Money is weird. One day you're looking at a screen thinking the exchange rate is a bargain, and the next, a single speech from a central banker in Pretoria or a job report out of D.C. sends your budget into a tailspin. If you’re trying to convert dollars to South Africa rand right now, you’re stepping into one of the most volatile but interesting currency pairings in the emerging market world.

The Rand (ZAR) is famously "twitchy." It’s the liquid proxy for risk in Africa. When the world feels nervous, the Rand usually takes the hit first. But lately, things have shifted. As of mid-January 2026, the Rand has been showing some serious teeth, trading around the R16.41 mark. That’s a massive swing from the R18+ levels we saw throughout much of 2024 and early 2025.

Why? Because the "Carry Trade" is back, and South Africa’s story is changing.

The Reality of the USD/ZAR Exchange Rate in 2026

If you’re sitting in New York or London looking at your banking app, you might see a mid-market rate and think that’s what you’re getting. You aren't. Honestly, the "spread"—that annoying gap between what the bank buys and sells at—is where most people lose their shirt.

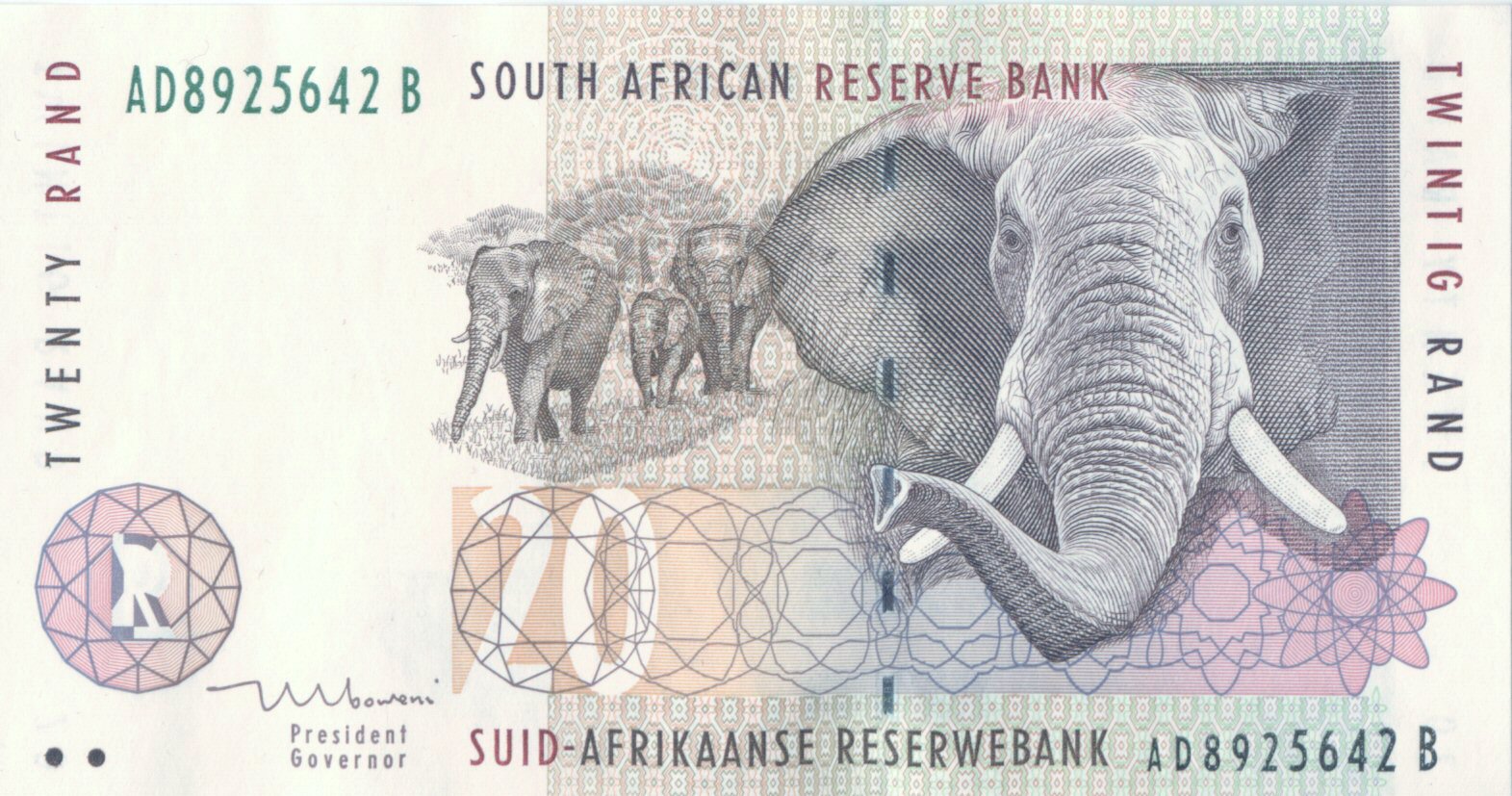

The South African Reserve Bank (SARB) recently cut the repo rate to 6.75%, while the US Federal Reserve has been even more aggressive with their cuts. This has created a sweet spot. When US interest rates drop faster than South African rates, the "interest rate differential" widens. Investors love this. They borrow cheap dollars and park them in high-yielding South African bonds. This inflow of cash is exactly what’s been propping up the Rand lately.

