So, you’re looking at Madison. Maybe it’s the Terrace chairs, the "Jump Around" tradition, or just the fact that it’s a world-class research hub. But then you hit the "Sticker Price" page and your stomach drops a bit. I get it. Honestly, trying to calculate the cost of attendance university of wisconsin feels like trying to solve a puzzle where the pieces keep changing shape.

The biggest mistake people make? Looking at the "Total" at the bottom of the official PDF and assuming that’s exactly what they’ll pay. It almost never is. Between residency quirks, the "hidden" costs of living on State Street, and the way financial aid actually flows in 2026, the real number is a moving target.

Let's break down what it actually looks like to fund a Badger life right now.

The Raw Numbers: Tuition and the 5% Factor

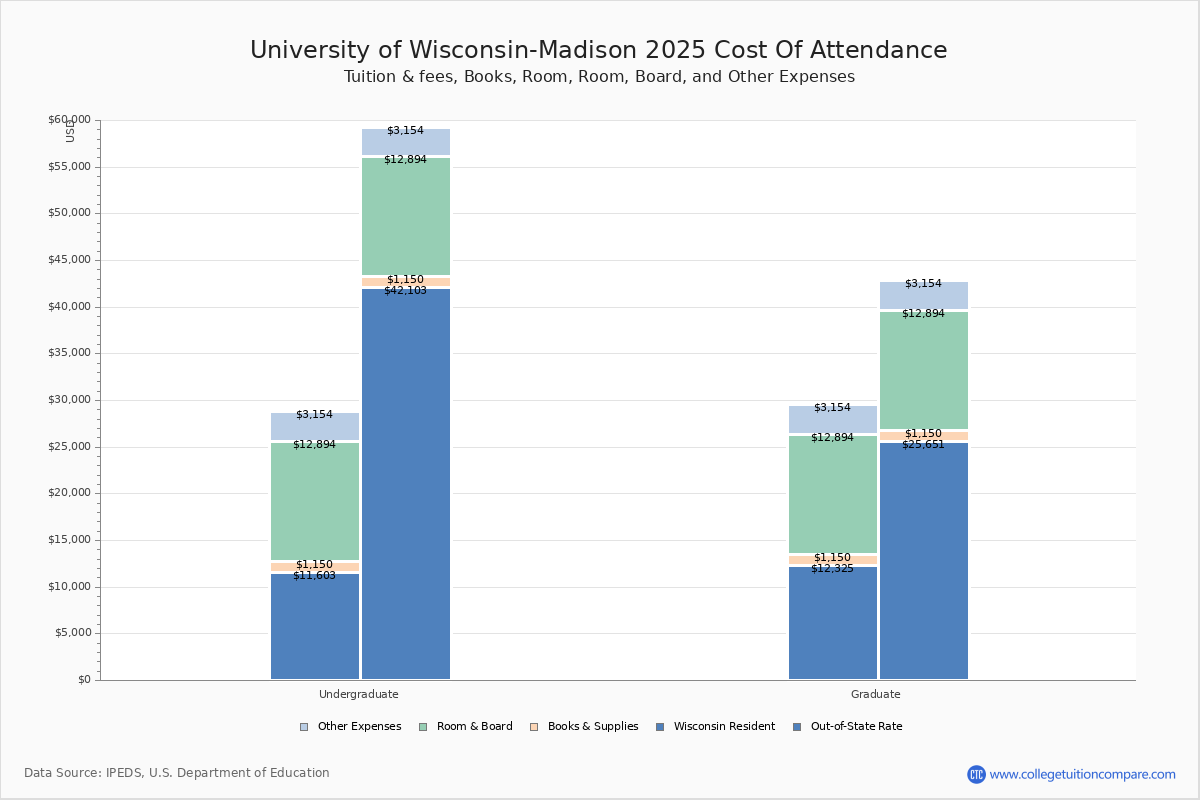

In July 2025, the Board of Regents approved a tuition hike that fundamentally changed the math for the 2025-2026 academic year. We’re looking at a 5% increase for undergraduates. For a Wisconsin resident, that pushes the base tuition to roughly $10,506 annually. If you’re coming from out of state, brace yourself—that figure jumps to about $42,531.

💡 You might also like: The Recipe Marble Pound Cake Secrets Professional Bakers Don't Usually Share

But wait. That’s just the "tuition." You also have "segregated fees." These are the costs that cover things like the bus pass, the Nick (that massive fitness center), and student organizations. For 2025-2026, these fees bring the total "Tuition & Fees" bill to roughly $12,186 for residents and a staggering $44,210 for non-residents.

