Honestly, if you've been watching the Cipla today share price, you've probably noticed it feels like a bit of a rollercoaster lately. It’s one of those stocks that everyone thinks they understand because, well, everyone has a strip of Cipla-made paracetamol in their medicine cabinet. But the market doesn't care about your medicine cabinet. Today, January 14, 2026, the stock has been showing some real grit, even as the broader pharmaceutical sector feels a bit shaky.

The stock is currently hovering around ₹1,434.50. That’s down about 0.95% from the previous close.

It opened at ₹1,443.80, hit a high of ₹1,449.80, and dipped to a low of ₹1,425.70. Seeing it slide nearly 1% in a single session might make some folks jumpy, but you’ve gotta look at the "why" behind the numbers. It’s not just random noise.

Why the Cipla Today Share Price is Acting This Way

Most people look at a red number on their screen and think the company is in trouble. That's usually the first mistake. With Cipla, the current price action is heavily tied to some very specific regulatory headwinds that popped up just a week ago.

Remember the USFDA news from January 7th? The regulator flagged some pretty serious compliance gaps at Pharmathen International, which is a massive manufacturing partner for Cipla's Lanreotide drug in the US. When the FDA starts talking about "weak procedures to prevent contamination" or "inadequate systems for sterile conditions," big institutional investors tend to hit the sell button first and ask questions later.

That single event wiped nearly 5% off the value in one go.

What we're seeing today is basically the aftermath of that shock. The market is trying to figure out if this is a temporary hiccup or a structural problem. If you're holding the stock, you're likely wondering if the "dip" is actually a "trap."

The Real Growth Drivers (The Stuff Nobody Talks About)

While the headlines are obsessed with FDA observations, Cipla is actually making some massive moves in the background that could change the game by the end of 2026.

💡 You might also like: Dollar to Azerbaijani Manat: What Really Happens Behind the 1.70 Peg

- The Respiratory Powerhouse: Cipla isn't just a generic pill maker. They are the kings of inhalers. They have four major respiratory assets planned for launch by the end of this calendar year. Specifically, everyone is waiting for Gadvair, which is supposed to roll out in Q4 of FY26.

- Peptide Therapy: They are entering the high-stakes world of peptides with products like Liraglutide. This isn't just another drug; it’s a foray into advanced therapeutics that usually carry much higher margins than your standard generic antibiotic.

- The "One-India" Strategy: While the US market is a headache, the domestic Indian business is a beast. It grew 7% YoY recently, with chronic therapies like cardiac and anti-diabetes treatments making up over 60% of their local sales.

Is it Undervalued or Overpriced?

The valuation conversation is where things get kinda weird. Cipla's Price-to-Earnings (P/E) ratio is currently sitting around 21.29.

Is that high?

Well, if you compare it to the industry average, which often sits north of 30, it looks like a bargain. But some analysts, like the folks at Choice Institutional Equities, have actually downgraded the stock to "Reduce" recently. They’re worried that the heavy spending on R&D—about 7% of their total sales—is going to eat into the margins.

Basically, the company is sacrificing a bit of today's profit to buy a much bigger tomorrow. Whether you like the stock depends entirely on if you believe in that "tomorrow."

What's Next for Investors?

If you're looking at the Cipla today share price as a quick flip, you might be disappointed. The next big catalyst is the Board Meeting scheduled for January 23, 2026, where they'll announce the quarterly results. That’s going to be the "put up or shut up" moment for the management regarding those margin concerns.

