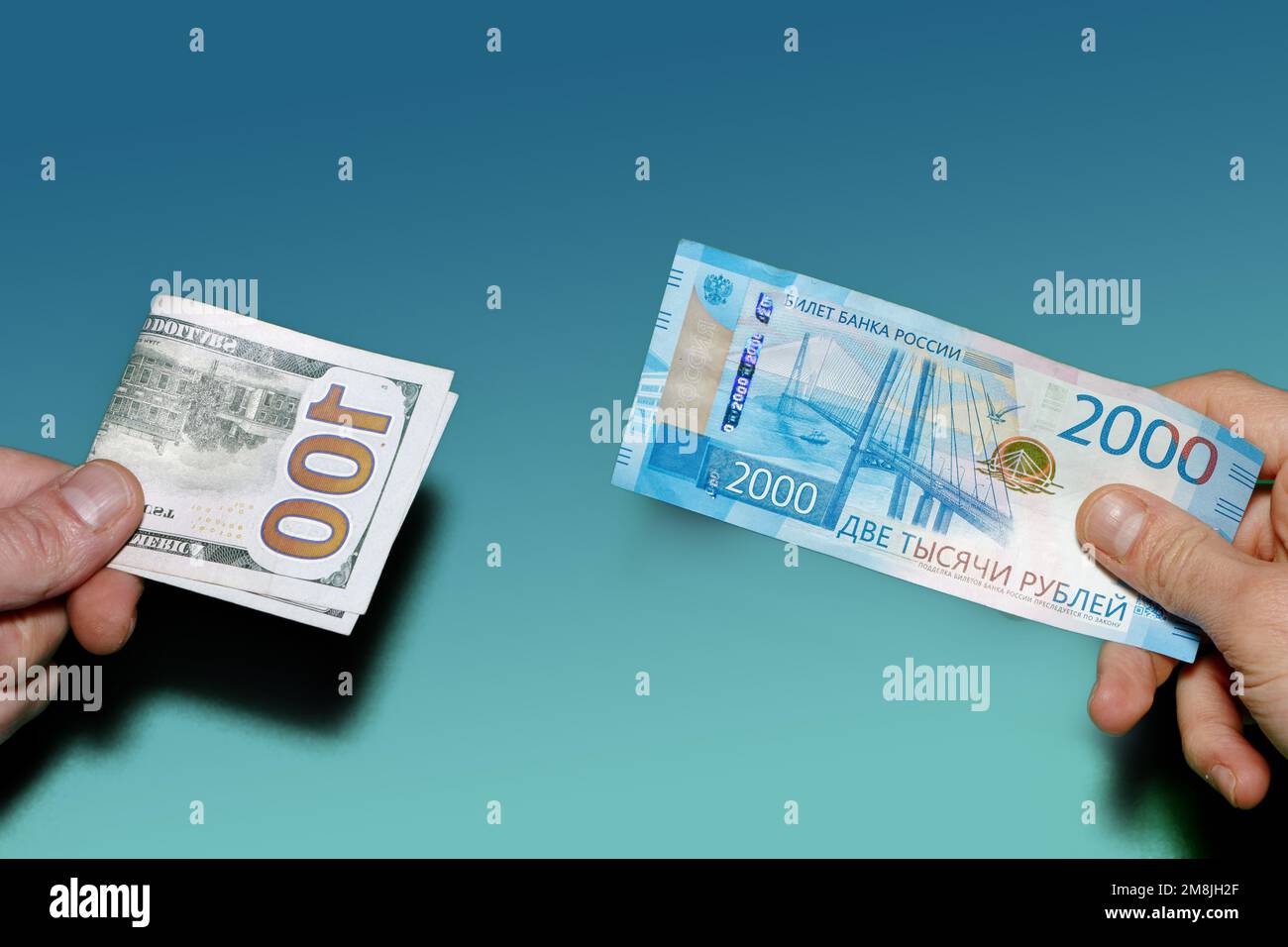

Moving money between currencies is usually as simple as tapping a button on an app. But if you're trying to convert ruble into dollar right now, you already know it’s anything but simple. It’s a mess. Honestly, the gap between the "official" rate you see on Google and what you actually get in your hand is massive.

The world of the Russian Ruble (RUB) changed forever in early 2022, and by 2026, the rules of the game have only become more layered. You can't just walk into a random bank in New York or London with a stack of 5,000-ruble notes and expect a fair trade. Most won't even touch them.

The Reality of the Exchange Rate Today

If you look up the rate today, January 13, 2026, you’ll see the ruble hovering around 78.75 per US Dollar. That looks stable. It looks "normal." But that number is a bit of a ghost. It’s the official rate set by the Bank of Russia, and while it's used for big government contracts and energy exports, it doesn’t reflect the "street" cost for a regular person trying to move their savings.

