Money is weird. One day you're sitting in a café in Paris feeling like a king because the Euro is strong, and the next, you're looking at your bank statement back in London wondering where that extra £50 went. If you’ve ever used a converter euro to pound sterling online and then felt gutted when your actual bank transfer didn't match the number on the screen, you aren't alone. It’s a gap that swallows billions of pounds in "hidden" fees every single year.

Most people think the exchange rate is a single, fixed number. It isn't. There is the mid-market rate—the real one banks use to trade with each other—and then there’s the "tourist rate" or "retail rate" they give to you. It's basically a markup.

The Mid-Market Rate vs. The Reality Check

When you search for a converter euro to pound sterling on Google, you're usually seeing the mid-market rate. Think of this as the wholesale price of currency. It’s the midpoint between the buy and sell prices on global markets. But unless you’re a massive hedge fund or a central bank, you aren't getting that rate.

Retail banks and high-street kiosks usually shave off 3% to 7% right off the top. They call it "zero commission," which is honestly a bit of a scam. They don't charge a flat fee, sure, but they give you a much worse exchange rate. If the real rate is 0.85, they might give you 0.82. On a £1,000 transfer, you just handed them £30 for doing essentially nothing.

It’s frustrating.

You’ve got to look at the "spread." That’s the difference between the interbank rate and what you’re being offered. Some apps like Revolut or Wise (formerly TransferWise) have made this better by offering rates closer to the real thing, but even they have weekend markups because the markets close and they need to protect themselves against "gap risk"—basically the price jumping before Monday morning.

📖 Related: Kimberly Clark Stock Dividend: What Most People Get Wrong

Why the Euro and Pound Keep Dancing

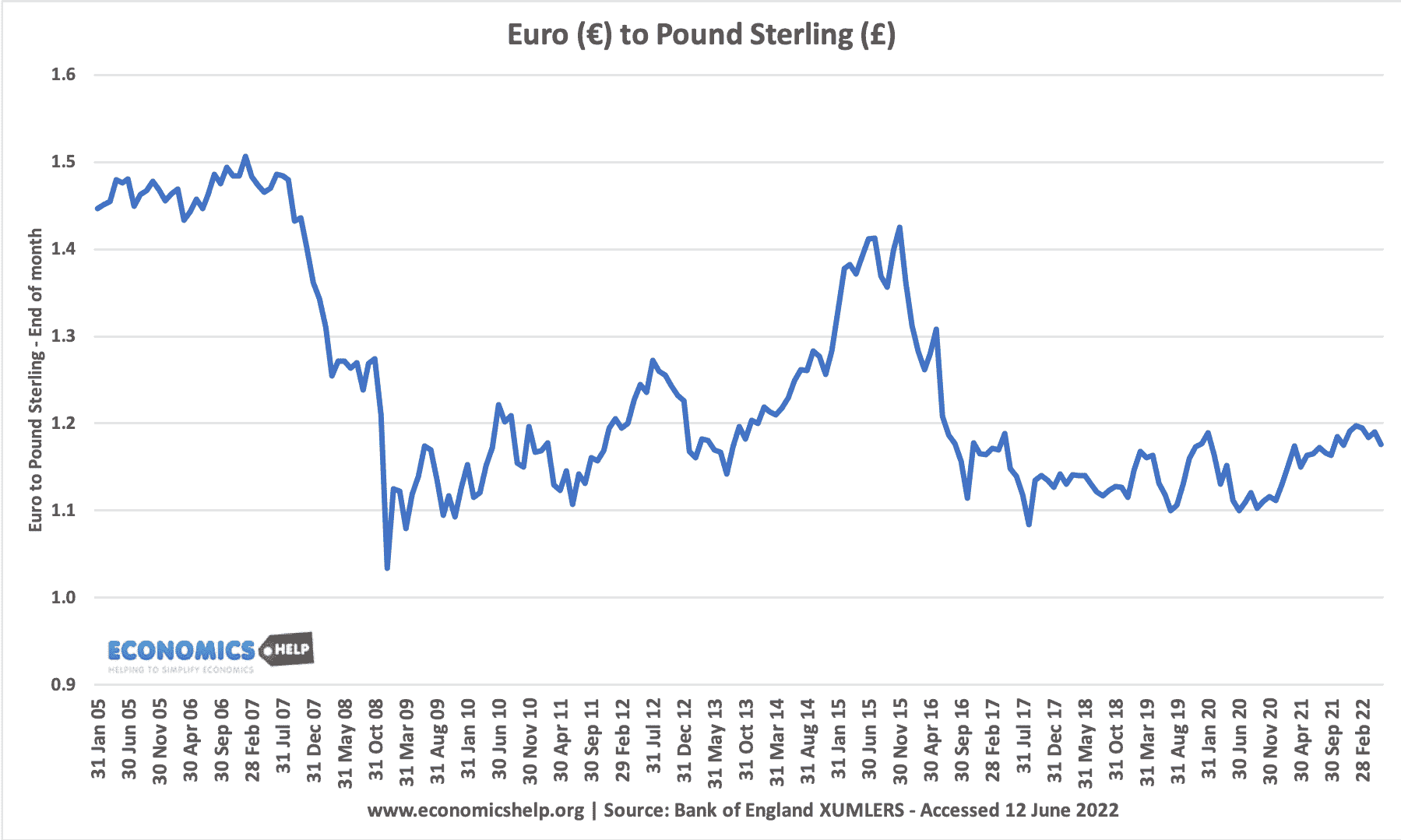

The relationship between the Euro (EUR) and the British Pound (GBP) is one of the most heavily traded pairs in the world. It’s driven by boring stuff that actually has a huge impact on your wallet. Interest rates are the big one. When the Bank of England raises rates, the Pound usually gets stronger because investors want to park their money in UK banks to get better returns.

