You’ve probably seen the headlines. For the 2025-2026 academic year, the total Cornell cost of attendance officially crossed that eye-popping $100,000 threshold for some students. It’s a number that feels a bit like a typo. How can a single year of college cost as much as a small house in the Midwest?

Honestly, looking at the raw numbers can give anyone a minor panic attack. If you’re a returning student in an endowed college (like Arts and Sciences or Engineering), the university’s estimated total—including the mandatory health insurance plan—hits about $100,288. Even for new students, it’s hovering right at $99,953.

But here’s the thing: almost nobody actually writes a check for $100k.

Breaking Down the Real Numbers

To understand why the price tag is so high, you have to look at what's actually being billed. Cornell splits its expenses into "billed" and "non-billed" costs. The billed stuff is what you see on your bursar statement—tuition, fees, housing, and food. The non-billed stuff is basically an estimate of what you’ll spend on books, travel, and that occasional late-night pizza in Collegetown.

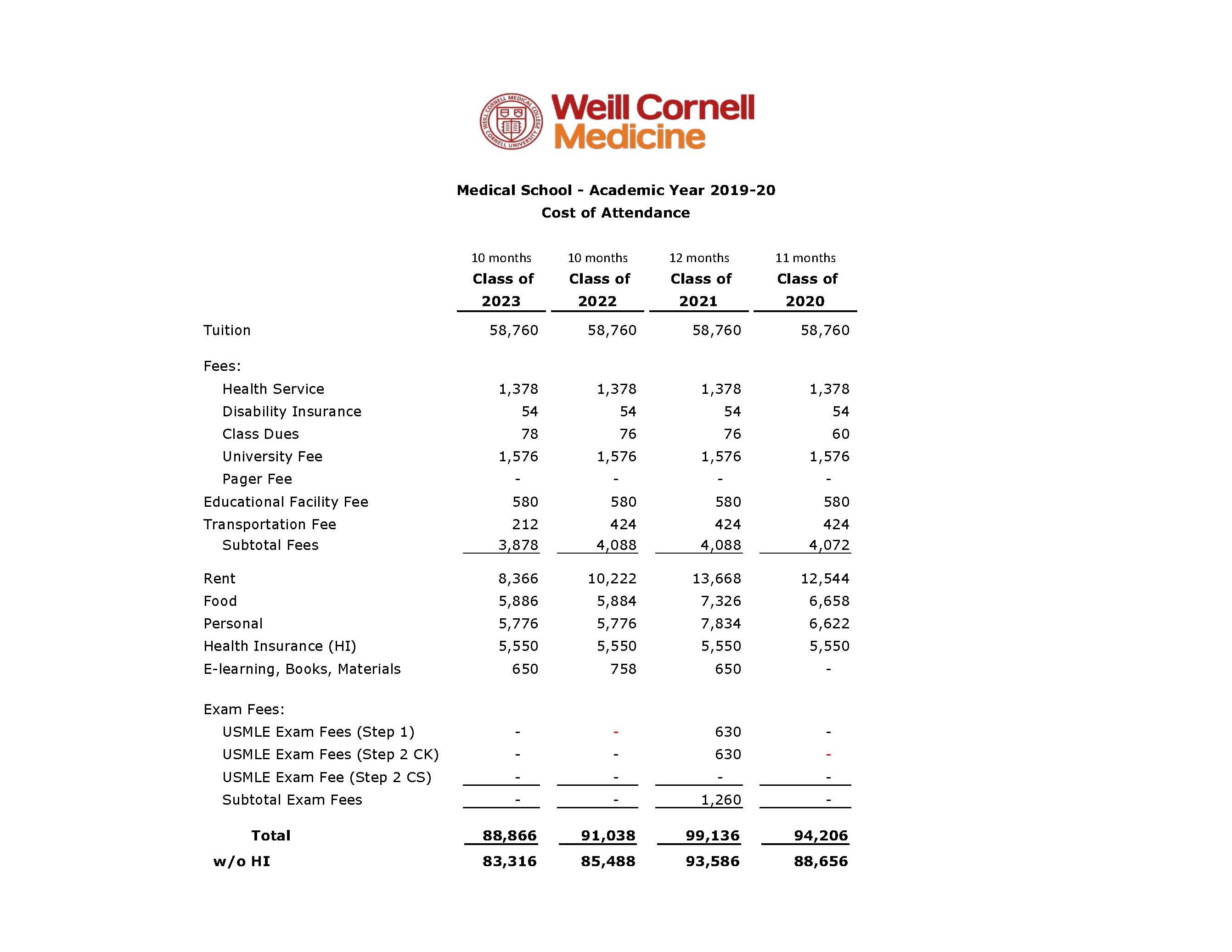

For the 2025-2026 year, the breakdown for a "typical" undergraduate in an endowed college looks something like this:

👉 See also: The Gospel of Matthew: What Most People Get Wrong About the First Book of the New Testament

- Tuition: $71,266

- Housing: $13,246 (usually a standard double)

- Food: $7,328 (the "Unlimited" plan)

- Mandatory Fees: $1,004 (this covers the Health Fee and Student Activity Fee)

When you add those up, you’re at $92,844. Then the university tags on about $3,424 for books and personal items. If you add the Cornell Student Health Insurance Plan (SHP), which is roughly $4,020 for returning students, you’ve officially hit the six-figure mark.

