You’re staring at a Chase check. Maybe it’s a paycheck, maybe it’s a rent check from a roommate, or maybe you’re just trying to set up a mortgage payment and the website is screaming for a nine-digit number. You see a string of digits at the bottom. Which one is which? Honestly, if you get it wrong, your money goes into the void—or at least bounces back with a nasty fee attached. Finding the check chase routing number shouldn't feel like decoding the Enigma machine, but because Chase is a massive banking behemoth that swallowed up dozens of smaller banks over the decades, it’s actually more complicated than it looks on the surface.

Banks have secrets. One of those secrets is that they don’t just have one routing number. They have dozens. If you use the one from a check you found in a drawer from 2018, and you’ve since moved from Chicago to Los Angeles, you might be setting yourself up for a headache.

👉 See also: 12 30 am ist to cst: Why This Midnight Shift Is the Secret Engine of Global Business

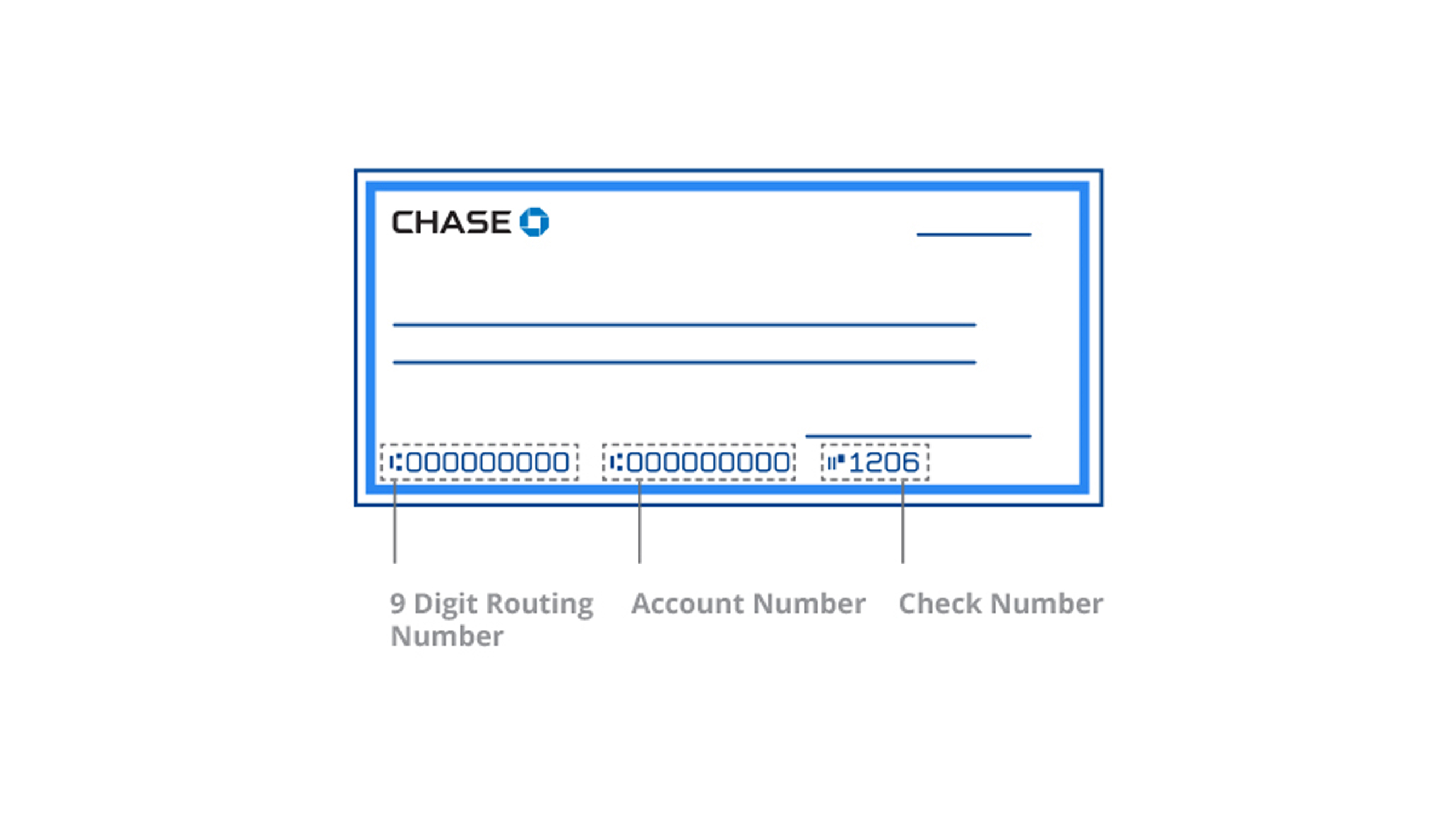

The Anatomy of Your Chase Check

Look at the bottom left. There’s a specific font used there—it's called MICR, or Magnetic Ink Character Recognition. It’s that blocky, retro-future look. Usually, you’ll see three sets of numbers. The first set, almost always nine digits long and flanked by a specific symbol that looks like a colon with a dash, is your routing number.

The second set is your account number. The third is the check number itself.

But here’s where people trip up. Chase uses different routing numbers for different things. Are you setting up a domestic wire transfer? Are you doing an ACH transfer for your electric bill? Are you receiving an international wire from your cousin in London? The check chase routing number printed on your paper checks is specifically for "Paper" or "Electronic/ACH" transactions. It is not always the same number you’d use for a wire. If you try to wire $10,000 using the routing number on your check, Chase might reject it. Or worse, it might sit in a clearing house for a week while you sweat.

