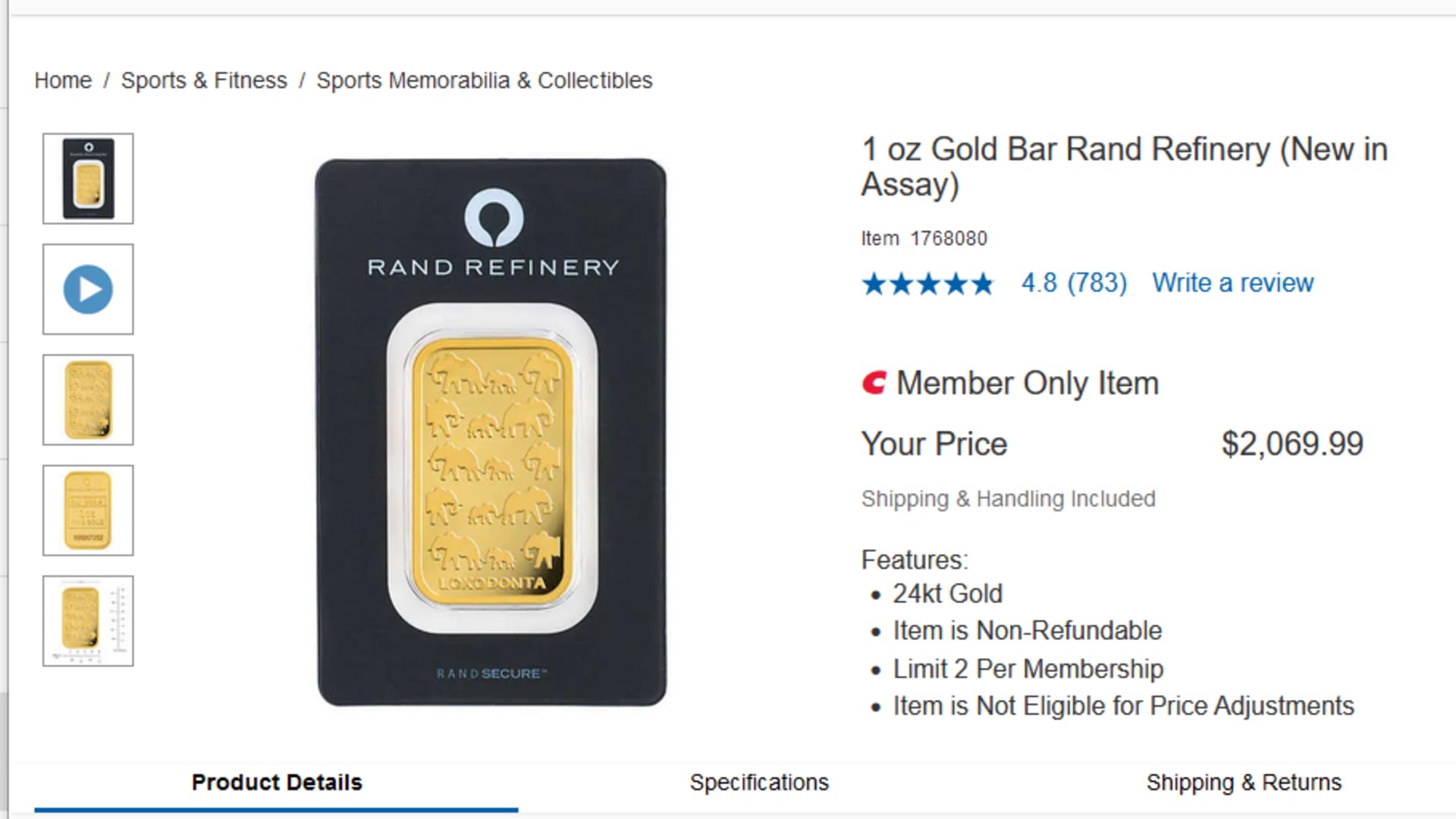

You’re pushing a flatbed cart past 30-packs of toilet paper and a rotisserie chicken when you see it. Tucked behind the jewelry glass, right next to the $15,000 diamond rings, sits a tiny, shiny rectangle of 24-karat gold. It’s the PAMP Suisse Lady Fortuna or maybe a Rand Refinery bar.

It looks out of place. It’s weird. But it’s also selling like absolute wildfire.

Since Costco started selling bullion in late 2023, the frenzy hasn't slowed down. In fact, by early 2026, analysts at Wells Fargo and JPMorgan have noted that Costco is likely moving $200 million in gold monthly. People aren't just buying it for the "cool factor" anymore; they're buying it because the costco gold bar value has outperformed almost every other "safe" investment over the last two years.

But if you think you’re going to walk into a warehouse, buy a bar, and flip it for a mortgage payment tomorrow, you’re missing the nuance. Gold isn't a rotisserie chicken. You can't just return it if you change your mind.

The Math Behind the Costco Gold Bar Value

Let’s talk numbers, because that’s why you’re here.

Most retail gold dealers—the ones you find online or in local coin shops—charge a "premium." This is the markup over the "spot price" (the global market price for raw gold). Typically, these markups range from 2% to 5%, and sometimes as high as 10% if you're buying small quantities.

📖 Related: Why Fred Smith Still Matters: The Real Story of the Man Who Built FedEx

Costco basically broke this model.

They usually list their 1 oz bars at about 1% to 2% over spot. As of early 2026, with gold hovering around $3,400 to $3,500 an ounce, a Costco bar might be listed for $3,550. That’s already competitive.

