If you’re trying to figure out the current tariff on China, you’ve probably realized that "it's complicated" is a massive understatement. Seriously.

As of January 2026, the trade landscape looks like a jigsaw puzzle where the pieces keep changing shape. You might remember the headlines from 2025—it was a wild year for imports. We saw everything from "fentanyl tariffs" to massive new duties on semiconductors. Honestly, keeping up with what you’ll actually pay at the border is a full-time job right now.

💡 You might also like: University of Maryland Carey Law: What Most People Get Wrong

But here’s the thing: most people are still looking at old 2024 data or general news snippets that don't reflect the specific deals struck late last year.

The 10% Floor and the "Reciprocal" Reality

Basically, the baseline has shifted. In early 2025, the U.S. implemented a wide-reaching 10% tariff on almost everything coming from China. This wasn't just about specific tech or steel; it was a broad-based move under the International Emergency Economic Powers Act (IEEPA).

However, things took a turn in November 2025.

President Trump and President Xi Jinping reached a "rebalancing" agreement. It didn't wipe the slate clean, but it definitely cooled the room. The United States agreed to maintain a suspension of the even higher "reciprocal" tariffs—those scary 25% to 60% figures you might have heard about—until November 10, 2026.

What does that mean for you today?

- The 10% Baseline: Most Chinese goods are still hitting that 10% reciprocal tariff floor.

- The Fentanyl Cut: One of the most specific changes was the "fentanyl tariff." Originally set at 20% to pressure China on drug precursor exports, it was lowered to 10% on November 10, 2025, as part of the new trade deal.

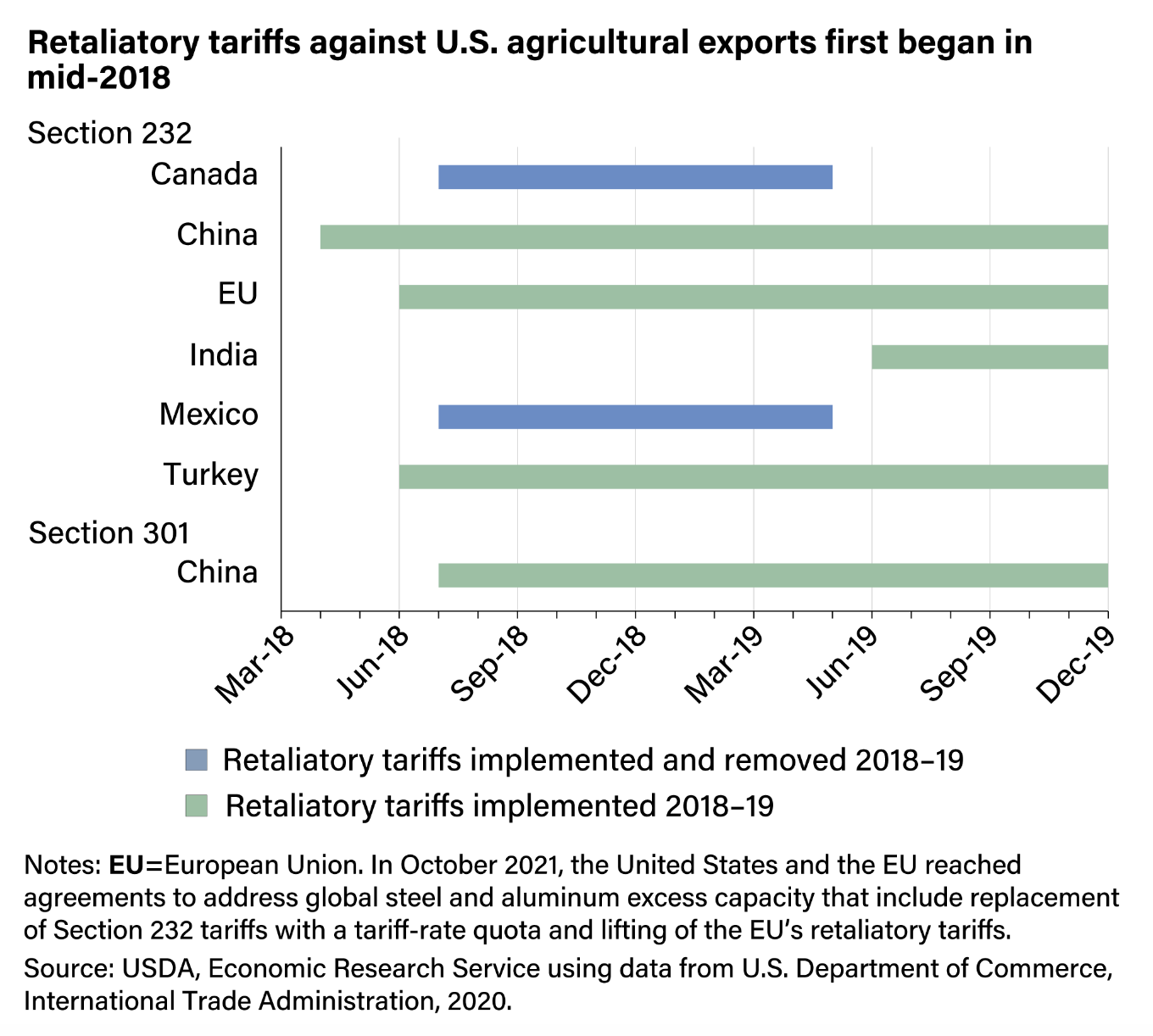

- Agricultural Relief: If you're on the export side, China suspended its retaliatory tariffs on U.S. soybeans, pork, and corn through December 2026.

