The latest numbers are finally in, and they’ve got everyone talking. If you're looking for a quick answer, the current unemployment rate for the US is 4.4%.

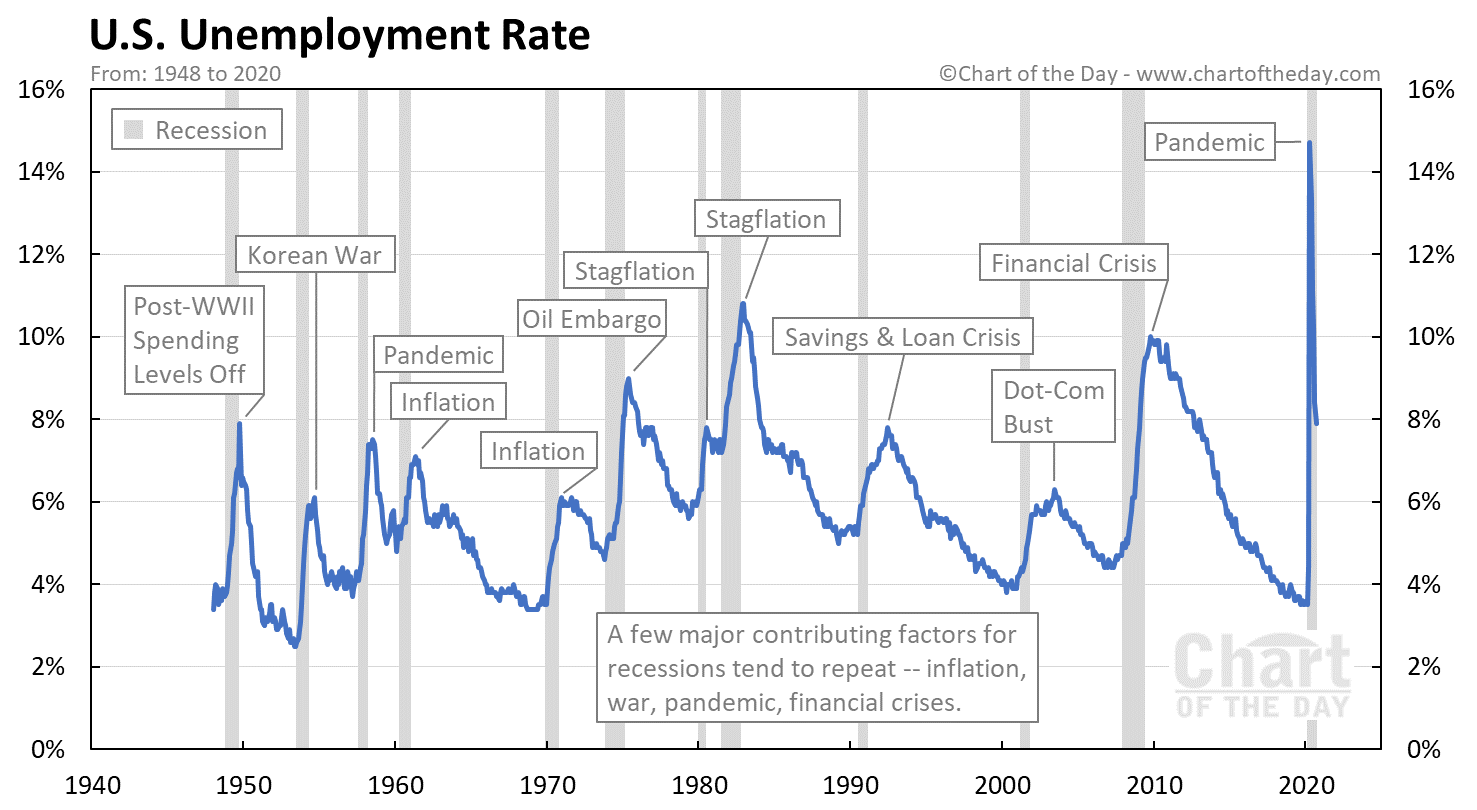

That figure comes straight from the Bureau of Labor Statistics (BLS) report released on January 9, 2026. On the surface, it looks like a win. We actually saw a slight tick down from the 4.5% or 4.6% highs we were seeing toward the tail end of 2025. But honestly? The headline number is barely scratching the surface of what's actually happening in the American workplace right now.

It’s a weird time. Companies aren't exactly firing people in massive waves, but they aren't exactly hiring either. Economists call this a "low-hire, low-fire" environment. Basically, everyone is just standing still, waiting to see what happens next with interest rates and those new trade policies everyone is arguing about.