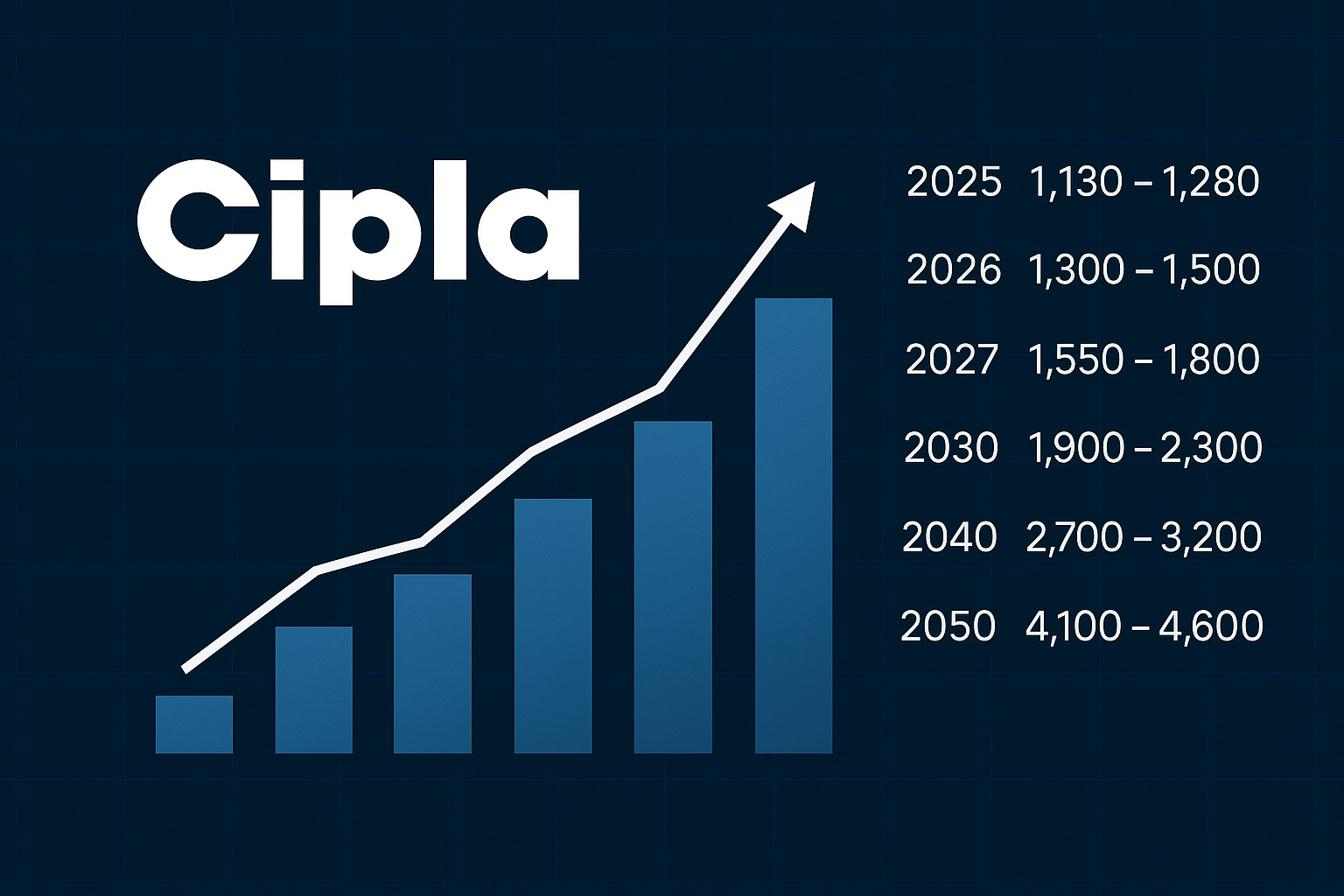

Current consensus among big-name analysts (we're talking about 16 different reports here) suggests a target price of roughly ₹1,672.31. That implies an upside of about 16-18% from where we are right now.

But—and this is a big but—that target assumes they can clear the air with the USFDA and keep their product launch timeline on track. If Gadvair gets delayed, all bets are off.

Actionable Insights for Your Portfolio

Don't just stare at the ticker. If you're trying to make a move, keep these specific points in mind:

- Watch the 1,420 Level: This has historically acted as a bit of a floor. If it breaks below this with high volume, we might see more "pain" before it finds a new bottom.

- The January 23rd Earnings: This is the date to circle. Look specifically at the EBITDA margins. If they stay at or above 25%, the market might forgive the regulatory noise.

- Diversification check: The Indian pharma sector is moving from "high volume" to "high value." Cipla is leading this charge, but it makes them more sensitive to R&D failures than they used to be.

The bottom line? Cipla is a transition story. It’s moving from being India’s chemist to a global biotech player. Those transitions are always messy, and the current share price reflects exactly that messiness.

Stay Disciplined with Your Entry Points

If you're considering a position, look for "staggered entries." Buying all at once in a volatile regulatory environment is usually a recipe for stress. Most successful long-term holders in the pharma space wait for the "maximum pessimism" that usually follows an FDA letter. Whether we've reached that point yet is the billion-dollar question.

Check the Institutional Ownership Changes

One final tip: Keep an eye on the Mutual Fund holdings for Cipla over the next month. If the big domestic funds are increasing their stakes despite the 1,434 price point, it’s a strong signal that the "smart money" sees the current dip as a gift. If they start dumping, you should probably rethink your thesis too.