👉 See also: Union Bank of India Share Price: Why the Recent Jump Caught Everyone Off Guard

But don't get too comfortable.

The Rand is still a commodity currency. South Africa is a massive exporter of gold, platinum, and coal. With gold prices screaming past $4,400 an ounce this month, the ZAR has a massive tailwind. When gold goes up, the Rand usually follows like a loyal shadow.

What Actually Moves the Needle?

It’s not just one thing. It’s a messy soup of geopolitics and local drama.

- The Fed’s Mood: If the US Federal Reserve hints at a "pause" in rate cuts, the dollar flexes. A strong dollar is the Rand’s worst enemy.

- The SARB’s Inflation Target: Governor Lesetja Kganyago has been a hawk, recently pushing a new, lower inflation target of 3%. This discipline makes the Rand more attractive to big institutional money.

- Logistics and Power: You can't talk about the ZAR without mentioning Eskom and Transnet. Operation Vulindlela—the government's reform program—is finally showing results. More reliable electricity means factories actually run, which means more exports, which means a stronger Rand.

- The Grey List: South Africa’s removal from the FATF "Grey List" has been a huge psychological boost for foreign investors who were scared of compliance headaches.

Stop Giving Your Money to Big Banks

Most people walk into a Chase or a Standard Bank and ask to convert dollars to South Africa rand at the teller. Please, don't do that.

Traditional banks often bake a 3% to 5% fee into the exchange rate. They call it "zero commission," but the rate they give you is hot garbage. If you're moving $10,000, you could be losing $500 just for the privilege of using a slow, legacy system.

Digital-first platforms like Wise, Revolut, or South Africa-specific services like CurrencyTransfer or Sable are almost always better. They use the mid-market rate—the one you actually see on Google—and charge a transparent, flat fee.

Pro Tip for Expats and Investors: South Africa has strict Exchange Control (Excon) rules. If you’re a South African resident moving money back from the US, you have a R1 million Single Discretionary Allowance per year. Go over that, and you need a Tax Compliance Status (TCS) pin from SARS. It’s a bit of a bureaucratic dance, but skipping it can get your funds blocked.

Timing the Market: Is Now a Good Time?

Trying to time the ZAR is like trying to catch a falling knife. You might get lucky, or you might get hurt.

📖 Related: The Rupee Explained: Why It’s Way More Than Just India’s Currency

Looking at the current data, the Rand is in a "strengthening cycle." Investec’s chief economist, Annabel Bishop, has noted that the tide is turning. We’ve seen a 10% appreciation in early 2026 compared to last year. If you need to convert a large sum, "layering" or "averaging" is the smartest move.

Basically, don't swap all your dollars at once.

Do 25% today, 25% next week, and so on. This protects you if there’s a sudden political flare-up—which, let’s be real, happens in South Africa. The upcoming municipal elections or a sudden shift in the Government of National Unity (GNU) dynamics could send the Rand back toward R17.50 in a heartbeat.

Comparing the Costs (The Prose Version)

If you use a Big Retail Bank, you'll likely get a rate around R15.90 when the market is at R16.41. You'll wait 3-5 business days. You'll probably have to sign a physical form. It's 1995 all over again.

Contrast that with a Specialist Broker. You get a rate around R16.35. The money arrives in 24 hours. You do it on your phone while drinking a flat white. The choice is pretty obvious.

Practical Steps to Convert Your Cash Right Now

First, check the live "spot rate." Don't trust the rate on a static travel blog. Use a live tool.

Second, verify your identity. Whether you use a bank or a fintech app, "Know Your Customer" (KYC) laws are intense in 2026. Have your passport and a utility bill ready in PDF format. If you're a South African citizen, have your ID number handy.

Third, look at the "hidden" fees. Some services offer a great rate but charge a "receiving fee" on the South African side. Ask your South African bank (like FNB or Capitec) what they charge for incoming international wire transfers. Sometimes it's a flat R150, sometimes it's a percentage.

The Bottom Line

The Rand is no longer the "sick man" of the currency markets, but it’s still high-octane. Converting USD to ZAR in 2026 requires a bit more strategy than it did five years ago because the margins are tighter and the moves are faster.

- Monitor the Gold Price: If gold is rallying, wait a day or two to see if the Rand strengthens further.

- Use Fintech: Avoid airport kiosks and traditional bank tellers at all costs.

- Watch the SARB: The next interest rate decision on January 29th will be a massive volatility trigger.

- Check Excon Limits: If you're a local, keep your SARS paperwork in order to avoid a "blocked fund" nightmare at the South African Reserve Bank.

The days of an "automatic" R19 to the dollar might be behind us for a while. If you're seeing R16.40, that's actually a position of strength for the South African economy. Plan your transfers around the R16.20 to R16.60 range for the first quarter of the year, and you’ll likely come out ahead.

🔗 Read more: UK Sterling Pound Rate in Pakistan: Why the Rates Vary So Much Today

Next Step: Check your current bank's "buy" rate versus the mid-market rate on a live exchange tracker to see exactly how much they are overcharging you before you hit the "transfer" button.