You're standing in a shop in Oak Park, and then you walk two blocks south into Berwyn. Suddenly, the legal math for your paycheck might change. It’s wild. Honestly, trying to pin down the cook county illinois minimum wage feels a bit like chasing a moving target because of how the local "opt-out" rules work.

As of right now in 2026, the baseline for most of Cook County is $15.00 per hour.

But wait. If you’re in Chicago, you’re looking at something much higher. Chicago handles its own business, and their rate usually jumps every July 1st. For the rest of the county, the rules follow a specific ordinance that tracks inflation, but it also has this weird "safety valve" where the wage won't go up if unemployment is too high.

Why the cook county illinois minimum wage is so confusing

Most states just pick a number. Illinois did that too—the state hit $15.00 on January 1, 2025—but Cook County likes to have its own layer of protection. Back in 2016, the county passed its own Minimum Wage Ordinance (MWO). The goal was to make sure suburban workers didn't fall behind the cost of living in one of the most expensive counties in the country.

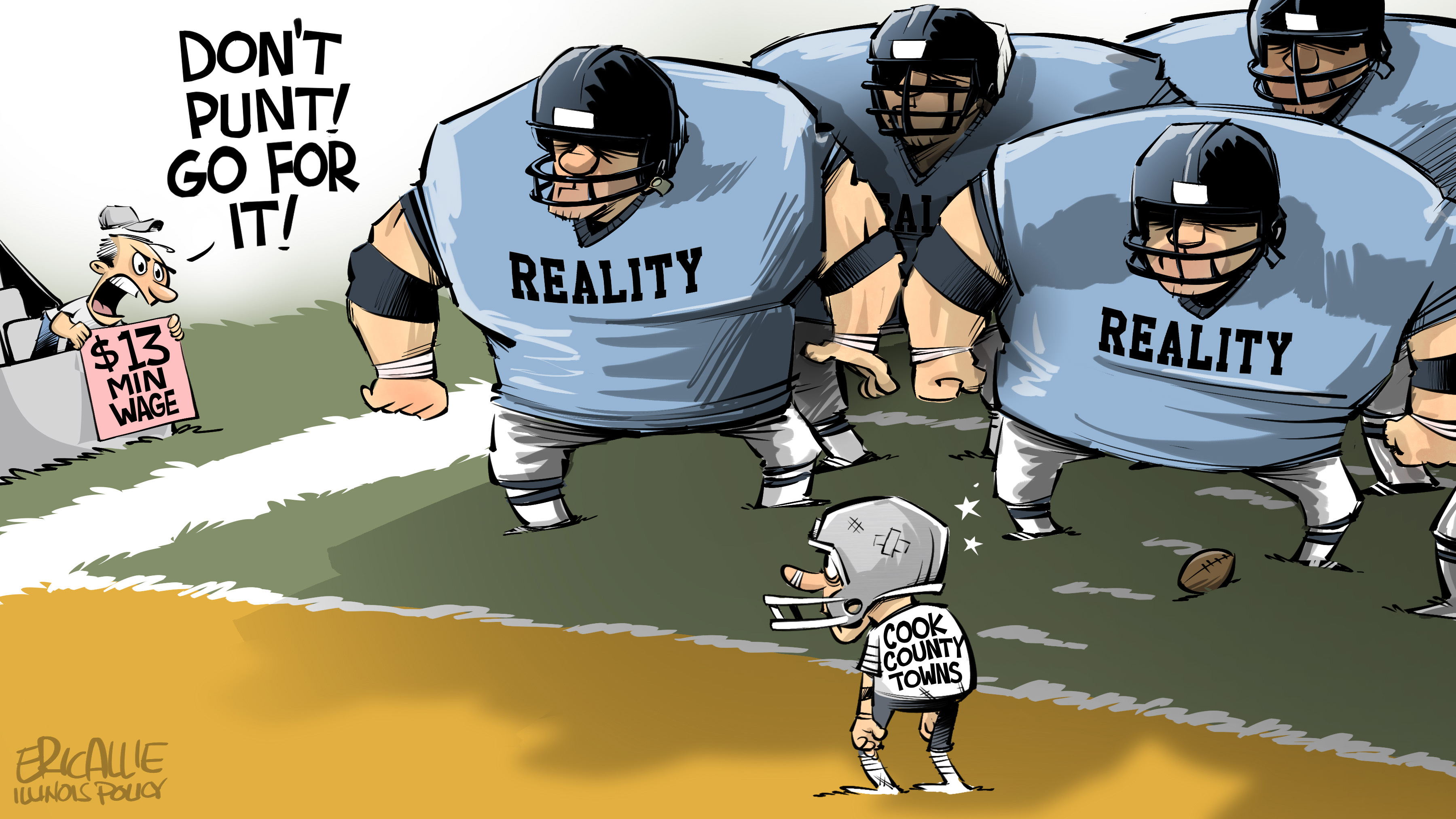

The catch? Home-rule municipalities were allowed to "opt out."

