If you've spent more than five minutes looking at a currency chart lately, you know the china currency to bdt exchange rate is a bit of a moving target. Honestly, it’s not just a number on a screen. For a business owner in Dhaka waiting on a shipment of machinery or a student in Beijing sending money home, that decimal point is the difference between profit and a headache.

As of early 2026, the rate is hovering around 17.55 BDT for 1 CNY. But if you think that’s the end of the story, you’re missing the bigger picture.

The Reality of the China Currency to BDT Rate in 2026

The Chinese Yuan (CNY), often called the Renminbi, hasn't just stayed stagnant. Over the last year, we've seen some pretty interesting shifts. Back in early 2025, you might have seen rates closer to 16.50 or 17.00. Now, with Bangladesh's economy recalibrating and China’s trade dominance holding firm, the Taka has had to do some heavy lifting.

Why does it jump around?

Global trade isn't a straight line. When China invests $2.1 billion into the Chinese Industrial Economic Zone (CIEZ) in Bangladesh—which they did recently—it creates a massive demand for currency coordination. You've got billions of dollars in "Panda Bonds" and yuan-denominated loans floating around. These aren't just fancy financial terms; they are the gears moving the exchange rate every single morning.

It’s Not Just About the US Dollar Anymore

For decades, if you wanted to trade between Dhaka and Guangzhou, you had to go through the US Dollar. It was a middleman nobody really liked but everyone used.

💡 You might also like: Big Lots in Potsdam NY: What Really Happened to Our Store

Things changed.

Bangladesh Bank has been pushing hard to use the Yuan directly in the Real-Time Gross Settlement (RTGS) system. Basically, they're trying to cut out the "dollar trap." If you can settle a bill in Yuan, you save on the double-conversion fees. It’s smarter. It’s faster. And it’s why the china currency to bdt pair is becoming one of the most watched tickers in South Asian finance.

Why the Rate Fluctuates (The Stuff Nobody Tells You)

Most people assume it’s just "supply and demand." Sure, that's part of it. But in the real world, the reasons are a lot more gritty.

- The Trade Deficit: Bangladesh imports way more from China than it exports. We’re talking about a gap that topped $16 billion recently. When Bangladesh needs to buy $20 billion worth of Chinese goods but only sells about $800 million back, there’s a constant, desperate need for CNY. This keeps the BDT under pressure.

- Interest Rate Gaps: Did you know that taking a loan in Yuan is often cheaper than in Dollars? Currently, Chinese loans in CNY might carry an interest rate around 2.5%, while Dollar-based ones can hit 6% or more. This makes the Yuan very attractive for the Bangladeshi government, influencing how much they keep in their reserves.

- The LDC Graduation: Bangladesh is moving up in the world. As it graduates from "Least Developed Country" status, some trade perks might vanish. China, however, has played a bit of a hero role here by extending zero-tariff access on 99% of goods until 2028. This extension keeps the trade flowing and the currency rate from spiraling.

Sending Money: How to Actually Get the Best Rate

If you’re trying to move money, don't just walk into a random bank branch in Chittagong or Shanghai and expect a fair deal. You’ll get "tourist rates," which are essentially a polite way of saying you’re getting ripped off.

