Ever walked into a bank in Oslo thinking you were getting a fair deal, only to realize later you basically paid for the teller's lunch in fees? It happens. A lot. Converting your hard-earned dollars into Norwegian Krone (NOK) isn't just about looking at a number on a screen. Honestly, it's about navigating a weird mix of oil prices, central bank politics, and the "hidden" tax of exchange rate markups.

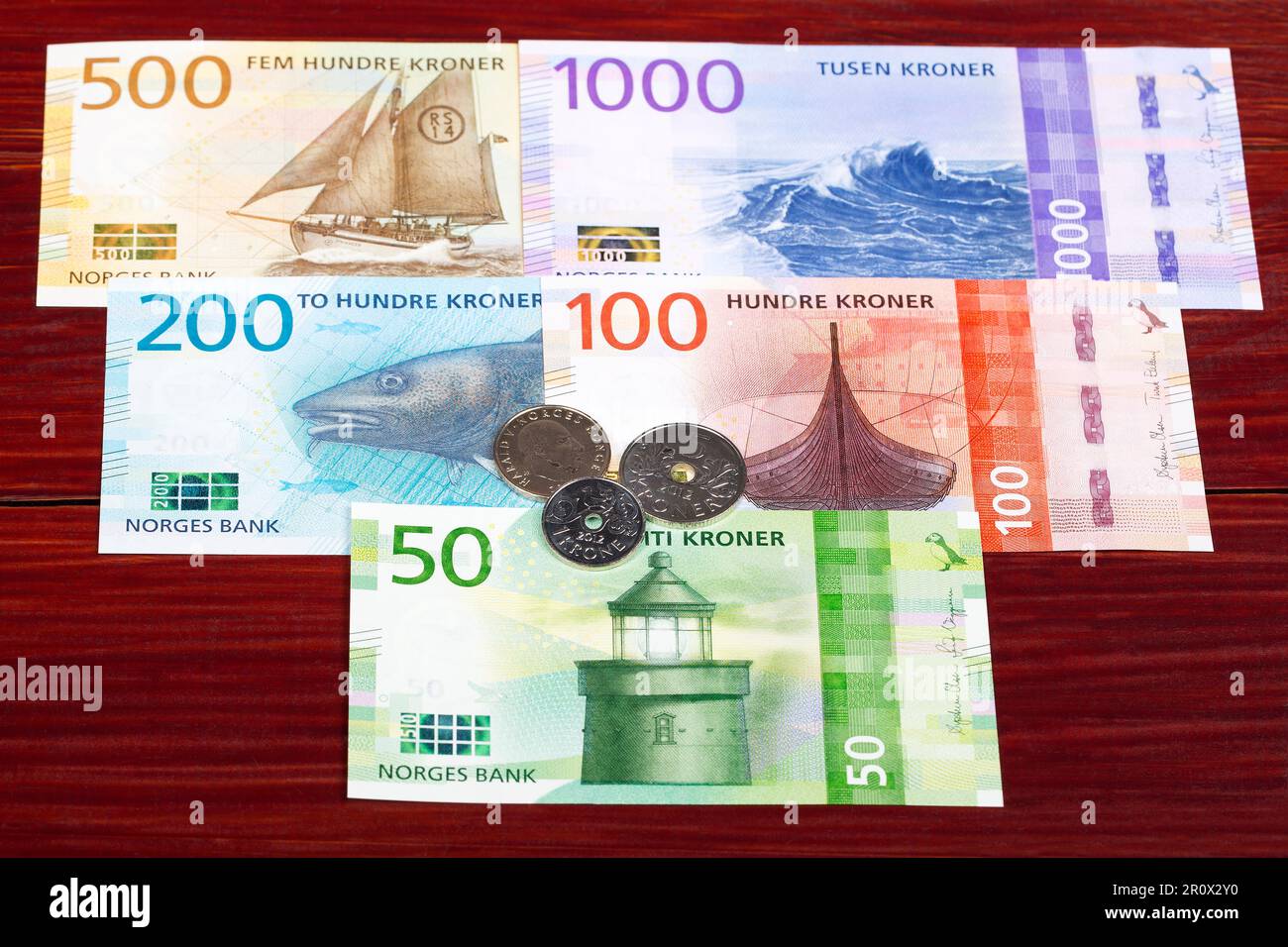

If you're looking to convert USD to Norwegian Krone right now, the rate is hovering around 10.10. That means for every $100, you’re looking at about 1,010 NOK. But here is the kicker: you will almost never actually see 1,010 NOK in your hand. Between the "spread" and the transaction fees, the math gets messy fast.

🔗 Read more: Africa Suez Canal Map: What Most People Get Wrong

The Oil Factor: Why the Krone is So Volatile

Norway is basically an oil company with a flag. Okay, that’s an exaggeration, but the value of the Krone is tied tightly to the price of Brent Crude. When oil prices tank, the Krone usually follows. If you're converting a large sum, you've got to watch the energy markets.

