Honestly, walking into a supermarket in early 2026 feels a whole lot different than it did a couple of years ago. Remember when seeing the price of a block of cheddar felt like a personal insult? We’ve been through the ringer. But if you are looking at the current level of inflation uk right now, the numbers are finally starting to tell a story of "getting there," even if your wallet doesn't always agree.

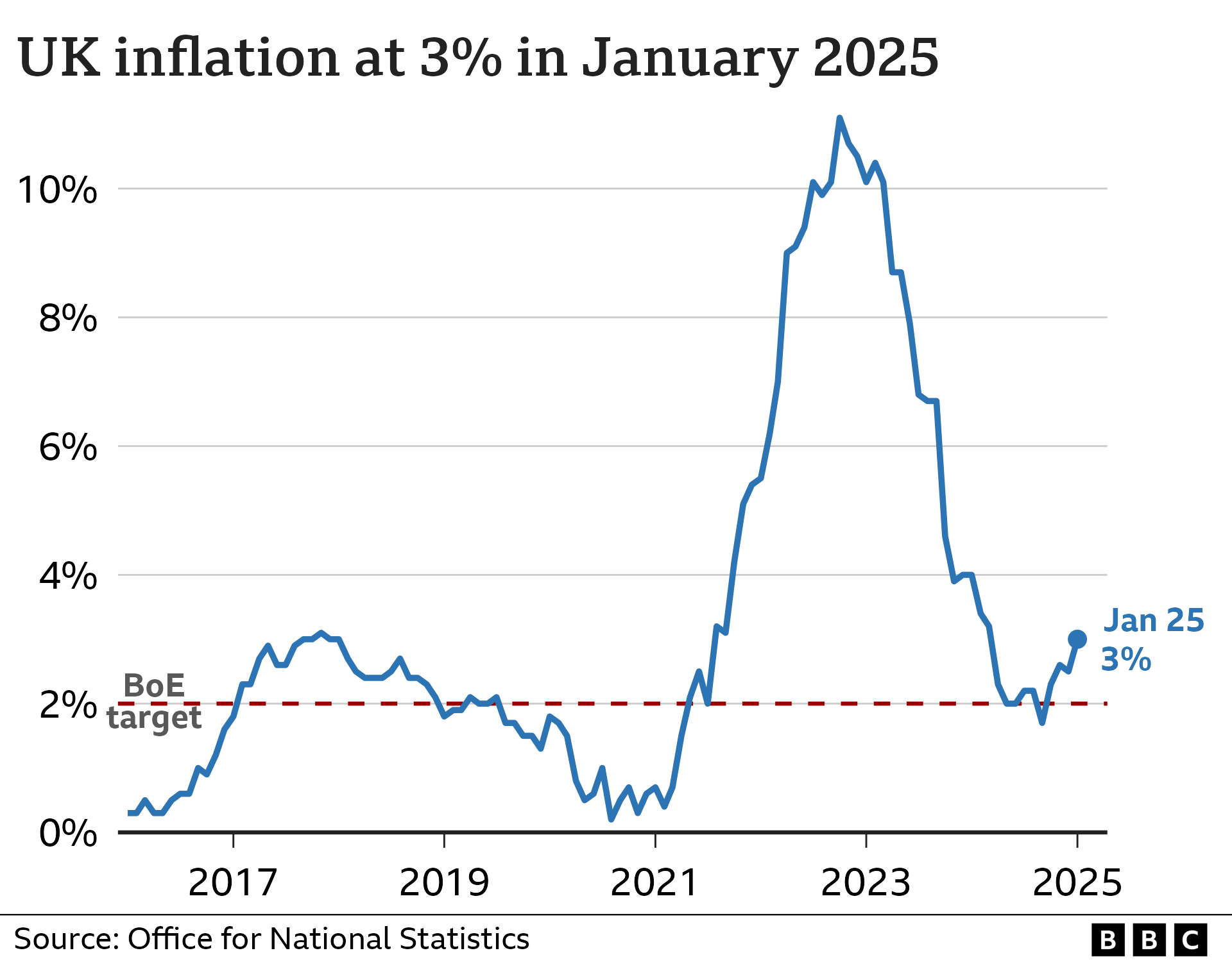

The latest data from the Office for National Statistics (ONS) is pretty clear. As of early 2026, we are looking at a headline Consumer Prices Index (CPI) rate that has settled around the 3.2% mark, continuing a downward trend from the bumpy rides we saw throughout 2025. It is a massive cry from that terrifying 11.1% peak back in late 2022.

What is actually happening with your money?