The "Statutory" Loophole (for New Yorkers)

One of the weirdest things about Cornell is that it’s both a private Ivy League university and part of the New York State land-grant system. This means if you’re a New York resident and you get into one of the "contract" or statutory colleges—like the College of Agriculture and Life Sciences (CALS), Human Ecology, or Industrial and Labor Relations (ILR)—you get a massive discount.

For 2025-2026, New York residents in these specific colleges pay $48,010 in tuition instead of $71,266. That’s a $23,000 difference right off the bat. If you're a local, that brings your total billed costs down to about $69,588. Still not "cheap," but it's a hell of a lot better than $100k.

Financial Aid: The Great Equalizer

The real reason you shouldn't just close the tab and give up on Ithaca is Cornell’s financial aid policy. They are "need-blind" for U.S. citizens and permanent residents, and they promise to meet 100% of your "demonstrated need."

✨ Don't miss: God Willing and the Creek Don't Rise: The True Story Behind the Phrase Most People Get Wrong

Basically, they look at your family's tax returns (via the FAFSA and CSS Profile) and decide what you can afford. If you make under a certain amount, the Cornell cost of attendance drops off a cliff.

Income Brackets and What You'll Actually Pay

Cornell recently revamped their "Access and Affordability" initiatives. Here is how it generally shakes out for families with typical assets:

- Under $75,000 income: You usually get a "full ride" for tuition, housing, and food. No student loans.

- Under $125,000 income: Cornell typically covers full tuition with grants.

- Between $75k and $125k: Your aid package might include a small "low-interest" loan, usually capped at $2,000 per year.

- Between $125k and $175k: The loan cap goes up to $4,000 per year.

- Above $175k: You might still get aid, but your max loan offer usually sits around $6,000.

I talked to a junior in the engineering school last month who told me her family makes about $90,000. Her "net price"—what they actually pay after grants—is about $12,000 a year. That’s less than she would have paid to go to her local state school.

The Hidden Costs Nobody Mentions

It’s easy to focus on tuition, but Ithaca isn’t exactly a budget-friendly town. If you live off-campus in your junior or senior year, Collegetown rents are notorious. We're talking $1,200 to $1,800 a month for a tiny room in a shared house.

🔗 Read more: Kiko Japanese Restaurant Plantation: Why This Local Spot Still Wins the Sushi Game

Then there’s the "Ithaca is Gorges" tax—also known as the cost of winter gear. If you aren't from the Northeast, you’re going to spend $500 on a decent parka and boots within your first month. Also, transportation to the Ithaca Tompkins International Airport (ITH) or taking the "Campus to Campus" bus to NYC adds up.

The "One Big Beautiful Act" Impact

Something to keep an eye on is the "One Big Beautiful Act" (OBBB) signed into law in July 2025. This changed some federal loan limits and repayment rules starting in mid-2026.

Cornell has stated they will adjust their own grants to compensate if federal Pell Grants change, but it's a reminder that the "sticker price" is a moving target. If you're applying for the 2026-2027 cycle, you absolutely have to stay on top of your CSS Profile dates. Missing the November 1 (Early Decision) or January 2 (Regular Decision) deadlines can cost you thousands in lost institutional aid.

Is the Investment Worth It?

At $100,000 a year, you’re looking at a $400,000 degree. Even with aid, it’s a lot. However, the data from the SC Johnson College of Business and the Engineering school shows starting salaries often range from $85,000 to $120,000.

For most, it’s a math problem. If you’re coming from a family making $250k+ and you don’t qualify for aid, you’re paying for the brand and the network. If you’re in that middle-income bracket, the Cornell Grant can actually make this one of the most affordable options on your list.

Your Next Steps

- Run the Net Price Calculator: Don't guess. Go to Cornell’s financial aid site and plug in your real 2024 or 2025 tax data. It’s the only way to get a realistic estimate.

- Check the Statutory Colleges: If you're a NY resident, look closely at CALS or ILR. You can study business (Dyson) within CALS and save $23k a year just by being a resident.

- Watch the Health Insurance Waiver: If you’re already covered by your parents' insurance, you MUST waive the Cornell SHP. If you forget, that’s a $4,000 "oops" on your bill.

- Apply Early for Aid: The CSS Profile opens in October. Get it done. Cornell is generous, but they are strict about their paperwork.

- Compare the Net Price, Not the Sticker Price: When you get your letters, ignore the $100k number. Look at the "Net Cost" at the bottom of the page. That’s the only number that matters.