In early 2026, we’ve seen some interesting shifts. Norges Bank—Norway's central bank—has been keeping interest rates relatively high, around 4% to 4.5%, to fight inflation that just won't quit. Meanwhile, the U.S. Federal Reserve is doing its own dance. When the "interest rate differential" (the gap between U.S. and Norwegian rates) changes, the exchange rate jumps.

Most people don't realize that Norges Bank actually buys Krone daily. They do this to fund government spending from the country's massive sovereign wealth fund. In 2026, they’re expected to continue these purchases at a rate of several hundred million NOK per day. While they say this isn't meant to manipulate the exchange rate, it definitely provides a "floor" for the currency.

Stop Using Your Local Bank

Seriously. Just stop.

Your neighborhood bank in the States is probably the worst place to convert USD to Norwegian Krone. They have to ship physical cash, which is expensive. To cover that, they give you a "retail rate" that’s often 5% to 8% worse than the actual market rate.

If you want to move money without losing a chunk of it, you've got a few better options:

💡 You might also like: Coca-Cola and the Real Thing Story: Why That 1971 Jingle Changed Marketing Forever

- Fintech Apps: Tools like Wise or Revolut are the gold standard now. They use the mid-market rate—the one you see on Google—and charge a small, transparent fee. For a $1,000 transfer, you might pay $6 in fees instead of $50 at a bank.

- ATM Withdrawals (The "Minibank"): In Norway, ATMs are called "Minibanks." If you use a card with no foreign transaction fees (like Charles Schwab or certain Capital One cards), you can pull out Krone at a very fair rate.

- Specialist Remittance Services: If you're sending money to a relative or paying for a rental, services like Remitly or MoneyGram sometimes have "new customer" deals that are actually decent, though their standard rates can be sneaky.

The "Dynamic Currency Conversion" Scam

You’re at a nice restaurant in Aker Brygge. The waiter brings the card machine. It asks: "Pay in USD or NOK?"

Always choose NOK. When you choose USD, the local merchant's bank chooses the exchange rate. It’s called Dynamic Currency Conversion (DCC), and it is a legal way to rip you off. They might charge you an effective rate that's 10% higher than what your own bank would have charged. Trust your own bank to do the math; they’re almost always cheaper than the merchant’s bank.

Real-World Costs in Norway (2026)

Norway is expensive. There is no way around it. Even with a strong Dollar, your money disappears fast. To give you an idea of what that convert USD to Norwegian Krone math looks like in the real world:

A standard cappuccino in Oslo will set you back about 50 to 65 NOK. That’s roughly $5 to $6.50. A decent mid-range dinner for two? Expect to pay at least 1,200 NOK ($120), and that’s without much wine.

Interestingly, Norway is almost entirely cashless. You can go a week in Bergen or Stavanger without ever touching a physical coin. Even the smallest hot dog stands and public toilets take cards or mobile payments like Vipps (though Vipps usually requires a Norwegian ID). Because of this, you don't actually need to carry much physical cash. Exchanging $50 for "emergency" use is plenty.

🔗 Read more: Why 115 S LaSalle Chicago Is The Most Interesting Mess In The Loop Right Now

Timing Your Exchange

Is there a "best" time to buy?

Historically, the Krone tends to be a bit weaker in the fourth quarter (October–December) and often sees a little rally in the spring. In 2026, experts at places like SEB Research and BCA Research have noted that if oil prices stabilize above $80 a barrel, the Krone could strengthen.

If you are planning a trip for later in the year, you might want to "layer" your conversions. Don't trade all your USD at once. Convert some now, some in a month, and the rest when you land. This protects you from a sudden spike in the exchange rate.

Actionable Steps for the Savvy Traveler

- Check the "Mid-Market" Rate: Before doing any transaction, pull up a live chart. If the rate is 10.10 and your provider is offering 9.50, they are taking a 6% cut.

- Get a No-FTF Card: Ensure your primary credit card has "No Foreign Transaction Fees." Without this, you'll pay an extra 3% on every single swipe.

- Use an App for Large Transfers: If you're moving more than $2,000 (maybe for a long-term rental or a car), use a dedicated FX provider rather than a wire transfer.

- Avoid Airport Kiosks: The "Zero Commission" signs at airports are a lie. They just bake their 10-15% profit into a terrible exchange rate.

Norway is a stunning country, but the financial "tourist taxes" can bite if you aren't looking. By avoiding the big banks and saying "no" to USD-denominated card payments, you'll keep more of your money for the things that actually matter—like that overpriced but delicious reindeer steak or a fjord cruise. Focus on the mid-market rate, stick to digital payments, and keep an eye on those oil prices.