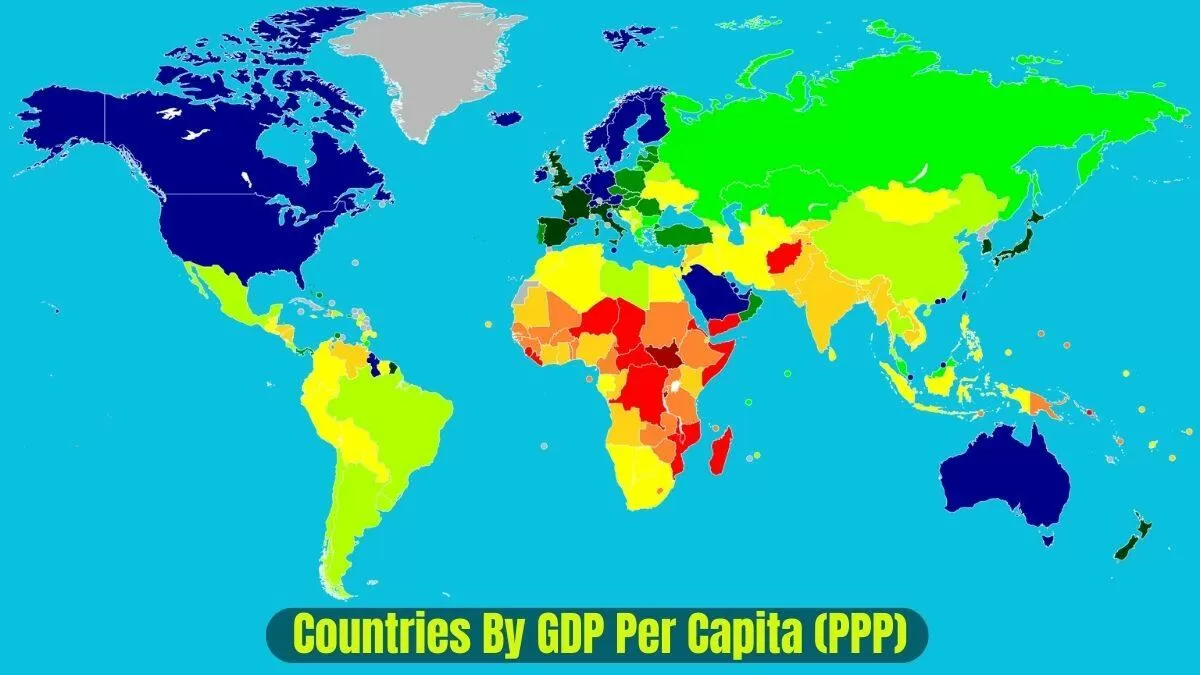

You've probably seen those flashy headlines claiming some tiny European nation is "ten times richer" than the United States. It makes for a great clickbait thumbnail, doesn't it? But honestly, when you look at the official lists of countries by GDP per capita PPP, the reality is a lot more nuanced—and frankly, a bit weirder—than just who has the most gold in the vault.

Most people treat GDP like a high score in a video game. Higher is better, right? Kinda. But if you don't adjust for the fact that a cup of coffee in Zurich costs three times as much as one in Taipei, the numbers are basically useless for comparing how people actually live.

That’s where Purchasing Power Parity (PPP) comes in. It’s the great equalizer. It adjusts for the cost of living and inflation rates so we can compare apples to apples. Or, more accurately, Big Macs to Big Macs.

The 2026 Leaders: Who’s Actually at the Top?

If we look at the latest IMF and World Bank data for 2026, the podium looks a bit different than you might expect. We aren't just talking about big industrial powerhouses. In fact, the top of the list is dominated by what economists sometimes call "microstates" and "tax havens."

Luxembourg usually sits comfortably at number one. By early 2026, its GDP per capita PPP is estimated to hover around $155,270. That is an insane amount of money for a country with fewer people than North Dakota.

But here is the catch: Luxembourg has a massive number of cross-border workers. These folks commute in from France, Germany, and Belgium, produce wealth that counts toward Luxembourg’s GDP, but then they take their paychecks home. They aren't counted in the "per capita" (per person) part of the denominator. It inflates the stats.

Then you have Singapore. It's currently nipping at Luxembourg’s heels with a figure around $161,550 in some recent projections. Singapore is a fascinating case because it has almost zero natural resources. Its wealth is built entirely on being the smartest, fastest, and most business-friendly port and financial hub on the planet.

