You're staring at your phone, scrolling through a transaction history that doesn't make any sense. Maybe there is a $35 overdraft fee that feels totally unfair, or maybe your debit card just got declined at a grocery store while you were standing there with a full cart and a growing sense of panic. You need the chase customer service number checking account line, and you need it right now. But let’s be real: calling a big bank like JPMorgan Chase often feels like shouting into a digital void.

It is frustrating.

Most people just want a human. They don't want a robot asking them to "speak a brief description of the problem." They want someone who can actually reverse a fee or track down a missing direct deposit. If you are looking for the direct line, the primary number for Chase personal banking is 1-800-935-9935. It's the "front door" to the bank.

👉 See also: Why Your First 20 Million Is Always The Hardest (And What Happens After)

But here is the thing. That number is just the beginning of the maze.

Navigating the Chase Customer Service Number Checking Account Maze

Wait times vary wildly. If you call on a Monday morning or the first day of the month when everyone is checking their rent payments, you are going to be on hold. It is just the way it works. However, Chase has one of the largest retail footprints in the United States, and their phone system is designed to handle millions of calls.

If you're outside the U.S., that 800 number won't work for you. You'll need the collect-call line, which is 1-713-262-3300.

The "Backdoor" to Faster Service

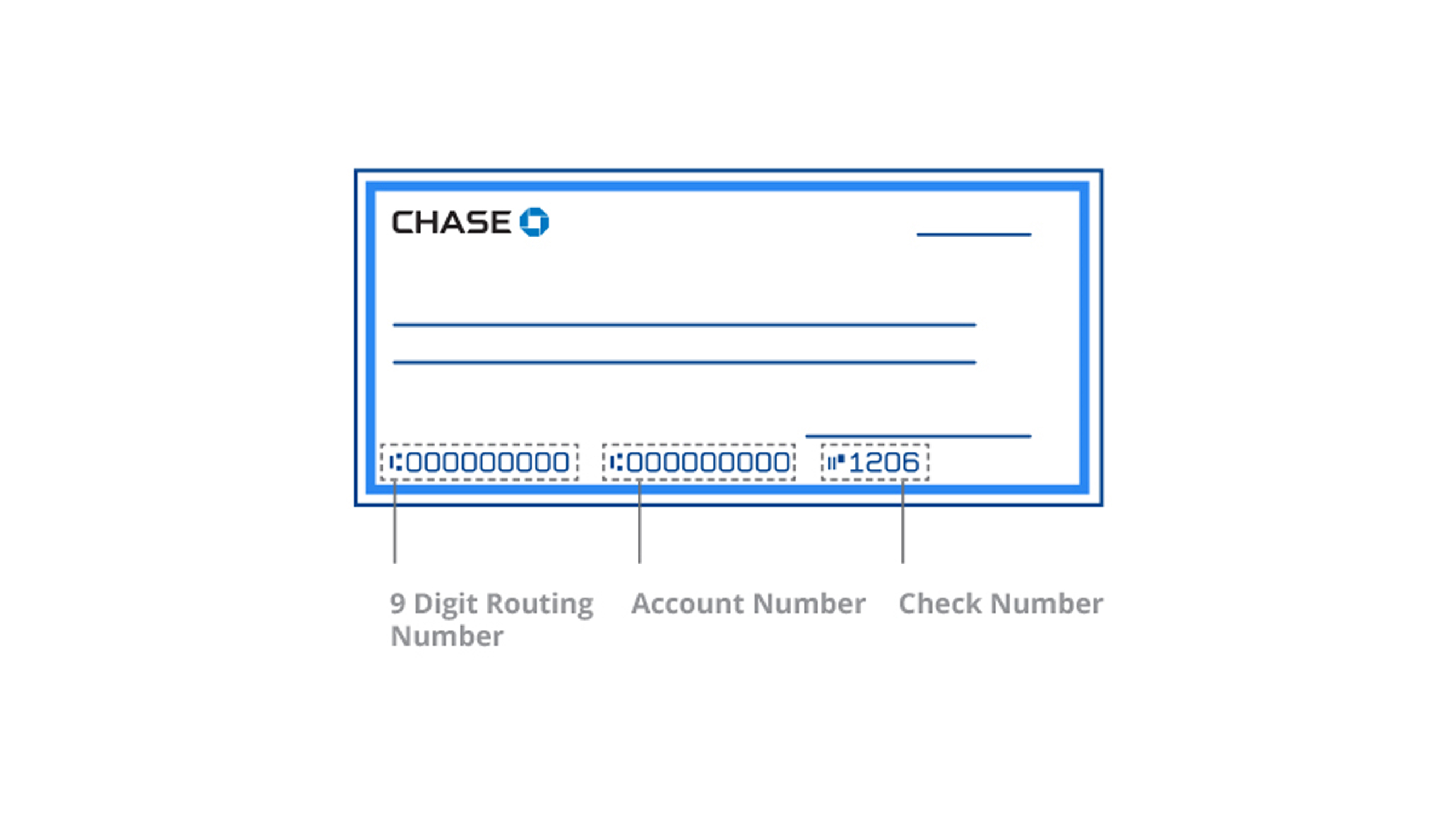

Have you ever noticed the number on the back of your debit card? That is usually a more direct route than the general 800-935 number you find on a Google search. The system recognizes the "bin" (the first few digits of your card) and routes you to the specific department that handles your account tier.

If you have a Chase Sapphire Banking account or Chase Private Client status, do not call the general line. You pay for better service, so use it. Private Clients have a dedicated team. If you're a regular Total Checking customer, you're in the general pool, but even then, calling through the Chase Mobile app can save you a massive headache.

When you're logged into the app and tap "Contact Us," the app generates a one-time code or passes your authentication directly to the representative. This means you don't have to spend five minutes screaming your Social Security number into your steering wheel while the automated system fails to understand your accent.

