So, you’re looking at 1 nok to usd and wondering why that tiny number matters. It’s usually a fraction of a dime. Currently, one Norwegian Krone (NOK) sits somewhere around $0.09 to $0.10, depending on which way the wind is blowing in the North Sea. It feels insignificant. But if you’re planning a trip to Oslo or trading energy futures, that tiny decimal point is basically a heartbeat for the global economy.

Norway is weird. It’s a tiny country with a massive bank account. When you check the exchange rate for 1 nok to usd, you aren't just looking at a currency pair; you're looking at the price of oil, the health of European tech, and the weird reality of a "Petro-currency" trying to survive a green energy transition.

💡 You might also like: Why the Chicago and North Western Railroad Still Matters to the Midwest

Why the 1 nok to usd rate is so stubborn

Most people assume all Western currencies move together. They don't. The Krone is famously volatile. While the Euro might stay relatively stable against the Dollar, the Krone acts like a tech stock. Why? Because Norway is the world's seventh-largest natural gas producer.

When Brent Crude prices spike, the Krone usually flexes its muscles. If you’ve ever sat in a cafe in Aker Brygge paying $9 for a black coffee, you’ve felt this. But lately, the correlation has been getting messy. We’ve seen oil prices stay high while the Krone struggles to keep up with the Greenback. This disconnect drives analysts at firms like DNB Markets and Nordea absolutely crazy.

The Fed vs. Norges Bank

The math is actually pretty simple, even if the results aren't. Interest rates are the steering wheel. If the U.S. Federal Reserve keeps rates high to fight inflation, the Dollar becomes a vacuum, sucking up capital from everywhere else. Even if Norway’s central bank, Norges Bank, raises their own rates, they’re often just playing catch-up.

Right now, the "carry trade" is a big deal. Investors borrow money where rates are low and park it where rates are high. If the gap between U.S. and Norwegian rates narrows, that 1 nok to usd figure starts creeping up toward the 0.11 or 0.12 mark. If the gap widens, Norway’s currency feels like a lead weight.

🔗 Read more: One Dollar in RMB: Why the Math Isn't as Simple as It Looks

The Oil Fund Factor

You can't talk about the Krone without talking about the Government Pension Fund Global. It’s the world’s largest sovereign wealth fund. It owns about 1.5% of all publicly traded shares on Earth. Think about that. Every time you buy an iPhone or a coffee at Starbucks, a tiny fraction of that profit technically belongs to a fisherman in Lofoten.

But here is the kicker: the fund doesn't invest in Norway. It’s all international. When the fund needs to move money back into Krone to fund the Norwegian government budget, it creates massive buying pressure. Conversely, the daily "Krone sales" by Norges Bank—where they swap NOK for foreign currency to fund the fund—can actually suppress the value of 1 nok to usd. It’s a self-balancing act that keeps the currency from getting too strong, which would destroy Norway's ability to export anything other than oil.

Inflation is the silent killer

Norway has high wages. Really high. But they also import almost everything that isn't fish or electricity. If the Krone is weak—meaning your 1 nok to usd gets you less than 9 cents—importing a Tesla or a crate of Spanish oranges becomes incredibly expensive. This creates a cycle where the central bank has to keep rates high just to keep the currency from collapsing and driving prices through the roof.

📖 Related: 3000 usd in gbp: How Much You Actually Get After the Fees

Trading 1 nok to usd in the real world

If you're a retail trader or just a traveler, you’re probably using a spread. You won't get the "mid-market" rate you see on Google. If Google says 0.095, your bank might give you 0.091. That's how they make their money.

- Timing the Market: Historically, the Krone performs better in the spring and summer.

- The Safe Haven Myth: People used to think the Krone was a safe haven. It’s not. In a crisis, people run to the Dollar. The Krone is "pro-cyclical." It does well when the world is happy and buying stuff.

- Liquidity Issues: Compared to the Euro or the Yen, the NOK is a "minor" currency. This means big trades can move the price significantly.

Honestly, the best way to handle 1 nok to usd if you’re traveling is to just use a low-fee card like Revolut or Wise. Don't bother with those airport exchange booths. They’ll fleece you for 15% of your value before you even leave the terminal.

The Future of the Krone

What happens when the oil runs out? Or more accurately, what happens when the world stops wanting it? Norway is currently trying to pivot. They are betting big on carbon capture, offshore wind, and hydrogen. But these industries don't provide the same immediate "cash-cow" effect that a North Sea oil rig does.

Some economists argue the Krone will never return to its 2012 glory days when $1 bought you only 5.5 NOK. Those days are gone. We are in a new era of "Dollar dominance." If you are looking at 1 nok to usd as a long-term investment, you’re basically betting on the U.S. economy cooling off and Europe—specifically Scandinavia—finding a new way to lead in tech and energy.