The Heavy Hitters and the Oil Giants

- Ireland: This one is controversial. Ireland’s PPP numbers are through the roof—often over $150,000. But a huge chunk of that is "Leprechaun Economics." Multinational tech and pharma giants book their global profits there for tax reasons. The money is there, but it’s not exactly in the pockets of the average guy in Cork.

- Qatar: The energy king. With massive natural gas reserves and a relatively small citizen population, Qatar consistently stays in the top five. By 2026, they are sitting around $122,000.

- United States: The U.S. is the outlier. It is the only large, diversified economy that competes with the tiny tax havens and oil states. In 2026, the U.S. GDP per capita PPP is roughly $92,880. When you consider there are over 340 million people in the U.S., maintaining that level of per-person wealth is actually an incredible feat of economic engineering.

Why PPP Matters More Than "Nominal" GDP

If I told you that you earned $100,000 a year, you’d be happy. But if I then told you that a loaf of bread costs $50, you’d realize you’re actually poor.

✨ Don't miss: US Oil and Refining: What Most People Get Wrong About the Pump

Nominal GDP is just the raw dollar amount. It’s what the currency is worth on the international exchange market. GDP per capita PPP is what that money actually buys you at the local grocery store.

Think about India. In nominal terms, India’s per capita income is quite low, around $2,934. But when you adjust for PPP, that number jumps to nearly $13,000. Why? Because your dollar goes about four times further in Mumbai than it does in Manhattan. You can't understand global poverty or emerging markets without looking through the PPP lens.

The "Finance Curse" and the Tax Haven Trap

We need to talk about the "Finance Curse." It’s a term popular among researchers like those at the Tax Justice Network.

Just because a country has a high GDP per capita PPP doesn't mean the "average" citizen is living like a king. In many tax havens, the cost of housing is so astronomical that even "wealthy" professionals feel the squeeze.

🔗 Read more: Is That an Amazing Offer or What: The Truth About High-Stakes Marketing Hooks

Take a look at Bermuda or the Cayman Islands. Their GDP figures are legendary. But the inequality is often just as legendary. If 10 billionaires move to an island of 100 people, the "average" wealth skyrockets, but the other 90 people might still be struggling to pay rent.

Emerging Players: Watch These Countries

The map is shifting. While the old guard in Western Europe stays stable, keep your eyes on these movers:

- Guyana: Thanks to a massive offshore oil boom, Guyana is currently the fastest-growing economy in the world. Their GDP per capita PPP has tripled in just a few years, shooting past $94,000 in 2026 projections.

- Poland: Often ignored, Poland has been a growth machine. It’s now nipping at the heels of the UK and France in terms of PPP-adjusted living standards. By 2026, they're at $58,560.

- Vietnam: While still lower on the list (around $16,000 PPP), the trajectory is steep. As manufacturing shifts away from China, Vietnam is absorbing that capital at a record pace.

Limitations: What the Numbers Hide

Honestly, GDP is a blunt instrument. It doesn't measure:

- Income Inequality: A high average can hide a desperate median.

- Unpaid Labor: Stay-at-home parents and community volunteers contribute massive value that never shows up in the data.

- Sustainability: A country can have a high GDP by burning through all its natural resources, essentially "selling the house to pay the mortgage."

Economists often suggest looking at Actual Individual Consumption (AIC) alongside GDP. AIC measures what households actually consume, which often gives a more "human" picture of wealth. In AIC rankings, the U.S. and Nordic countries often look much stronger than the corporate-heavy tax havens.

How to Use This Data

If you’re a business owner or an investor, you shouldn't just look for the "richest" country. You should look for the gap between nominal GDP and PPP.

A country with a low nominal GDP but a rising PPP GDP often represents a massive opportunity for arbitrage. It means labor is cheap, but the domestic market's "real" buying power is growing. That’s the sweet spot for expansion.

Actionable Next Steps:

- Check the Median, not just the Mean: When researching a country for relocation or business, look for the median household income. It tells you what the "middle" person actually makes, which is far more revealing than the GDP average.

- Cross-Reference with HDI: Compare a country's GDP per capita PPP with its Human Development Index (HDI) score. If the GDP is high but the HDI is low (like in some oil states), it suggests the wealth isn't being converted into education or healthcare.

- Watch Exchange Rates: If you are earning in USD but living in a high-PPP country, your "real" wealth is much higher than your bank statement suggests. Use this to your advantage if you're a digital nomad or remote worker.

Understanding countries by GDP per capita PPP is basically about seeing through the "currency illusion." It's not about how many pieces of paper you have; it's about what those papers can get you.