But here’s the kicker: The Executive Membership.

If you have a Costco Executive Membership, you get 2% back. If you use the Costco Anywhere Visa® Card by Citi, you get another 2% back on Costco.com.

Do the math. If you’re getting 4% back on a purchase that was only marked up by 2%, you are literally buying gold below the spot price. That is unheard of in the precious metals world. It’s the primary reason these bars sell out within hours of being posted online. You’re essentially getting paid to own the gold.

Why the Price Varies Every Single Day

Gold isn't static. It’s a living, breathing market.

The value of your bar is tied to the LBMA (London Bullion Market Association) prices. If the Federal Reserve hints at interest rate cuts, gold usually jumps. If there’s geopolitical tension in Eastern Europe or the Middle East—as we’ve seen consistently throughout 2025—investors flee to gold as a "safe haven."

When you look at the price tag at Costco, it’s not what it was yesterday. It changes based on the market's mood. In September 2024, you could grab a bar for $2,679. By January 2026, that same bar is worth roughly $3,500. That’s a gain of over 30% in just over a year.

Is It "Real" Gold? Purity and Authenticity

You might be skeptical. It’s Costco, after all.

Rest assured, they aren't selling gold-plated lead. The bars are almost exclusively .9999 fine gold. That’s as pure as it gets. They partner with legendary refineries:

- PAMP Suisse: Known for the "Lady Fortuna" design. These are the gold standard (pun intended) and come with Veriscan technology so you can verify them with a smartphone app.

- Rand Refinery: The South African giant that produces the Krugerrand.

- The Royal Mint: Occasionally, you’ll see Britannia bars.

Each bar comes in a tamper-evident "assay card." This is your birth certificate for the gold. It lists the weight, the purity, and a serial number that matches the one engraved on the bar itself. Do not open the assay card. Once you break that seal, the resale value can take a hit because a buyer then has to re-test the metal's purity, which costs time and money.

The "Final Sale" Trap

Here is where the honeymoon ends for some buyers.

Costco’s legendary return policy? It doesn't apply here. You can return a half-eaten bag of kale, but you cannot return a gold bar.

Once you click "buy" or walk out of the warehouse, that gold is yours. If the market crashes 10% the next day, you’re holding the bag. This makes gold a "high-conviction" purchase. You shouldn't buy it with money you need for next month’s rent.

Also, storage is a thing. You can’t just leave $3,500 worth of metal on your nightstand. You’ll need a floor safe or a bank deposit box. Insurance companies often won't cover "loose" bullion unless you have a specific rider on your homeowner’s policy. These are the hidden "carrying costs" that eat into the total costco gold bar value.

Selling Your Bar: Where the Rubber Meets the Road

Buying gold is easy. Selling it for a fair price is the hard part.

Costco will not buy it back. They are a one-way street. To realize your gains, you have to find a buyer. You have a few options, and honestly, some of them suck:

- Local Coin Shops: They offer "instant cash." But they have to make a profit, so they’ll likely offer you 1% to 3% under spot price.

- Online Bullion Dealers: Sites like APMEX or JM Bullion have "sell to us" programs. They’re reliable but you’ll have to ship the gold via insured mail, which is nerve-wracking and expensive.

- Peer-to-Peer (eBay/Facebook): You might get the full market value, but the risk of getting scammed is astronomical. Most experts, including Jon Ulin of Ulin & Co. Wealth Management, strongly advise against this for physical gold.

Essentially, your "exit price" will always be slightly lower than the "spot price" unless you find a private collector. This "spread" is why gold is a terrible short-term trade but a great 5-year hedge.

The 2026 Outlook: Will the Value Keep Rising?

JPMorgan and Goldman Sachs have been bullish on gold for 2026, with some analysts predicting it could cross the $4,000 mark by the end of the year. Why? Inflation is still sticky, and global central banks—especially in China and India—are stockpiling gold to diversify away from the U.S. dollar.

When the big players (central banks) are buying, the "floor" for gold prices stays high. This bodes well for anyone holding a Costco bar.

Actionable Steps for Potential Buyers

If you’re looking to pick up a bar on your next Costco run, don't just wing it.

- Upgrade to Executive first. If you aren't an Executive Member, the "below spot" math doesn't work. The $120 annual fee pays for itself with a single gold bar purchase.

- Set up "Product Alerts." Use a third-party tracker or check the Costco "Coins & Bullion" section at 8:00 AM local time. They sell out fast.

- Check the Spot Price. Before you hit "checkout," open a tab for Kitco or Bloomberg. Make sure the Costco price is within 1-2% of the current spot.

- Leave it in the plastic. Keep that assay card pristine. Any scratch on the plastic or a broken seal makes it "raw gold" to a dealer, lowering your payout.

- Think in years, not weeks. If you need the money in six months, buy a high-yield savings account instead. Gold is for the "I want to make sure I have wealth in 2030" mindset.

The costco gold bar value isn't just about the metal; it’s about the unique way Costco allows regular people to bypass the high-fee gatekeepers of the precious metals industry. It’s a retail anomaly that actually favors the consumer. Just make sure you have a safe place to hide it—and maybe grab a hot dog on your way out.

Next Steps for You:

Check your current membership tier on the Costco app. If you're a "Gold Star" member, you're leaving 2% on the table. You should also look up the current "Gold Spot Price" on a financial site to see if the market is currently in a dip or at an all-time high before your next warehouse visit.