If you’re staring at a screen trying to convert 1 USD to Japanese Yen right now, you’re likely seeing a number somewhere around 158.34 yen.

That’s the "mid-market" rate. It’s the clean, mathematical average that banks use to trade with each other. But honestly? You’ll probably never actually get that rate in your pocket. Whether you’re a tourist landing at Narita or a day trader watching the candle charts, that single dollar bill has a complicated life.

The yen is currently doing a strange dance. It’s caught between a rock and a hard place: a Japanese government that wants it stronger and a global market that seems determined to keep it weak.

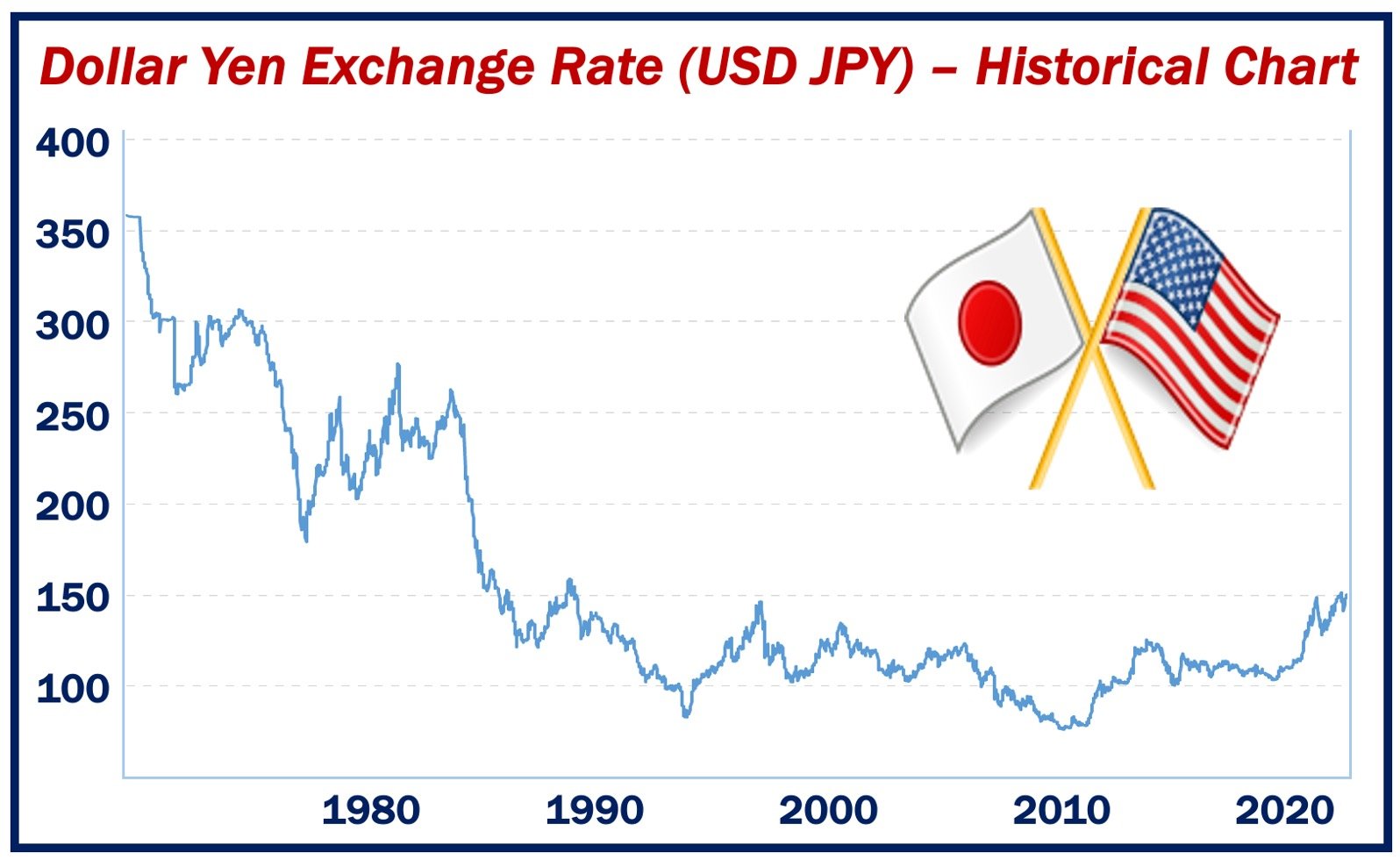

Why 158 Yen Isn't Just a Random Number

Back in early 2026, the yen took a serious hit. It wasn't just one thing. It was a perfect storm of "Sanaenomics"—the fiscal policies of Prime Minister Sanae Takaichi—and a US Federal Reserve that refused to budge on interest rates.

When you convert 1 USD to Japanese Yen, you’re essentially measuring the "interest rate gap."

Think of it like this:

Investors are greedy. If they can put their money in a US bank and get 3.5% or 4% interest, why would they put it in a Japanese bank that only offers 0.75%? They wouldn't. So, they sell their yen, buy dollars, and the value of the dollar shoots up.

Wait, didn't Japan raise rates?

