You’ve probably heard the rumors that natural gas is on its way out. People have been saying it for years. But if you look at the actual combined cycle power plant news hitting the wires this January 2026, the reality is the exact opposite. We aren't seeing a fade-out; we're seeing a full-blown stampede.

Basically, the world realized that wind and solar are great, but they can't power a 5-gigawatt AI data center at 3:00 AM when the air is dead still.

The Data Center Gold Rush

The biggest shocker in the industry right now is how tech giants are ditching the grid entirely. On January 12, 2026, word got out about a massive 5 GW gas-powered campus in South Dallas. A company called GridFree AI is basically building its own private power kingdom. They aren't waiting for local utilities to catch up. They are putting in high-efficiency combined cycle units right next to the server racks.

It’s kinda wild.

Think about Vistra Corp. Just last week, on January 5, they dropped a cool $4 billion to snatch up Cogentrix. That deal adds about 5,500 megawatts of gas capacity to their portfolio. Why? Because in regions like PJM (the Mid-Atlantic grid) and ERCOT (Texas), "modern natural gas" is the only thing keeping the lights on as demand from AI and electric vehicles hits vertical growth.

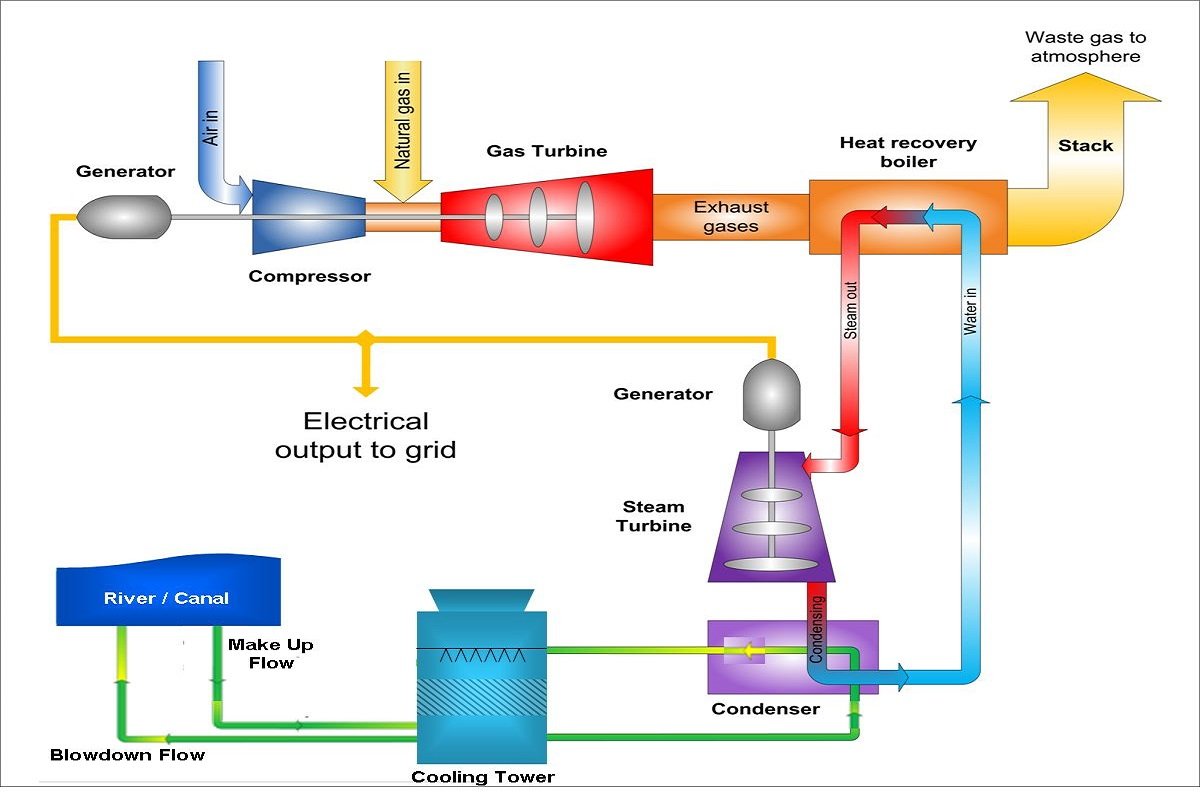

Honestly, the "combined cycle" part is the secret sauce here. A simple gas turbine just burns fuel and spins. But a combined cycle plant takes the "waste" heat from that first spin and uses it to make steam for a second turbine. You’re getting two for the price of one, pushing thermal efficiency toward 60% or higher. In a world where fuel costs are volatile, that efficiency is the difference between a profitable plant and a multi-billion dollar paperweight.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

The Hydrogen Pivot is Real (Sorta)

There's a lot of hype about "hydrogen-ready" plants. You’ll see it in every press release. But what does it actually mean for 2026?

