You’ve seen the headlines. A K-pop star buys a penthouse in Hannam-dong for 10 billion won. A Netflix sensation like Squid Game offers a 45.6 billion won prize. It sounds like an astronomical, planet-sized amount of money, right? Well, it is. But when you start trying to figure out what a billion won in US dollars actually buys you, things get a bit messy.

The exchange rate is a fickle beast.

Honestly, most people just mentally "drop three zeros" and call it a day. If you have 1,000 won, that’s roughly a buck. Simple. But when you scale that up to the billions, that "rough estimate" starts to fail you by hundreds of thousands—sometimes millions—of dollars. In the world of international finance and high-stakes real estate, that margin of error is basically a massive hole in your pocket.

If you’re looking at a billion won in US dollars today, you’re generally looking at somewhere between $730,000 and $770,000. It depends entirely on whether the Federal Reserve is feeling grumpy about inflation or if the Bank of Korea decides to nudge interest rates.

The Tricky Reality of the 1,000-to-1 Rule

We love shortcuts. Our brains are wired for them. For the longest time, travelers and business ex-pats used the 1,000:1 ratio because it was easy math. 1,000,000,000 won? That’s a million dollars. Easy.

Except it isn't.

Since about 2008, the South Korean Won (KRW) hasn't spent much time at that 1,000 mark against the Greenback. It usually hovers much higher, meaning the dollar is stronger. If the exchange rate is 1,350 won to $1, your "billion won" is suddenly only worth about $740,000. You just "lost" $260,000 in imaginary math. That’s a whole house in some parts of the US.

South Korea’s economy is heavily export-reliant. Think Samsung, Hyundai, and SK Hynix. When the global economy gets shaky, investors often flock to the US Dollar as a "safe haven." This drives the dollar up and the won down. So, even if a Korean company makes a "billion won" in profit, its value in US dollars might actually be shrinking if the currency market is volatile. It’s a weird paradox. You’re making the same amount of money locally, but you’re getting poorer on the global stage.

Why Billion Won in US Dollars Matters for Pop Culture

Let’s talk about Squid Game. The prize was 45.6 billion won. At the time the show aired, that was roughly $38 million. If that show were filmed today with a weaker won, the dollar value would be lower, even if the "45.6" number stayed the same.

