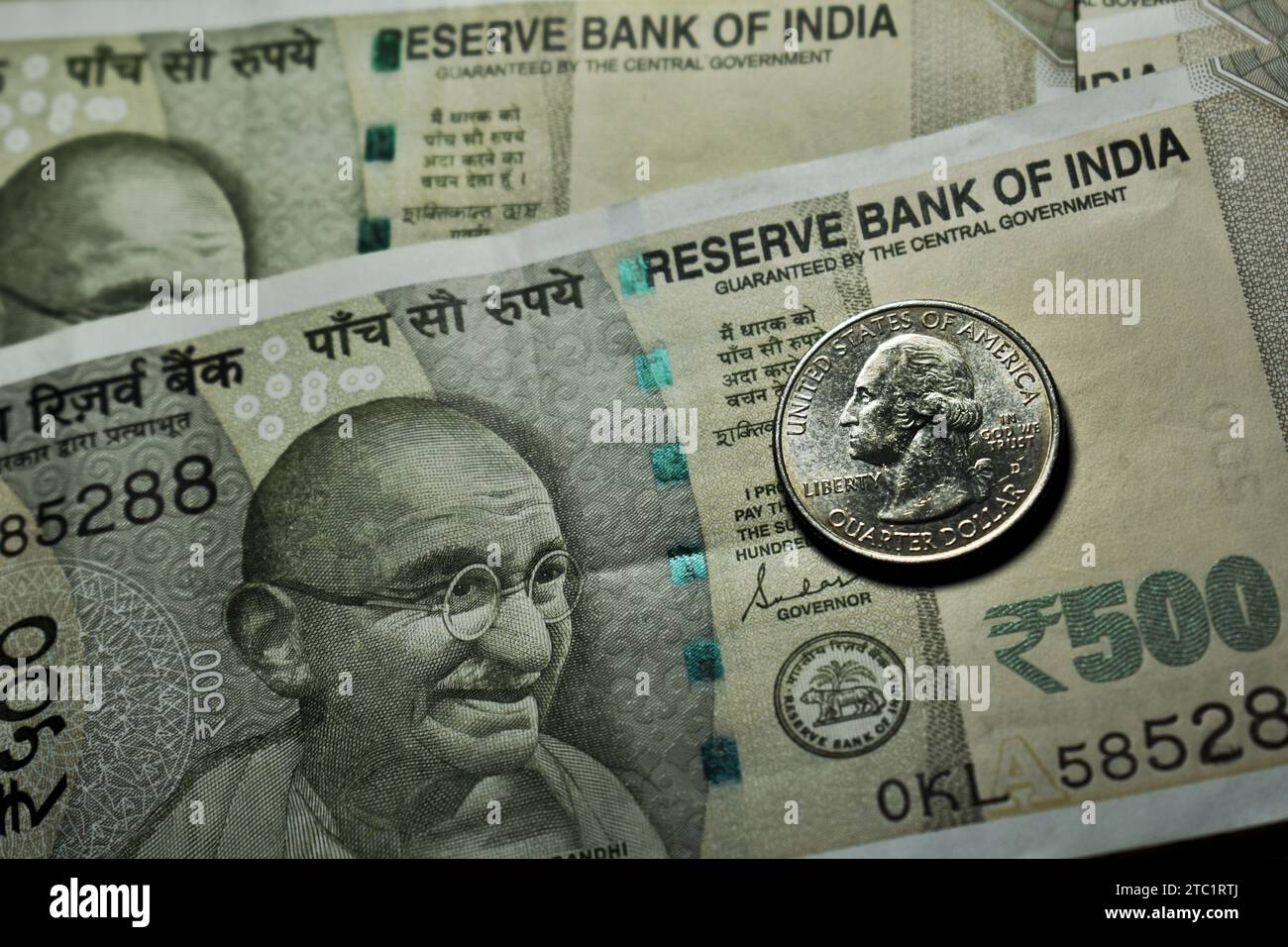

The number 90. It used to feel like a distant, slightly scary finish line for the Indian Rupee. Yet, as of January 17, 2026, here we are. The currency of american dollar in indian rupees is currently hovering around ₹90.87. If you’re trying to send money home to Delhi or paying for a SaaS subscription from a Mumbai startup, that number hits different. It isn’t just a digit on a flickering forex screen; it’s the price of your next iPhone, the cost of your kid's master's degree in Chicago, and the reason your gas bill feels like a personal attack.

Forex markets are notoriously fickle. One minute the Rupee is "holding steady," and the next, a stray comment from a Fed official in D.C. sends it into a tailspin. Honestly, keeping up with the USD to INR rate feels like watching a high-stakes thriller where the hero—your purchasing power—keeps getting cornered in dark alleys.

Why the Rupee is Sweating Right Now

Money doesn't move in a vacuum. It flows where it's treated best. Right now, the U.S. Dollar is acting like the popular kid in school that everyone wants to hang out with. Even though the U.S. Federal Reserve recently trimmed interest rates to a range of 3.5% to 3.75% in December 2025, the "Greenback" hasn't lost its muscle.