Why Location Changes Everything

Back in the day, banking was local. When JPMorgan Chase acquired banks like Washington Mutual or Bank One, they inherited those old routing numbers. This is why your friend in New York has a routing number starting with 02 and your sister in Texas has one starting with 11.

Check this out: If you opened your account in Illinois, your routing number is likely 071000013. But if you’re in California, you’re probably looking at 121000248.

It’s about the "Fed region." The Federal Reserve divides the US into 12 districts. Your routing number is basically a physical address for your money. The first two digits of that check chase routing number actually tell the Fed which district the bank belongs to. It’s a literal map.

If you’ve moved, things get weirder. Let’s say you opened an account in Florida (District 06) but now live in Seattle. You might think you should use a Washington routing number. Nope. You stick with the one tied to the branch where you originally opened the account, unless you’ve specifically closed that account and opened a new one locally. It’s a legacy system. It’s clunky. But it’s how the plumbing of the American financial system works.

Wire vs. ACH: The Great Confusion

I see this happen all the time. Someone gets a new job, they grab their checkbook, and they copy the routing number for their direct deposit form. That works. That’s an ACH (Automated Clearing House) transaction.

But then, that same person buys a house. The title company asks for a "Routing Number for Wires." They give the one from the check.

Boom. Error.

Chase, like many large institutions, often uses a "Real Time Wire" routing number that is entirely different from the one on your check. For example, Chase's main wire routing number is often 021000021, regardless of where you live. If you use the check chase routing number for a wire, it might eventually get there, but it’ll take a detour through the slow lane. Sometimes it just gets kicked back. When you're dealing with a house closing, that’s a heart attack you don’t need.

The Fraud Factor

Let’s talk about security for a second. Your routing number is public information. I can find the routing number for Chase in Ohio with a five-second Google search. It’s not a secret. Your account number, however, is the key to the vault.

When you’re looking at your check, the routing number is the "public" part. It just identifies the bank. The account number is the "private" part. Scammers love it when people post photos of their "first paycheck" on Instagram without blurring those numbers. They don't even need your signature anymore. With just the check chase routing number and your account number, someone can print their own "demand drafts" and pull money out of your account. It’s an old-school hack, but it still works because the check system is based on trust established in the 1950s.

How to Double Check if You’re Right

If you don't have a check handy, don't just guess. Don't just trust a random PDF you found on a third-party site.

- Log into the Chase Mobile App. Tap on your account. Look for "Account Details." It will explicitly list the "Routing Number" and often clarify if it's for ACH or Wires.

- The Chase Website. They have a specific "Routing Number by State" landing page. It’s the gold standard.

- The Check itself. If you have the physical book, use the number on the far left.

There is a weird edge case. If you have a "Chase Plus" or specialized commercial account, your routing number might not match the general state list. Always trust what is printed on your specific checks over a general list you found online.

The "State of Origin" Trap

One thing that really messes people up is the "State of Origin" rule. Suppose you live in New Jersey but work in Manhattan. You walked into a Chase branch near your office in NYC to open your account.

Your check chase routing number will be a New York routing number. Even if you move to Florida ten years later, as long as you keep that same account, you are effectively "banking in New York." You must use the New York routing number for every direct deposit, every tax refund, and every car payment.

People try to be helpful and look up "Chase routing number Florida" because that's where they live now. If they put that on a form, the transaction will fail because the account number doesn't exist in the Florida database. It’s a digital mismatch.

What Happens if You Use the Wrong One?

Usually, one of three things.

First, the "Soft Fail." The system realizes the routing number is for Chase, but not your specific branch region. It might take an extra 48 hours to clear as the bank's internal systems reroute it.

Second, the "Hard Reject." This is common with the IRS or mortgage companies. They try to "ping" the account, it doesn't resolve, and they cancel the transaction. This often results in a "returned item fee" from Chase, which is usually around $34.

Third, and rarest, is the "Wrong Destination." This almost never happens with routing numbers alone, but if you typo both the routing and account number, your money could technically land in someone else's lap. Recovering that is a nightmare that involves "Letters of Indemnity" and weeks of legal back-and-forth.

Specific Numbers for Common Regions

Just to give you a sense of the variety, here are a few real-world examples of the check chase routing number you might encounter across the country:

- California: 121000248

- Texas: 111000614

- New York / New Jersey: 021000021

- Illinois: 071000013

- Arizona: 122100024

- Washington State: 125000024

Notice a pattern? They all start with different prefixes. Those prefixes tell the automated sorters at the Fed exactly where to send the digital image of your check.

Actionable Steps for Managing Your Routing Info

Don't leave your finances to guesswork. The system is old, and it's rigid.

- Verify the Transaction Type: Before you give out your check chase routing number, ask: "Is this for an ACH transfer or a Wire?" If it's a wire, go to the Chase app and specifically look for the wire routing number. It’s often different.

- Check Your "Home" Branch: If you've moved multiple times, look at your monthly statement. The address of the branch where your account is "held" is usually printed there. Use the routing number associated with that state.

- Update Your Employer Immediately: If you ever close an account and open a new one in a new state, you must update your payroll. Using an old routing number for a closed account is the fastest way to miss a paycheck.

- Keep a Voided Check Digital Copy: Take a photo of a voided check and keep it in a secure, encrypted folder (like a password manager). Many HR portals require you to upload an image of a check to verify the routing number anyway.

Banking feels like it’s all in the cloud, but it’s still running on rails laid down decades ago. The check chase routing number is the GPS coordinate for your cash. Make sure you're pointing the map in the right direction, or your money might end up taking a very long, very expensive vacation without you.

When in doubt, open your Chase app, tap the account, and look at the "Routing Number" link. It’s the only way to be 100% sure in a world of legacy bank mergers and regional Fed districts. Stick to the numbers on your specific checks for daily stuff, and you'll be fine.