You're ready to trade. You've got your coffee, your screen is glowing, and you're watching the pre-market movers on a crisp December morning. But then you realize something feels off. The volume is thin. The spreads are wide. It's December 24th. Most people are thinking about eggnog or last-minute gift wrapping, but if you’re staring at a ticker, you need to know exactly when the lights go out. Christmas Eve stock market hours aren't like your typical Tuesday. The New York Stock Exchange (NYSE) and the Nasdaq don't just stay open until the usual 4:00 PM ET. They cut the day short, and if you aren't prepared, you might find yourself stuck in a position you intended to close before the long holiday weekend.

Trading on Christmas Eve is weird. It’s quiet. It’s almost hauntingly still on the floor—or what’s left of the physical floor these days. Most of the big institutional players, the folks moving millions of shares at Goldman Sachs or JP Morgan, have already cleared their desks. They’re halfway to Aspen or the Hamptons. What’s left is a mix of retail traders, automated algorithms, and a few skeleton crews at the big desks.

The Hard Schedule: When Does the Market Actually Close?

Let’s get the brass tacks out of the way. On Christmas Eve, the NYSE and Nasdaq officially close at 1:00 PM ET. That’s the big one. If you’re used to that late-afternoon rush where the "Closing Cross" happens and volume spikes, you have to recalibrate. Everything happens three hours earlier.

But it’s not just the stocks. The bond market—which is arguably more important for the overall plumbing of the financial system—usually packs it up even earlier. The Securities Industry and Financial Markets Association (SIFMA) typically recommends a 2:00 PM ET close for bonds, but on Christmas Eve, they often suggest a 12:00 PM ET close. If you’re trading Treasury notes or corporate bonds, your window is incredibly narrow.

Wait. There is a catch.