Misconceptions about Norwegian wealth

Just because the country is rich doesn't mean the currency is "expensive." Switzerland is rich, and the Franc is a powerhouse. Norway is rich, but the Krone is often undervalued. This is partly due to the "Dutch Disease," where a focus on natural resources hurts the rest of the economy. If the Krone gets too strong, Volvo (technically Swedish, but the logic holds for the region) or Norwegian salmon becomes too expensive for Americans to buy.

Actionable Steps for Navigating NOK/USD

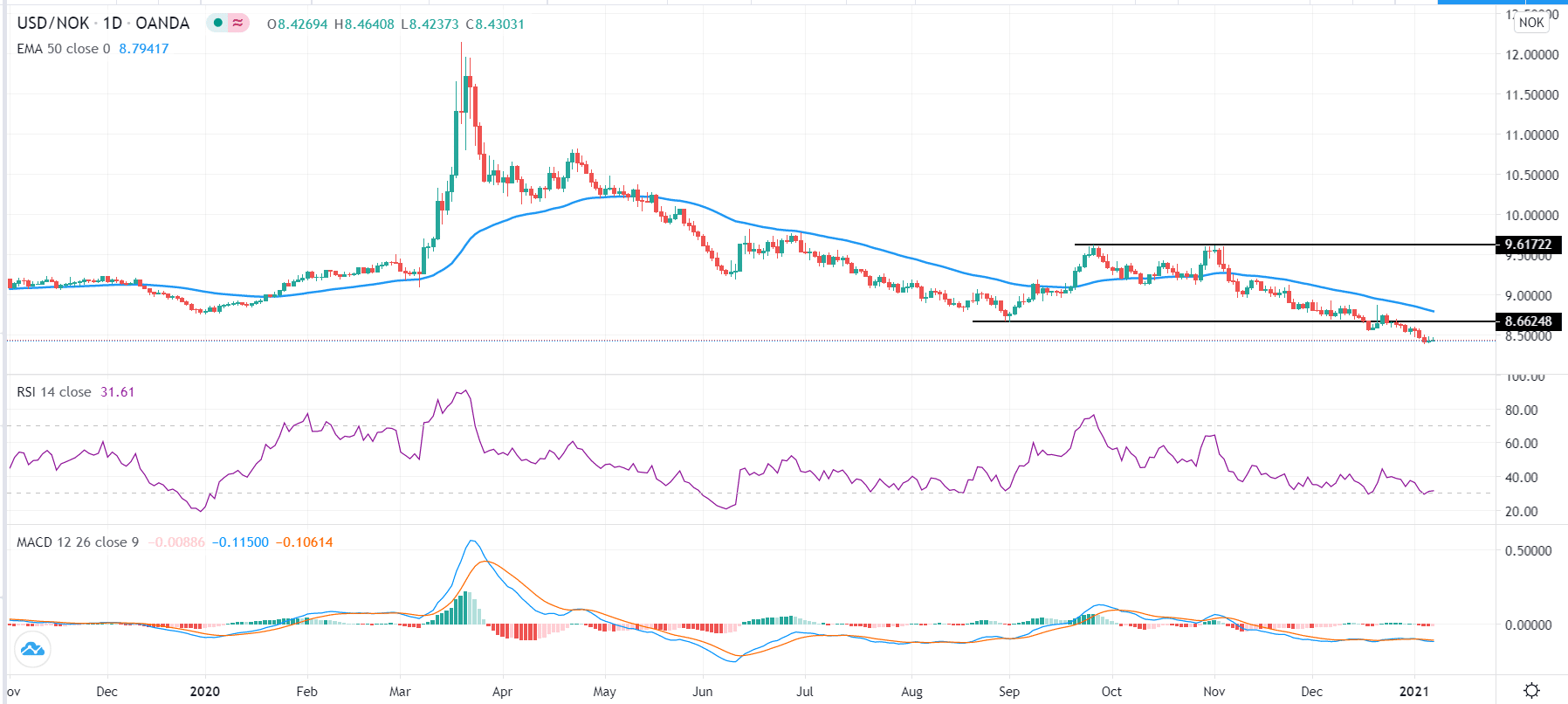

If you are dealing with Norwegian currency right now, stop looking at the daily charts and look at the "Big Three" indicators.

- Watch Brent Crude: If oil drops below $70, expect the Krone to slide.

- Monitor the Fed: Any hint of rate cuts in Washington D.C. is a green light for the Krone to gain ground against the Dollar.

- Norges Bank Announcements: They meet eight times a year. Read the "Executive Board’s assessment." If they sound "hawkish" (meaning they want to raise rates), buy. If they sound "dovish," sell.

For the average person, 1 nok to usd is just a number on a screen. But for the savvy observer, it's a window into how the world’s most successful social democracy manages its wealth against the backdrop of an aggressive American economy. Keep your eyes on the energy sector and the interest rate spreads; that's where the real story lives.

Before you make any big moves, check a real-time feed from a reputable source like Bloomberg or Reuters. Currency markets move in milliseconds, and what was true ten minutes ago might be history by the time you hit "confirm" on your bank transfer. Stick to digital platforms for the best rates and avoid physical cash whenever possible, as Norway is almost entirely cashless anyway.