Money is weird. One minute you think you've got a handle on your budget, and the next, the foreign exchange market decides to do a backflip. If you're looking to swap 1000 rs to us dollar, you’re probably staring at a search engine result that says something around $11 or $12. But here is the thing: that number is a bit of a lie. Well, not a lie, but it’s definitely not the whole story.

Most people just want to know if they can afford a decent lunch in New York with a thousand-rupee note. The short answer? Barely. Maybe a street cart hot dog and a soda if you're lucky.

The Reality of the 1000 rs to us dollar Exchange

When you search for the exchange rate, Google usually shows you the "mid-market" rate. Banks use this to trade with each other. You? You aren't a bank. Unless you're running a massive hedge fund, you’re going to pay a "spread." This is basically the hidden fee that currency exchange booths at the airport or apps like PayPal tack on so they can keep the lights on.

Right now, the Indian Rupee (INR) has been hovering in a specific range against the Greenback. For a long time, we saw it sitting around 82 or 83 rupees to the dollar. Recently, it’s pushed closer to 84. If you divide 1000 by 84, you get roughly $11.90.

But wait.

If you go to a physical counter at a mall, they might give you an exchange rate of 86 or 87. Suddenly, your 1000 rs to us dollar conversion drops to $11.50 or less. It sounds like pennies, but when you scale that up to larger amounts, it’s a massive chunk of change.

🔗 Read more: ROST Stock Price History: What Most People Get Wrong

Why the Rupee fluctuates so much

Central banks are the puppet masters here. The Reserve Bank of India (RBI) doesn't just let the rupee float freely like a leaf in the wind. They intervene. They buy and sell dollars to make sure the rupee doesn't crash too hard or get too strong too fast. Why? Because a weak rupee makes petrol more expensive in Delhi, while a strong rupee makes Indian software exports less competitive. It’s a delicate balancing act that involves thousands of variables from oil prices to US Federal Reserve interest rate hikes.

Honestly, the "USD/INR" pair is one of the most watched metrics in emerging markets. When the Fed in Washington D.C. raises rates, investors pull their money out of India and put it into US Treasuries. This creates a sell-off. Rupee value drops. Your 1000 rupees buys even fewer cents.

Where to actually get the best deal

Don't go to the airport. Just don't. It is the absolute worst place to convert 1000 rs to us dollar because their overhead is insane. They know you're desperate.

If you are sending money to a friend or buying something online, use specialized fintech platforms. Companies like Wise (formerly TransferWise) or Revolut have disrupted this entire industry by offering the real mid-market rate and charging a transparent, upfront fee. It’s way better than the "zero commission" scams you see at tourist traps where they just bake a 5% markup into the exchange rate itself.

Digital vs. Physical Cash

There is also a massive difference between "Forex" and "Banknotes."

💡 You might also like: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

- Forex: This is digital money moving between accounts. It's cheaper.