Semiconductors Just Got More Expensive (Again)

If you're in tech, I have some less-than-stellar news. Just a few days ago, on January 15, 2026, a brand-new 25% duty kicked in.

This is a Section 232 tariff specifically targeting high-performance semiconductors and their derivatives. We’re talking about the guts of advanced AI computing. The goal here is pretty transparent: the U.S. wants to make it prohibitively expensive to source high-end chips from China, pushing companies to look at domestic options or "friendly" partners like Taiwan or South Korea.

🔗 Read more: Kroger on Morse Road: What Most People Get Wrong

It’s a surgical strike. While your average consumer toaster might only face the 10% baseline, anything with "AI-capable" silicon inside is likely looking at that 25% surcharge.

Why Canada Just Threw a Wrench in the Works

You sort of have to look at our neighbors to see where the current tariff on China might go next.

Last week, Canada’s Prime Minister Mark Carney basically broke ranks with Washington. Canada had a 100% tariff on Chinese electric vehicles (EVs). They just slashed it. Now, they've agreed to a 6.1% rate for a certain number of vehicles in exchange for China lowering tariffs on Canadian canola seeds.

Why does this matter to a U.S. importer? Because it puts pressure on the U.S. to either tighten the borders even more to prevent "transshipment" (China sending goods through Canada to dodge U.S. taxes) or to negotiate similar carve-outs.

Right now, the U.S. response has been... frosty. The U.S. Trade Representative, Jamieson Greer, called the Canadian move "problematic." Don't be surprised if we see new rules about "country of origin" for car parts popping up by springtime.

What You’re Actually Paying: The Math

Let's get real about the numbers. The Tax Foundation and the Tax Policy Center are both projecting that the average effective tariff rate on all imports is sitting around 17% to 21% for 2026.

It’s not just one tax. It’s a stack.

- Section 301 Tariffs: These are the "OG" trade war taxes from the first Trump term, mostly kept by Biden, and now extended again. They cover about $300 billion worth of goods.

- Section 232 Tariffs: These hit steel (25%), aluminum (25%), and now those semiconductors (25%).

- The 10% IEEPA Surcharge: The broad "national emergency" tax applied to almost all Chinese origin goods.

If you’re importing a piece of furniture, you might be looking at a Section 301 duty plus the 10% IEEPA surcharge. Suddenly, that "cheap" sofa is 35% more expensive before it even leaves the port.

The "Invisible" Costs Nobody Talks About

Tariffs aren't just a line item on an invoice. They're a logistical nightmare.

Customs and Border Protection (CBP) is now incredibly aggressive about "melt and pour" requirements for metals. If you're bringing in something made of steel, you have to prove where that steel was originally melted. If it was melted in China and turned into a pipe in Vietnam? It still gets the China tariff.

They call this "preventing evasion," but for a small business owner, it's just a mountain of paperwork.

Also, the "De Minimis" loophole is effectively dead. You used to be able to ship packages under $800 duty-free. The Biden-era rules that finally went into full effect late last year mean that if your product is on a Section 301 list, you pay the tariff regardless of the price. Those $15 fast-fashion hauls are getting a lot more expensive.

Actionable Steps for Navigating 2026

You can't change the geopolitical weather, but you can change your umbrella. If you're dealing with the current tariff on China, here is what you should be doing right now:

- Audit Your HTS Codes: The Harmonized Tariff Schedule was updated on January 1, 2026. A code that worked in 2024 might be under a new "high-duty" sub-category now. Check the semiconductor derivatives specifically.

- Verify Your Exclusion Window: Many Section 301 exclusions were extended until November 10, 2026. Check if your specific product is on the list. If it is, you're essentially getting a temporary "tax holiday" that expires in ten months.

- Watch the "Secondary" Surcharge: There is a 40% additional duty for goods found to be "transshipped" to evade tariffs. If your supplier says, "We'll just ship it through Malaysia to save you money," run. The risk of a 40% penalty and a seized shipment isn't worth it.

- Pivoting to "Friendly" Sourcing: Start looking at the new U.S.-Taiwan trade agreement. It actually reduces tariffs on many of the same things China is being taxed on.

The reality is that "low-cost" China sourcing is a relic of the past. The current tariff on China isn't just a temporary hurdle; it's the new cost of doing business. Whether you're a consumer or a CEO, the 2026 trade environment is designed to make "Made in USA" or "Made in Anywhere Else" look a lot more attractive.

💡 You might also like: SSA Benefit Verification Delay: What Most People Get Wrong

The trade war didn't end; it just got a lot more specific. Keep your eyes on that November 2026 expiration date—that's when the next big cliff is coming.