Checking your bank statement and seeing a few pennies of interest feels like a bad joke. Honestly, we've all been there. If you are looking into the citi bank interest rate on saving account, you probably already know that big banks aren't exactly known for being the most generous. But with Citi, it is actually a bit more complicated than just a single, low number.

Depending on where you live or how much money you keep with them, you could be looking at a rate that is practically zero or a rate that actually competes with online-only high-yield accounts. It is kinda wild how much your zip code matters here.

The Reality of the Citi Bank Interest Rate on Saving Account

Let's get the numbers out of the way first. If you open a standard Citi Savings account in a "non-Accelerate" market—basically a place where Citi has a lot of physical branches like New York or Chicago—the interest rate is usually around 0.03% APY.

That is tiny.

However, if you live in a market where they offer Citi Accelerate Savings, the story changes. In those areas, you might see rates closer to 3.30% to 4.35% APY, depending on the current Fed environment and promotional offers. As of early 2026, many experts, including those at Bankrate, note that rates are trending slightly downward because the Federal Reserve has been trimming the benchmark rate.

Why the Zip Code Lottery Happens

Banks like Citi use different strategies for different regions. In cities where they have a branch on every corner, they don't feel the need to "buy" your deposits with high interest. They figure you're there for the convenience.

In "out-of-market" areas where they don't have many branches, they use the citi bank interest rate on saving account as a lure. They want your money, and since they aren't paying for physical rent and tellers in your town, they pass some of those savings to you in the form of a higher APY.

Relationship Tiers and How They Affect Your Yield

Citi moved to a "Simplified Banking" model recently. They got rid of those old, confusing account packages and replaced them with Relationship Tiers. Basically, the more money you have across all your Citi accounts (checking, savings, and even investments), the higher your "tier."

- Citi Priority: $30,000+ balance

- Citigold: $200,000+ balance

- Citigold Private Client: $1,000,000+ balance

You’d think having a million bucks would get you a massive interest rate. Surprisingly, it doesn't always work like that. Often, the citi bank interest rate on saving account for a Citigold member is only slightly higher than the base rate—think 0.06% or 0.12% in branch-heavy markets.

The real value of these tiers isn't usually the interest. It’s the perks. We’re talking about waived wire transfer fees, higher ATM withdrawal limits, and access to "wealth teams." If you’re chasing pure yield, the tier system might leave you feeling a bit underwhelmed.

Fees Can Eat Your Interest Alive

There is no point in earning 4% interest if the bank takes it all back in fees. The standard Citi Savings account usually carries a $4.50 monthly service fee.

You can avoid this, though. You just need to:

- Maintain a $500 average monthly balance.

- Or, link the account to a Citi checking account that meets its own waiver requirements (like having $250+ in "Enhanced Direct Deposits").

- Or, be in one of those Relationship Tiers mentioned above.

For most people, keeping $500 in the account is the easiest way to keep the bank's hands off your money. Honestly, if you can't keep $500 in there, the 0.03% interest you'd earn wouldn't even buy you a cup of coffee anyway.

