So, you've seen the headlines or maybe just heard the whispers in the office breakroom. The CPA exam changed big time in 2024. People were freaking out. They called it "CPA Evolution," which sounds like a sci-fi movie but was actually just a massive overhaul of how we license accountants. Honestly, everyone wanted to know one thing: did it get harder to pass?

Now that the full 2024 data is out, the answer is... kinda complicated. Some sections became absolute nightmares, while others—believe it or not—saw pass rates that look like a typo because they're so high. If you're looking at cpa pass rates 2024 to decide which section to tackle next, you need to look past the "50% average" myth.

The Core Sections: A Tale of Two Realities

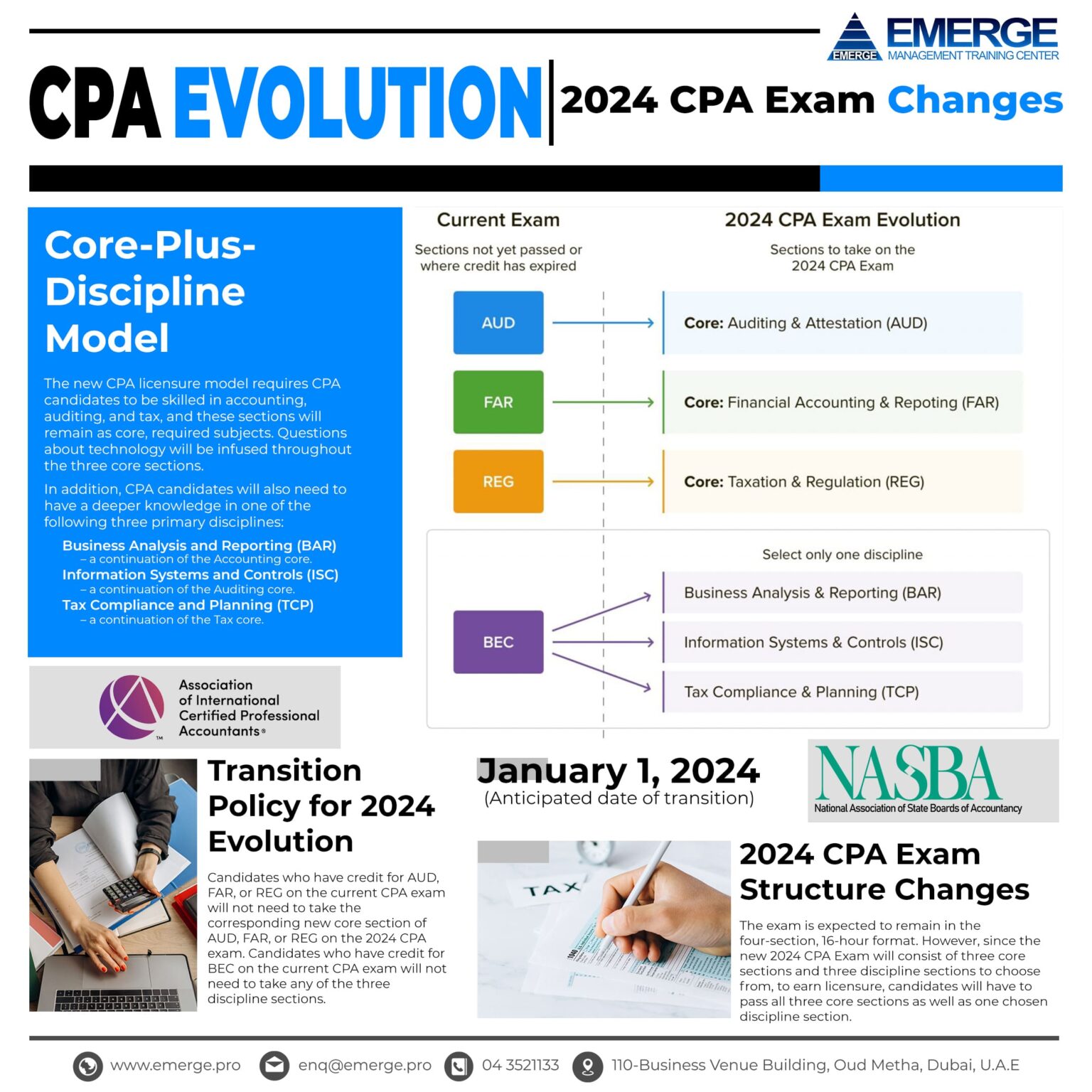

In the new world, everyone still has to pass the three "Core" sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Regulation (REG). But the 2024 numbers show a massive divide in how people actually performed.

FAR: The Heavyweight Champ of Difficulty

Financial Accounting and Reporting (FAR) has always been the "beast." In 2024, it lived up to the reputation. The cumulative pass rate for FAR in 2024 was about 39.59%.

