You’re standing in your kitchen, check in hand, trying to get that money into your account without driving to a branch. It should be easy. You open the app, snap a couple of photos, and wait for the "Success" screen. But then, it hangs. Or worse, you get a rejection notice two hours later. Chase mobile deposit check features are honestly some of the best in the banking world, but they aren't foolproof. If you've ever dealt with a "blurry image" error when the photo looked crisp to you, you know the frustration.

Most people think it’s just about the camera. It’s not. There are backend limits, specific endorsement requirements, and timing issues that can lock your funds up for days if you skip a step.

The Secret to Not Getting Your Deposit Rejected

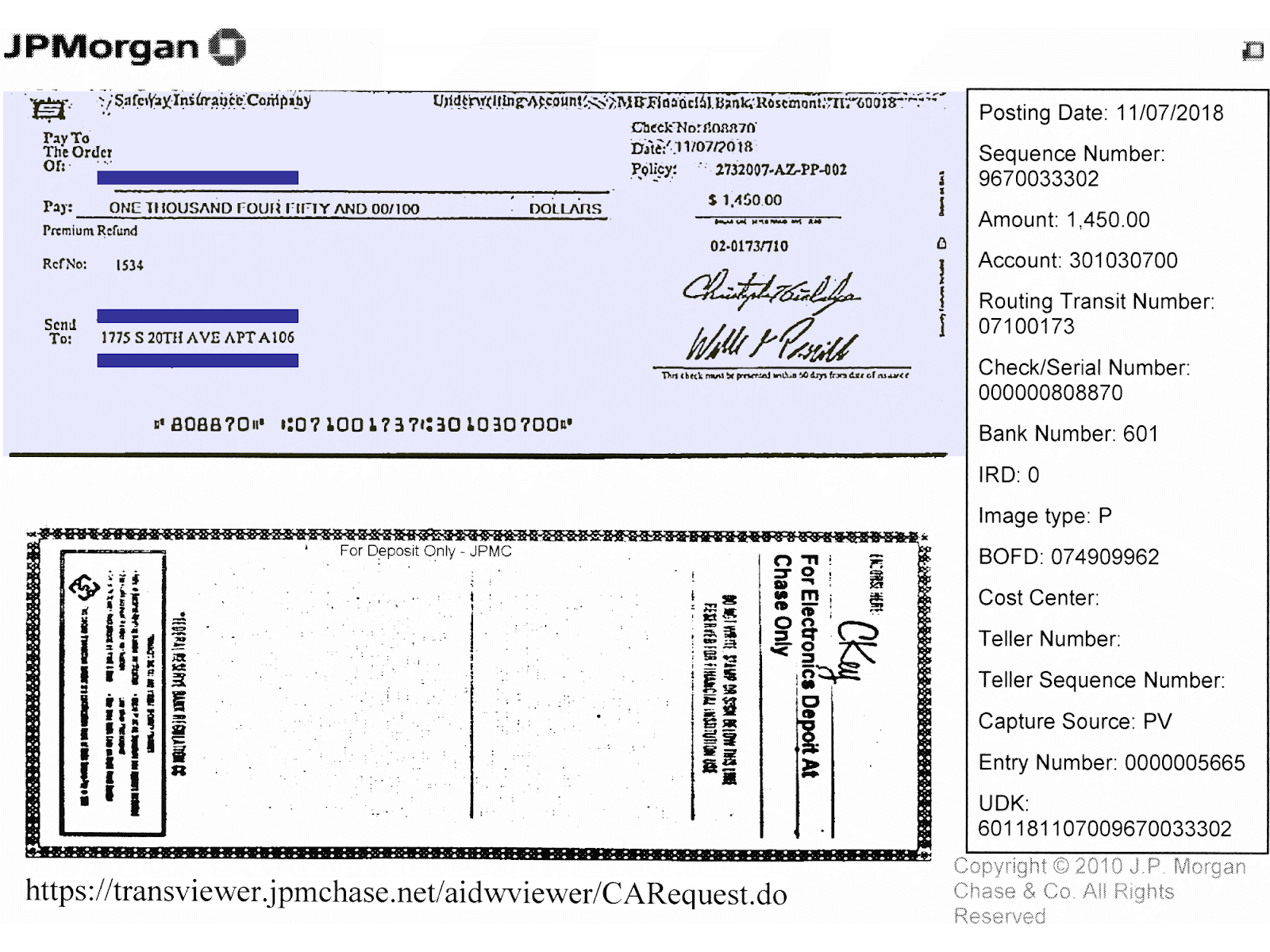

Chase is picky. They have to be. To prevent fraud, their algorithms look for very specific markers on that slip of paper. First off, you have to endorse the back. But just signing your name isn't enough anymore. You actually have to write "For Electronic Deposit at Chase Only" under your signature. If you skip that phrase, there is a massive chance their system will spit it back out. Why? Because without that restrictive endorsement, a person could theoretically try to cash the physical check at a local liquor store after the mobile deposit clears. Chase wants to close that loophole tight.