What Happens When You Call?

Once you dial the chase customer service number checking account line, you’ll hit the Interactive Voice Response (IVR). It's that polite, slightly robotic voice.

To get past it? Some people swear by pressing "0" repeatedly, but that often just triggers the system to hang up on you or restart the prompt. Honestly, the best way is to provide the automated system with your account number or the last four digits of your card immediately. Once the system knows who you are, it is much more likely to put you in a queue for a human.

Common Reasons People Call About Their Checking Accounts

Why are you calling? Knowing the "why" can change which department you actually need to speak with.

Fraud and Unauthorized Charges: If you see a charge from a random gas station in a state you've never visited, call 1-800-955-9060 instead. This is the dedicated fraud department. They move faster than general customer service because, frankly, Chase wants to stop the bleeding as much as you do.

Overdraft Fee Reversals: This is the big one. If you’ve been a customer for a while and you don’t have a history of bouncing checks, Chase reps often have the "discretionary authority" to waive one or two fees a year. Don't be rude. Just say, "I've been a loyal customer for X years, and I was wondering if you could help me out with this fee as a one-time courtesy." It works surprisingly often.

💡 You might also like: Why Gas Prices Have 9/10 of a Cent: The Weird Reason You’re Still Paying a Fraction

Wire Transfers: If a wire is stuck, the general chase customer service number checking account rep might not be able to see the backend details. You might get transferred to the Global Wire department.

ATM Issues: If the machine ate your cash or didn't spit out the right amount, you need to file a "Reg E" dispute. This isn't an instant fix. The bank has to audit the machine physically. It sucks, but it's a legal process.

The Reality of "24/7" Support

Chase claims to have 24/7 support for certain things, but don't expect a high-level manager to be available at 3:00 AM on a Sunday.

The people working the graveyard shift are usually handled by overseas call centers or skeleton crews in the U.S. They are great for "transactional" help—locking a card, checking a balance, or reporting a lost card. But if you have a complex issue regarding a "frozen" account or a legal hold, you need to call during Eastern Standard Time business hours.