Think about that. Nearly two out of every three people who sat for FAR walked away without a passing score. It started the year okay at 41.92% in Q1 but basically slid downhill, hitting a rough 36.80% by Q4. Why? Well, even though the AICPA moved some of the "hard stuff" to the new BAR discipline, the core material left in FAR is still dense. It's the technical heart of accounting. If you don't know your leases or consolidations, FAR will find out.

📖 Related: Elon Musk Tesla CEO: What Most People Get Wrong About 2026

REG: The Surprising Success Story

On the flip side, Regulation (REG) was a total outlier. While FAR was crushing dreams, REG was handing out passing scores like candy—relatively speaking. The cumulative cpa pass rates 2024 for REG sat at a healthy 62.61%.

It’s weird, right? Usually, tax and law scare people. But under the new 2024 structure, a lot of the complex "advanced" tax stuff moved to the TCP discipline. This left the REG core feeling much more manageable. It stayed consistent all year, never dipping below 60%.

AUD: The Middle Ground

Then there’s AUD. Auditing is that middle child that just stays steady. It ended 2024 with a cumulative pass rate of 45.79%. It’s the section where people often think they "get it" because they work in audit, but then the exam asks a question about a specific report wording and—boom—point lost. It peaked in Q3 at 47.80% but stayed predictably in that mid-40s range.

The Disciplines: Where the Wild Things Are

This is where 2024 got really interesting. Instead of everyone taking BEC (the old "Business Environment and Concepts" section), candidates now pick one of three "Disciplines." The results were, frankly, lopsided.

- Tax Compliance and Planning (TCP): This section was the absolute winner. It had a staggering 82.36% pass rate in Q1 and ended the year with a cumulative 73.91%. If you’re good at tax, or even just okay at it, these numbers suggest TCP is the "path of least resistance" for many.

- Information Systems and Controls (ISC): This one focused on IT audit and data. It grew on people. It started at 50.93% and climbed as high as 61.88% in Q3. It finished the year at a solid 58.00%.

- Business Analysis and Reporting (BAR): If FAR is the heavyweight champ, BAR is the contender that hits just as hard. It was the lowest-performing discipline with a cumulative pass rate of only 38.08%. By Q4, it dropped to a brutal 33.68%.

Basically, if you choose BAR, you better love technical accounting and data analytics, because the numbers say it’s the hardest nut to crack in the new lineup.

Why the Numbers Shifted So Much

You’ve gotta realize the AICPA isn't just throwing darts at a board. They set a "cut score." But in 2024, everything was new. Candidates were using brand-new study materials. Review providers like Becker, UWorld, and Gleim were basically guessing what the sims would look like.

There’s also the "burnout" factor. NASBA data from Q4 of 2024 showed that pass rates usually dip at the end of the year. People are tired. They’re trying to squeeze in one last exam before the holidays or before their credits expire. In Q4 2024, the pass rate for first-time testers was around 51%, but for those retaking a section, it dropped to 39.3%.

✨ Don't miss: What Elon Musk Owns in 2026: The Truth About His Trillion-Dollar Portfolio

Age matters too, believe it or not. The data consistently shows that if you’re under 22 or 23 (meaning you’re probably still in "student mode"), your odds are way better. Candidates under 22 had a 64.1% pass rate in late 2024, while those in their late 20s hovered closer to 46%. It’s just harder to study when you have a 50-hour work week and a mortgage.

What This Means for Your Strategy

Look, don't let a 39% pass rate in FAR scare you out of the profession. It just means you can't wing it.

Honestly, the cpa pass rates 2024 tell a story of specialization. If you look at the high success in TCP, it suggests that candidates who play to their strengths (like tax) are winning. If you hate IT, don't take ISC just because you heard it's "easier" than BAR. The "easiest" section is always the one you actually understand.

Practical Next Steps

- Audit your own strengths first. If you did well in your advanced accounting classes, maybe BAR is for you. if you're a tax person, TCP is a no-brainer given that 74% cumulative pass rate.

- Front-load the "Beast." Most experts suggest taking FAR early. Why? Because its content spills over into BAR and even parts of AUD. Plus, if you pass the hardest one first, the psychological boost is massive.

- Don't wait for the "perfect" window. In 2024, many people waited for the "easier" Q1 results, but that just created a backlog. Continuous testing is back for Core sections, so use it.

- Target 300 hours. It sounds like a lot, but the Miami Herald and other sources have noted that candidates hitting that 300-hour mark per section see significantly higher success.

- Watch the Discipline windows. Unlike Core sections, Disciplines usually have specific testing windows. Map your calendar now so you don't miss a window and get stuck waiting three months to test.

The 2024 data proves the CPA exam is still a gauntlet, but it’s a beatable one. You just need to be the one who prepares more than the 50% who didn't make the cut.