it sit and compound.

Second, audit your recurring bills. Check if your internet provider or cell phone carrier accepts Apple Pay. If they do, switch the autopay. Most people miss out on 3% rewards because they have their bills hitting a standard debit card or a lower-tier credit card.

Third, use the "Advanced Fraud Protection" feature. This rotates your three-digit security code periodically. It’s a bit of a nerd move, but it makes your daily cash apple card account nearly bulletproof against online theft.

Finally, stop using the physical card unless it’s an emergency. If a store doesn't take Apple Pay, use a different card that gives you a flat 1.5% or 2% back. Use the Apple Card for what it was built for: the 2% and 3% tiers.

The daily cash apple card is a tool of convenience and integration. When used correctly, it’s a seamless way to claw back a few hundred dollars a year without ever having to log into a clunky banking portal from 2005. It’s not the highest-paying card on the market, but it’s definitely the smartest one. Use the tech, get the cash, and let the interest do the heavy lifting in the background. That's how you actually "win" at the credit card game in 2026.

Keep an eye on the "Merchant" section in the Wallet app frequently. Apple adds new 3% partners without much fanfare. One day it’s just T-Mobile, the next day Ace Hardware is on the list. Checking that list once a month ensures you aren't missing out on the top-tier rewards for places you already shop. It’s your money; you might as well get it back the same day you spend it.