If you’ve been watching the cvs health corp share price lately, you know it’s been a bit of a rollercoaster. Honestly, calling it a rollercoaster might be an understatement. It’s more like a high-stakes game of Tetris where the pieces keep moving just as you’re about to clear a line. As of mid-January 2026, the stock is hovering around $78.60. Just a few days ago, it was over $81.

Why the sudden dip? Well, the market is a fickle beast. Last Friday, January 16, the price shed about 3.39% in a single session.

People get this stock wrong all the time. They think it’s just a pharmacy. Or just an insurance company. In reality, it’s a massive, tangled web of retail, PBM (Pharmacy Benefit Management), and health insurance that is currently trying to reinvent itself under David Joyner. Joyner took the reins in late 2024, and ever since, the company has been on a "prove it" tour.

The Numbers Under the Hood

It's easy to look at a ticker and see red or green, but the cvs health corp share price is reacting to some pretty specific internal gear-shifting.

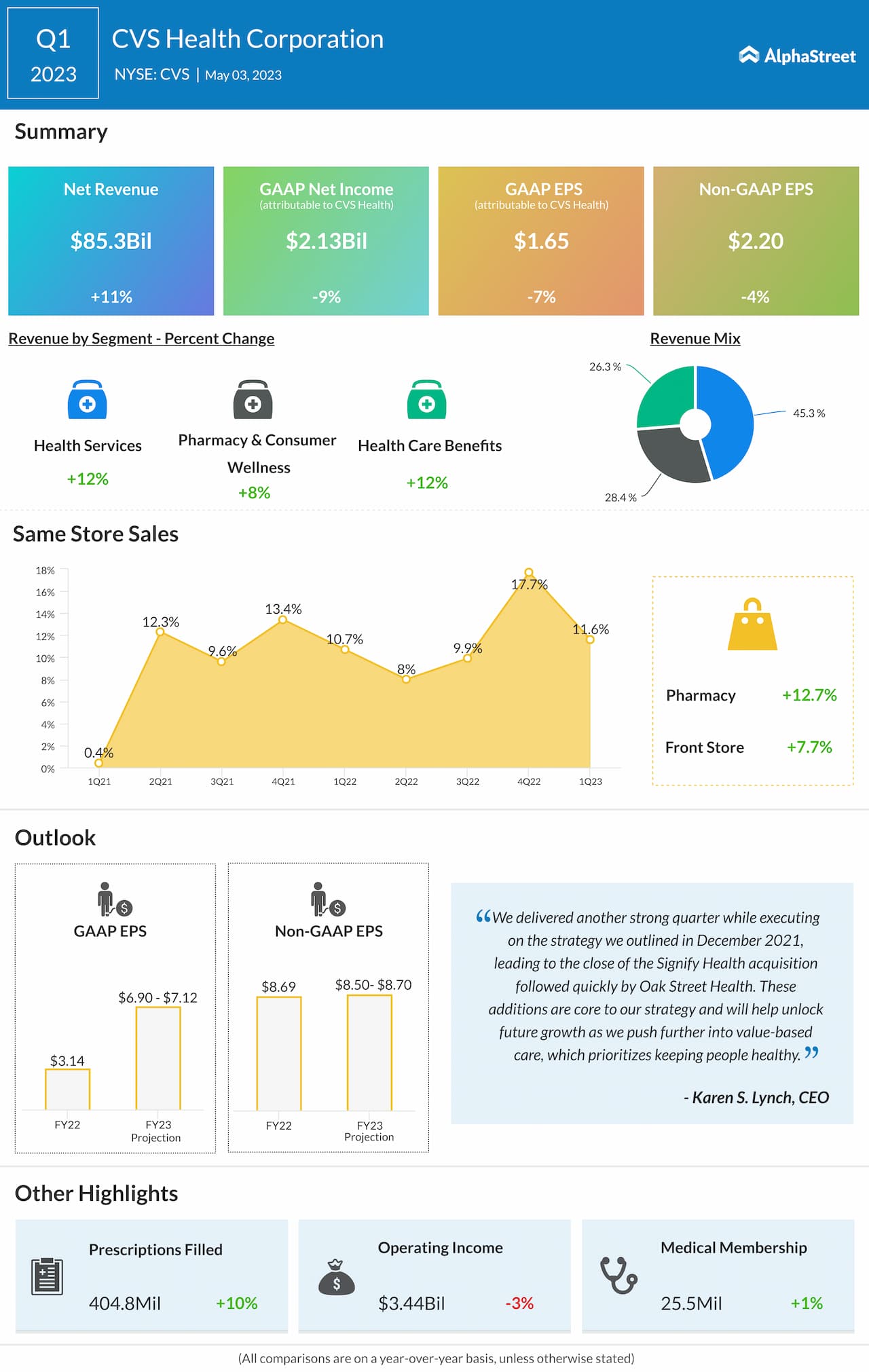

Look at the guidance they just dropped. For the full year 2026, the company is targeting an Adjusted EPS (Earnings Per Share) between $7.00 and $7.20. That’s a decent jump from the $6.60 to $6.70 range they expect for 2025. Investors generally like growth, but they love predictable growth. CVS hasn't exactly been the poster child for predictability lately.

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

What the Analysts Are Chewing On

- Revenue Targets: They’re aiming for at least $400 billion in total revenue for 2026.

- Cash Flow: This is the big one. They expect cash flow from operations to hit at least $10 billion.

- The Aetna Factor: Aetna is finally finding its footing after a brutal 2024. About 81% of Aetna Medicare Advantage members are now in 4-star plans or higher for the 2026 cycle.

Stars matter. They aren't just for show; they dictate the bonus payments the government sends to insurers. In 2024, Aetna’s star ratings took a hit, and it felt like the sky was falling for the stock. Now that those ratings are climbing back up, the floor under the share price feels a lot more solid.

Why 2026 is the "Make or Break" Year

We’re currently in the middle of a massive turnaround. Brian Newman, the CFO who came over from UPS, is basically the guy tasked with tightening the bolts. He’s looking at a $2 billion cost-savings plan.

Think about that for a second. $2 billion.