Why the Current Unemployment Rate for the US is Only Half the Story

If you just look at that 4.4% and think everything is fine, you’re missing the nuance.

Take a look at the "long-term" unemployed. These are people who have been out of work for 27 weeks or more. According to the BLS, that group has grown by nearly 400,000 people over the last year. That's a huge deal. It means that while the total number of people without jobs hasn't exploded, the people who do lose their jobs are getting stuck in limbo.

🔗 Read more: Johnson and Johnson San Diego: Why This Biotech Hub is Growing Right Now

Finding a new gig is just taking longer. Much longer.

Then there’s the youth gap. While the national average is sitting at 4.4%, teenage unemployment is hovering around 15.7%. If you’re a Gen Z'er trying to break into the market right now, it feels less like a "stable economy" and more like a brick wall.

Where the Jobs Are (and Aren’t)

The December 2025 data showed that the US added about 50,000 jobs. To put that in perspective, we were averaging over 160,000 jobs a month just a couple of years ago. We are definitely in a cooling phase.

- Healthcare is the MVP: This sector added 21,000 jobs. Aging baby boomers need care, and that demand isn't going anywhere.

- Food Services and Bars: Still hiring, though at a slower clip.

- The Federal Government: This is the big outlier. Payrolls dropped by over 270,000 in 2025. It’s the biggest decline in years, largely driven by the massive push to reduce the civil service workforce.

- Manufacturing and Tech: These areas are basically flat or shedding roles. If you’re in software or factory work, the market feels pretty tight right now.

The "Vibe-Cession" and Your Wallet

Even though the unemployment rate is technically low by historical standards, people feel broke. Why? Because wage growth is barely keeping pace with the cost of living.

Average hourly earnings are around $37.02. That’s a 3.8% increase over the year. But when you factor in the "static annual tax" from new tariffs—which J.P. Morgan economists estimate at over $500 billion on imported goods—the price of everyday stuff is eating those raises alive.

It’s a perfect storm. We have aging demographics, shifting immigration policies that are tightening the labor supply, and a corporate sector that’s obsessed with AI.

Speaking of AI, that’s another reason the current unemployment rate for the US is staying low while hiring stays sluggish. Companies are pouring money into data centers and software instead of new employees. They’re betting that tech can fill the gaps left by a shrinking workforce.

👉 See also: Why the Straits of Malacca Map Is Actually Every CEO’s Worst Nightmare

The Regional Reality

Don't let the national average fool you into thinking every state is the same. It’s not.

California and New Jersey are currently seeing some of the highest jobless rates in the country. Meanwhile, states like Florida and Virginia are still seeing decent gains, mostly in service and healthcare roles. If you're looking for work, where you live matters just as much as what you do.

The labor force participation rate—the measure of people actually working or looking—dipped slightly to 62.4%. That’s a bit lower than last year. Some people are just giving up or retiring early because they’re tired of the grind.

What This Means for Your Next Move

So, what should you actually do with this information?

If you’re employed, now probably isn’t the time to quit on a whim. The "quits rate" is at a multi-year low for a reason. People are clinging to the security they have because they know the "low-hire" environment makes finding a replacement job a marathon, not a sprint.

For those hunting for work, you've got to be strategic. The data shows that "entry-level" is the hardest hit area. You need to highlight specialized skills. If you can show an employer how you’ll help them navigate the messy economy—whether that’s through efficiency or specific technical expertise—you’ll have the edge.

Actionable Steps for the Early 2026 Market:

📖 Related: Egyptian Pound to GBP: What Most People Get Wrong About the 2026 Rates

- Audit Your Skillset: Focus on "recession-proof" sectors like healthcare, social assistance, or specialized construction.

- Expect a Longer Search: Budget for a 4–6 month job hunt rather than the 2-month window we saw during the post-pandemic boom.

- Watch the Fed: Keep an eye on the February 6th BLS release. If the rate climbs toward 4.5% or 4.6% again, expect the Federal Reserve to start cutting interest rates more aggressively to keep the wheels from falling off.

- Leverage Stability: If you’re an employer, this is actually a "buyer's market" for talent. You can find high-quality people who are looking for stability after a rocky 2025.

The bottom line is that 4.4% is a decent number, but the "low-hire" reality means the safety net is thinner than it looks. Stay informed, stay specialized, and don't get distracted by the headline noise.