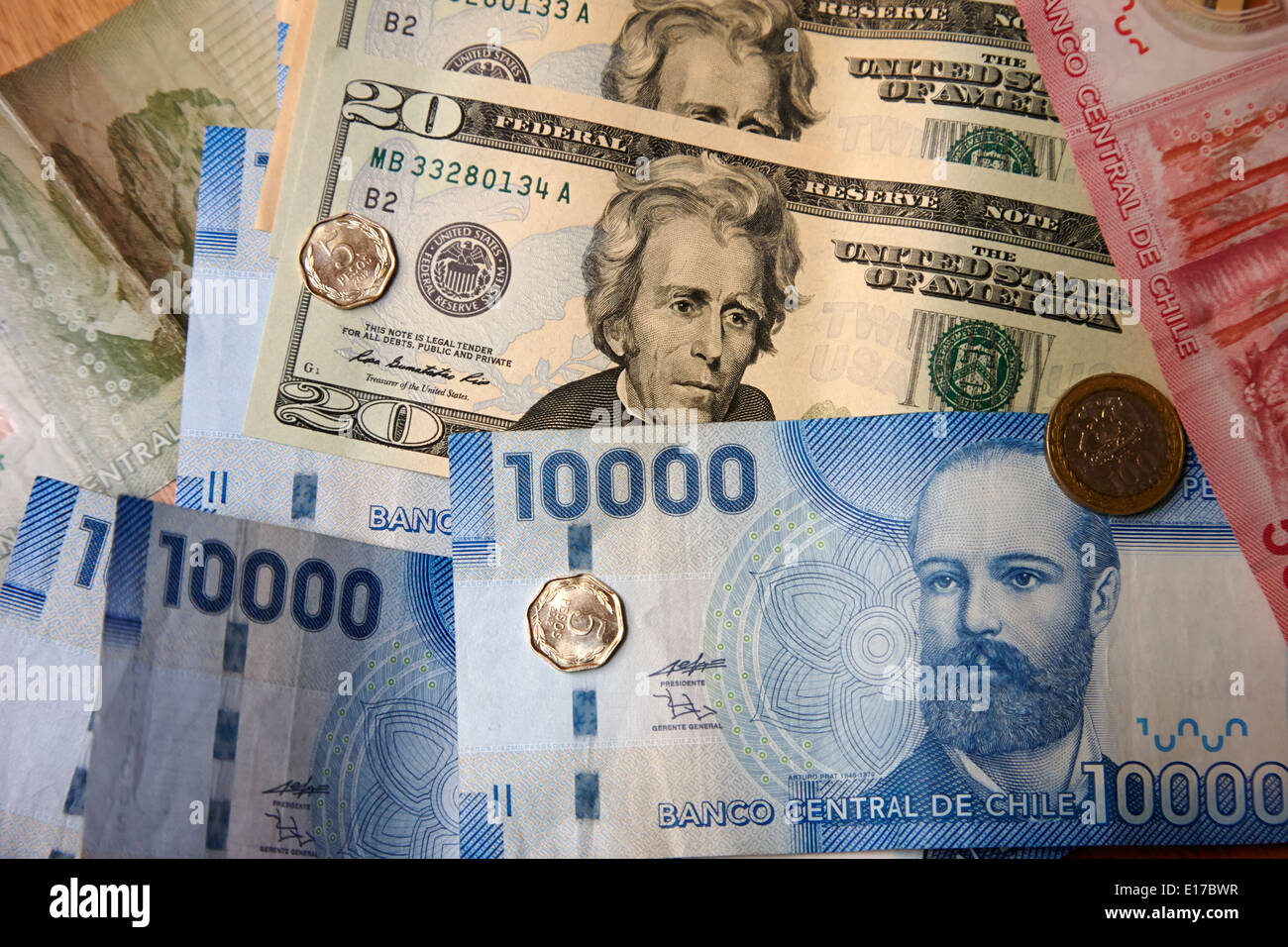

If you’ve ever stared at a 20,000 Chilean peso bill and wondered if you’re holding a small fortune or just enough for a decent sandwich, you’re not alone. The math is weird. Honestly, seeing all those zeros can give any traveler or investor a bit of "sticker shock" until they realize the exchange rate for chilean money to us dollars usually hovers around a fraction of a cent.

As of January 2026, the Chilean Peso (CLP) is sitting at approximately 0.00113 USD. To put that in human terms, 1,000 pesos is roughly $1.13. It sounds simple, but the "why" behind those numbers is where things get interesting. Chile isn't just another South American economy; it's a massive mining powerhouse whose currency breathes in sync with the global price of copper. When the world needs wire for EVs or AI data centers, the peso flexes. When copper supply hit a wave of disruptions late last year—including accidents at the El Teniente mine—the currency felt the heat.