That is when the people with the actual power to click the "unfreeze" button are at their desks.

Why Your Account Might Be Flagged

Sometimes the chase customer service number checking account line won't help you because your account is under "Review." This is the nightmare scenario.

Under the Bank Secrecy Act and the Patriot Act, banks are required to monitor for suspicious activity. If you suddenly deposit $9,500 in cash three days in a row, a red flag goes up. The customer service rep on the phone might say "I can't see the reason for the hold" or "The account is being reviewed by another department."

This is often a "tipping off" rule. They literally aren't allowed to tell you why they are investigating you. In these cases, calling the 800 number is like hitting a brick wall. You're better off going into a physical branch with your ID and asking to speak with the Branch Manager.

Digital Alternatives That Actually Work

If you hate the phone—and let's be honest, most of us do—there are other ways.

- Secure Message Center: Log into the Chase website. Go to the "hamburger" menu (those three little lines) and find "Secure Messages." It’s like email but encrypted. It's great for things that aren't emergencies, like requesting a change to your statement delivery or asking for a fee breakdown. You get a paper trail this way.

- Twitter (X): @ChaseSupport is surprisingly active. Do not—I repeat, DO NOT—post your account number or phone number publicly. Just tweet at them saying you need help with a checking account issue. They will usually DM you and tell you how to get a call back.

- The In-Person Visit: Chase has nearly 5,000 branches. Sometimes, the most effective "customer service number" is your own two feet walking into a lobby. If you have a complicated issue, a banker in a branch can call internal lines that the public doesn't have access to. They can bypass the "front door" for you.

Tips for a Successful Call

When you finally get a human on the chase customer service number checking account line, keep these tips in mind:

Have your info ready. Don't be the person looking for a pen while the rep is waiting. Have your account number, your last three transactions, and your "Telephone Service Code" if you have one set up.

Take names. "Hi, who am I speaking with?" Write it down. Write down the time. If they promise you a refund, ask for a reference number for the call. If that refund doesn't show up in 48 hours, you have leverage when you call back.

Be "Kinda" Nice. I know you're mad. You've been on hold for twenty minutes. But the person on the other end of the line gets yelled at for eight hours a day. If you're the one person who is actually polite, they are much more likely to go the extra mile to find a solution for you.

Escalating Your Issue

What if the person on the chase customer service number checking account line says "No"?

Ask for a supervisor. It's a cliché, but it works. Not because the supervisor is smarter, but because they have higher "limit" authority. A front-line rep might only be allowed to waive a $15 fee. A supervisor might be able to waive $100.

If the supervisor can't help, and you feel like the bank is genuinely in the wrong (not just that you're unhappy, but that they broke their own Terms of Service), you can mention the CFPB (Consumer Financial Protection Bureau). Banks take CFPB complaints very seriously. Once a formal complaint is filed, the bank has a legal obligation to respond within a specific timeframe.

Moving Forward With Your Chase Account

Getting the help you need shouldn't be a full-time job. Chase is a massive machine, and sometimes you just have to know which lever to pull.

Actionable Steps to Take Right Now:

- Check the App First: Before calling, see if you can resolve the issue (like locking a lost card or disputing a charge) directly in the Chase Mobile app. It is often faster than the phone.

- Call the Direct Line: Use 1-800-935-9935 for general checking issues, but look at the back of your specific card for a potentially faster route.

- Call During Off-Peak Hours: Try Tuesday or Wednesday mid-morning. Avoid lunch hours and the 5:00 PM rush.

- Document Everything: If you're disputing something, keep a log of who you talked to and what they said.

- Update Your Contact Info: Make sure Chase has your current cell phone number. Often, they send a text verification code while you are on the phone with them to prove you are who you say you are. If they have your old landline from 2012, you're going to have a hard time.

Dealing with bank bureaucracy is never fun. But with the right number and a bit of patience, you can usually get your checking account issues sorted out without losing your mind. Stay persistent, keep your records organized, and remember that you're the customer—you're entitled to clear answers about your money.