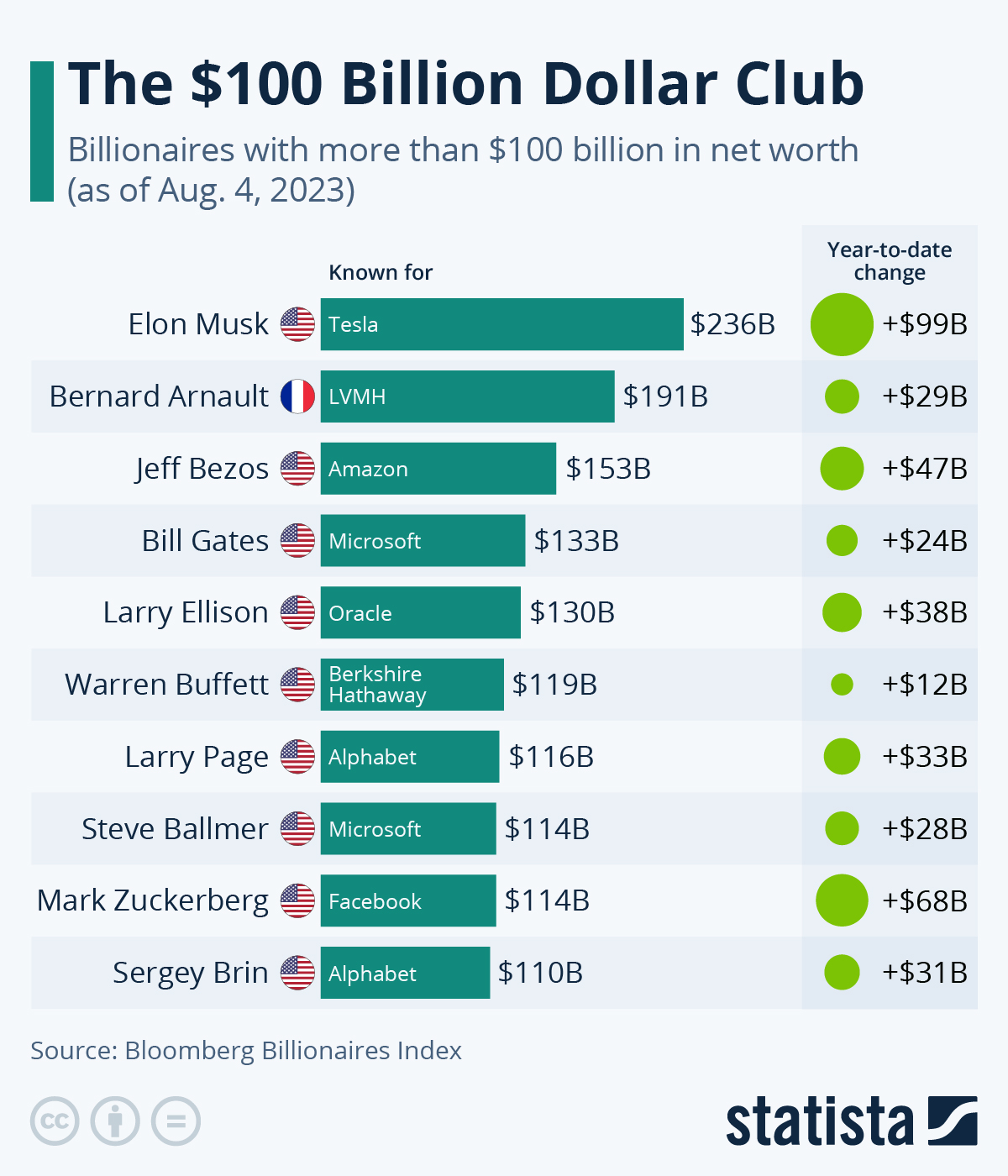

This creates a massive disconnect for Western audiences. When we hear "billion," we think Bruce Wayne or Elon Musk. But in Korea, being a "billionaire" (in won) just means you have about $750,000. Don't get me wrong, having three-quarters of a million dollars is fantastic. You’re doing great. But you’re not "private island and a superyacht" rich. You're "nice three-bedroom condo in a good suburb" rich.

If you're tracking celebrity net worths or K-drama production budgets, you have to be careful. A "100 billion won" movie budget sounds like a Marvel blockbuster. In reality, it's about $75 million. That’s more like a mid-budget Hollywood thriller or a very expensive indie. Still a lot of cash? Absolutely. But the scale is different.

The Real Estate Context

In Seoul’s Gangnam district, a standard apartment can easily run you 2 or 3 billion won.

Think about that.

If you convert billion won in US dollars, you realize that a "billionaire" in Seoul might just be a middle-aged office manager who bought an apartment in the 90s and is now "house rich" but cash poor. They live in a property worth $2.2 million (3 billion won) but might still be eating convenience store ramen to pay the property taxes.

What Actually Drives the Conversion Rate?

It isn't just random luck. Several heavy-hitting factors move the needle on what your won is worth.

- Interest Rate Differentials: If the US Federal Reserve raises rates and the Bank of Korea stays put, money flows toward the US to chase higher yields. The dollar gets stronger. Your billion won buys fewer dollars.

- Trade Balances: Korea lives and dies by semiconductors and cars. If global demand for chips drops, fewer people need to buy won to pay Korean companies. The currency weakens.

- Geopolitics: Any time there’s a flare-up with the neighbors to the north, the won tends to take a nervous dip. Markets hate uncertainty.

I remember talking to a currency trader in Myeong-dong a few years back. He told me that the won is often used as a "proxy" for the Chinese Yuan. Because Korea is so closely tied to Chinese manufacturing and trade, investors often sell off won when they’re worried about China. It’s not always about what’s happening in Seoul; sometimes it’s about what’s happening in Beijing or Washington D.C.

Practical Examples of Conversion

To give you a concrete feel for the numbers without a boring table, let's look at some hypothetical scenarios based on a 1,350 KRW/USD exchange rate:

A startup gets 5 billion won in seed funding. That’s roughly $3.7 million. Enough to hire a solid team and run for two years, but not enough to buy a Super Bowl ad.