Entergy Texas is currently the one to watch. Their Orange County Advanced Power Station is over 80% finished. When it clicks on later this year, it’s designed to handle a 30% hydrogen blend right out of the gate. That's not just a theoretical "maybe someday" feature. They are actually planning to burn the stuff.

However, don't let the marketing fool you into thinking we're 100% green tomorrow.

A recent test at Georgia Power’s Plant McDonough-Atkinson successfully hit a 50% hydrogen blend on a Mitsubishi M501GAC turbine. That sounds massive, right? It is. But that 50% hydrogen blend only actually cuts carbon emissions by about 22%. Hydrogen is "fluffy"—it takes a lot of volume to get the same energy as natural gas.

We also have to talk about the price. According to some fresh data from MDPI, for hydrogen blending to be "economically neutral" without subsidies, you’d need a carbon price of nearly $1,800 per ton. Nobody is paying that. So, while the technology is ready, the bank accounts are still waiting for cheaper electrolysis or fatter government checks.

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

The 2026 Supply Chain Bottleneck

If you wanted to buy a heavy-duty H-Class turbine today, you’re basically out of luck.

The "Big Three"—GE Vernova, Siemens Energy, and Mitsubishi Power—are booked solid. Siemens Energy reported a record-breaking €136 billion order backlog. They are literally selling out of delivery slots for 2026 and 2027.

It’s a weird paradox.

- We want to decarbonize.

- We need more power for ChatGPT and Netflix.

- Nuclear takes 15 years to build.

- Solar needs batteries that don't exist at this scale yet.

- Result: Everyone buys a gas turbine.

Mitsubishi Power recently noted they are trying to boost production by 25% to 35% annually just to keep up. Even Solar Turbines, which usually plays in the smaller "industrial" space, is winning big because they have a "fast-swap" service model. If your turbine breaks, they can swap the whole engine in 48 hours. In 2026, uptime is the only metric that matters to a data center operator losing $1 million an hour during a blackout.

What's Happening Locally?

Keep an eye on West Virginia. It’s becoming the unlikely capital of the combined cycle world.

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

FirstEnergy is pushing for a 1,200 MW plant paired with a small solar farm. Meanwhile, Blackstone Energy is working on the 600 MW Wolf Summit project. They’re using the GE 7HA.02 turbine, which is basically the Ferrari of the power world. It’s fast, it’s efficient, and it can ramp up or down in minutes to balance out the grid when the sun goes behind a cloud.

Even in Europe, where the "anti-gas" sentiment is strongest, reality is setting in. Ireland just had to lift its de facto ban on new data centers in Dublin. The catch? The data centers have to build their own on-site generation. Most of them are looking at—you guessed it—combined cycle gas.

Actionable Insights for 2026

If you're an investor or an energy manager, the "green or bust" narrative is a trap. The smart money is moving toward "hybridization."

- Watch the Heat Rate: If a plant isn't hitting sub-7,000 Btu/kWh, it's going to get eaten alive by carbon taxes and fuel costs. Efficiency is the only shield.

- Hydrogen is a Hedge: Don't build for 100% hydrogen today, but if your new plant isn't "30% capable," it will be an un-sellable stranded asset by 2035.

- Direct-to-Load is the Future: The grid is congested. The most successful new combined cycle projects are the ones bypassing the utility and plugging directly into a high-demand customer like a Google or Meta campus.

The narrative that combined cycle plants are a "bridge technology" is starting to feel wrong. With the way AI is sucking up juice, these plants look less like a bridge and more like the permanent foundation of the 21st-century grid.

Next Steps for Your Energy Strategy

Audit your current fleet's ramping capability. In the 2026 market, a plant that takes 4 hours to start is a liability. Focus on "Fast Start" retrofits—like those offered by GE or Siemens—that can get a 1-on-1 configuration to full load in under 30 minutes. This allows you to capture the high-price spikes when renewables dip, which is where the real profit margin lives now. Additionally, secure your O&M (Operations and Maintenance) contracts early. With the current technician shortage and parts backlog, an unsecured service agreement is a recipe for a 6-month outage.