Don't use a felt-tip pen. The ink bleeds. Use a standard blue or black ballpoint.

The lighting matters way more than the megapixels on your iPhone or Samsung. If there’s a shadow cast by your hand over the routing number, the OCR (Optical Character Recognition) software will fail. Put the check on a dark, non-reflective surface. A dark wood table or a black mousepad works wonders. White checks on white countertops are a recipe for a "cannot detect edges" error.

Understanding Those Annoying Chase Deposit Limits

Your limit isn't the same as your neighbor's. Chase doesn't publish a universal "this is what you get" table because it's based on your specific relationship with the bank. If you've had a Chase Total Checking account for ten years with a steady direct deposit, your daily limit might be $5,000 or even $10,000.

👉 See also: Why Tangle Pets on Shark Tank Still Matters for Every Parent With a Brush-Hating Kid

New accounts? You might be stuck at $2,000 a day.

How to check your personal limit:

- Open the Chase Mobile app.

- Tap on "Deposit Checks."

- Look at the "Deposit to" field and select your account.

- Right there, under the amount field, it will say "Remaining limit".

That number is your hard ceiling. If you try to deposit a $5,001 check and your limit is $5,000, the app won't even let you take the photo. It’s a hard stop. You’ll have to head to an ATM or a teller. Interestingly, Chase usually resets these limits on a rolling 30-day basis, not just a daily one. If you deposit a huge check on Monday, your remaining monthly limit drops accordingly.

The "Funds Availability" Trap

Just because the app says "Success" doesn't mean you can go spend that money at Costco five minutes later. This is where people get caught with overdraft fees.

💡 You might also like: NJ Child Tax Credit Explained (Simply): How to Get Your $1,000 Check

Generally, if you submit your Chase mobile deposit check before 11 PM Eastern Time on a business day, Chase considers that the day of deposit. If you do it at 11:30 PM? That counts as the next day. Usually, the first $225 is available the next business day. The rest takes longer.

For checks over $5,525, Chase often applies "Large Deposit" holds. This is governed by Regulation CC, but banks have some leeway. You might see the full balance in your "Account Ledger," but your "Available Balance" will be much lower. Always check the "Available" line before you pay your rent.

What Most People Get Wrong About the Physical Check

Once the app says the deposit is pending, what do you do with the paper?

I’ve seen people shred them immediately. Don't do that. Chase officially recommends keeping the physical check for two weeks. Mark it with a small "deposited" note on the front in the corner. Keep it in a safe spot. If the person who wrote you the check has insufficient funds, or if there’s a smudge on the image that the backend team can't read, you’ll need that original paper to re-scan it or take it to a branch. Once 14 days have passed and you see the money is fully cleared and "available," then you can shred it.

✨ Don't miss: Ohio AG Sues Clermont Auto Dealership: What Really Happened

When the App Just Won't Work

Sometimes the app is just buggy. It happens. If you’re getting a persistent error, try clearing your app cache or checking for an update in the App Store.

Another weird tip: clean your camera lens. We touch our phones all day, and a tiny bit of thumb grease can create a haze that the human eye ignores but the Chase AI hates. A quick wipe with a microfiber cloth—or even your shirt—can be the difference between a rejected deposit and a cleared one.

If you’re trying to deposit a third-party check (a check made out to someone else who then signed it over to you), save yourself the headache. Chase almost always rejects these via mobile deposit. You’ll almost certainly have to go into a branch and show ID for that kind of transaction.

Actionable Steps for a Flawless Deposit

To ensure your Chase mobile deposit check goes through the first time, follow this specific workflow:

- Verify your limits in the app before you even pick up a pen.

- Endorse with the phrase "For Electronic Deposit at Chase Only" followed by your signature.

- Find a high-contrast background. Black or dark brown is best for standard white or light blue checks.

- Flatten the check. If it’s been folded in a card, iron it out with your fingers so it doesn't curl at the edges.

- Steady your breath. Hold your phone parallel to the check, not at an angle. Most rejections are due to "keystoning," where the check looks like a trapezoid instead of a rectangle.

- Watch the clock. Get it in before 11 PM ET if you need that first chunk of cash by tomorrow.

- File it away. Put the check in a dedicated "Pending" folder for 14 days.

By following these specific technical requirements, you bypass the automated filters that trigger manual reviews and holds. Mobile banking is meant to be a convenience, but it requires a bit of precision to keep the gears turning smoothly.