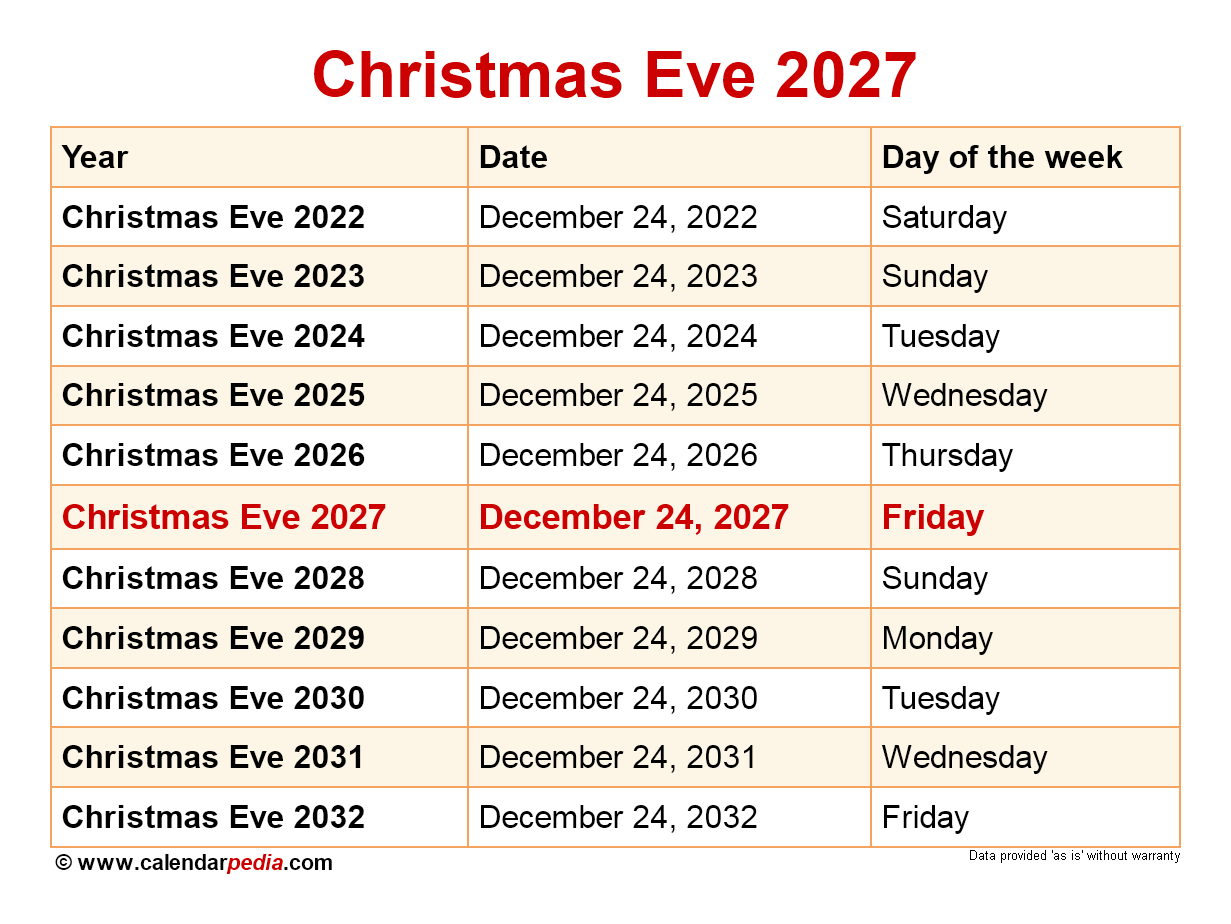

What if December 24th falls on a weekend? This is where people get tripped up every few years. If Christmas Eve is a Saturday, the markets are closed because, well, it’s Saturday. If Christmas Day falls on a Sunday, the market stays closed on Monday, December 26th, in observance of the holiday. In those specific years, December 24th doesn't even see a "half-day" because the market isn't open at all. You have to check the calendar. Don’t just assume because it’s the 24th that you’ll have a morning session.

Why Does the Early Close Matter for Your Portfolio?

Liquidity. Or rather, the lack of it.

🔗 Read more: The Stock Market Since Trump: What Most People Get Wrong

When Christmas Eve stock market hours kick in, liquidity vanishes. Think of liquidity like water in a pool. On a normal day, the pool is full. You can dive in (buy) or jump out (sell) without splashing anyone. On Christmas Eve, the pool is a puddle. If you try to move a large block of shares, you’re going to make a massive splash. This leads to "slippage," where the price you actually get is way worse than the price you saw on your screen a second ago.

Low volume also means volatility can get spicy. It sounds counterintuitive. You’d think a quiet day would mean stable prices. Nope. It’s the opposite. Because there are fewer buyers and sellers, a single relatively small order can shove the price of a stock up or down a couple of percentage points in seconds. It’s a playground for algorithms. These "algos" hunt for stop-loss orders in thin markets. If you have a tight stop-loss set on a mid-cap stock, a random dip at 11:45 AM could trigger your sell order and dump your position right before the market recovers.

Honestly? It's often better to just stay away.

International Markets: A Global Patchwork

Don't assume the rest of the world follows Wall Street's lead. The London Stock Exchange (LSE) usually has an early close too, often around 12:30 PM local time. But then you look at markets in Asia or certain parts of Europe where Christmas isn't a public holiday, and it's business as usual.

If you're trading ADRs (American Depositary Receipts) or international ETFs, you're playing a game of musical chairs where the chairs are being pulled away at different times in different time zones. It's messy.

- LSE (London): Usually closes at 12:30 PM GMT.

- Euronext (Paris/Amsterdam): Often closes around 2:05 PM CET.

- ASX (Australia): Early close is common, usually 2:10 PM AEDT.

- TSX (Toronto): Typically mirrors the US with a 1:00 PM ET close.

The Psychology of the Holiday Session

There’s a term traders use: "The Santa Claus Rally." Yale Hirsch, the guy who started the Stock Trader’s Almanac, defined this as a specific period—the last five trading days of December and the first two of January. Christmas Eve is often the gateway to this phenomenon.

💡 You might also like: Target Town Hall Live: What Really Happens Behind the Scenes

There's a psychological bias at play. People are generally feeling optimistic. Tax-loss harvesting (where investors sell losers to offset capital gains) is mostly wrapped up by the 24th. What's left is a "long bias." If there’s no bad news, the market tends to drift upward on low volume. It’s not a guarantee, obviously. A random geopolitical event or a bad inflation print can ruin the vibe instantly. But historically, the atmosphere is "risk-on" but quiet.