It's a lot.

However, if you're from Minnesota, the reciprocity agreement is still a lifesaver, landing you somewhere in the middle at about $17,584.

📖 Related: Why the Man Black Hair Blue Eyes Combo is So Rare (and the Genetics Behind It)

Housing: The "Madison Premium"

Living in Madison isn't cheap. If you’re a freshman, you’re likely in the dorms. A standard double room in a hall like Witte or Sellery, combined with a mid-tier dining plan like the "Go14," is going to run you about $14,520 for the academic year.

Here’s where it gets tricky for sophomores and juniors. Most students move off-campus after year one. While the university estimates housing and meals at that same $14k-ish range for off-campus students, the Madison rental market is aggressive.

- The "High-Rises": If you want to live in those shiny new buildings near the Kohl Center, you could easily spend $1,200 to $1,800 a month just for a bedroom in a shared suite.

- The "Houses": If you’re willing to live in an old house in the Vilas or Bassett neighborhoods, you might find a room for $800.

- The Food Factor: Don't forget that off-campus, you aren't just swiping a Wiscard. Groceries in Madison are roughly on par with the national average, but eating out on State Street will eat your budget alive.

The "Real" Cost of Attendance University of Wisconsin

The university puts out an "official" total budget. For a Wisconsin resident living on campus, they estimate the total cost of attendance university of wisconsin is $30,644. For a non-resident, it’s $63,268.

👉 See also: Chuck E. Cheese in Boca Raton: Why This Location Still Wins Over Parents

But let's look at the "hidden" line items they include in those totals:

- Books and Supplies: They estimate $700. Honestly? If you’re a STEM major, you’ll hit that in one semester. If you’re savvy with PDFs and used rentals, you might spend $200.

- Personal Expenses: They budget $2,570. This is your coffee, your winter coat (you need a good one), and your social life. In a city like Madison, this is where the "thrifty" students separate from the "big spenders."

- Transportation: $600 to $1,200. This mostly covers trips home. If you live in California, $1,200 for a year of flights is optimistic.

Financial Aid: The Great Equalizer (Sometimes)

About 60% of freshmen at UW-Madison receive some form of financial aid. The average package is around $17,741.

If your family income is under $65,000, you need to look into Bucky’s Tuition Promise. This is a program that guarantees to cover tuition and segregated fees for four years for Wisconsin residents who qualify. It’s basically a game-changer. For families making more, the aid becomes a mix of federal loans, work-study, and the occasional institutional grant.

One thing people miss: the School of Engineering and the Wisconsin School of Business often have "differential tuition." This is an extra charge—sometimes several hundred or even a thousand dollars—added to your bill because those programs cost more to run. If you’re an engineering major, your cost of attendance is higher than a history major’s. Period.

Strategies for Slashing the Bill

- The "Thrifty" Housing Move: Look at the Lakeshore dorms. They are often slightly cheaper than the Southeast "social" dorms and offer a much quieter environment. Plus, the 80 bus is free for students.

- Dining Plan Hacks: Don't start with the "GoUnlimited" plan. Most students don't eat 21 meals a week in a dining hall. Start with the "Go10" and add money to your Wiscard if you need more. You’ll save thousands.

- Student Jobs: UW-Madison is one of the best places for student employment. From working at the Unions to tech support at DoIT, you can earn $12–$17 an hour. It won’t pay for tuition, but it covers the "State Street Tax" (aka your late-night Ian's Pizza runs).

Actionable Next Steps

- Use the Net Price Calculator: Don't trust the sticker price. Go to the UW-Madison Financial Aid website and plug in your real family data.

- Check for "Differential Tuition": If you are applying to Business, Engineering, or Nursing, look up the specific "differential" fees for those colleges so you aren't surprised by an extra $1,000 bill.

- Apply for the FAFSA early: Even if you think you won't qualify for much, having a FAFSA on file is required for many "merit" scholarships.

- Research Bucky's Tuition Promise: if you're a Wisconsin resident, verify your eligibility immediately; it can drop your out-of-pocket tuition to zero.

The cost of attendance university of wisconsin is a steep climb, especially for out-of-state Badgers. But between the high graduation rates (89%) and the median starting salary for grads (around $73k), the ROI usually justifies the struggle—provided you don't sleep on the financial aid deadlines.