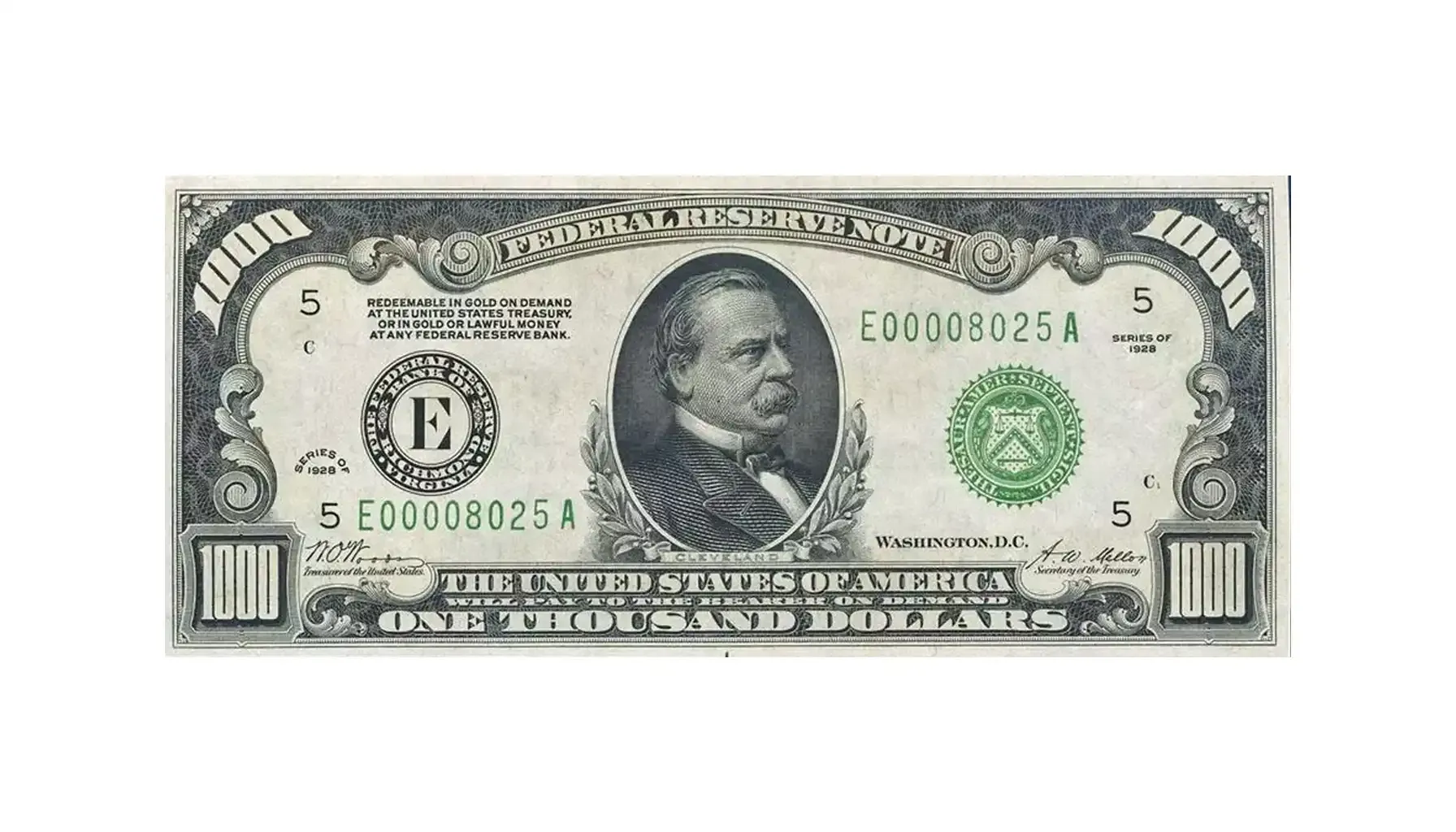

- Banknotes: This is physical paper. It costs money to ship, guard, and store paper bills.

If you walk into a bank in Mumbai asking for a $10 bill (which is roughly what 1000 rupees gets you), they might not even want to do the transaction because the paperwork costs them more than the profit they'd make.

What 1000 Rupees buys in America vs India

This is where the concept of Purchasing Power Parity (PPP) comes in. In India, 1000 rupees can actually get you quite a lot. You could have a very nice dinner for two at a mid-range restaurant, or buy a decent shirt, or cover your mobile phone bill for three months.

In the United States, $12 is... nothing.

Seriously. In San Francisco or New York, $12 might not even cover a fancy coffee and a croissant once you add tax and tip. This is why the 1000 rs to us dollar conversion is often a "sticker shock" moment for Indian travelers. You feel like a king with a thousand-rupee note in your pocket in Bangalore, but you feel like a pauper the moment you land at JFK.

Surprising factors that move the needle

You might think it's all about trade balances, but psychology plays a huge role. Market sentiment is a fickle beast. If traders think the US economy is slowing down, the dollar weakens, and suddenly your 1000 rupees might buy $12.10 instead of $11.90.

📖 Related: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Crude oil is the big one for India. Since India imports a massive amount of its oil, every time the price of a barrel of Brent Crude goes up, the rupee tends to take a hit. It’s a direct correlation that most casual observers miss. If you see news about tensions in the Middle East, expect your rupee-to-dollar conversion to get a little worse the next day.

How to track the rate like a pro

Don't just rely on the first number you see on a search engine. If you're serious about timing a conversion, use tools like XE or Bloomberg. They provide real-time candles. You can see the "bid" and the "ask."

- The Bid: What the market is willing to pay for your rupees.

- The Ask: What the market wants to charge you for dollars.

The gap between these two is the "spread." A tight spread means the market is liquid and healthy. A wide spread means things are volatile and you’re probably going to get a bad deal.

Actionable steps for your next conversion

If you need to move money or travel soon, stop waiting for the "perfect" rate. It rarely happens. Instead, look into "laddering" your exchange. Convert a bit of your 1000 rs to us dollar equivalent now, a bit next week, and a bit the week after. This averages out your cost and protects you from a sudden spike in the dollar's value.

Also, check your credit card. Many modern travel cards offer "Zero Forex Markup." This is a lifesaver. Instead of carrying physical cash, you just swipe your card, and the bank does the conversion at the Visa or Mastercard network rate, which is usually way better than any kiosk you'll find on the street.

Lastly, always choose to pay in the "Local Currency" when an ATM or card machine asks you. If you're in the US, pay in USD. If the machine offers to do the conversion for you (Dynamic Currency Conversion), say no. That’s just another way for the bank to take a 3% to 5% cut of your hard-earned money.

Keep an eye on the RBI's monthly bulletins if you really want to geek out on why the rupee is moving. They provide the most accurate context on inflation and foreign exchange reserves, which are the true engines behind that 1000 rs to us dollar figure you see on your screen.