But then there's the European Central Bank (ECB). They’re managing 20 different countries. If Germany's economy is booming but Greece is struggling, the ECB has to play a delicate balancing act. This tug-of-war is why your converter euro to pound sterling results look different every single morning.

Politics matters too. We saw this during the Brexit years, where a single headline could send the Pound spiraling. Even now, trade agreements or energy price shifts in the EU can make the Euro jittery. If you're planning a big purchase—like a house in Spain or a car in Germany—timing is everything. A 2% shift on a €200,000 property is €4,000. That’s a lot of sangria.

How to Actually Use a Converter Euro to Pound Sterling Without Getting Burned

Don't just trust the first result you see. Use it as a baseline. If your bank's app says they'll give you X amount, compare it to the mid-market rate. If the gap is huge, walk away.

- Avoid Airport Booths. This is the golden rule. They have the highest overheads and the worst rates in the galaxy.

- Watch the Weekends. Currency markets close on Friday night. Most providers add a buffer to the rate to cover potential volatility before markets reopen. If you can wait until Tuesday, do it.

- Look for Transparency. A good converter should show you the fee separately from the exchange rate. If they bake the fee into the rate, they're hiding something.

Let's talk about "Dynamic Currency Conversion" or DCC. You’re at a shop in Berlin, and the card machine asks if you want to pay in GBP or EUR. Always choose EUR. If you choose GBP, the merchant's bank chooses the exchange rate, and it is almost always terrible. Let your own bank handle the conversion; even with their fees, they're usually fairer than a random terminal in a souvenir shop.

👉 See also: Online Associate's Degree in Business: What Most People Get Wrong

The Technical Side of the EUR/GBP Pair

In the world of forex trading, the EUR/GBP pair is known for being relatively "range-bound." Unlike the US Dollar, which can go on massive streaks, the Euro and Pound tend to stay within certain boundaries because the UK and EU economies are so deeply linked.

When you use a converter euro to pound sterling, you’re looking at a "quote currency" (GBP) and a "base currency" (EUR). If the rate is 0.86, it means 1 Euro gets you 86 pence. If that number goes up to 0.90, the Euro is stronger, and your Pounds are worth less in Paris.

High inflation in the UK has recently kept the Pound on its toes. If the UK's inflation is higher than the Eurozone's, the purchasing power of the Pound drops, which theoretically should push the exchange rate up (meaning more Pounds per Euro). However, because high inflation often leads to higher interest rates, it sometimes has the opposite effect. It's a bit of a headache, honestly.

Real-World Impact: Moving Large Sums

If you’re moving more than £5,000, don't use a standard bank. Look into currency brokers. These are firms that specialize in nothing but foreign exchange. They can offer "forward contracts," which let you lock in a rate today for a transfer you’re making in three months.

Imagine you’re buying a flat. The rate is great today. You’re worried it might crash before you close the deal. A forward contract protects you. You pay a small deposit, and that rate is yours, no matter what happens to the markets. Banks rarely offer this to individuals; it’s usually reserved for corporate clients.

✨ Don't miss: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

Actionable Steps for Your Next Conversion

Stop losing money to laziness. It takes two minutes to check if you're being ripped off.

First, pull up a reliable converter euro to pound sterling to find the current "spot" rate. This is your "truth" number.

Second, check your provider's rate. Calculate the percentage difference. If it's more than 1% or 2% on a large sum, you're paying too much.

Third, consider a multi-currency account. Digital-first banks allow you to hold both Euros and Pounds simultaneously. You can convert your money when the rate is in your favor and just keep it there until you need to spend it. This takes the "timing" stress out of the equation.

Fourth, if you are physically traveling, use a travel credit card that offers the interbank rate with no foreign transaction fees. Many modern fintech cards do this natively. You spend in Euros, and they pull the exact amount in Pounds from your account using the real-time rate. No markups, no drama.

Finally, keep an eye on the news. Central bank meetings (the ECB and BoE) are the primary drivers of volatility. If a big announcement is coming up tomorrow, maybe wait to hit the "send" button. A little patience often pays for a very nice dinner.

Next Steps for Better Exchange Rates:

Check your primary bank's "Foreign Transaction Fee" policy in their T&Cs—most charge 2.99% plus a flat fee, which is often hidden in the fine print. Compare this against a specialized FX provider to see exactly how much you can save on your next transfer. For amounts over £10,000, contact a currency broker to discuss a "limit order," which automatically triggers your trade only when the market hits your target price.