You're standing in your kitchen, staring at a job offer in a city halfway across the country. The salary looks huge. It’s $20,000 more than you make now. But then you remember: eggs in Seattle don't cost the same as eggs in Des Moines. This is where the cnn money cost of living calculator usually enters the chat.

Honestly, it's one of those legacy internet tools that has survived multiple redesigns and corporate mergers for a reason. It’s simple.

Moving is stressful. Trying to figure out if $100k in Austin is the same as $140k in Boston shouldn't be. Most people use these calculators to avoid the "geographic pay cut"—that painful realization that your shiny new raise just got swallowed by a $3,000 studio apartment.

How the CNN Money Tool Actually Works

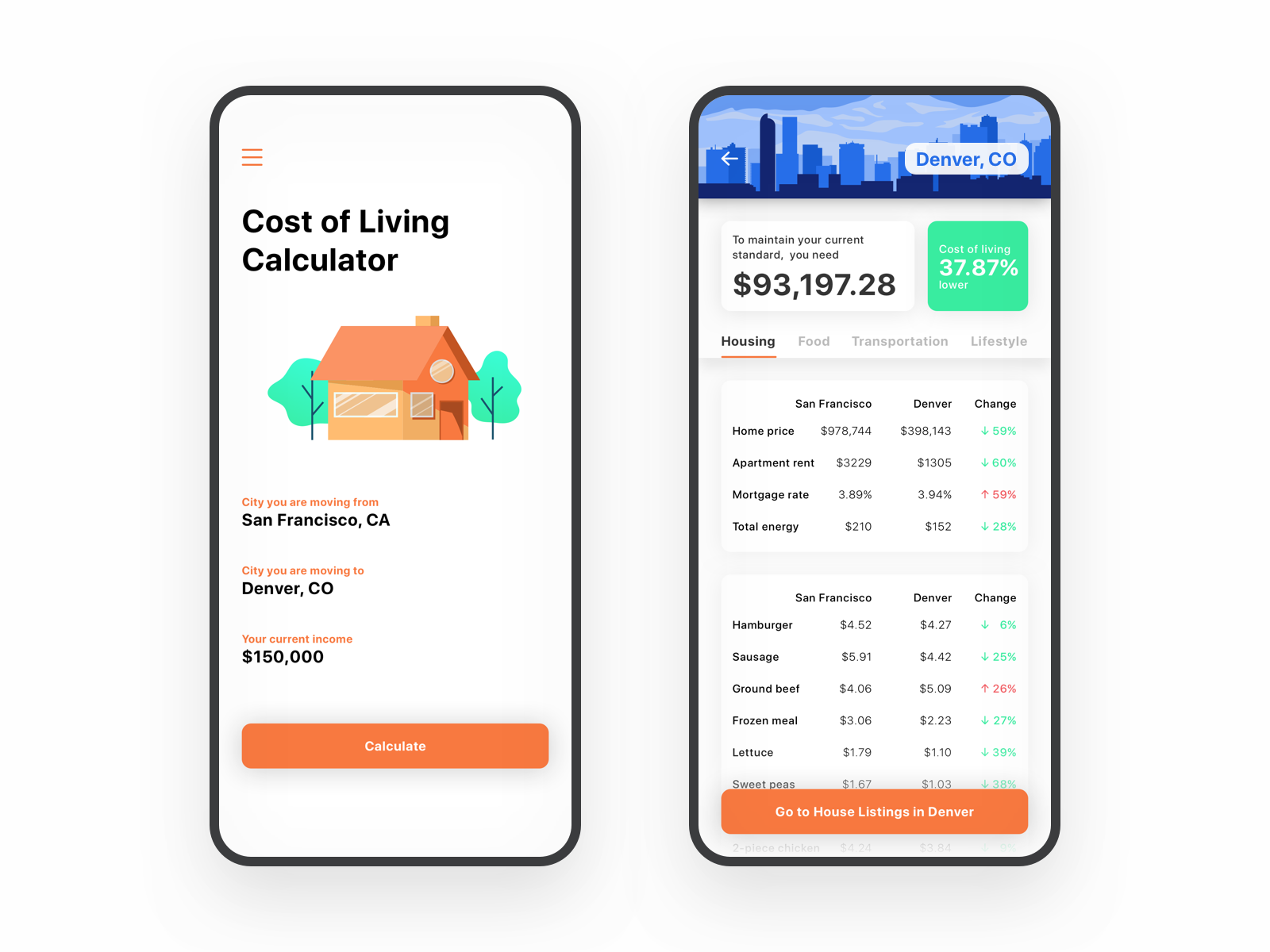

The cnn money cost of living calculator isn't doing some secret magic. It’s basically a math bridge. You plug in your current city, the city you're eyeing, and your current salary.