It’s easy to get lost in the jargon. CPI. CPIH. RPI. Basically, the current level of inflation uk is just a measure of how much more expensive life is compared to exactly one year ago.

So, if the rate is 3.2%, it doesn't mean prices are falling. It just means they are rising slower. If a basket of groceries cost you £100 last January, that same basket is roughly £103.20 today. It’s not "cheap," but it’s no longer the runaway train it was.

Interestingly, Bank of England policymaker Alan Taylor recently suggested that we might hit that "magic" 2% target by mid-2026. This is actually a bit of a surprise. Previous projections didn't have us hitting 2% until 2027. Why the change? Mostly because wage growth is finally cooling down and import prices are behaving themselves.

Breaking down the current level of inflation uk

Not everything is getting "less expensive" at the same speed. That’s the tricky part about the current level of inflation uk—it hits different parts of your life in waves.

👉 See also: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

Take food. Food inflation was a nightmare for a long time, peaking at nearly 20% in 2023. Now, it’s hanging around 4.2%. Still higher than the overall average, but a huge relief compared to where we were. We’ve actually seen the price of things like bread and cereals—specifically biscuits and cakes—dip slightly over the last few months.

Then there’s the "services" side of things. Think haircuts, restaurant meals, and gym memberships. This is what keeps the Bank of England up at night. Services inflation is currently sitting at roughly 4.4%. It’s "sticky." Because wages make up such a big part of these businesses' costs, the prices don't drop as fast as, say, the price of a pint of milk.

The energy factor (It’s complicated)

Energy is the big swing factor. In late 2025, the Ofgem price cap changes actually helped pull the headline inflation rate down. Gas and electricity prices are significantly more stable now than they were during the initial shock of the Ukraine war.

- Gas prices: Rose only about 2.1% annually by late 2025.

- Electricity: Around 2.7% annual increase.

- Motor fuels: Actually saw some downward pressure, though global oil markets remain a wildcard.

Housing and utilities still represent a big chunk of the 4.8% (CPIH) annual rise, mainly because rents are still climbing at a pace that makes most tenants want to cry.

What the experts are saying (and what they get wrong)

Economists at places like Goldman Sachs and MUFG are watching the labor market like hawks. Goldman Sachs expects the UK economy to grow by about 1.4% this year. That’s not "booming," but it’s steady.

✨ Don't miss: Are There Tariffs on China: What Most People Get Wrong Right Now

They also think the Bank of England will cut interest rates three times in 2026, eventually landing at a "terminal rate" of about 3%. If you have a mortgage, that is the most important sentence in this entire article.

But there’s a catch.

There is a "hawkish" contingent within the Bank of England’s Monetary Policy Committee (MPC). They worry that if they cut rates too fast, the current level of inflation uk might bounce back. They are terrified of a "second wave" of inflation. If food prices tick back up—which some analysts think might happen next month—the Bank might hold off on those rate cuts. It is a delicate balancing act.

Is 2% actually realistic for 2026?

The government’s official target is 2%. We aren’t there yet.

Some factors are working in our favor. Trade diversion—where we buy stuff from different countries to avoid high costs—could shave about 0.2 percentage points off inflation this year. Also, the 2025 Autumn Budget measures are expected to start having a disinflationary effect by April 2026.

🔗 Read more: Adani Ports SEZ Share Price: Why the Market is kida Obsessed Right Now

However, we have to talk about "Core Inflation." This is the number that strips out volatile stuff like energy and food. Core inflation is currently around 3.2%. When core inflation is high, it means the price rises are "baked in" to the whole economy, not just caused by a temporary spike in oil prices.

Actionable steps to protect your cash

Knowing the current level of inflation uk is one thing, but what do you actually do with that information?

First, look at your savings. If you have money sitting in a standard current account earning 0.1%, you are effectively losing 3.1% of your buying power every year. With interest rates likely to fall later this year, now is the time to lock in a fixed-rate savings bond while they are still relatively high.

Second, if you're a renter or a homeowner with a deal ending soon, pay attention to the February 5th Bank of England meeting. The language they use there will dictate what happens to mortgage rates for the rest of the spring.

Finally, keep an eye on your "personal inflation rate." If you spend a lot on "services" (eating out, travel, education), your life is getting expensive faster than the 3.2% headline figure suggests.

The worst is likely over, but the road back to "normal" prices is more of a long, slow walk than a sprint. We are moving in the right direction, but keep that budget tight for a few more months.

Your next move: Check your mobile and broadband contracts. Most companies hike prices in April based on January's inflation figures. If you are out of contract, switch now before the "mid-contract" price hikes kick in based on these current numbers.