Honestly, if you're looking for a stock that moves like a caffeinated tech startup, Consolidated Edison (ED) is going to bore you to tears. It’s a utility. It's New York City's power grid. It’s basically the financial equivalent of a sturdy pair of work boots—not flashy, but they’ll get you through a blizzard.

As of mid-January 2026, the consolidated edison stock price has been hovering in that $100 to $103 range. It’s a weird spot. On one hand, you’ve got the "Dividend Aristocrat" crowd who loves the 51-year streak of raises. On the other, Wall Street analysts are currently giving it a "Reduce" or "Hold" rating because, well, the math is getting complicated.

What’s Actually Moving the Consolidated Edison Stock Price?

It’s not just about how many people in Brooklyn left their AC on last summer. Utility stocks are essentially "bond proxies." When interest rates stay high, these stocks usually struggle because investors can get a decent yield from a Treasury bill without the risk of a regional power outage.

But here is the thing: Con Ed is in the middle of a massive identity shift. They sold off their Clean Energy Businesses a couple of years back to focus almost entirely on regulated utilities.

Why does that matter?

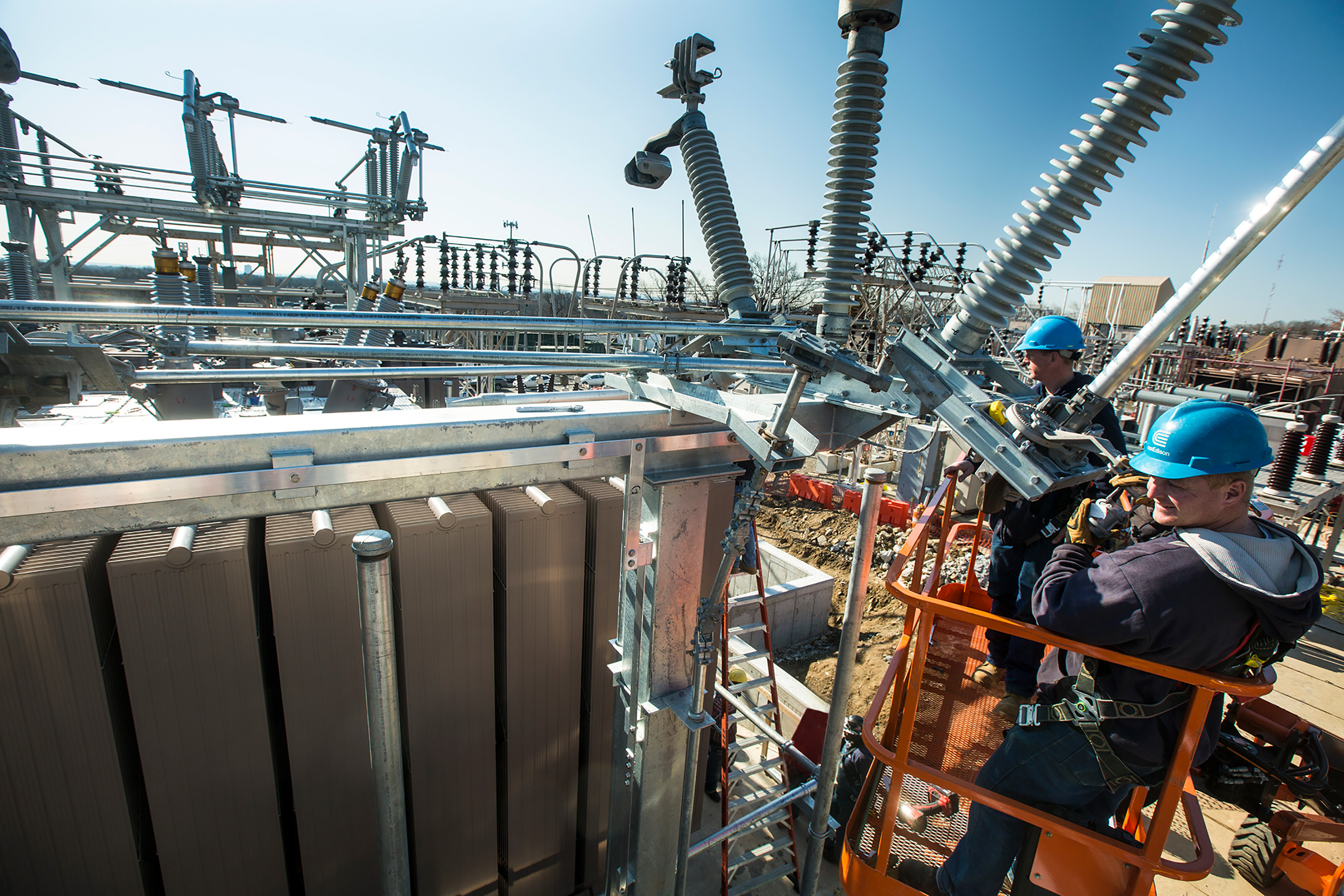

Regulated means the government (specifically the New York State Public Service Commission) basically tells them how much profit they're allowed to make. It’s predictable. Boring. Safe. But the "boring" part is getting expensive. They’re planning to dump billions into "Reliable Clean City" projects and storm resiliency. We're talking 14 new substations and thousands of electric vehicle charging plugs.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

The Dividend Dilemma

You can’t talk about this stock without mentioning the dividend. It’s the law.

In early 2025, they bumped the quarterly payout to $0.85 per share. That was their 51st consecutive annual increase. That's a huge deal. It means even when the 2008 crash happened, or when COVID shut down Times Square, Con Ed kept sending checks.

Current yield is sitting around 3.3% to 3.4%. Is that enough? If you can get 4% in a savings account, a 3.3% dividend yield feels a bit thin. This is exactly why the consolidated edison stock price hasn't rocketed to the moon lately. Investors are weighing that safety against better returns elsewhere.

The "Green" Transition is a Double-Edged Sword

New York has some of the most aggressive climate goals in the country. They want zero-emission electricity by 2040. Con Ed is the one who has to build the pipes and wires to make that happen.

- The Pro: They get to charge customers for these upgrades.

- The Con: New Yorkers are already paying some of the highest utility bills in the nation.

Starting January 2026, many customers are seeing double-digit percentage increases in their bills to fund these grid upgrades. If the public pushback gets too loud, regulators might tighten the leash on Con Ed’s profits. That’s a risk most people don't think about when they just look at a chart.