The Copper Connection and Why Your Dollars Move

You can't talk about chilean money to us dollars without talking about the "Red Metal." Chile is the world's largest copper producer. It’s basically a massive copper mine with a country attached to it. Experts like Victor Garay from Cochilco (the Chilean Copper Commission) have been tracking record-high price forecasts for 2026, often citing a global refined copper deficit of around 330,000 metric tons.

Basically, when copper prices soar, the Chilean peso usually strengthens. This is great for Chileans buying iPhones or gas, but it means your US dollars won't go quite as far when you're visiting Santiago or the Atacama Desert.

There's a specific formula that the State uses: for every one-cent increase in the annual average copper price, the Chilean government pulls in between $20 million and $25 million in extra revenue. That’s a lot of weight on the exchange rate.

Real-World Math: Living on Pesos

Forget the theoretical charts for a second. What does this actually look like on the ground?

In early 2026, prices in Santiago have stabilized, but they aren't "cheap" compared to neighboring countries like Argentina. If you’re grabbing lunch, expect to shell out anywhere from 9,000 to 30,000 pesos. Do the quick math: that’s about $10 to $34. A coffee will set you back roughly 3,000 pesos ($3.40). It’s remarkably similar to mid-sized US cities.

🔗 Read more: Cuanto tarda en llegar un cheque por correo del irs: Lo que nadie te dice sobre los retrasos del correo

One thing that catches people off guard is the 19% IVA (sales tax). Here’s a pro tip: if you’re a foreigner and you pay for your hotel in US dollars (cash or certain international cards), you can often get that 19% tax waived. It’s one of the few times using "greenbacks" directly actually saves you money. Most other places—restaurants, shops, pharmacies—will look at you sideways if you try to hand over a $20 bill.

Where to Swap Your Cash Without Getting Ripped Off

Avoid the airport. Seriously.

The exchange kiosks at Santiago’s Arturo Merino Benítez International Airport are convenient, sure, but they’ll eat 5-10% of your value in "convenience fees" and bad rates. If you need to convert chilean money to us dollars, head to the "Casas de Cambio" on Agustinas Street in downtown Santiago. It’s the unofficial Wall Street of currency exchange in Chile. The competition there is so fierce that the spreads are razor-thin.

Banks are okay, but they’re slow. ATMs (Redbanc) are everywhere, but watch out for the withdrawal fees. Most Chilean ATMs charge between $8 and $10 USD per transaction. To minimize the pain, use Banco Estado or Scotiabank; they historically have the lowest fees for international cards.

👉 See also: What Is 40 Pounds in American Money Explained (Simply)

The "Gabriela" and Other Quirks

Chilean bills are pretty. They’re made of a polymer (plastic) that’s hard to rip and survives a trip through the washing machine. You’ll hear locals use slang for their money that can be confusing:

- A "luca" is 1,000 pesos. If someone says "five lucas," they mean 5,000 pesos.

- A "gamba" used to mean 100 pesos, though it's used less often now.

- The 5,000 peso note features Gabriela Mistral, the Nobel Prize-winning poet. Some people literally call the bill "una Gabriela."

Forecasting the Peso in 2026

The Central Bank of Chile (BCCh) has been aiming for a 3% inflation target for the first quarter of 2026. They've been relatively successful. Investment in machinery and equipment is up, and the economy is expected to grow between 2% and 3% this year.

However, there’s a shadow of uncertainty. Trade conflicts and the Federal Reserve’s actions in the US always ripple down to the Southern Hemisphere. If the US dollar strengthens globally due to higher interest rates, the peso will likely take a hit, making chilean money to us dollars a more favorable trade for those holding USD.

Survival Steps for Your Wallet

If you're moving money between these two currencies, don't just wing it.

- Use an App First: Download something like Revolut or Wise. They let you hold both CLP and USD in separate "buckets" and convert at the mid-market rate.

- The "Con la Propina" Rule: In restaurants, the tip (10%) is almost always suggested but not mandatory. When the waiter brings the machine, they’ll ask "con la propina?" If you say yes, they add the 10%.

- Small Bills are Gold: Once you get outside Santiago, especially in Patagonia or the Lake District, small shops struggle to change 20,000 peso bills. Break your large notes at supermarkets or gas stations.

- Crisp Notes Only: If you are bringing US cash to exchange, ensure the bills are pristine. No tears. No ink marks. Chilean exchange houses are notoriously picky and will reject a $100 bill for a tiny corner crease.

Keep an eye on the London Metal Exchange (LME). It sounds nerdy, but checking the daily price of copper will give you a better "weather report" for the Chilean peso than any news broadcast. If copper is up, the peso is likely rising too.

To make the most of your exchange, track the rates on a site like XE.com for a few days before making a big move. If you see a sudden dip in the peso, that's your window to lock in a better rate for your US dollars.