Money is weird. One day you’re planning a trip to Puerto Vallarta and feeling like a king, and the next, you’re looking at a bank app wondering where all your buying power went. If you’ve been tracking the currency peso to canadian dollars lately, you’ve probably noticed the ride has been anything but smooth.

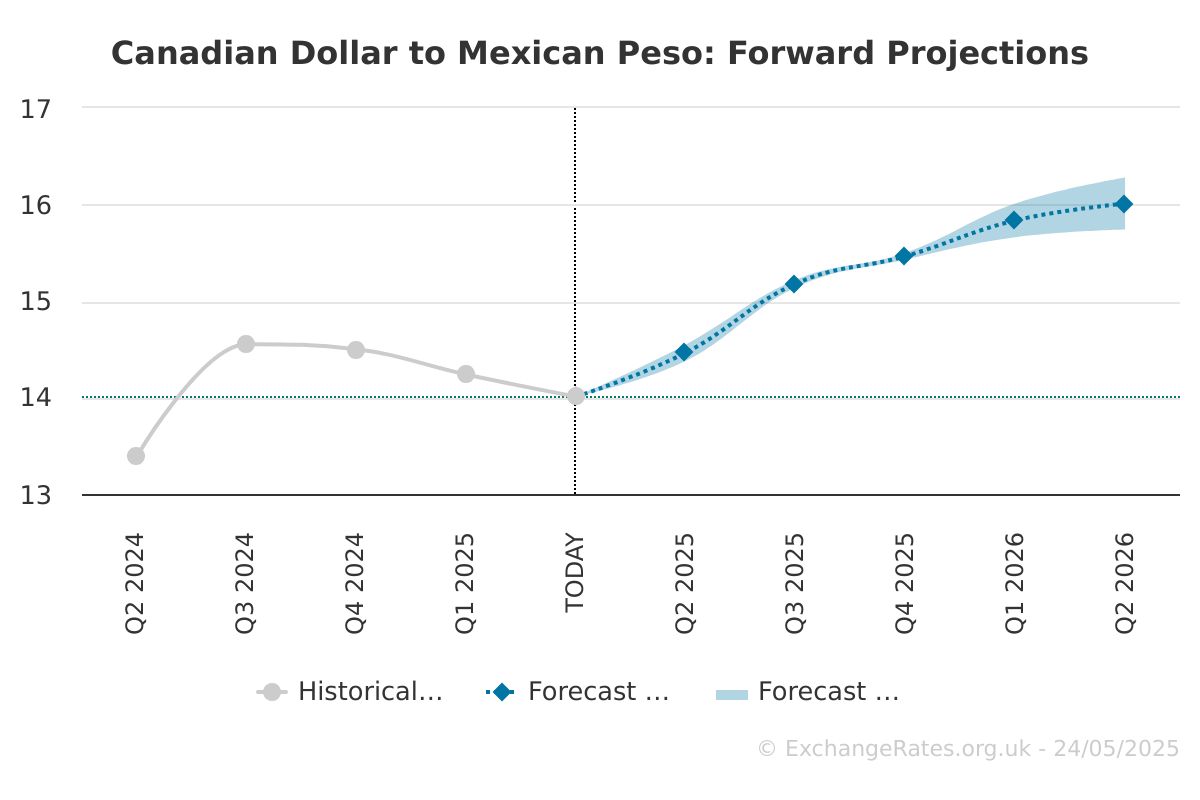

Right now, as of mid-January 2026, the Mexican Peso (MXN) is sitting around 0.078 to 0.079 Canadian Dollars (CAD).

That might not sound like much of a shift if you're just looking at decimals. But for anyone moving five or six figures—maybe for a real estate closing in Tulum or a manufacturing contract in Monterrey—those tiny numbers are everything. Honestly, the relationship between these two "Loonie-adjacent" currencies is currently being dictated by a chaotic mix of trade wars, interest rate gambles, and some very specific North American drama.

The Trump Tariff Shadow and the Mexican Peso

You can't talk about the Mexican Peso in 2026 without talking about the "Tariff Wall."

Since President Trump returned to the White House, his aggressive stance on global trade has sent shockwaves through the MXN. Mexico is in a tough spot. On one hand, it’s Canada’s massive trading partner; on the other, it’s being squeezed by U.S. threats of double-digit tariffs.

Whenever a headline drops about a new trade restriction or a "national security" tariff under the IEEPA (International Emergency Economic Powers Act), the Peso flinches. Traders hate uncertainty. When the U.S. market looks like it might close its doors or become significantly more expensive for Mexican goods, investors pull their money out of the Peso and park it in "safer" spots.