Brokerage Support and Technical Limits

You might think your broker is an unfeeling machine that works 24/7. Not quite. While your app will let you place trades, the human beings behind the scenes—the support staff, the risk management teams, the guys who handle complex option exercises—are also on holiday hours.

If you run into a technical glitch or a margin call issue at 12:30 PM on Christmas Eve, getting a human on the phone is going to be a nightmare. Most major brokerages like Charles Schwab, Fidelity, or Vanguard operate with skeleton crews. Your "instant" deposits might take longer to clear. Your wire transfers? Forget about it until the 26th or 27th.

Real-World Strategy: What Should You Actually Do?

If you must trade during Christmas Eve stock market hours, use limit orders. This is the single most important piece of advice. Never, ever use a market order in a thin, low-volume session. A market order tells the exchange, "I don't care about the price, just get me out now." In a ghost town market, that’s a recipe for getting fleeced. A limit order ensures you only buy or sell at your price or better.

Also, check your options. If you have options expiring around the holidays, be hyper-aware of the early close. The 1:00 PM ET cutoff applies to option trading too. If you’re "in the money" and don’t want to be exercised, or if you need to roll a position, you have three fewer hours to act.

One more thing: the "Santa Rally" isn't a strategy; it's a historical observation. Don't bet the mortgage on a Christmas Eve pump. Sometimes the "Grinch" shows up, and in a low-volume environment, the Grinch can be devastating.

📖 Related: Les Wexner Net Worth: What the Billions Really Look Like in 2026

Historical Context: It Wasn't Always Like This

Back in the day—we’re talking 19th and early 20th century—the market's relationship with holidays was a lot more informal. There were times when the NYSE would just decide to stay closed if a holiday fell on a Thursday to give everyone a "bridge" weekend.

The standardized 1:00 PM ET close for Christmas Eve is a relatively modern convenience designed to balance the global need for price discovery with the reality that even floor traders want to go home and see their kids. It's a compromise. We keep the markets open long enough for the morning data releases to be digested, then we shut it down before things get too weird in the afternoon.

Looking Ahead to the New Year

Once the clock hits 1:00 PM ET on the 24th, that's basically it for the week. Christmas Day is one of the few days the market is 100% closed—no pre-market, no after-hours, nothing. The 26th usually sees a return to normal hours, but the "holiday hangover" persists until after New Year’s Day.

Volume usually stays pathetic until the first full week of January. This is when "New Year's Resolutions" hit the market. New capital flows into 401ks, fund managers rebalance their portfolios for the new quarter, and the real price action begins.

Actionable Steps for Traders

Don't get caught off guard by the shortened session. If you’re managing an active portfolio, follow these steps to ensure you don't end up with a holiday headache:

- Clear your "messy" positions by December 23rd. Don't wait for the low-liquidity environment of the 24th to try and exit a volatile small-cap stock.

- Verify your orders. Check your open "Good 'Til Canceled" (GTC) orders. A sudden, low-volume spike on the 24th could trigger an order you forgot about, executing at a price that doesn't reflect the true market value.

- Adjust your stops. If you’re worried about "stop-hunting" algos taking advantage of the thin Christmas Eve tape, consider widening your stop-losses slightly or moving to "mental stops" (though that requires the discipline to actually sell when the price hits your target).

- Confirm the bond schedule. If you deal in fixed income, remember the noon cutoff. Bond markets are less forgiving than equity markets when it comes to last-minute liquidity.

- Log off at noon. Honestly, the best trades on Christmas Eve are usually the ones you don't make. The risk-to-reward ratio is rarely in your favor when the big money is away from the desk.

The market will be there on the 26th. The ticker will keep blinking. The 1:00 PM ET close is a reminder that even the financial world has its limits. Take the win, or the loss, and go enjoy the break.

Check your brokerage’s specific holiday calendar one last time. While the NYSE and Nasdaq are the gold standard, some niche exchanges or specific commodities markets might have slightly different rules depending on the year. Stay sharp, use limit orders, and keep an eye on the clock.

Strategic Summary of 2024-2025 Sessions:

In 2024, Christmas Eve falls on a Tuesday. The 1:00 PM ET close will be in full effect. In 2025, it falls on a Wednesday, again following the early close rule. Always double-check for any rare "Special Closings" that the NYSE board might announce in response to extreme economic events, though these are historically very rare.