Church & Dwight just dropped their Q1 2025 numbers, and honestly, it’s a bit of a mixed bag. If you were looking for a clean, straight-up victory, this isn't quite it. The company behind Arm & Hammer and OxiClean managed to beat profit expectations, but they hit a serious wall with revenue. It’s the kind of report that makes analysts scratch their heads because while the bottom line looks decent, the top line—the actual sales—took a hit that nobody really saw coming.

Basically, Church & Dwight Q1 2025 earnings show a company grappling with a "weaker U.S. consumer" and some aggressive inventory cutting from big retailers.

The Numbers That Actually Matter

Let’s get into the weeds. Adjusted earnings per share (EPS) came in at $0.91. That’s a penny higher than what management predicted and two cents better than the Wall Street consensus of $0.89. On paper, a beat is a beat.

But then you look at the revenue.

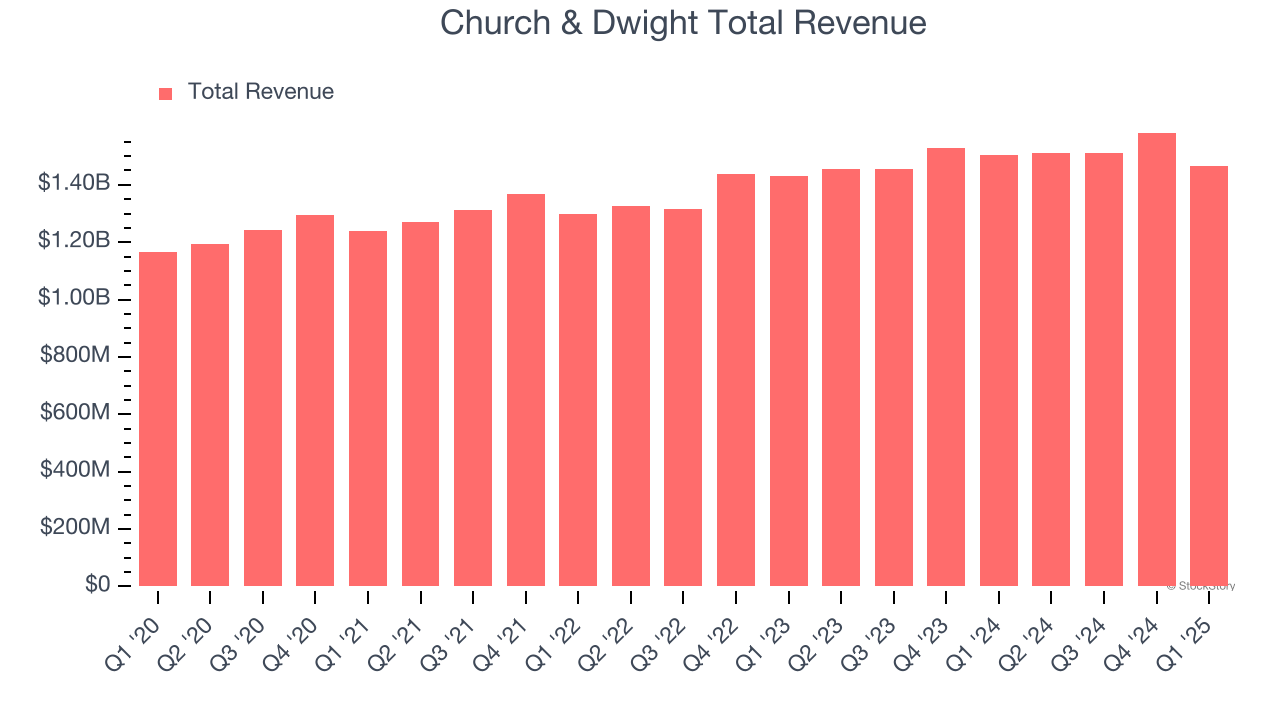

Net sales fell 2.4% to $1.47 billion. Wall Street was expecting something closer to $1.52 billion. That’s a pretty significant gap. Even more telling is the organic sales growth, which is basically the health check for brands without the noise of acquisitions. It dropped 1.2%. Management blamed about 300 basis points of that decline on "retailer destocking." That's corporate-speak for stores like Walmart or Target deciding they didn't need as many boxes of laundry detergent sitting in their backrooms, so they stopped ordering as much.