Basically, over 100 suburbs decided they didn't want to follow the county's higher path and instead stuck to the state minimum. This created a checkerboard. You could be making $15.00 in one town, and if you drive five minutes over the border to a town that opted out, you're still making the state minimum—which, luckily, is now also $15.00.

The Tipped Worker Situation

If you're waiting tables or bartending, the math gets even messier. The cook county illinois minimum wage for tipped employees is currently $9.00 per hour.

Employers are allowed to take a "tip credit," but they have to prove that your tips plus that $9.00 base actually equal the full $15.00. If it’s a slow Tuesday and you don't make enough in tips, the boss has to open the wallet and make up the difference. No excuses.

👉 See also: Pierce Sandwith Bass Berry: Why This Legal Move Matters

Chicago is currently on a totally different path here. They are actually phasing out the tipped wage entirely. By 2028, Chicago tipped workers will make the full minimum wage just like everyone else. But for the rest of Cook County? We're still in the $9.00 base-wage world for now.

Who Actually Gets Paid the cook county illinois minimum wage?

It isn't everyone. The law is specific. If you’re under 18, you might be looking at a "youth wage." In Illinois, that’s generally $13.00 per hour for minors who work fewer than 650 hours in a year. Once that kid hits 651 hours, though, they’ve gotta be paid like an adult.

Also, the county ordinance generally applies to:

🔗 Read more: No Taxes on Overtime Effective Date: What the New Rules Actually Mean for Your Paycheck

- Employees who work at least 2 hours in a two-week period within the county.

- Work performed in "unincorporated" Cook County.

- Work performed in municipalities that didn't opt out (places like Skokie, Evanston, and Oak Park).

If you’re an independent contractor (1099), you're sorta out of luck here. These protections are for W-2 employees.

Does the rate go up every year?

Sorta. Every July 1st, the Cook County Commission on Human Rights looks at the Consumer Price Index (CPI). If inflation is up, the wage can go up, but it's capped at 2.5%.

There is a huge "but" here. If the Cook County unemployment rate is 8.5% or higher, the wage stays flat. No raise. The county decided that if the economy is hurting that bad, forcing small businesses to pay more might lead to more layoffs. It's a balancing act that people on both sides of the aisle still argue about.

✨ Don't miss: How to invest in an IRA without making the mistakes everyone else makes

What most people get wrong

A lot of folks think that because the Illinois state wage hit $15.00, the Cook County ordinance doesn't matter anymore. That's wrong.

The county ordinance is still "on the books." If the state stops raising the wage but inflation keeps climbing, the Cook County rate could theoretically move ahead of the state again. Also, the county ordinance has different rules for things like "training wages" (which can be $14.50 for the first 90 days for certain workers).

Actionable Steps for Workers and Bosses

If you’re a worker in Cook County and your paycheck looks light, don't just sit on it. Check if your specific town opted out. If they didn't, and you're making less than $15.00 (or $9.00 plus tips), you might have a claim.

- Check the Map: Look up the "Cook County Minimum Wage Map" or your local village's ordinances.

- Save Your Stubs: Always keep your pay stubs. If there’s a dispute, the burden is usually on the employer to prove they paid you right.

- File a Complaint: The Cook County Commission on Human Rights handles these. You don't need a lawyer to file a basic complaint.

- Bosses, Update Your Posters: If you run a shop, you are legally required to have the 2026 posters up where people can see them. Failing to do that is an easy way to get a fine you don't want.

The landscape for the cook county illinois minimum wage is constantly shifting. Between the July updates and the state-wide changes, it pays to stay sharp.

Whether you're running a cafe in Schaumburg or stocking shelves in Alsip, knowing the exact floor of the labor market is just good business. Keep an eye on those July 1st announcements from the county—that's when the "inflation adjustment" news usually hits the wires.