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

Is the Stock Overvalued Right Now?

Some analysts, like those at Morgan Stanley and Bank of America, have been a bit skeptical. They’ve pointed out a P/E ratio around 17 or 18. For a company growing its earnings at maybe 5% to 7% a year, that’s not exactly a "bargain-bin" price.

Last year’s Q3 earnings were actually pretty solid—they beat the $1.76 EPS estimate by hitting $1.90. But a beat doesn't always mean a buy. The company has a decent amount of debt (a debt-to-equity ratio over 1.0), which is common for utilities but still something to watch when the consolidated edison stock price feels a bit stagnant.

Looking Ahead to February 2026

The next big catalyst is the Q4 2025 earnings report, estimated for February 19, 2026. This is where we’ll see if the mild winter or the new rate hikes are actually hitting the bottom line.

If they report another beat and give strong guidance for the rest of 2026, we might see the stock break out of its current range and test those 52-week highs near $114. If they miss? We could be looking at a slide back toward the $90 support level.

Actionable Insights for Your Portfolio

If you’re holding ED, you’re likely in it for the income. Don't expect NVIDIA-style gains. It's just not that kind of party.

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

Watch the 10-Year Treasury Yield. If bond yields start dropping significantly, the consolidated edison stock price will almost certainly catch a tailwind. Utility stocks thrive when they are the only "safe" place to find yield.

Check the Rate Case Filings. The biggest "secret" to utility investing isn't the earnings report; it’s the regulatory filings. Keep an eye on the New York Public Service Commission. If they approve the full $2.1 billion investment plan Con Ed wants for 2026-2030, that's a long-term green light for dividend growth.

Don't ignore the debt. While Con Ed is stable, a utility with too much leverage can get sluggish. Ensure their interest coverage remains healthy, especially if the "higher for longer" interest rate environment persists.

Reinvest those dividends. If you're a long-term holder, using a DRIP (Dividend Reinvestment Plan) is basically the only way to make the total return on this stock look impressive over a decade.

At the end of the day, Consolidated Edison is a bet on the lights staying on in Manhattan. It's a bet on a company that has survived everything the last century threw at it. Just don't expect it to make you rich overnight. It’s a slow-and-steady play in an increasingly volatile world.

Next Steps for Investors:

Review your current portfolio allocation to the utility sector. If you are seeking income and stability, check the upcoming February 19 earnings call for updates on the 2026 rate hike implementations. Compare the current 3.3% yield against high-yield money market funds to ensure the risk-reward profile still fits your financial goals.