Honestly, sitting around waiting for a tax refund feels a bit like watching paint dry. Except the paint is your own money, and you probably already have it spent in your head. If you've been searching for a way to check my ca state refund, you're likely staring at a screen wondering why the status hasn't budged.

It’s frustrating.

You filed weeks ago. Your neighbor already got their check. You’re left refreshing a portal that looks like it was designed in 2004. Let’s get into what is actually happening behind the scenes at the California Franchise Tax Board (FTB) and how you can actually track down that cash without losing your mind.

The Reality of the Check My CA State Refund Portal

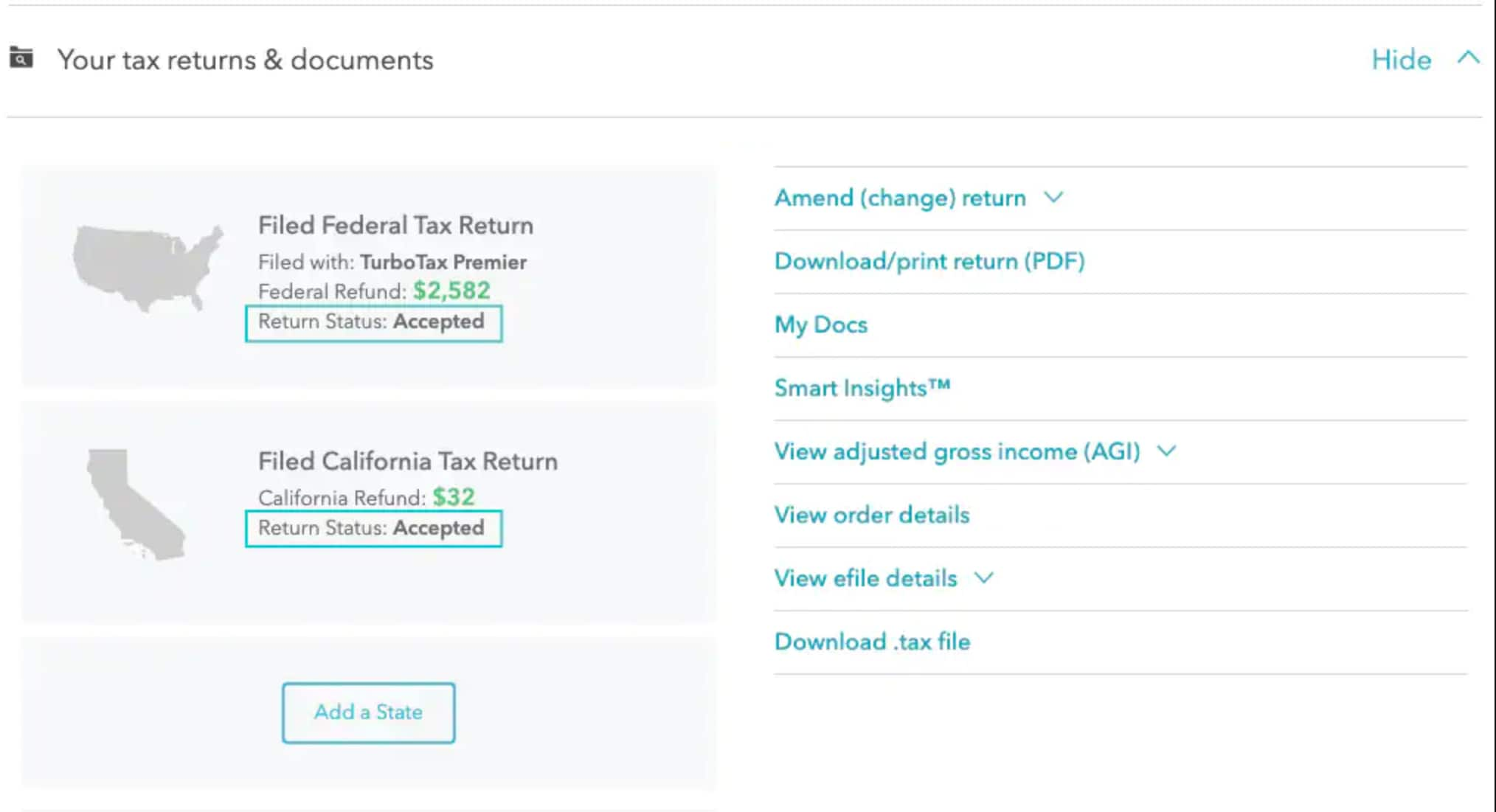

Most people head straight to the FTB "Check Your Refund" tool. It’s the logical first step. To use it, you basically need four specific things: your Social Security Number, your zip code, your complete mailing address (just the numbers), and the exact refund amount you're expecting.