👉 See also: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

Yeah, they did. In December 2025, the Bank of Japan (BoJ) nudged their rate up to 0.75%. For Japan, that was a 30-year high! But compared to the rest of the world, it’s still peanuts. The market saw that 0.75% and basically shrugged.

The Invisible War at 160.00

There is a "line in the sand" that traders talk about constantly. It’s the 160.00 mark.

Every time the dollar creeps toward 160 yen, Japanese officials like Finance Minister Satsuki Katayama start getting "deeply concerned." That’s central bank code for: “If you keep selling our currency, we are going to flood the market with dollars and force the price back down.”

They call this intervention. It’s like a high-stakes game of chicken. If you’re trying to time a big currency exchange, keep a very close eye on that 160 level. If it breaks, things could get messy fast.

What Your Dollar Actually Buys You in Tokyo Today

Let's get away from the spreadsheets for a second. What does that 158-ish yen actually mean for your wallet?

Japan is famous for being expensive, but with the dollar this strong, it’s arguably one of the best value destinations on the planet right now.

✨ Don't miss: USD to UZS Rate Today: What Most People Get Wrong

- A "One-Coin" Lunch: You can still find a decent bowl of ramen or a beef bowl (gyudon) for around 500 to 700 yen. That’s roughly $3.15 to $4.40.

- The Vending Machine Test: A hot coffee or a green tea from a machine usually costs 130 to 160 yen. Basically, one dollar gets you a drink and maybe a tiny bit of change.

- The 100-Yen Shop: These are the holy grail. At places like Daiso, almost everything is 100 yen (plus 10% tax). Your single US dollar covers one item with room to spare.

But there's a catch. Inflation is finally hitting Japan. After decades of prices never moving, things like eggs, electricity, and train fares are creeping up. So while your dollar buys more yen than it used to, those yen don't go quite as far as they did in 2023.

The "Tourist Trap" of Currency Exchange

If you’re physically traveling and need to convert 1 USD to Japanese Yen, please don't just walk into your local US bank branch and ask for cash. They will fleece you.

Most US banks will give you a "retail rate" that is 5% to 8% worse than the actual market rate. You’ll walk out with 145 yen for your dollar instead of 158.

Here is the better way to do it:

- Use the ATM: When you land at Haneda or Narita, go to a 7-Eleven (Seven Bank) ATM. They are everywhere. They usually give you the "real" exchange rate plus a small, transparent fee (usually 110 or 220 yen).

- Credit Cards are (mostly) King: Use a card with no foreign transaction fees. You'll get the Visa or Mastercard wholesale rate, which is almost identical to the live market rate.

- The Suica/Pasmo Trick: If you have an iPhone, add a Suica or Pasmo travel card to your Apple Wallet. You can "top it up" using your US credit card. The phone does the conversion instantly at a great rate, and you can use that card at almost every convenience store and vending machine in the country.

Why the Yen Might Actually Get Stronger Soon

Nothing stays this lopsided forever.

Most analysts, including the folks at Morgan Stanley and JPMorgan, think the yen is undervalued. There's a theory that the "Carry Trade"—where people borrow cheap yen to buy stuff elsewhere—is starting to break.

🔗 Read more: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

As Japan slowly, painfully raises interest rates throughout 2026, that gap with the US will shrink. Some experts predict we could see the dollar drop back down to 140 or 145 yen by the end of the year.

If you are holding a lot of USD and planning a big purchase in Japan—maybe a luxury watch or a high-end Niseko ski trip—it might be smart to lock in some of that 158 rate now.

Real-World Example: Buying a Grand Seiko

Let’s say you want a high-end Japanese watch that costs 1,000,000 yen.

- At a rate of 130 (early 2023), that watch cost you $7,692.

- At today’s rate of 158, that same watch costs you $6,329.

That is a massive $1,300 difference just because of the exchange rate. This is why Japan’s tourism industry is absolutely exploding right now.

Actionable Steps for Your Money

Don't just watch the numbers flicker on the screen. If you need to move money, do it with a plan.

- Check for Hidden Fees: If you're using a service like PayPal or a traditional wire transfer, they often hide their profit in a "markup" on the exchange rate. Always compare their offered rate against the Google "mid-market" rate.

- Use Wise or Revolut: For moving larger amounts of money (like paying for a wedding or a business invoice), these platforms are almost always cheaper than banks because they use the real 1:1 rate and just charge a small, flat fee.

- Download a Currency App: Grab something like "XE Currency" or "Currency Plus." Set an alert for 160.00. If it hits that, it’s a historic "buy" signal for yen, but it’s also the moment the Japanese government is most likely to jump in and mess with the market.

- Get Cash for Small Towns: While Tokyo and Osaka are very card-friendly now, if you go to a rural onsen (hot spring) or a small temple in Kyoto, they will still expect physical yen. Always carry at least 10,000 yen in cash just in case.

The bottom line? Converting 1 USD to Japanese Yen is a great deal for Americans right now, but it's a volatile one. Watch the 160.00 level, avoid airport exchange kiosks like the plague, and enjoy the fact that your dollar has rarely had this much power in the Land of the Rising Sun.