Why the Stock Took a Dive

The market didn't take this news lying down. Shares of CHD fell over 5% right after the announcement. It wasn't just the missed revenue; it was the vibe shift in the full-year outlook.

✨ Don't miss: Gold rate for Chennai: What most people get wrong about buying today

Management slashed their 2025 expectations across the board. They originally thought organic sales would grow between 3% and 4%. Now? They’re looking at 0% to 2%. They also chopped the adjusted EPS growth forecast down to that same 0% to 2% range, a massive drop from the 7% to 8% they were bragging about just a few months ago.

A Tale of Two Consumers

What’s wild about these results is the divide between what’s winning and what’s losing.

TheraBreath is absolutely crushing it. While the overall mouthwash category was basically flat, TheraBreath consumption jumped 26%. People are clearly obsessed with it. Hero (the acne patch brand) is another bright spot, with market share climbing to 22%.

Then you have the "problem children":

- Vitamins: The gummy vitamin business continues to be a massive drag.

- OxiClean: Stain fighters are struggling as people perhaps get a bit lazier—or cheaper—with their laundry extras.

- Waterpik: People aren't buying the expensive showerheads or flossers like they used to.

In fact, the company is so over the underperformers that they’re looking to sell or shut down Flawless, Spinbrush, and the Waterpik showerhead business. These brands represent about 2% of their total sales but they’re just not profitable enough to keep around. It’s a "trim the fat" moment for CEO Rick Dierker.

The Tariff Ghost in the Machine

We have to talk about tariffs because they’re casting a long shadow over everything right now. Church & Dwight is projecting a gross 12-month tariff exposure of about $190 million. That is a terrifying number for a consumer goods company.

They claim they can mitigate about 80% of that through supply chain shifts and "strategic portfolio decisions" (read: getting rid of the brands made in places hit by high tariffs). Still, the net impact for 2025 is expected to be a $30 million headwind. That’s money that could have gone to marketing or R&D but is instead just... gone.

The International Bright Spot

If there's a silver lining, it’s the world outside the U.S. International organic sales actually grew 5.8%. It turns out people in other countries are just starting to discover things like Hero acne patches and TheraBreath, and they’re buying them up. Volume was up nearly 6% globally, which proves the brands have legs; the U.S. market is just currently exhausted.

What This Means for Your Wallet

If you’re a consumer, you might notice fewer "deep" discounts on Arm & Hammer. The company is leaning into its "value" positioning. As household finances get stretched, Church & Dwight is betting that you'll swap the super-premium detergent for Arm & Hammer because it’s "good enough" and cheaper.

They’re also shifting more money into online sales. E-commerce now makes up almost 23% of their total consumer sales. They’re following you to your phone because that’s where the growth is.

Moving Forward with Church & Dwight

Honestly, the next few months look like a slog for CHD. They aren't expecting a "bounce back" from the retailer inventory cuts. They’re basically battening down the hatches.

If you're watching this company, keep an eye on these specific moves:

- The Vitamin Exit: Watch if they finally find a buyer for the gummy vitamin business or if they just keep let it bleed.

- New Product Launches: They’re betting big on TheraBreath toothpaste (hitting stores January 2026) and Trojan G.O.A.T. non-latex condoms.

- Marketing Spend: They plan to keep marketing at about 11% of sales. If they cut this, it’s a sign they’re worried about cash.

- Price Hikes: With gross margins contracting by 60 basis points, don't be surprised if the price on the shelf ticks up another few cents this summer.

The bottom line is that the company is playing defense. They have strong brands, but even the best laundry detergent can’t fix a consumer who’s decided to stop spending.

🔗 Read more: Examples of Letter of Recommendations: Why Most People Get Them Wrong

To stay ahead of the curve, monitor the company’s next major update scheduled for January 30, 2026, which will cover the full-year 2025 results and their strategy for 2026. This will be the "prove it" moment to see if their brand exits and tariff mitigation actually worked. For now, expect more volatility in the stock as the market waits to see if the U.S. consumer finds their wallet again.