📖 Related: Dow Stock Market Results Today: What Really Happened Behind the Slump

A luxury car costs 150 million won. That's about $111,000. Definitely high-end, but we're talking Porsche territory, not gold-plated Bugatti territory.

If you win a small lottery of 1 billion won, you walk away with $740,000 before taxes. After the Korean government takes its cut (which can be up to 33% for large prizes), you might be left with around $500,000. It’s a life-changing amount, but you’re probably not quitting your job forever unless you’re very good at investing.

How to Get the Best Rate

If you're actually moving a billion won in US dollars, for the love of everything, do not go to a retail bank at the airport. You will lose a staggering amount of money.

Banks charge a "spread." This is the difference between the price they buy the currency for and the price they sell it to you. For a billion won, a 1% or 2% spread is $7,500 to $15,000. That is a very expensive mistake.

Business professionals use specialized FX (Foreign Exchange) firms or "wire transfer" services that offer mid-market rates. These services essentially match buyers and sellers directly, bypassing the heavy bank fees. Even a 0.5% difference in the rate can save you enough to buy a decent used car.

Common Misconceptions

People often ask me, "Is the won just like the yen?"

Sorta. But not really.

The Japanese Yen (JPY) usually trades at around 100-150 to the dollar. The Won is usually 1,100-1,450. They both have "no decimals" in their standard daily usage, which confuses Americans used to dollars and cents. In Korea, you don't use "cents." The smallest unit in common circulation is the 10-won coin, and even those are becoming rare as everything goes digital.

📖 Related: XRP Listing HashKey Global: Why This Regulated Move Actually Matters

Another big mistake? Forgetting inflation. Just because 1 billion won was worth a lot in 2010 doesn't mean it has the same purchasing power now. Both the US and Korea have seen prices rise. However, the exchange rate doesn't always reflect local inflation perfectly. You might find that your dollars go much further in Daegu than they do in San Francisco, even if the "math" says they shouldn't.

Actionable Steps for Dealing with KRW/USD Conversions

If you are handling large sums—or just trying to understand the news—keep these points in your back pocket.

1. Use a Real-Time Tracker, Not Your Memory

The rate changes every second during market hours. Use a tool like XE, Oanda, or even just Google’s built-in converter. But remember: those are "interbank" rates. You, as an individual, will likely get a rate that is 0.5% to 3% worse than what you see on the screen.

2. Watch the "Resistance Levels"

In the world of finance, 1,300 won and 1,400 won are huge psychological barriers. When the rate hits 1,400, the Korean government often steps in to "stabilize" the currency by selling US dollars from their reserves. If you see it approaching 1,400, it might be a bad time to buy dollars and a great time to buy won.

3. Factor in Transfer Fees

If you’re sending a billion won abroad, look into "SWIFT" fees and intermediary bank charges. Sometimes, sending money in won and letting the receiving bank convert it is cheaper. Other times, converting it in Korea and sending it as USD is the way to go. You have to ask both banks for their "fee schedule" and do a little bit of homework.

4. Consider the "Kimchi Premium" (for Crypto)

This is a weird one, but it’s real. Sometimes, Bitcoin and other assets trade for more in Korea than they do in the US because of strict capital controls. This can actually skew how "wealthy" someone appears if their assets are held in Korean exchanges. It doesn't affect the raw exchange rate of a billion won in US dollars, but it definitely affects the purchasing power of that money if you're moving between asset classes.

Why You Should Care

Even if you aren't a high-flying CEO, the billion-won-to-dollar pipeline affects you. It affects the price of the Samsung phone in your pocket. It affects whether a Korean movie studio can afford to greenlight that sci-fi epic you want to see. It even affects the price of Korean skincare products at your local Sephora.

Understanding the scale of these numbers helps you cut through the sensationalism of the news. When you hear "billion," take a breath. Divide by 1,350 (or whatever the current rate is). Then you'll see the real story.

✨ Don't miss: Why the T-Mobile Integrity Line is Actually Your Best Friend at Work

To stay ahead of the curve, keep an eye on the Bank of Korea's monthly policy meetings. Their decisions on interest rates are the single biggest driver of whether your billion won will be worth a little more—or a lot less—by the end of the year. If you're planning a major transaction or investment, timing your conversion to these announcements can be the difference between a successful deal and a costly oversight.