Most people don't realize that the Central Bank of Russia has extended restrictions on foreign cash withdrawals until at least March 9, 2026. This means even if you have "dollars" in a Russian bank account, getting them out as physical greenbacks is restricted if that money was deposited after September 2022. You’re basically holding "digital dollars" that the bank will only give you in rubles if you want to touch the cash.

Why the "Official" Number is Tricky

Banks like Raiffeisenbank or UniCredit—some of the last European players still operating with SWIFT access in Russia—often charge commissions that would make your head spin. We're talking fees that can eat up to 50% of a transfer in some extreme cases.

You’ve got to be careful.

How People Are Actually Converting Rubles Right Now

Since traditional banks have largely pulled up the drawbridge, three main paths have emerged for anyone needing to convert ruble into dollar. None of them are perfect. All of them have trade-offs.

1. The "Friendly" Third Country Loophole

This is the most common "legit" way. People open accounts in countries like Kazakhstan, Armenia, or Kyrgyzstan. You send rubles from Russia to your account in Almaty or Yerevan, convert them to dollars there (where the markets are more open), and then wire those dollars to the US or Europe.

It sounds easy. It isn't. Banks in these "friendly" countries are under immense pressure from US Treasury officials to stop this "mirror" trading. You might find your account frozen for "compliance checks" just when you need the money most.

2. The Crypto Bridge (The USDT Method)

Stablecoins like Tether (USDT) have become the unofficial reserve currency of the region.

- You buy USDT on a P2P (Peer-to-Peer) platform like Bybit or Volet using rubles from a Russian bank.

- You hold that USDT in a digital wallet.

- You sell that USDT for US Dollars on an international exchange and withdraw to a Western bank.

It’s fast. Sometimes it takes less than 20 minutes. But—and this is a big "but"—Western banks hate seeing money come in from crypto exchanges without a clear paper trail. If you drop $50,000 into a Chase or Barclays account from a crypto platform, expect a phone call from the fraud department.

3. Physical Cash Swaps

In cities like Moscow or St. Petersburg, specialized exchange offices still operate. You walk in with rubles, you walk out with dollars.

As of late 2025 and into 2026, the Russian government actually lifted some restrictions on how much foreign currency individuals can send abroad (up to $1 million a month for residents), but the physical supply of $100 bills is low. Because of sanctions, Western cash isn't being legally shipped to Russia. This creates a "black market" premium. You might see the official rate at 78, but the guy behind the glass is asking for 85 or 90.

What to Watch Out For (The Red Flags)

Honestly, the biggest mistake is trusting "individuals" on Telegram. You'll see groups promising "instant transfers" at amazing rates.

Don't do it.

These are almost always "cash swap" scams. You send your rubles to their local account, and the "dollar" transfer to your US account never arrives. Or worse, the money they send you is "dirty"—linked to criminal activity—and your Western bank account gets permanently blacklisted.

Sanctions and the "Unfriendly" List

Russia keeps a list of "unfriendly" countries (which includes the US, UK, and EU). If you are a citizen of one of these countries working in Russia, you can generally only transfer your salary amount abroad. Legal entities from these countries are still largely blocked from moving capital out.

🔗 Read more: Why the Time Warner Cable Logo Still Bothers Design Geeks

The Bank of Russia is also pushing the Digital Ruble, which launched for government use on January 1, 2026. While it doesn't help you get dollars today, it's a sign that the government wants to track every single kopek moving through the system.

Actionable Steps for Converting RUB to USD

If you have a significant amount of money to move, you need a strategy that won't get you banned from the global financial system.

Check the Spread First

Compare the Central Bank of Russia (CBR) rate with the rates on BestChange. This site aggregates various e-exchangers. If the gap (the spread) is more than 10%, you're being overcharged.

Use "Clean" Intermediaries

If you're using the crypto route, don't send the money directly to your main bank. Send it to a "fintech" bank like Revolut or Wise first (if they allow the region-specific transaction), then move it to your main savings. This adds a layer of separation, though it doesn't fix the source-of-funds requirement.

Document Everything

If you sold a flat in Moscow and want to move those rubles to dollars in Florida, you need the original sales contract translated and notarized. Your US bank will ask where the money came from. Without a "legitimate legal basis," that money will sit in limbo for months.

Small Amounts? Use Cash

For anything under $3,000, physical cash is still the least headache-inducing method if you are physically in Russia. Just remember that you must declare anything over $10,000 when crossing borders, and Russia currently limits the export of foreign cash to $10,000 per person.

The days of easy RUB/USD conversions are gone for now. It requires patience, a bit of tech-savviness, and a high tolerance for paperwork. Always prioritize safety over a slightly better exchange rate; a 2% gain isn't worth a frozen bank account.

To get started, verify the current official rate on the Bank of Russia's website and then compare it against P2P rates on a platform like Bybit to see the real-world cost of your transaction.