💡 You might also like: Between a Shot and a Hard Place: Why Workplace Health Mandates Are Getting Complicated Again

Don't round the numbers. If your tax software says you're getting $542.89, don't type $543. The system is picky. It’s a computer, not a person who understands "close enough."

If the tool tells you it's "processing," that is actually good news. It means it hasn't been flagged for a manual review yet. If you e-filed, the FTB usually says to wait about three weeks. Paper filers? You’re looking at three months. Yes, months. In 2026, mailing a paper return is basically choosing the scenic route through a blizzard.

Why Everything Might Be Taking Forever

The FTB doesn't just hold onto your money for fun. Usually, a delay happens because something didn't line up. Maybe your W-2 doesn't match what your employer reported. Or perhaps you claimed a credit, like the California Earned Income Tax Credit (CalEITC), that triggered an extra fraud check.

Fraud is a massive headache for the state. They’ve added layers of "safeguards" that act like speed bumps. Sometimes these bumps feel more like brick walls.

Another big one? Debt. If you owe back taxes, child support, or even certain vehicle registration fees to the DMV, the state can "intercept" your refund. They call it the Interagency Intercept Program. You think you’re getting a thousand bucks, but the state decides that money is better spent paying off that three-year-old speeding ticket you forgot about.

How to Check My CA State Refund When the Tool Fails

If the online tool is giving you the cold shoulder, you've got a few other options. None of them are particularly "fun," but they work.

- The Automated Phone Line: You can call 800-338-0505. It's available 24/7. It’s the same data as the website, but sometimes it’s easier to navigate via keypad than a mobile browser that keeps crashing.

- The MyFTB Account: This is the "pro" version of checking your status. It takes longer to set up because they have to mail you a PIN for security, but once you're in, you can see way more detail. You can see if they’ve sent you a letter that’s still sitting in a sorting facility somewhere.

- Live Chat: If you’re a MyFTB user, you can chat with a human during business hours (8 AM to 5 PM). This is often faster than waiting on hold for two hours.

Common "Gotchas" in the Process

I’ve seen people get stuck because they changed addresses mid-season. If the address on your return doesn't match what the FTB has on file, the system might throw a red flag.

Also, check your bank info. One typo in a routing number and your direct deposit turns into a paper check. If that happens, add another 3-4 weeks to your wait time. The FTB has to wait for the bank to reject the deposit before they even start printing the physical check.

What Most People Get Wrong About California Refunds

A lot of folks assume that once the IRS approves their federal refund, the state one follows immediately. That’s not how it works. They are two entirely separate entities. The FTB has its own "fraud filters."

🔗 Read more: Canada Targeting Red States: Why Your Local Economy Depends on Your Northern Neighbor

In fact, some years the FTB intentionally slows down refunds to verify data against the IRS records later in the season. If you're wondering why you need to check my ca state refund even though your federal money hit your bank last Tuesday, that's why. Different systems, different rules.

Dealing with "The Letter"

If you get a letter from the FTB (usually an FTB 4734D or something similar), don't panic. It usually just means they need to verify your identity. They might ask for copies of your W-2 or a photo ID. Just send it in. If you ignore it, your refund will stay in limbo forever.

Actionable Steps to Get Your Money Faster

If you haven't filed yet, e-file. It’s a no-brainer. Use direct deposit.

If you've already filed and you're just stuck in "processing" hell, here is exactly what you should do:

- Verify your amount: Double-check your actual tax return (Form 540) to make sure you're searching for the exact dollar amount.

- Wait the full 21 days: If you e-filed, don't even bother calling until 21 days have passed. They’ll just tell you to keep waiting.

- Check for "The Intercept": If your refund is lower than expected, wait for the notice in the mail. It will explain which agency took a bite out of your check.

- Update your address: If you moved, get on the FTB website and update it immediately so your check doesn't go to your old landlord.

The reality is that "Check My CA State Refund" is a game of patience. Most refunds move through the system without a hitch, but for the 10% that get caught in the gears, it takes a bit of detective work to get things moving again.

💡 You might also like: WBD Stock Price Today: What Everyone Is Missing About the Netflix and Paramount War

Next Step: Head over to the Official FTB Refund Status page and ensure you have your SSN and exact refund amount ready to go.