Money is weird. One day you’re holding a stack of notes that feels like a small fortune in Accra, and the next, you’re looking at a single twenty-dollar bill in New York wondering where it all went. If you’ve spent any time tracking the conversion Ghana Cedi to US Dollar, you know it’s less of a straight line and more of a chaotic heart rate monitor.

Honestly, the "official" rate you see on Google or Bloomberg rarely tells the whole story of what’s happening on the ground at Osu or inside the banks. As of mid-January 2026, we are seeing some fascinating—and frankly, stressful—shifts in how the Cedi is behaving.

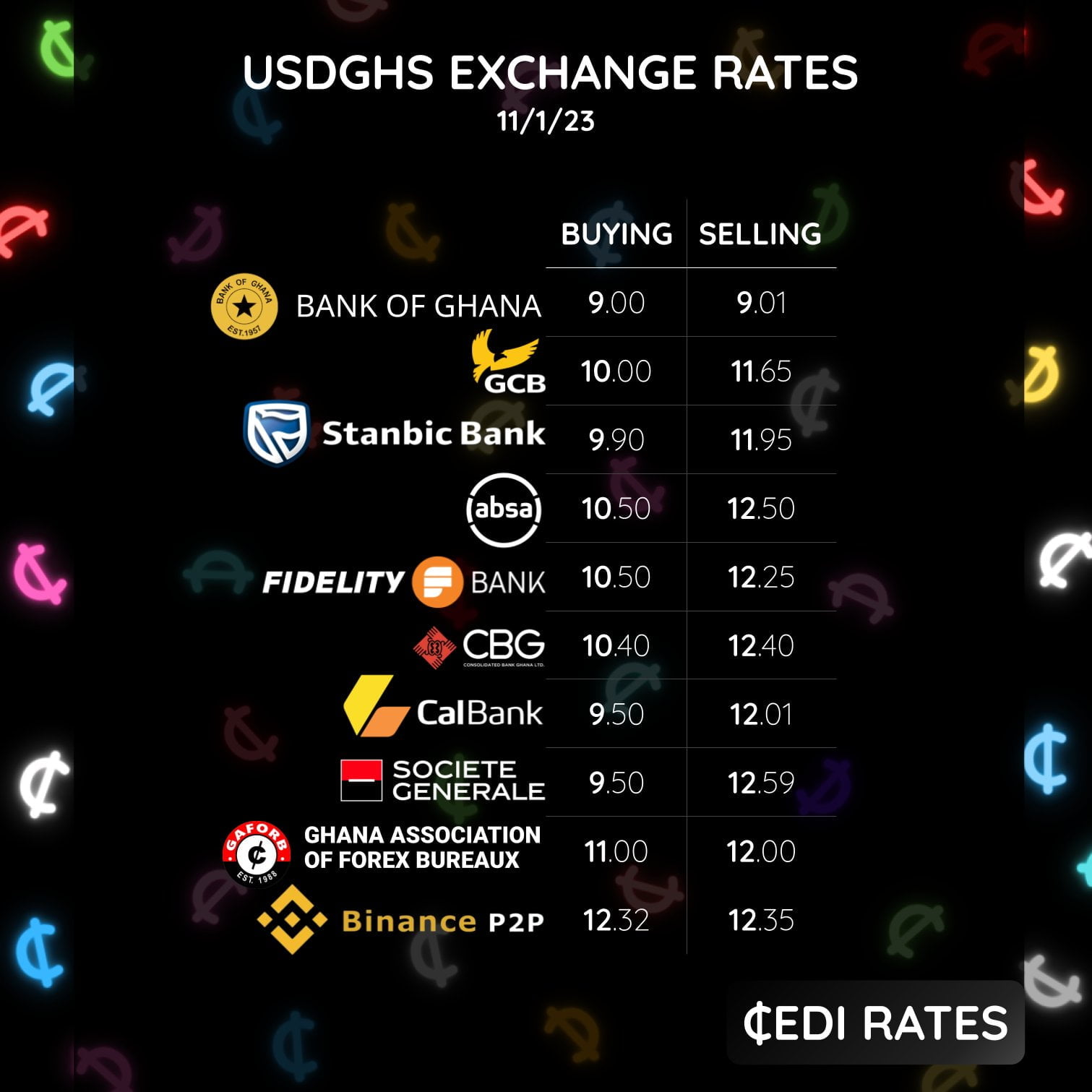

The Bank of Ghana (BoG) recently pegged the interbank exchange rate around 10.82 GHS to 1 USD. Just a few days ago, on January 16, 2026, the weighted median rate was sitting right at that mark. But if you walk into a commercial bank or a forex bureau, you’ve likely noticed the "spread." They buy low and sell high. You might see a selling rate closer to 11.00 or 11.20 depending on who you’re talking to.