You don't find that kind of money by switching to cheaper office pens. It involves massive structural changes. They’ve already closed dozens of pharmacies and are leaning heavily into "Health Care Delivery"—clinics like Oak Street Health and Signify Health.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

The cvs health corp share price essentially reflects whether the market believes these clinics will actually make money. For 2025, that segment has been a drag. They’re aiming for "breakeven" in the near future. If they hit it, the stock could finally break out of its multi-year funk.

The Retail Struggle vs. The Insurance Win

CVS stores feel different these days. Have you noticed? More clinical space, fewer aisles of random knick-knacks.

That’s intentional. The retail pharmacy side is a tough business with razor-thin margins. Most of the profit isn't in the front of the store; it’s in the pharmacy and the "Caremark" PBM business.

Caremark is the giant in the room that most people don't see. It's the "front door" to healthcare for millions. But it’s also under a microscope from regulators who are worried about drug pricing transparency. This regulatory heat is a constant shadow over the share price.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

Actionable Insights for Your Watchlist

If you're holding or thinking about buying, you need to watch three things like a hawk.

First, keep an eye on the medical benefit ratio (MBR). This is basically how much of the insurance premiums Aetna collects actually goes out the door to pay for care. In Q3 2025, it was 92.8%. Lower is better for the stock. If that number creeps back up toward 95%, expect the share price to take a hit.

Second, watch the 2026 cash flow. Management promised $10 billion. If they miss that, the "credibility gap" will widen, and the stock will likely languish in the $70s.

Third, look at the "Health Care Delivery" profitability. Oak Street Health needs to stop being a line item for losses. The moment that segment turns a profit, the narrative changes from "struggling retailer" to "healthcare powerhouse."

Immediate Next Steps:

- Check the upcoming Q4 2025 earnings call (usually late Jan/early Feb) for any adjustments to the 2026 guidance.

- Review your exposure to the healthcare sector; CVS often moves in tandem with UnitedHealth (UNH) and Humana (HUM), but it’s currently trading at a lower P/E ratio, making it a "value" play.

- Set price alerts at $75 (support) and $85 (resistance) to catch the next swing.