Digital is King

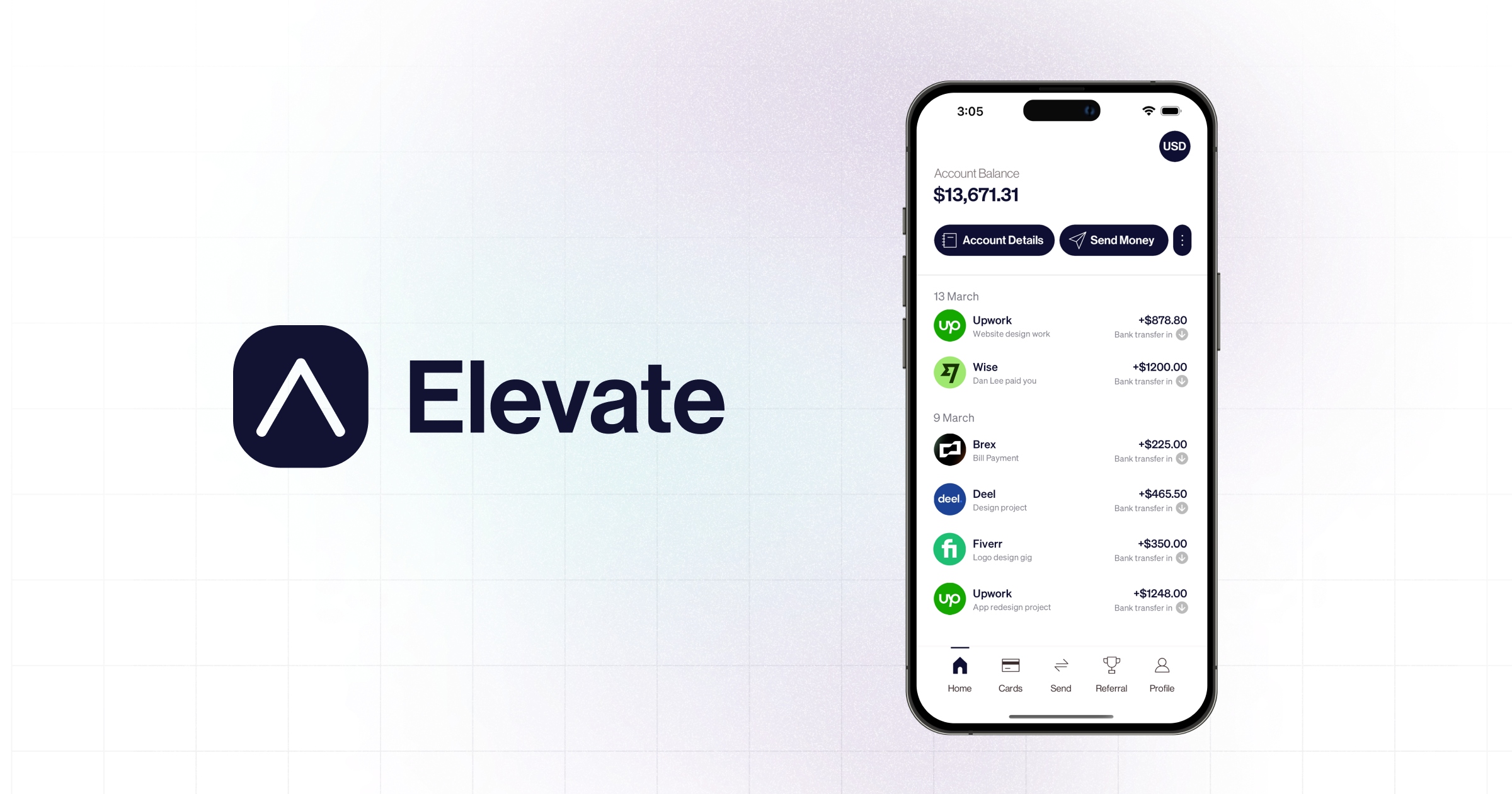

Apps like Wise, Remitly, and Western Union are usually your best bet. For instance, Wise often uses the "mid-market" rate—the one you actually see on Google—and then charges a transparent fee. Traditional banks often hide their fees by giving you a worse exchange rate.

📖 Related: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

The Alipay and WeChat Factor

In China, physical cash is basically a relic. If you’re a Bangladeshi expat, you’re likely using Alipay or WeChat Pay. These platforms now have much better integration for international transfers. Just make sure the recipient in Bangladesh has a verified account or a bank linked to the bKash or Nagad network.

Timing the Market

Don’t be reactive. If you see the rate dip toward 17.20, that’s usually a "buy" signal for Taka. If it spikes toward 17.80, maybe wait a few days if you can. The market is volatile, but it tends to bounce within a specific range unless there’s a major political announcement.

What Most People Get Wrong

The biggest misconception? Thinking the "official" rate is what you'll actually pay.

There is the interbank rate (what banks charge each other), the official rate (what the central bank says), and the kerb market rate (the "open market" or street rate). In Bangladesh, the gap between the official and the open market can sometimes be significant. If you’re looking at a screen and it says 17.55, but the guy at the exchange booth says 18.10, he’s not necessarily "scamming" you—he’s just pricing in the scarcity of the currency.

The Future of the Taka and the Yuan

Looking ahead through 2026, expect more "Yuan-ization."

👉 See also: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

The shift away from the dollar isn't just a political statement; it's a survival tactic. As Bangladesh builds its reserves back up—which recovered to about $28 billion recently—holding a diverse basket of currencies is key. The Yuan is a huge part of that basket now.

We're also seeing more Chinese firms moving their manufacturing directly into Bangladesh to bypass US tariffs. This is huge. It means instead of just sending money out to buy goods, Chinese companies are bringing investment in. This could eventually help stabilize the Taka because it creates local jobs and exports.

Actionable Insights for You

- For Importers: Start asking your Chinese suppliers if they accept direct CNY payments. You might find they’ll give you a discount because they also want to avoid dollar volatility.

- For Remitters: Use a comparison tool before hitting "send." A 1% difference in the china currency to bdt rate might not seem like much on 1,000 Yuan, but on 50,000 Yuan, it’s a lot of groceries.

- For Investors: Keep an eye on the Bangladesh Bank's circulars. They often change the rules on how much foreign currency you can hold or transfer, and these rules affect the "real" rate you encounter at the bank.

The relationship between these two currencies is a direct reflection of how the world is changing. It's less about Washington and more about the direct line between Dhaka and Beijing. Keep your eyes on the trade data, not just the currency converter.

To get the most out of your currency exchange, your next step is to compare the real-time "all-in" costs—including hidden spreads—on a transfer comparison tool rather than relying on the mid-market rate shown on standard search engines.