Why the Cedi is doing that thing again

It’s easy to blame "the economy" and leave it at that, but there’s a bit more nuance to the current situation. Last year, in 2025, the Cedi actually had a bit of a hero moment. Around June 2025, it appreciated significantly, dropping from the 15-range all the way down to about 10.28 per dollar.

👉 See also: Ace Coffee Bar Inc: Why This Suburban Powerhouse is More Than Just a Vending Company

People were shocked.

The World Bank and IMF were even recalculating their targets because nobody expected that kind of a comeback. Fast forward to now, January 2026, and the honeymoon phase is cooling off. The BoG has been cutting interest rates—dropping the policy rate to about 18% late last year—to try and kickstart growth.

While lower interest rates are great for local businesses looking for loans, they often make the currency less attractive to international investors who want high returns on Cedi-denominated bonds. When those investors pull back, the conversion Ghana Cedi to US Dollar feels the heat.

The GoldBod Factor

You can't talk about the Cedi right now without mentioning "GoldBod." This is Ghana's relatively new strategy of using local gold reserves to back the currency and manage foreign exchange. The government has been aggressive about this, even abolishing certain taxes on small-scale miners to get more gold into the system.

The logic? More gold in the vault means more "gold dollars" to stabilize the exchange rate without relying solely on IMF loans. It’s a bold move. Some experts, like Bright Simons, have pointed out that while gold production hit over 100 tonnes in 2025, the actual financial "profit" from these operations is still being debated.

If you're trying to move a large amount of money, this matters. The supply of dollars in the market is literally being dictated by how much gold the state can flip and how many "bonuses" they’re paying to local miners.

Real-world math for the rest of us

Let’s get away from the high-level policy stuff for a second. If you have 5,000 GHS in your pocket today, what does that actually get you?

At the current interbank rate of 10.82, 5,000 GHS is roughly $462.11.

But wait. If you go to a forex bureau, they might give you a rate of 11.10. Suddenly, your 5,000 GHS is only worth $450.45. You just "lost" twelve bucks to the spread. That’s a couple of Jollof plates or a Bolt ride across the city.

Where to actually get the best rates

I’ve found that timing is everything. Usually, the rate fluctuates based on the demand from importers. In Ghana, importers need massive amounts of dollars to bring in everything from cars to frozen chicken. When these guys hit the market at the end of the month, the dollar gets more expensive.

If you’re looking to convert:

- Commercial Banks: Usually the safest, but they have the most paperwork. You’ll need a valid ID (Ghana Card is non-negotiable) and a reason for the transaction if it’s large.

- Licensed Forex Bureaus: These are often faster and might give you a slightly better "street rate" than the big banks, but you have to check a few of them. Rates vary by street corner.

- The Black Market: Just... be careful. It’s technically illegal and the risk of counterfeit notes or getting "short-changed" is high. Most pros stay away unless they have a very trusted relationship.

Inflation is the invisible hand

Inflation in Ghana ended 2025 at about 5.4%, which is actually a massive improvement from the 50%+ nightmare we saw a couple of years ago. Lower inflation usually means the conversion Ghana Cedi to US Dollar stays more stable.

However, Dr. Asiama from the Bank of Ghana has been vocal about "consolidation" in 2026. This is central-bank-speak for "we’re trying to make sure this doesn't blow up again." They are recalibrating how much foreign currency banks can hold (Net Open Position limits) to prevent hoarding.

If banks can't hoard dollars, they have to sell them, which theoretically keeps the Cedi from crashing.

What to do next

If you are holding Cedi and need Dollars—or vice versa—don't just jump at the first rate you see on a converter app. Those apps use "mid-market" rates that you and I can't actually get.

First, check the Bank of Ghana's daily interbank FX rates on their official site. This gives you the "floor." If a bureau is charging you way above that, walk away.

Second, if you're an expat or someone receiving remittances, look into apps like LemFi, TapTap Send, or Wise. Sometimes their internal conversion rates are better than what you'll get at a physical teller because they bypass some of the local liquidity issues.

Third, watch the gold price. It sounds disconnected, but since the Cedi is now so closely tied to the "Gold for Oil" and "Gold for Reserves" programs, a jump in global gold prices usually gives the BoG more ammunition to defend the Cedi.

📖 Related: Amass Middle East Shipping Services: What You Should Actually Expect When Moving Cargo Through Dubai

The conversion Ghana Cedi to US Dollar is probably going to remain "behaved" (as some politicians like to put it) for the first half of 2026, but global trade tensions and US interest rate decisions by the Fed will always be the wildcard.

Keep your eye on the BoG's Monetary Policy Committee (MPC) meetings. Their next move on interest rates will tell you exactly which way the wind is blowing. If they cut rates again, expect the Cedi to weaken slightly. If they hold steady, we might see 10.80 hold for a while.