The tool then spits out a "comparable salary."

If you make $75,000 in Atlanta and you’re looking at Manhattan, the tool might tell you that you need $165,000 just to keep your head above water. It breaks it down into buckets like housing, groceries, and utilities.

Why the Data is (Mostly) Reliable

CNN doesn't send reporters out to count the price of milk in 300 different cities every Tuesday. They typically source their data from the Council for Community and Economic Research (C2ER).

✨ Don't miss: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

C2ER is the gold standard for this stuff. They’ve been at it since the late 60s. They track the "Cost of Living Index" (COLI), which is what most serious financial sites—including Bankrate and SmartAsset—use under the hood.

The index uses a national average of 100. If a city has a score of 120, it's 20% more expensive than the average American town. It’s a snapshot of the professional-executive lifestyle, which is worth noting. If you're living a "ramen and roommates" lifestyle, the numbers might feel a little inflated.

The Massive "Housing" Gap

Housing is the elephant in the room. In the cnn money cost of living calculator, housing usually accounts for about 30% or more of the weight.

In 2026, this is even more volatile. We’ve seen markets like Boise and Austin cool off while others stay red hot. If the calculator says housing in your destination is 80% higher, that's not just a statistic—that's a lifestyle shift. You might go from a three-bedroom house with a yard to a two-bedroom condo where the "balcony" is just a railing.

What Most People Get Wrong About These Numbers

Here is the thing: calculators are kinda dumb. They don't know your life.

They assume your spending habits will stay exactly the same. But they won't. If you move from a car-dependent city like Houston to a walkable city like Chicago, your "Transportation" costs might plummet because you sold your car.

🔗 Read more: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

A standard cost of living calculator might say transportation is 10% more expensive in Chicago because of transit passes and occasional Ubers, but it won't factor in the fact that you no longer have a $500 monthly car payment and $150 in insurance.

The Tax Trap

A lot of these tools—and this is a critique of the cnn money cost of living calculator specifically—often gloss over the nuances of state income tax.

Moving from Florida (0% state income tax) to New York (high state income tax) is a massive hit to your take-home pay that isn't always reflected in the "cost of groceries." You have to look at your net pay, not just the price of a burger.

Comparing the Big Players

If you’re obsessing over the move, don't just use one tool. Triangulate.

- Bankrate: Great for deep dives into mortgage rates alongside COL.

- NerdWallet: Very user-friendly, though some users on Reddit and financial forums complain their data updates can feel a bit sluggish during high-inflation periods.

- SmartAsset: Excellent for the tax implications I mentioned earlier.

- The CNN Money Tool: Best for a "quick and dirty" vibe check on a salary offer.

Real-World Example: The "Raise" That Wasn't

Let’s look at a real scenario. Say you’re a mid-level manager in St. Louis making $90,000. You get a "dream job" in San Francisco for $130,000.

You feel rich.

💡 You might also like: Why Toys R Us is Actually Making a Massive Comeback Right Now

But when you run the cnn money cost of living calculator, you realize that to maintain your St. Louis lifestyle, you actually need closer to $180,000. You’re technically taking a $50,000 pay cut in terms of purchasing power.

Suddenly, that dream job looks like a financial nightmare unless you're willing to radically downsize your life.

How to Negotiate Using This Data

Don't just look at the screen and sigh. Use it.

When you’re in the final stages of a job interview, bring the data. You can say, "Based on the cost of living differential between my current location and this new office, a salary of $X is required to maintain my current standard of living."

Employers know these numbers exist. They use them too. HR departments have their own "geo-pay" scales, but they won't volunteer the high end of the range unless you ask.

Actionable Next Steps

- Run the numbers twice: Once for your current salary and once for the salary you want to ask for.

- Check the tax delta: Use a separate state tax calculator to see what your actual paycheck will look like after the move.

- Look at the "Micro" level: Within a city, costs vary. Manhattan is not Queens. Downtown Los Angeles is not the Valley.

- Don't forget the "Soft" costs: Factor in things the calculator can't see, like the cost of being away from family (which might mean more money spent on flights or childcare).

The cnn money cost of living calculator is a great starting point, but it's just one piece of the puzzle. Use it to start the conversation, not to end it.