Why? Because the U.S. economy is surprisingly resilient. While the rest of the world is navigating a bit of a sludge, the U.S. is still pumping out decent growth. This creates a "growth differential." If investors think they can make a safer, better buck in New York than in Mumbai, they pull their cash out of Indian stocks. We saw this clearly in early January 2026, when Foreign Institutional Investors (FIIs) dumped billions of rupees worth of equities. When everyone sells Rupee to buy Dollar, the Rupee's value drops. It’s basic supply and demand, but with way more zeros involved.

📖 Related: Panamanian Balboa to US Dollar Explained: Why Panama Doesn’t Use Its Own Paper Money

Then there's the oil factor. India imports over 80% of its crude. When Brent crude prices tick up—currently wobbling around $63.44 per barrel—India has to shell out more dollars to keep its lights on. This creates a "Current Account Deficit" that puts massive pressure on the local currency.

The RBI's Secret Playbook

You’ve gotta hand it to the Reserve Bank of India (RBI). They aren't just sitting there watching the Rupee burn. Governor Shaktikanta Das and his team have been playing a very tactical game of "currency defense."

Instead of just burning through forex reserves—which, by the way, took a nearly $10 billion hit in the first week of January 2026—they are changing the rules of the game. They are pushing for the "internationalization" of the Rupee. Basically, they want the world to stop using the Dollar as the middleman.

👉 See also: Walmart Distribution Red Bluff CA: What It’s Actually Like Working There Right Now

- 18-Month Windows: The RBI recently gave a huge break to exporters. If you bill your clients in Indian Rupees instead of Dollars, you now get 18 months to bring that money back to India. If you stick with Dollars? You only get 15. It’s a classic "nudge."

- Regional Lending: India is now lending Rupees to Sri Lanka, Bhutan, and Nepal. By making the Rupee a "trade currency" in South Asia, the RBI reduces the domestic demand for Dollars.

- The 5.25% Repo Rate: In December 2025, the RBI cut its key interest rate (the Repo rate) to 5.25%. Usually, cutting rates makes a currency weaker because it offers lower returns to investors. But the RBI is betting that lower rates will spur domestic growth, making India a more attractive long-term destination for "sticky" investment, not just hot speculative money.

What This Means for Your Wallet

If you’re a regular person, the currency of american dollar in indian rupees isn't an abstract concept. It's a tax on your lifestyle.

Think about it. Most of the chips in your phone, the oil in your car, and even the fertilizer used for your food are priced in Dollars. When the Rupee falls to 90.44 or 90.87, those things get more expensive. This is "imported inflation." You might see the RBI saying inflation is "under control" at 2%, but your grocery bill might tell a different story.

On the flip side, if you're a freelance coder in Bengaluru getting paid by a client in San Francisco, you’re probably popping champagne. A stronger Dollar means your $2,000 paycheck just got a "raise" in Rupee terms without you doing an extra lick of work.

✨ Don't miss: Do You Have to Have Receipts for Tax Deductions: What Most People Get Wrong

Looking Ahead: Will it Hit 95?

Predicting forex is a fool’s errand, but we can look at the signposts. MUFG Research and other analysts are projecting the Rupee to stay in the 89.50 to 91.50 range for the first half of 2026.

A lot depends on the U.S. election cycles and whether the "Trump Tariffs" (or the threat of them) actually materialize. If the U.S. starts slapping big taxes on Indian exports, the Rupee will face even more selling pressure. However, India's forex reserves are still massive—sitting around $686 billion. That’s a lot of "dry powder" the RBI can use to step in and prevent a total freefall.

Actionable Insights for the "90-Rupee" Era:

- For Travelers: If you're planning a trip to the States or Europe, lock in your forex now. Don't wait for a "dip" that might not come. Use "Reloadable Forex Cards" to hedge against daily volatility.

- For Students: If you have an education loan in Rupees but expenses in Dollars, consider "Forward Contracts." Talk to your bank about fixing an exchange rate for your future tuition payments. It might cost a small fee, but it protects you if the Rupee suddenly slides to 93.

- For Investors: Look at Indian IT and Pharma sectors. These "export-oriented" businesses actually benefit from a weaker Rupee because their costs are in INR but their revenues are in USD.

- For Remitters: If you are sending money to India, keep an eye on "TransferWise" (now Wise) or "Revolut" rates. Traditional banks often hide a 2-3% "spread" on the exchange rate. At ₹90.87, a 2% spread is nearly 2 Rupees per dollar down the drain.

The days of an 80-Rupee dollar are likely in the rearview mirror. We are entering an era of "structural adjustment." The Rupee is finding its new floor, and while the transition is bumpy, the underlying Indian economy remains one of the fastest-growing in the world. Just keep an eye on that 90-mark; it’s the new baseline for the foreseeable future.

To manage your finances effectively in this environment, track the RBI's Weekly Statistical Supplement released every Friday. It's the most honest look you'll get at how much "armor" India has left to protect the Rupee.