The Fed Factor in 2026

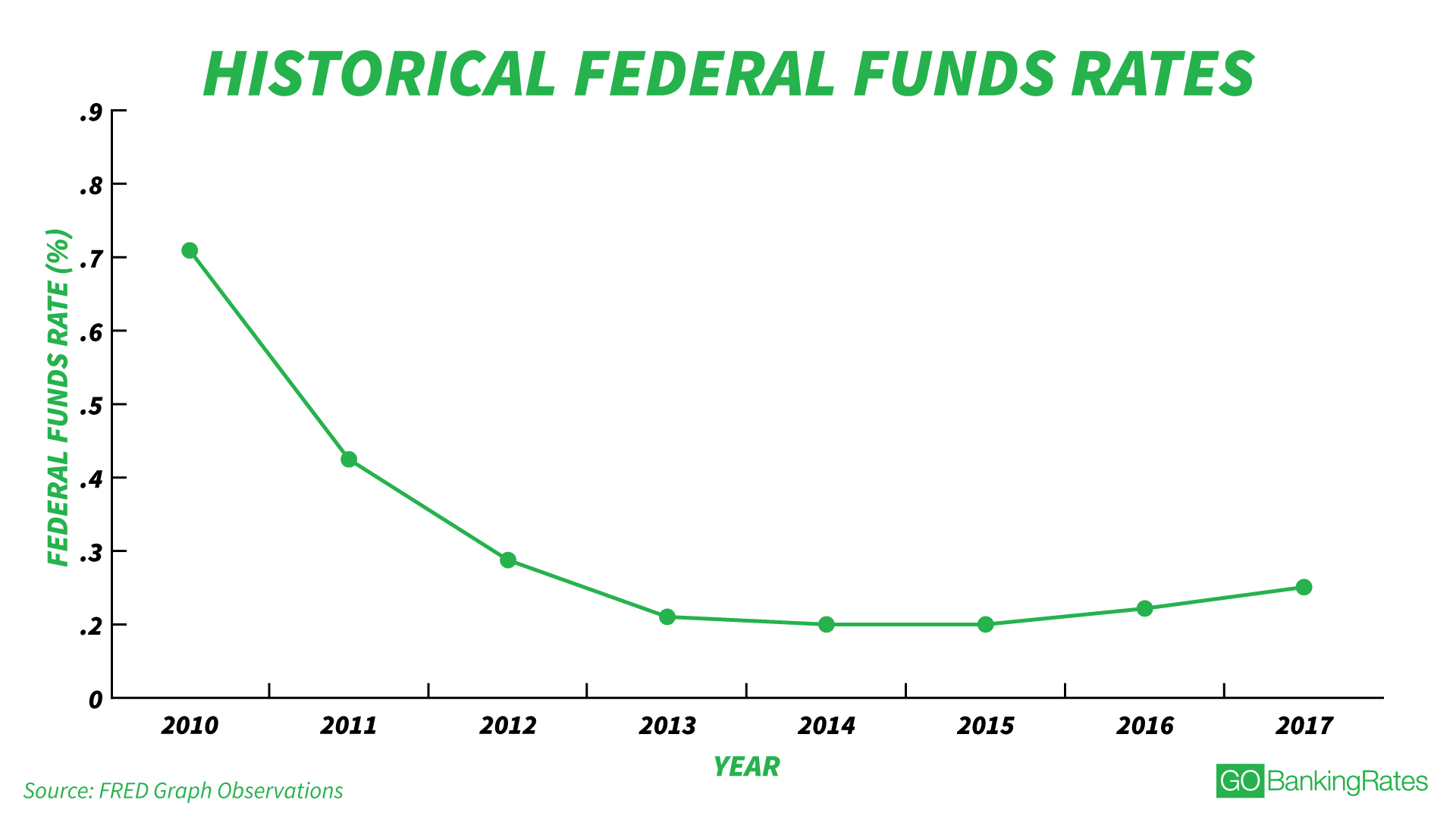

We have to talk about the economy for a second. The Federal Reserve cut rates several times through 2024 and 2025. This has a direct "waterfall" effect on your savings. When the Fed lowers the cost of borrowing, banks almost immediately lower the amount they pay you to hold your cash.

💡 You might also like: 1300 Franklin Ave Garden City NY: Why This Professional Hub Still Dominates Long Island Real Estate

If you see a high citi bank interest rate on saving account today, it might not be there in six months. These are variable rates. They can—and do—change without much warning.

Comparing Citi to the Competition

Is Citi the best place for your cash? It depends on what you value.

If you want a one-stop shop where your credit card, mortgage, and savings are all in one app, Citi is hard to beat. Their app is sleek, and the "65,000+ fee-free ATMs" claim is actually legit. But if you are a "rate chaser," you might find better options at online-only banks like Ally, SoFi, or Marcus by Goldman Sachs.

| Bank Type | Pros | Cons |

|---|---|---|

| Citi (Big Bank) | Branches, ATM access, complex wealth management | Lower rates in many states, fees if balance is low |

| Online Banks | Consistently high APY, usually no monthly fees | No physical branches, harder to deposit cash |

What You Should Do Now

If you are sitting on a pile of cash in a Citi account, don't just leave it on autopilot.

First, log in and check your actual APY. Don't assume you're getting the "Accelerate" rate just because you saw it in an ad. If you're stuck at 0.03%, you're losing purchasing power to inflation every single day.

Second, look into Citi Certificates of Deposit (CDs). Sometimes Citi offers "Featured" CD rates that are significantly higher than their savings rates. For example, a 9-month or 1-year CD might offer over 4.00% even when the savings account is lagging. The catch? You can't touch that money for the duration of the term without paying a penalty.

Third, if you have more than $30,000, make sure your accounts are "linked" so you're at least getting the Tier benefits.

Your next move: Open the Citi mobile app, tap on your savings account, and look for the "Account Details" or "Rates" section. If that number starts with a zero and a decimal point, it is time to either move your money to a Citi CD or look for a high-yield savings alternative.