But here is the twist.

✨ Don't miss: Online Associate's Degree in Business: What Most People Get Wrong

Canada isn't exactly in the clear either. While the CAD usually benefits when oil prices are steady, Canada is also feeling the heat from U.S. trade realignment. Recently, Canada even cut its own taxes on Chinese EVs to help its farmers, showing a major break from Washington's lead. This "every country for itself" vibe in North America is making the currency peso to canadian dollars exchange rate more volatile than it’s been in years.

Why the CAD and MXN are Playing Tug-of-War

Usually, these two currencies move somewhat in tandem because they are both heavily tied to the U.S. economy. When the U.S. does well, they both do well. Kinda.

Lately, that link is fraying.

- Mexico’s Interest Rate Advantage: The Banco de México (Banxico) has kept rates relatively high to fight off inflation. If you’re an investor, you want to put your money where the interest is high. This "carry trade" has historically supported the Peso.

- Canada’s Cautious Approach: The Bank of Canada has been a bit more conservative. With the Canadian housing market always on the edge of a cliff, they can't just jack up rates without hurting homeowners. This makes the CAD feel "cheaper" compared to the Peso when interest rate spreads widen.

- The China Factor: As the search results suggest, China is using Mexico as a "back door" to get goods into North America to avoid U.S. tariffs. This has actually pumped a lot of investment into Mexico, keeping the Peso stronger than many analysts expected.

How to Get the Most CAD for Your Peso

Stop using big banks. Just don't do it.

I’ve seen people lose 3% to 5% of their total transfer amount just because they walked into a branch and asked for a wire transfer. They give you a "retail rate" that is miles away from the mid-market rate you see on Google.

If you are moving currency peso to canadian dollars, you need to look at specialized fintech providers. Here is the breakdown of what's working best in early 2026:

🔗 Read more: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

Wise (formerly TransferWise) This is basically the gold standard for transparency. They use the real mid-market rate and charge a small, upfront fee. For a transfer from Mexico to Canada, you're usually looking at a total cost of less than 1%. It's fast, often arriving the same day.

OFX If you are moving more than $10,000, call these guys. They don't charge "fees" in the traditional sense, but they take a small margin on the exchange rate. For large amounts, you can often negotiate a better deal than what an app will give you.

Paysend They’ve been making waves with a fixed fee model—around 29 MXN for some transfers. It’s great for smaller, frequent remittances, especially if you're sending money to family and want it to arrive in minutes.

Western Union / MoneyGram Only use these if the recipient needs actual cash. Their exchange rates are generally the worst in the business, though they have the biggest physical footprint.

The 2026 Outlook: What Most People Get Wrong

A lot of people assume the Peso will just keep getting weaker because of the political noise in the U.S. That’s a mistake.

The "Nearshoring" trend is real. Companies are still moving manufacturing from Asia to Mexico to be closer to the North American consumer. This creates a structural demand for Pesos that isn't going away just because of a few tweets or tariff threats.

💡 You might also like: Modern Office Furniture Design: What Most People Get Wrong About Productivity

On the Canadian side, the CAD is struggling with a sluggish manufacturing sector and a government that is trying to find its footing in a post-globalization world. If Canada continues to drift away from U.S. trade policy, we might see the CAD weaken independently, which would actually make the Peso "stronger" in comparison.

Practical Steps for Your Next Exchange

Don't just watch the ticker. If you have a big payment coming up, you need a strategy.

First, set up rate alerts. Apps like XE or Wise let you set a target price. If the Peso hits 0.081 CAD, you get a ping on your phone. Jump on it.

Second, consider a forward contract if you’re a business owner. This allows you to "lock in" today's rate for a transfer you plan to make in three or six months. It protects you if the trade war escalates and the Peso takes a 10% dive overnight.

Third, watch the oil prices. Canada is an oil exporter. Mexico is too, but to a lesser extent in terms of currency impact. If Brent Crude spikes, the CAD usually gets a boost, making your Pesos buy less.

The currency peso to canadian dollars market is moving fast. Between the 2026 World Cup preparations (which are pouring money into both countries) and the shifting trade alliances, the old "stable" rates are gone. Stay nimble, use the right tech, and don't let the banks take a cut they didn't earn.

Log into your preferred transfer app today and check the "Mid-Market" rate versus what they are actually offering you. If the gap is more than 1%, keep shopping. You can also set a limit order on platforms like Wise to automatically trigger your exchange when the MXN/CAD pair hits your ideal number.